Finance

What Does Consolidation Mean In Stocks

Published: January 17, 2024

Learn what consolidation means in stocks and how it impacts your financial investments. Stay informed in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of stock trading. As an investor, it’s essential to understand the various terms and concepts that influence the stock market. One significant concept that can greatly impact your trading decisions is consolidation in stocks. Consolidation refers to a period of time when a stock trades within a defined price range with relatively little to no upward or downward momentum.

During consolidation, the price of a stock tends to remain range-bound, moving between support and resistance levels. This sideways movement can be frustrating for both short-term traders looking for quick gains and long-term investors seeking steady growth. However, consolidation can also present unique opportunities for those who know how to navigate it wisely.

Understanding consolidation is crucial because it can provide insights into future price movements, helping investors make informed decisions. In this article, we will delve deeper into the concept of consolidation in stocks, its causes, advantages, drawbacks, and strategies for trading during these periods. We will also explore real-life case studies of successful consolidation. By the end of this article, you will have a comprehensive understanding of the concept and be equipped with the knowledge to effectively navigate consolidation in the stock market.

Definition of Consolidation in Stocks

Consolidation in stocks refers to a period when the price of a stock trades within a specific price range without showing any significant upward or downward movement. During this phase, the stock price will typically oscillate between a support level (the lower boundary of the range) and a resistance level (the upper boundary of the range).

Consolidation is often characterized by a lack of clear trend or momentum. Instead, the stock price moves in a sideways or horizontal fashion, forming a pattern known as a trading range. This trading range can last for days, weeks, or even months, depending on the underlying factors and market conditions.

There are several key components that define consolidation in stocks:

- Price Range: Consolidation occurs when the stock price remains within a specific range. This range is formed by identifying clear levels of support and resistance.

- Sideways Movement: During consolidation, the stock price exhibits little to no upward or downward movement. It often moves horizontally, indicating a lack of clear market direction.

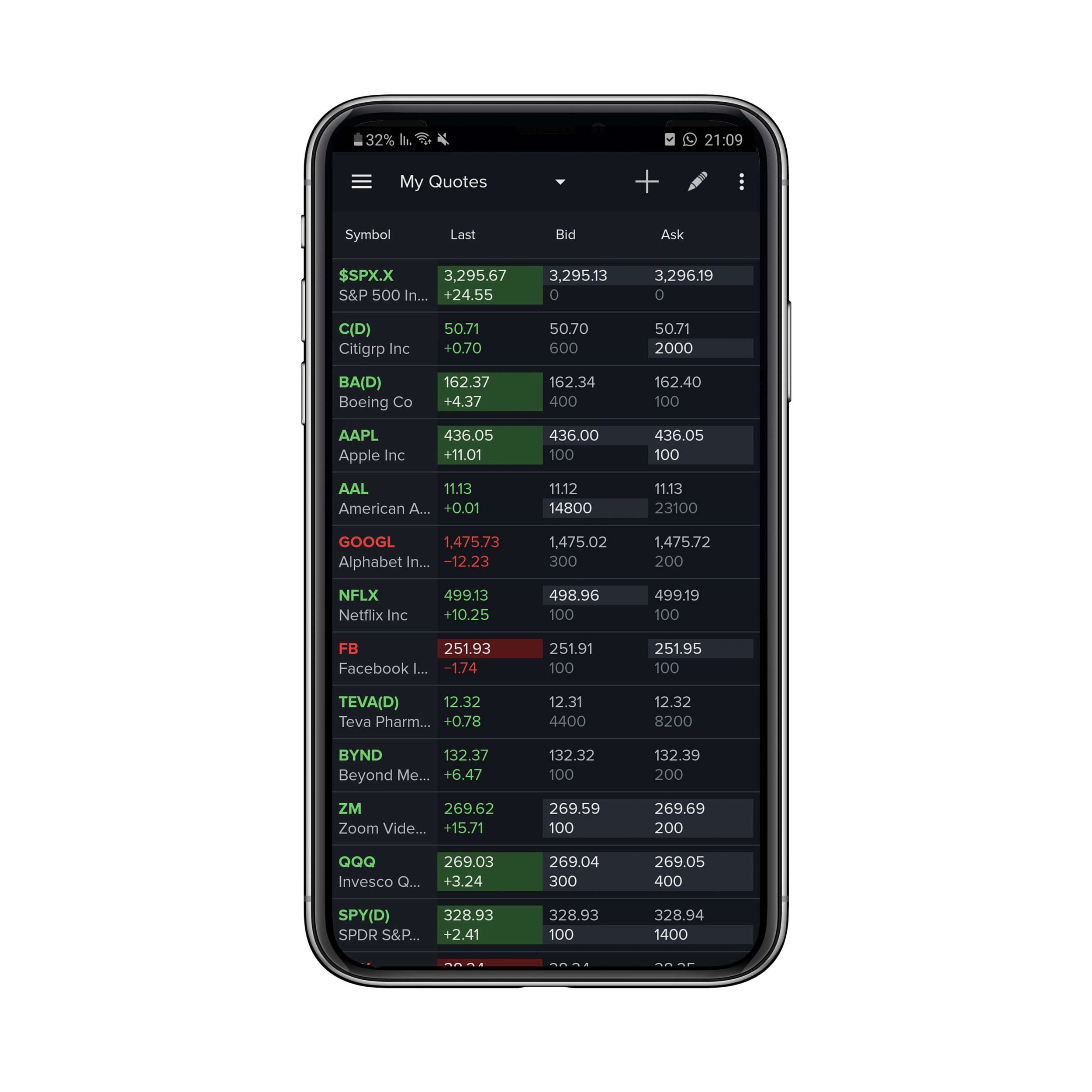

- Volume: Volume tends to be lower during consolidation compared to periods of significant price movements. This reflects a decline in market activity and liquidity.

- Duration: Consolidation can last for varying lengths of time, ranging from a few days to several months. The duration of consolidation is influenced by market conditions and the underlying factors impacting the stock.

It’s important to note that consolidation is a temporary phase in the stock market, and eventually, the stock price will break out of the trading range, signaling the start of a new trend. Traders and investors can use consolidation patterns as a tool for predicting future price movements and identifying potential trading opportunities.

Factors contributing to Consolidation in Stocks

Consolidation in stocks can occur due to a variety of factors. Understanding these factors can provide insights into why a stock is experiencing a period of consolidation and help investors make more informed trading decisions. Here are some of the key factors that contribute to consolidation:

- Market Sentiment: The overall sentiment of the market can play a significant role in causing consolidation in stocks. During times of uncertainty or market indecision, investors may hesitate to take new positions, leading to a lack of clear trends and price movement.

- Earnings Reports: Quarterly earnings reports can impact stock prices and trigger consolidation. If a company’s earnings report falls short of expectations, it can create uncertainty among investors, causing the stock to enter a consolidation phase.

- Market Overbought or Oversold Conditions: When a stock or the overall market becomes overbought or oversold, it can result in a period of consolidation. Overbought conditions indicate that the stock price has risen too rapidly and may need to stabilize, while oversold conditions suggest that the stock price has fallen too much and needs time to recover.

- News and Events: Significant news or events, such as economic data releases, geopolitical tensions, or regulatory changes, can cause consolidation in stocks. Uncertainty surrounding these events can lead to a lack of direction in the market.

- Company-specific Factors: Internal factors related to a specific company can contribute to consolidation. These factors may include changes in management, mergers and acquisitions, legal issues, or product launches. Investors may adopt a wait-and-see approach during these times, resulting in a period of consolidation.

It’s important to note that consolidation is a natural part of the stock market cycle and can occur in individual stocks, sectors, or the overall market. By analyzing these contributing factors, traders and investors can gain a better understanding of why a stock is consolidating and make more informed trading decisions.

Benefits and Drawbacks of Consolidation in Stocks

Consolidation in stocks can have both advantages and disadvantages for traders and investors. Understanding these benefits and drawbacks is crucial for making informed decisions during periods of consolidation. Let’s explore them in more detail:

Benefits:

- Accumulation Phase: Consolidation provides an opportunity for investors to accumulate shares at relatively lower prices. As the stock price moves within a specific range, investors can gradually build their positions, anticipating a breakout when the consolidation phase ends.

- Finding Support and Resistance Levels: Consolidation can help identify key support and resistance levels for a stock. These levels can serve as valuable reference points for setting stop-loss orders, determining profit targets, or establishing entry and exit points for trades.

- Chart Pattern Recognition: Trading ranges formed during consolidation can create recognizable chart patterns such as triangles, rectangles, or flags. These patterns provide traders with valuable signals for potential breakouts or reversals, allowing them to take advantage of future price movements.

- Reduced Volatility: Consolidation periods tend to have lower volatility compared to periods of strong trends. This can be beneficial for risk-averse investors who prefer more stable price movements and want to avoid sudden, unpredictable price swings.

Drawbacks:

- Limited Profit Opportunities: During consolidation, the stock price often exhibits limited upward or downward movement. This can restrict the profit potential for short-term traders who rely on volatility to generate gains.

- False Breakouts: Breakouts from consolidation patterns can sometimes result in false signals. The stock may briefly break out of the trading range but quickly reverse direction, trapping traders who enter positions based on the false breakout.

- Extended Duration: Consolidation can last for prolonged periods, causing frustration and impatience among traders. It requires discipline and patience to wait for a breakout or a clear trend to emerge, which can test the psychological resilience of investors.

- Uncertainty and Indecision: Consolidation often occurs during periods of market uncertainty and indecision. This can create a challenging environment for traders and investors, as the lack of clear direction makes it harder to make well-informed trading decisions.

It’s important for traders and investors to weigh these benefits and drawbacks and adapt their strategies accordingly during periods of consolidation. By understanding the potential opportunities and challenges that consolidation presents, one can optimize their trading approach and minimize potential risks.

Strategies for Trading during Consolidation in Stocks

Trading during consolidation in stocks requires a different approach compared to trading in trending markets. Here are some effective strategies to consider when navigating the challenges of consolidation:

- Range Trading: One popular strategy during consolidation is range trading. Traders identify the support and resistance levels of the trading range and look for opportunities to buy near the support level and sell near the resistance level. This strategy aims to capitalize on the predictable price movements within the range.

- Breakout Trading: Breakout trading involves identifying key levels of support or resistance and waiting for the stock price to break out of the consolidation range. Traders can enter positions on the breakout in the direction of the breakout, betting on a continuation of the trend. It’s important to wait for confirmation of the breakout to avoid false signals.

- Volatility-Based Strategies: While consolidation might reduce overall volatility, short-term traders can still take advantage of smaller price fluctuations within the range. Techniques such as scalping, day trading, or using option strategies can help capitalize on short-term price movements during consolidation.

- Pattern Recognition: Analyzing chart patterns formed during consolidation can provide valuable insight into potential future price movements. Patterns like triangles, rectangles, or flags often precede breakouts or reversals. Traders can use these patterns as a basis for their entry and exit points.

- Adaptive Trading Approach: The key to successful trading during consolidation is flexibility. Traders need to adapt their strategies based on the specific characteristics of the stock and market conditions. This may involve using shorter time frames, adjusting position sizes, or utilizing different technical indicators.

It’s important to note that regardless of the chosen strategy, risk management should always be a top priority. Implementing proper stop-loss orders and practicing disciplined risk control is crucial to protect capital during periods of unpredictability.

Ultimately, the success of trading during consolidation depends on careful analysis, adaptability, and a thorough understanding of the underlying factors influencing the stock. Traders should continuously monitor the price action, volume, and news events to make informed decisions when navigating the challenges of consolidation.

Case Studies of Successful Consolidation in Stocks

Examining real-life case studies can provide valuable insights into how consolidation in stocks can present profitable trading opportunities. Let’s explore a couple of examples:

Case Study 1: ABC Company

ABC Company, a technology firm, experienced a period of consolidation after a significant uptrend. The stock had been trading in a range between $50 and $60 for several weeks. Traders recognized this consolidation pattern and implemented a range trading strategy. They would buy near the support level of $50 and sell near the resistance level of $60.

After observing the stock’s behavior within the range for some time, traders noticed increasing buying pressure near the support level and diminishing selling pressure near the resistance level. This indicated a potential breakout. When the stock finally broke above the $60 resistance level with high volume, traders entered long positions, expecting a continuation of the uptrend.

The breakout from the consolidation range led to a significant price surge, with the stock reaching new highs at $75. Traders who identified and capitalized on this consolidation pattern were able to generate substantial profits by effectively timing their entry and exit points.

Case Study 2: XYZ Company

XYZ Company, a pharmaceutical company, experienced a prolonged period of consolidation due to uncertainties surrounding regulatory approvals for one of their drugs. The stock had been trading within a range between $30 and $40 for nearly two months, with low volatility and volume.

Traders recognized this consolidation pattern and adopted a breakout trading strategy. They patiently waited for a catalyst that could potentially lead to a breakout and a new trend. When news of a positive regulatory development was announced, the stock quickly broke above the $40 resistance level with a surge in volume.

Traders who identified this breakout and entered long positions were able to ride the price momentum as the stock soared to $50 within a short period. By closely monitoring the stock’s consolidation pattern and having the patience to wait for a significant catalyst, these traders were able to capitalize on the breakout and reap substantial profits.

These case studies highlight the importance of recognizing consolidation patterns, implementing appropriate trading strategies, and having patience to wait for key catalysts. Successful traders who can identify and leverage consolidation periods have the potential to profit from breakouts and subsequent price movements.

Conclusion

Consolidation in stocks is a common occurrence in the financial markets. It refers to a period when the price of a stock trades within a defined range without showing significant upward or downward movement. Traders and investors need to understand and adapt to these consolidation phases in order to make informed trading decisions.

Throughout this article, we have explored the definition of consolidation in stocks and the factors contributing to this phenomenon. We have also discussed the benefits and drawbacks of consolidation, as well as strategies for trading during these periods. Case studies of successful consolidation have provided practical insights into how traders can capitalize on price range-bound movements.

Consolidation can present both opportunities and challenges. The range trading strategy allows traders to profit from predictable price movements within the consolidation range, while breakout trading allows traders to enter positions as the stock breaks out of the range. Volatility-based strategies, pattern recognition, and adaptive trading approaches are also useful techniques during consolidation periods.

It is important to note that consolidation is a temporary phase in the stock market. Traders and investors should always exercise caution and employ proper risk management techniques. Setting appropriate stop-loss orders and being mindful of market sentiment and news events can help manage risk effectively.

By understanding and applying the concepts and strategies outlined in this article, traders and investors can navigate periods of consolidation with greater confidence and potentially profit from the subsequent price movements. Consolidation can be seen as an opportunity to accumulate shares at lower prices, identify key support and resistance levels, and recognize chart patterns that may signal future breakout or reversal opportunities.

In conclusion, consolidation in stocks is a natural part of market dynamics and can offer unique opportunities for those who know how to interpret and act upon them. By staying informed, adapting to market conditions, and employing appropriate trading strategies, traders and investors can maximize their potential for success during consolidation phases in the stock market.