Finance

Why Do Dispensaries Not Take Credit

Published: January 7, 2024

Discover why dispensaries don't accept credit for cannabis purchases, and explore alternative finance options in this insightful guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When you step into a cannabis dispensary to purchase your favorite strain or CBD product, you might notice that an all-too-common sign hangs by the cash register: “Cash Only.” While we live in an increasingly digital world where credit and debit cards have become the standard form of payment, dispensaries seem to operate in a cash-only environment. So why do dispensaries not take credit?

There are several reasons behind this cash-only approach that are deeply rooted in the financial and regulatory challenges faced by the cannabis industry. From federal banking restrictions to compliance with anti-money laundering laws and ongoing security concerns, the cash preference of dispensaries can be seen as a necessity rather than a choice.

In this article, we will delve into the various factors that contribute to dispensaries not accepting credit cards, shedding light on the complexities faced by the cannabis industry in accessing traditional financial services. Let’s explore the reasons behind their cash-only policies and the potential shift we might see in the future.

Cash-Only Policies

One of the primary reasons behind dispensaries’ cash-only policies is the federal illegality of cannabis. Despite the growing number of states legalizing both medicinal and recreational use, cannabis remains classified as a Schedule I controlled substance at the federal level in the United States. This classification creates significant challenges for dispensaries when it comes to accessing traditional banking services.

Due to its federal illegality, most banks and credit card companies are unwilling to work with cannabis businesses. Financial institutions that are federally insured are particularly cautious about engaging with an industry that is still considered a violation of federal law. As a result, dispensaries are left with limited options, one of which is operating as cash-only establishments.

Operating on a cash-only basis presents its own set of challenges. Dispensaries have to manage large sums of cash on a daily basis, making them vulnerable to theft and increasing the risk associated with the transportation and storage of money. Additionally, managing cash introduces inefficiencies in bookkeeping and tax reporting, making it harder for dispensaries to establish transparent and accountable financial practices.

Moreover, cash-only policies can create inconvenience for customers. Many people have become accustomed to the convenience of using their credit or debit cards for all their purchases. Having to withdraw cash beforehand can be an additional step that can deter some customers from patronizing dispensaries. These cash-only policies also limit the ability of dispensaries to provide electronic receipts and track customer preferences, hindering their ability to analyze and improve their business operations.

Despite these challenges, many dispensaries have adapted by implementing technologies such as ATMs on-site, making it more convenient for customers to obtain cash. Additionally, some dispensaries have implemented alternative payment solutions such as mobile payment apps or virtual currency systems. While these options are not as widespread as credit card acceptance, they provide customers with additional payment choices while still adhering to the cash-driven nature of the industry.

Federal Banking Regulations

One of the biggest hurdles that dispensaries face when it comes to accepting credit cards is federal banking regulations. As mentioned earlier, cannabis is still classified as a Schedule I controlled substance at the federal level, which makes it difficult for dispensaries to access traditional banking services.

Financial institutions operate under federal regulations, and engaging in transactions related to illegal activities, including cannabis, can lead to severe consequences. Banks that knowingly provide services to cannabis businesses risk facing criminal charges, hefty fines, and even the potential loss of their banking charter. As a result, most banks are reluctant to work with dispensaries, and credit card companies refuse to process transactions for cannabis products.

Without access to banking services, dispensaries are left with no choice but to operate on a cash-only basis. This creates significant challenges for business owners, who must deal with the risks associated with handling large amounts of cash and lack access to essential financial tools such as loans, lines of credit, and merchant services.

Furthermore, the lack of access to banking services hampers the ability of dispensaries to engage in basic financial activities, such as paying bills electronically or receiving electronic transfers. This adds additional complexity and inefficiency to their day-to-day operations, making it harder to run a dispensary as effectively as other businesses in different industries.

Recognizing the need for a solution, some states have attempted to establish their own state-level banking systems explicitly designed for the cannabis industry. However, these initiatives are still in the early stages and face challenges in terms of legality and acceptance at the federal level. Until substantial changes are made in federal banking regulations, dispensaries will continue to face the limitations of operating in a cash-only environment.

Compliance with Anti-Money Laundering Laws

Another significant factor behind dispensaries’ cash-only policies is their need to comply with anti-money laundering (AML) laws and regulations. AML laws aim to prevent illicit funds from being laundered through legitimate businesses, including the sale of cannabis.

Financial institutions are required to have robust AML compliance programs in place to detect and report any suspicious financial activities. However, due to the federal illegality of cannabis, most banks are reluctant to engage with dispensaries and potentially expose themselves to the risks associated with handling funds derived from the sale of a controlled substance.

By adopting cash-only policies, dispensaries minimize their involvement with the formal banking system and reduce the potential scrutiny they may face from financial regulators. This allows them to operate in accordance with state laws while avoiding potential complications related to AML compliance.

However, operating solely with cash brings its own set of challenges. While cash transactions provide dispensaries with a level of anonymity, it also makes it difficult to track funds and ensure transparency in financial activities. This lack of transparency can further complicate compliance with AML laws and may hinder the efforts of regulators to combat money laundering in the cannabis industry.

Additionally, the absence of electronic transaction records makes it harder for dispensaries to establish a clear audit trail and demonstrate compliance with financial regulations. It creates difficulties in conducting thorough financial due diligence and may raise concerns for potential investors and stakeholders who are accustomed to more transparent financial practices.

As the legal cannabis industry continues to evolve, there have been efforts to address the AML compliance challenges faced by dispensaries. Some states have implemented systems that require stringent record-keeping and reporting mechanisms, aiming to mitigate the risks of financial crimes associated with the industry. However, as long as cannabis remains illegal at the federal level, these compliance efforts may remain fragmented and inconsistent across different states.

Overall, dispensaries’ cash-only policies are driven by the need to navigate the complexities of AML laws while operating within the current legal and regulatory frameworks governing the cannabis industry.

Fraud and Chargeback Risks

One significant concern for dispensaries when it comes to accepting credit cards is the risk of fraud and chargebacks. In industries where credit card transactions are prevalent, merchants face the potential for customers initiating chargebacks, which can result in financial losses and administrative burdens for businesses.

In the case of cannabis dispensaries, the risk of chargebacks is amplified due to the federal illegality of cannabis. Customers who have made purchases at dispensaries may decide to dispute the charges with their credit card companies, claiming that the transaction was illegal or that they did not receive the expected goods or services, knowing that the federal law does not protect cannabis transactions.

Chargebacks can be a significant issue for dispensaries, as they often struggle to obtain adequate legal protection and recourse in such disputes. Credit card companies are more likely to side with customers, given the ambiguous legality of cannabis, resulting in funds being withheld from dispensaries and potential damage to their reputation.

By operating on a cash-only basis, dispensaries minimize the risk of chargebacks and the associated financial losses. Cash transactions, once completed, are generally considered final and irreversible, reducing the likelihood of customers later disputing the transaction. This allows dispensaries to have more control over their financial stability, ensuring that funds collected are not subject to reversal.

However, it is worth noting that cash transactions also present their own fraud risks. Dispensaries must implement robust cash-handling procedures to mitigate the risk of theft and counterfeit currency. These security measures include the use of safes, video surveillance, and employee training to ensure the safety of both customers and staff.

As the cannabis industry continues to evolve and gain legal recognition, there may be opportunities for dispensaries to explore alternative payment solutions that provide more protection against chargebacks. Some companies are working on developing specialized payment gateways and virtual currencies specifically designed for the cannabis industry, which could help mitigate the risks associated with fraud and chargebacks.

Overall, the cash-only policies adopted by dispensaries serve as a mechanism to minimize the risks of fraud and chargebacks, which can be more pronounced in an industry that operates in a legal gray area at the federal level.

Limited Access to Financial Services

One of the most significant challenges faced by cannabis dispensaries is their limited access to traditional financial services. Due to the federal illegality of cannabis, dispensaries often find themselves excluded from the same financial services that are readily available to businesses in other industries.

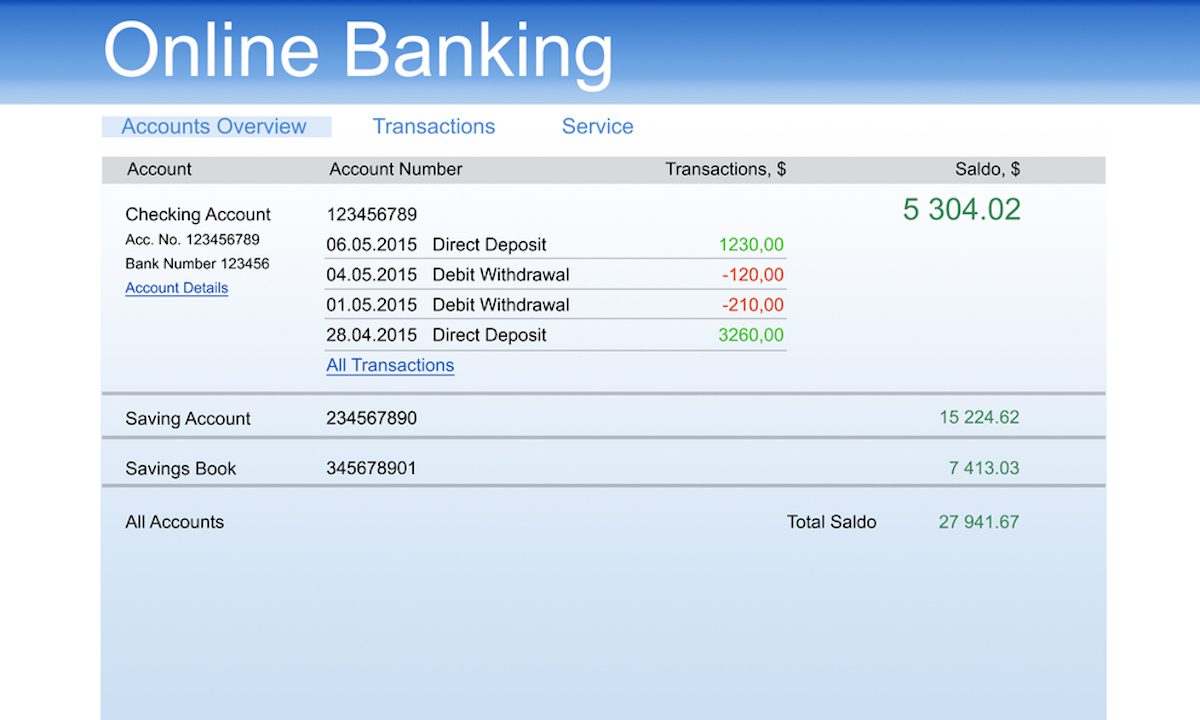

As mentioned earlier, most banks and credit card companies are unwilling to work with dispensaries due to the legal and regulatory risks associated with the industry. This means that dispensaries are unable to open bank accounts or obtain merchant services, such as credit card processing, that are crucial for businesses’ day-to-day operations.

Without access to banking services, dispensaries face numerous obstacles. They cannot easily accept credit or debit card payments, forcing them to rely on cash transactions. This, in turn, limits their customer base, as some individuals may prefer the convenience and safety of using cards for their purchases.

Furthermore, the lack of banking services makes it challenging for dispensaries to manage their finances effectively. They are unable to take advantage of banking tools and services that other businesses utilize, such as business loans, lines of credit, and financial planning services. This hampers their ability to grow and expand their operations.

Additionally, dispensaries face difficulty in paying their vendors and suppliers electronically. Traditional payment methods, such as checks or electronic fund transfers, are typically unavailable to businesses operating in the cannabis industry. This limits their options for establishing reliable supply chains and can lead to inefficiencies in their operations.

The limited access to financial services also affects dispensaries’ ability to meet their tax obligations. Without bank accounts or official financial records, it becomes challenging to report accurate sales figures and calculate taxes accurately. This can result in increased scrutiny from tax authorities and potential legal and financial consequences.

Some states have recognized the need to address the issue of limited access to financial services for the cannabis industry. Several have implemented programs that allow cannabis businesses to access limited banking services, such as state-chartered credit unions specifically designed for dispensaries. Additionally, there have been proposals to amend federal laws to provide clear guidance and protections for financial institutions that choose to work with cannabis businesses.

While these efforts are steps in the right direction, the lack of consistent federal regulations continues to hinder dispensaries’ access to essential financial services. Until there are substantive changes at the federal level, dispensaries will continue to face significant challenges in navigating the financial landscape.

Problems with Merchant Processors

One of the significant hurdles faced by cannabis dispensaries in accepting credit cards is the lack of support from merchant processors. Merchant processors are financial institutions or service providers that facilitate credit card transactions for businesses.

Due to the federal illegality of cannabis, most mainstream merchant processors are unwilling to work with dispensaries. These processors have stringent underwriting guidelines and compliance requirements, which often exclude businesses operating in the cannabis industry.

Merchant processors consider the risk associated with the industry, including legal and regulatory uncertainties, as a barrier to providing their services. They are concerned about potential legal implications, financial risks, and reputational damage if they engage with cannabis businesses.

As a result, dispensaries are left with limited options for processing credit card payments. They often have to rely on specialized cannabis-friendly merchant processors, which may charge higher fees or have stricter requirements compared to traditional processors.

The limited availability of merchant processors leads to higher transaction costs for dispensaries. Cannabis-friendly processors typically charge higher fees to compensate for the perceived risks associated with the industry. These additional costs, combined with the already high regulatory and operational expenses of running a dispensary, further contribute to the cash-driven nature of the business.

Moreover, the limited options for merchant processors can also lead to operational challenges. Dispensaries might face delays in receiving funds or encounter difficulties in reconciling transactions and obtaining detailed sales reports. This lack of streamlined payment processing can create inefficiencies and hamper the ability of dispensaries to effectively manage their finances.

Despite these challenges, the cannabis industry has seen some new entrants in the payment processing landscape. Fintech startups have emerged to provide innovative solutions specifically tailored to the needs of dispensaries. These companies leverage technology and legal frameworks to offer compliant payment processing services, providing a glimmer of hope for improved payment options in the future.

However, widespread adoption of these services is still limited, and dispensaries often must navigate a complex landscape of available options to find a reliable and affordable merchant processing solution.

In summary, the lack of support from traditional merchant processors poses a significant obstacle for dispensaries in accepting credit cards. The limited availability of cannabis-friendly processors, coupled with higher fees and operational challenges, contributes to the prevalence of cash-only policies in the industry.

Security Concerns

Security is a paramount concern for cannabis dispensaries, and it plays a significant role in their decision to adopt cash-only policies. Operating in an industry that deals with valuable products and large amounts of cash makes dispensaries potential targets for robberies and theft.

Unlike traditional retail businesses where transactions are typically conducted electronically, dispensaries handle cash transactions extensively. The accumulation of cash on-site can attract criminals who are aware that dispensaries cannot rely on traditional banking services. The cash-only policies aim to reduce the risk of theft by minimizing the visibility and accessibility of funds. By avoiding electronic payment methods, dispensaries can limit their exposure to potential security breaches and protect both their staff and customers.

Additionally, the federal illegality of cannabis makes dispensaries ineligible for banking services, including armored transport services commonly used by other cash-intensive industries. Lacking access to specialized security companies, dispensaries often have to rely on their own security measures to safeguard their cash. This might involve implementing enhanced security systems, surveillance cameras, and alarm systems to mitigate the risks associated with handling large sums of cash.

Moreover, operating on a cash basis can help protect customer data and privacy. Electronic transactions leave trails of data that can be vulnerable to cyberattacks and unauthorized access. By avoiding electronic payment methods, dispensaries can reduce the potential for customer data breaches and safeguard the privacy of their clientele.

However, it’s important to note that relying solely on cash transactions does not eliminate all security risks. Dispensaries must still implement robust security protocols to safeguard the physical premises and ensure the safety of their staff and customers. These security measures often include stringent employee training, secure cash-handling procedures, and physical security features such as safes and controlled access points.

The industry is continuously evolving, and as legalization expands, there may be opportunities for dispensaries to explore alternative payment methods that provide a balance between convenience and security. Some dispensaries are already exploring digital payment solutions specifically designed for the cannabis industry, which offer increased security features and traceability while still respecting their need for privacy.

Overall, security concerns associated with handling cash and protecting customer data are major factors contributing to dispensaries’ cash-only policies. Until more secure and widely adopted payment solutions become available, dispensaries will continue to prioritize physical security measures to mitigate the risks they face.

Customer Privacy

Customer privacy is a significant concern for cannabis dispensaries, and it is one of the reasons why they often adopt cash-only policies. Dispensaries operate in an industry that is subject to strict regulations and legal uncertainties surrounding the federal legality of cannabis. As a result, protecting customer privacy becomes a top priority.

Electronic transactions, such as credit card payments, leave a digital footprint that can potentially be accessed or tracked by various entities. This raises concerns for both customers and dispensaries regarding the privacy and confidentiality of their transactions. By accepting cash only, dispensaries minimize the digital trail, reducing the potential exposure of customer data and protecting their privacy.

Furthermore, cash transactions eliminate the need for customers to disclose sensitive information associated with credit and debit card payments. When customers pay with cash, they can remain anonymous, eliminating the risk of their personal information being compromised or misused by third parties.

In a time where data breaches and identity theft are prevalent, the cash-only policies of dispensaries provide customers with a sense of security and peace of mind, knowing that their financial information is not being stored in databases that could potentially be vulnerable to cyberattacks.

However, it is essential to note that cash transactions may not completely guarantee anonymity. Dispensaries must still abide by applicable regulations, such as collecting identification to verify the legal age and eligibility of customers. These identification requirements are necessary for dispensaries to comply with state laws and regulations governing the sale of cannabis.

As the cannabis industry continues to evolve and gain legal recognition, there is a growing interest in exploring alternative payment solutions that balance customer privacy with convenience. Some companies are working on developing encrypted digital payment platforms that prioritize data security and anonymity, presenting potential opportunities for dispensaries to offer more privacy-focused payment options in the future.

In summary, customer privacy is a significant factor contributing to dispensaries’ preference for cash transactions. By operating on a cash-only basis, dispensaries can minimize the potential exposure of customer data and provide a higher level of confidentiality, aligning with the expectations and concerns of customers in a digital age where data privacy is of utmost importance.

Potential Shift in the Future

While cash-only policies have been the norm for many cannabis dispensaries, there is a possibility of a shift towards alternative payment options in the future. As the cannabis industry continues to gain legal recognition and public acceptance, there are ongoing efforts to address the financial challenges faced by dispensaries.

One potential solution lies in the advancement of cannabis banking regulations at the federal level. If changes are made to federal laws, financial institutions may become more willing to work with dispensaries, providing them access to traditional banking services and enabling credit card processing. This would open the door for customers to have more payment options, similar to other retail experiences.

Moreover, progress is being made in some states that have implemented or are considering the creation of state-level banking systems for the cannabis industry. These systems would provide dispensaries with avenues for accessing banking services, potentially leading to the integration of electronic payment methods.

In addition to regulatory changes, technological advancements could also drive a shift in the payment landscape for dispensaries. Innovative fintech companies are exploring specialized payment solutions designed specifically for the cannabis industry. These solutions aim to address the unique challenges faced by dispensaries, such as ensuring compliance with financial regulations while offering convenience and security to customers.

Some of these alternative payment solutions leverage blockchain technology, encrypted digital wallets, or specialized virtual currencies to facilitate transactions within the cannabis industry. These technological advancements prioritize security, privacy, and compliance, making them potentially attractive options for both dispensaries and customers.

While these advancements show promise, it is important to recognize that implementing widespread changes in the payment landscape for dispensaries will require significant coordination and collaboration among regulatory bodies, financial institutions, and the cannabis industry itself.

Ultimately, the shift towards alternative payment options in the cannabis industry will depend on further legal and regulatory developments, as well as the willingness of financial institutions to engage with the industry. As the legal and social landscape continues to evolve, it is conceivable that in the future, dispensaries may have the opportunity to offer a wider range of payment options, providing customers with greater convenience and flexibility.

Conclusion

The prevalence of cash-only policies in cannabis dispensaries stems from the complex challenges faced by the industry. Federal illegality, limited access to financial services, compliance with anti-money laundering laws, and security concerns all contribute to dispensaries’ preference for cash transactions.

Dispensaries operate in an environment where cannabis remains classified as a Schedule I controlled substance at the federal level, making it difficult to access traditional banking services. Financial institutions are hesitant to engage with the industry due to legal and regulatory risks, resulting in limited options for dispensaries in accepting credit cards.

Furthermore, compliance with anti-money laundering laws and the desire to protect customer privacy also drive dispensaries to operate on a cash-only basis. By avoiding electronic transactions, dispensaries minimize the digital footprint and potential exposure of customer data, providing a sense of security and anonymity in an industry that still faces legal uncertainties.

While cash-only policies present their own challenges, such as increased security risks and limited convenience for customers, there are potential shifts on the horizon. Changes in federal banking regulations, advancements in specialized payment solutions, and the evolving legal landscape offer hope for alternative payment options in the future.

As the cannabis industry continues to progress and gain acceptance, there is the potential for dispensaries to access traditional banking services, rely on cannabis-friendly merchant processors, and offer more secure and convenient payment methods. Technological advancements, such as blockchain-based solutions and encrypted digital wallets, hold promise for providing secure and compliant payment options.

However, any shifts in the payment landscape for dispensaries will require ongoing efforts to address legal and regulatory challenges, promote collaboration among industry stakeholders, and adapt to changing consumer expectations.

In conclusion, the cash-only policies of dispensaries are a response to the unique challenges faced by the cannabis industry. While cash transactions may offer privacy and compliance benefits, there is a growing recognition of the need for more convenient and secure payment options. With continued progress in the legal, regulatory, and technological realms, an evolution in the payment landscape for cannabis dispensaries may be on the horizon, enhancing the overall experience for both businesses and customers.