Home>Finance>How Do I Find Out Who My Homeowners Insurance Is Done

Finance

How Do I Find Out Who My Homeowners Insurance Is Done

Published: November 22, 2023

Find out who your homeowners insurance provider is in just a few steps. Understand the process of identifying and contacting your finance-based insurance company.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Importance of Knowing Your Homeowners Insurance Provider

- Gathering Information from the Mortgage Lender

- Searching through Past Documents and Records

- Contacting the Homeowners Association

- Reaching Out to the Insurance Agent or Broker

- Checking Online Portals or Databases

- Contacting the State Insurance Department

- Utilizing Public Records

- Seeking Assistance from a Professional Insurance Locator Service

- Conclusion

Introduction

When it comes to homeowners insurance, it’s crucial to know who your insurance provider is. Whether you’re purchasing a new home or have been living in your current property for a while, being aware of your homeowners insurance is important for a variety of reasons. In the event of a disaster or unforeseen event that damages your home, having knowledge of your insurance provider will allow you to quickly and efficiently file a claim and begin the process of restoring your property.

Moreover, understanding your homeowners insurance coverage is essential for determining what is protected under your policy and what isn’t. It’s also important for budgeting purposes, as insurance premiums can have an impact on your monthly finances.

Despite the significance of knowing who your homeowners insurance provider is, it’s not uncommon for homeowners to be unsure about this information. It may be that you’ve recently purchased a home and haven’t received all the necessary documentation yet, or perhaps you’ve lived in your property for many years and haven’t had a reason to think about your insurance provider.

Fortunately, there are several methods you can use to find out who your homeowners insurance is with. In this article, we’ll explore various strategies that can assist you in discovering this information. By following these steps, you’ll be well-equipped to handle any insurance-related issues that may arise and ensure that your property is adequately protected.

Importance of Knowing Your Homeowners Insurance Provider

Knowing who your homeowners insurance provider is can have significant implications for the safety and protection of your property. Here are some key reasons why it’s essential to be aware of your insurance provider:

- Quick and Efficient Claims Process: In the unfortunate event that your home sustains damage from a natural disaster, fire, or other covered incidents, having knowledge of your insurance provider will allow you to promptly file a claim. This enables you to initiate the necessary steps for repairs and restore your home to its pre-damaged state.

- Understanding Your Coverage: Homeowners insurance policies can vary in terms of coverage limits, deductibles, and types of protection. By knowing your insurance provider, you can access and review your policy documents to understand the extent of coverage for your dwelling, personal belongings, liability, and additional endorsements or riders.

- Budgeting and Financial Planning: Homeowners insurance premiums are a regular expense that homeowners need to budget for. By knowing your insurance provider, you can stay informed about your premium amount and payment schedule, allowing you to incorporate it into your monthly budget and ensure timely payments to maintain coverage on your property.

- Policy Updates and Changes: Insurance providers periodically update their policies to account for changing market conditions, regulations, and client needs. Being aware of your homeowners insurance provider allows you to stay informed about any changes or updates that may affect your coverage, such as policy enhancements, rate adjustments, or changes in terms and conditions.

Additionally, knowing your homeowners insurance provider can be crucial in case you need to contact them for general inquiries, making changes to your policy, or seeking guidance on coverage limits and options. It’s essential to maintain open communication with your insurance provider to ensure that your coverage aligns with your needs and expectations.

By being proactive and staying informed about your homeowners insurance provider, you can protect your investment, provide peace of mind for your family, and mitigate potential financial risks associated with property damage or liability claims. Let’s explore various methods you can employ to find out who your insurance provider is.

Gathering Information from the Mortgage Lender

One of the primary sources to find out who your homeowners insurance provider is through your mortgage lender. If you have a mortgage on your property, the lender typically requires homeowners insurance to protect their investment. Here’s how you can gather information from your mortgage lender:

- Loan Documents: Review your mortgage loan documents, including the closing statement or settlement statement. These documents often contain information about the required homeowners insurance and the name of the insurance company. Look for sections that mention insurance requirements or escrow details, as this can provide insights into your insurance provider.

- Contact the Lender: Reach out to your mortgage lender directly and inquire about the details of your homeowners insurance. You can contact the customer service department or your loan officer for assistance. They should be able to provide you with the necessary information, including the name of the insurance provider and policy contact details.

- Online Account: Log in to your online mortgage account if your lender provides one. Many lenders have online portals where you can access important mortgage-related information, including insurance details. Look for sections or tabs related to insurance coverage or documents, as this can lead you to the relevant information.

- Loan Statements: Examine your mortgage loan statements. Some lenders include information about the homeowners insurance provider on the statements to ensure transparency regarding your insurance payments and coverage.

By exploring these avenues and gathering information from your mortgage lender, you can often uncover the name of your homeowners insurance provider. If you’re unable to find the information through this channel, there are other methods you can utilize to determine your insurance provider.

Searching through Past Documents and Records

If you’re unable to obtain information about your homeowners insurance provider from your mortgage lender, another method to consider is searching through your past documents and records. Here are some steps to help you in this process:

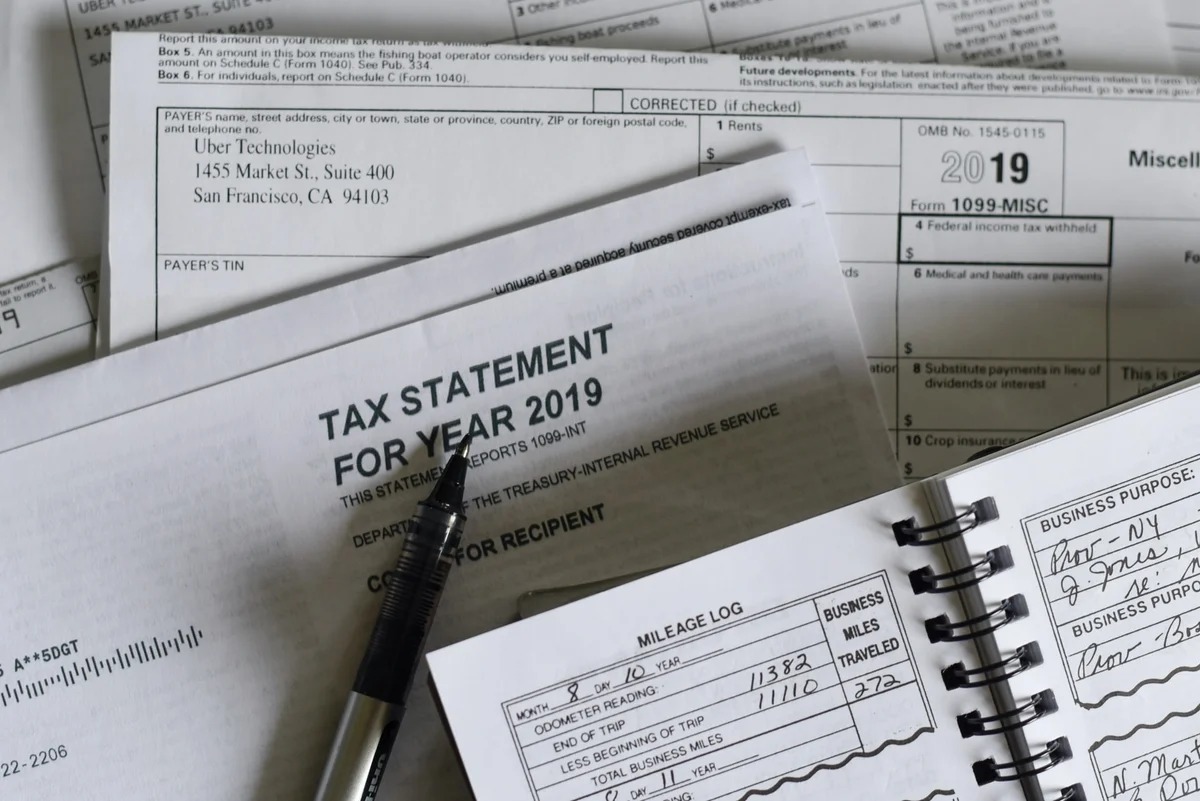

- Home Purchase Documents: Start by reviewing the documents related to your home purchase. This may include the settlement statement, closing documents, or any paperwork provided by the title company. Look for any references to homeowners insurance or insurance providers. These documents are often kept in a safe place, such as a filing cabinet or a folder specifically for important records.

- Insurance Payment Records: Examine your bank statements or cancelled checks for any past insurance premium payments. These records may contain the name of the insurance company or even the policy number. Look for recurring payments or any noticeable transactions related to insurance.

- Insurance ID Cards or Declarations Pages: If you have ever received physical insurance identification cards or declarations pages, they may contain information about your homeowners insurance provider. Check any files or folders where you typically store important paperwork like insurance documents.

- Correspondence with Insurance Companies: Review any past correspondence, letters, or emails you may have received from insurance companies. Look for any communication related to your homeowners insurance, as it may contain information about the provider or policy details. Check both physical and digital correspondence folders.

- Property Tax Records: Property tax records sometimes include information about the homeowners insurance provider. Contact your local tax assessor’s office or check their online database to see if you can obtain this information.

Searching through your past documents and records requires some patience and organization, but it can be an effective way to uncover important information about your homeowners insurance provider. If you’re still unable to find the necessary details, there are additional resources and methods you can explore.

Contacting the Homeowners Association

If you live in a community that has a homeowners association (HOA), reaching out to them can be a valuable step in finding out who your homeowners insurance provider is. The HOA often has important information about the insurance policies that cover the community and its homeowners. Follow these steps to contact the homeowners association:

- Locate HOA Contact Information: Find the contact information for your homeowners association. This may be available on their website, in community newsletters, or through a directory provided by the association. If you’re unsure about the contact details, your neighbors or the property manager may be able to assist you.

- Reach Out to the HOA Board: Contact the HOA board or the designated representative responsible for insurance matters. Explain that you’re looking to find out who your homeowners insurance provider is. They should have access to the necessary information or be able to direct you to the appropriate resource.

- Provide Property Details: When contacting the homeowners association, be prepared to provide your property address and any other relevant details that can help them identify your specific insurance coverage. This ensures they can provide you with accurate information pertaining to your property.

- Ask about Master Insurance Policy: In many HOAs, there is a master insurance policy that covers common areas and shared structures. Inquire about this policy and if it includes coverage for individual homes as well. If not, the HOA might still have information on the recommended or required insurance providers for homeowners within the community.

By contacting the homeowners association, you can tap into their knowledge and resources to find out who your homeowners insurance provider is. They may also be able to provide you with other relevant insurance-related information specific to your community. If this approach doesn’t yield the desired results, don’t worry – there are still more avenues to explore.

Reaching Out to the Insurance Agent or Broker

If you have previously worked with an insurance agent or broker, they can be a valuable resource in helping you find out who your homeowners insurance provider is. Insurance professionals have access to comprehensive records and can assist you in locating this information. Follow these steps to reach out to your insurance agent or broker:

- Locate Contact Information: Find the contact information for your insurance agent or broker. This may be available on their website, in your policy documents, or through any past communications you’ve had with them. If you can’t find the information, reach out to their agency or the insurance company they represent for help.

- Explain Your Situation: When you contact the insurance agent or broker, explain that you’re trying to find out who your homeowners insurance provider is. Provide them with any relevant details, such as your name, property address, policy number (if available), and the approximate time period when you obtained the insurance.

- Request Policy Details: Ask the insurance agent or broker to provide you with the details of your homeowners insurance policy, including the name of the insurance provider. They should be able to access their records and provide you with the necessary information you’re looking for.

- Discuss Coverage and Updates: While you have the agent or broker on the line, take the opportunity to discuss your coverage limits, policy endorsements, and any updates or changes you may need to make. This is also an ideal time to inquire about any additional coverages or discounts that may be available to you.

Reaching out to your insurance agent or broker not only helps you in finding out who your homeowners insurance provider is but also allows you to have a conversation about your policy and ensure it adequately meets your needs. If you don’t have an existing relationship with an insurance professional or are unable to locate your agent, don’t worry – there are still other avenues to explore.

Checking Online Portals or Databases

In today’s digital age, checking online portals or databases can be a convenient and efficient way to find out who your homeowners insurance provider is. Here are some online resources and platforms you can utilize in your search:

- Insurance Account Portals: If you have created an online account with your insurance provider, log in and navigate through the portal. Look for sections or tabs that contain policy details or documents. Often, insurance account portals provide access to policy information, including the name of the insurance provider.

- Insurance Aggregator Websites: Visit insurance aggregator websites, which allow you to compare insurance quotes, policies, and providers. These sites often require you to enter your property address and other details to generate quotes. While exploring these websites, you may come across the name of your homeowners insurance provider.

- Online Insurance Directories: Search through online insurance directories that compile information on different insurance companies. Many directories allow you to search by location and type of insurance coverage. By entering your address or ZIP code, you may find a list of insurance providers that operate in your area, including your homeowners insurance company.

- State Insurance Department Websites: Visit your state’s insurance department website, as they often provide resources and tools for consumers. Some state websites offer search functions to find licensed insurance companies and agents. By searching for homeowners insurance providers in your state, you may find the name of your insurance company.

While checking online portals or databases can be a convenient method, keep in mind that some insurance companies may not have online presence or provide access to policy information online. If you’re unable to find the information through these online resources, there are other avenues you can explore.

Contacting the State Insurance Department

If you’re having difficulty finding out who your homeowners insurance provider is, one helpful resource to turn to is your state insurance department. State insurance departments regulate insurance companies and agents within their jurisdiction and can assist you in obtaining the necessary information. Here’s how to contact the state insurance department:

- Locate the Contact Information: Visit the website of your state insurance department to find their contact information. Typically, they will have a dedicated phone number or email address for consumer assistance or inquiries. If you can’t find the information on their website, try conducting a web search using the name of your state and “insurance department.”

- Explain Your Situation: When you contact the state insurance department, explain that you’re trying to determine your homeowners insurance provider. Provide them with any relevant details, such as your name, address, and any other information related to your insurance coverage. They should be able to guide you on the next steps to obtain this information.

- Ask for Assistance: Request their assistance in locating your homeowners insurance provider. They may have access to databases or resources that can help identify the company that issued your policy. The state insurance department can also provide guidance on how to file a formal complaint or dispute if needed.

- Follow Their Recommendations: Follow any instructions or recommendations provided by the state insurance department. They may advise you to submit a formal request for information or direct you to specific resources or online tools to assist in finding your insurance provider.

Contacting the state insurance department can be an effective way to obtain information about your homeowners insurance provider, especially if other methods have proven unsuccessful. These departments exist to protect consumers and ensure that insurance companies operate within the bounds of the law.

If all else fails, there is still one more option to consider in your search for your homeowners insurance provider.

Utilizing Public Records

If you’re still unable to determine who your homeowners insurance provider is through other methods, utilizing public records can be a valuable resource. Public records often contain information about the insurance policies held on a specific property. Here’s how to utilize public records in your search:

- Property Tax Records: Contact your local tax assessor’s office or access their online database. Property tax records sometimes include information about homeowners insurance providers. Provide them with your property address and inquire about any available insurance details.

- Property Deeds and Title Documents: Review property deeds and title documents. These records can often contain information about insurance policies associated with the property. If you’re unsure where to find these documents, consult with the local recorder’s office or a real estate attorney for guidance.

- County Clerk’s Office: Visit or contact the county clerk’s office where your property is located. They may have records related to insurance policies filed for properties in the area. Inquire about any available information that can help you identify your homeowners insurance provider.

- Homeowners Association Records: If you live in a community with a homeowners association, check their records for any information regarding homeowners insurance providers. The association may keep records of insurance policies held by homeowners within the community.

- Insurance Filing Requirements: Some states require insurance companies to file policy information with a state agency. Check with your state’s insurance division or department to see if there is an online database or filing system that provides access to insurance information, including the homeowners insurance provider associated with your property.

Utilizing public records can be a time-consuming process as it may involve navigating through various government agencies and databases. However, these records are often reliable and can provide you with the information you need to identify your homeowners insurance provider. If you’re still unsuccessful in locating the necessary details, there is one final option to consider.

Seeking Assistance from a Professional Insurance Locator Service

If all other methods have failed to help you find out who your homeowners insurance provider is, seeking assistance from a professional insurance locator service can be a viable option. These services specialize in helping individuals locate their insurance policies and providers. Here’s how they can assist you:

- Research and Database Access: Insurance locator services have access to extensive databases and resources that contain information about insurance policies. They can conduct thorough research and use their expertise to find the necessary details about your homeowners insurance provider.

- Policy Document Retrieval: If you’ve misplaced or lost your policy documents, an insurance locator service can assist in retrieving them. They have the knowledge and experience to navigate through the necessary channels to obtain copies of your policy, which often contain information about your insurance provider.

- Experienced Insurance Professionals: Insurance locator services employ experienced insurance professionals who are well-versed in the industry. They understand the complexities of insurance policies and can quickly identify the necessary information based on the details you provide.

- Persistent Follow-Up: Insurance locator services will persistently follow up with insurance companies, agents, and other relevant parties to obtain the information you need. They have established relationships and communication channels that can expedite the process of finding your homeowners insurance provider.

- Specialized Knowledge: These services have deep knowledge of insurance policy language, terms, and industry practices. They can decipher complex policy documents to gather pertinent information, such as the name of your homeowners insurance provider.

Seeking assistance from a professional insurance locator service can save you time and frustration in your search for your homeowners insurance provider. They have the expertise and resources to navigate complex insurance systems and locate the necessary information on your behalf.

Keep in mind that professional insurance locator services may charge a fee for their services. However, the convenience and peace of mind they provide can be well worth the investment, especially if you’ve exhausted other avenues in your search.

Remember, it’s crucial to know who your homeowners insurance provider is to have a comprehensive understanding of your coverage, ensure effective claims processing, and protect your property adequately. By leveraging these methods and resources, you’ll be able to identify your insurance provider and have the peace of mind that comes with knowing your home is protected.

Conclusion

Knowing who your homeowners insurance provider is a crucial aspect of being a responsible homeowner. It ensures you have access to the necessary information and resources in case of an unfortunate event or damage to your property. Throughout this article, we have explored various methods to help you find out who your insurance provider is.

We started by emphasizing the importance of knowing your homeowners insurance provider. From quickly filing a claim to understanding your coverage and budgeting effectively, being aware of your insurance provider plays a critical role in protecting your investment and providing peace of mind.

We then delved into different strategies, including gathering information from the mortgage lender, searching through past documents and records, contacting the homeowners association, reaching out to the insurance agent or broker, checking online portals or databases, and utilizing public records. Each method offers a unique approach that can help you identify your homeowners insurance provider.

If all else fails, seeking assistance from a professional insurance locator service can be a wise choice. These services have the expertise, resources, and persistence to track down the necessary information on your behalf.

By taking the time to uncover your homeowners insurance provider, you empower yourself to adequately protect your property, understand your coverage, and ensure seamless claims processing. Remember, being proactive and informed about your insurance provider is an essential part of responsible homeownership.

In conclusion, navigate through the recommended methods and resources, and don’t hesitate to seek assistance if needed. Take the necessary steps to determine who your homeowners insurance provider is, and enjoy the peace of mind that comes from knowing your property is properly protected.