Home>Finance>How Do State Public Pension Funds Amortize Portfolio Losses?

Finance

How Do State Public Pension Funds Amortize Portfolio Losses?

Published: January 23, 2024

Learn how state public pension funds amortize portfolio losses in finance, ensuring stability and sustainability for future retirees.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

State public pension funds play a crucial role in providing retirement benefits to millions of public employees across the United States. These funds are designed to ensure financial security for retired public servants, and their management is a topic of significant public interest and scrutiny. One of the key challenges faced by state public pension funds is the management of portfolio losses, which can have far-reaching implications for the fund's financial health and its ability to fulfill its long-term obligations.

The amortization of portfolio losses is a complex yet essential aspect of managing state public pension funds. It involves the strategic allocation of resources to mitigate the impact of investment downturns and stabilize the fund's financial position over time. Understanding how state public pension funds amortize portfolio losses is critical for policymakers, fund managers, and stakeholders to make informed decisions that safeguard the interests of current and future retirees.

In this article, we will delve into the methods and strategies employed by state public pension funds to amortize portfolio losses. By exploring the intricacies of these approaches and their implications, we can gain valuable insights into the financial dynamics of pension fund management. Additionally, we will examine the potential long-term effects of different amortization methods on the sustainability and stability of state public pension funds. This exploration will provide a comprehensive understanding of the challenges and opportunities associated with managing portfolio losses within the context of public pension funds.

As we navigate through the complexities of amortization methods used by state public pension funds, it is essential to recognize the broader impact of these strategies on the financial well-being of retirees and the fiscal responsibilities of state governments. By shedding light on this critical aspect of pension fund management, we aim to empower readers with a deeper understanding of the mechanisms employed to navigate investment challenges and uphold the integrity of public pension systems.

Background on State Public Pension Funds

State public pension funds are instrumental in providing retirement benefits to public employees, including teachers, firefighters, police officers, and other government workers. These funds serve as a cornerstone of financial security for individuals who dedicate their careers to public service. State governments sponsor and manage these pension funds, which are funded through a combination of employee contributions, employer contributions, and investment returns.

Public pension funds operate on the premise of long-term sustainability, aiming to ensure that retirees receive adequate financial support throughout their post-employment years. The funds are typically structured as defined benefit plans, where retirees are entitled to receive predetermined benefits based on factors such as years of service and salary history. This contrasts with defined contribution plans, where the retirement benefits are based on the performance of individual investment accounts.

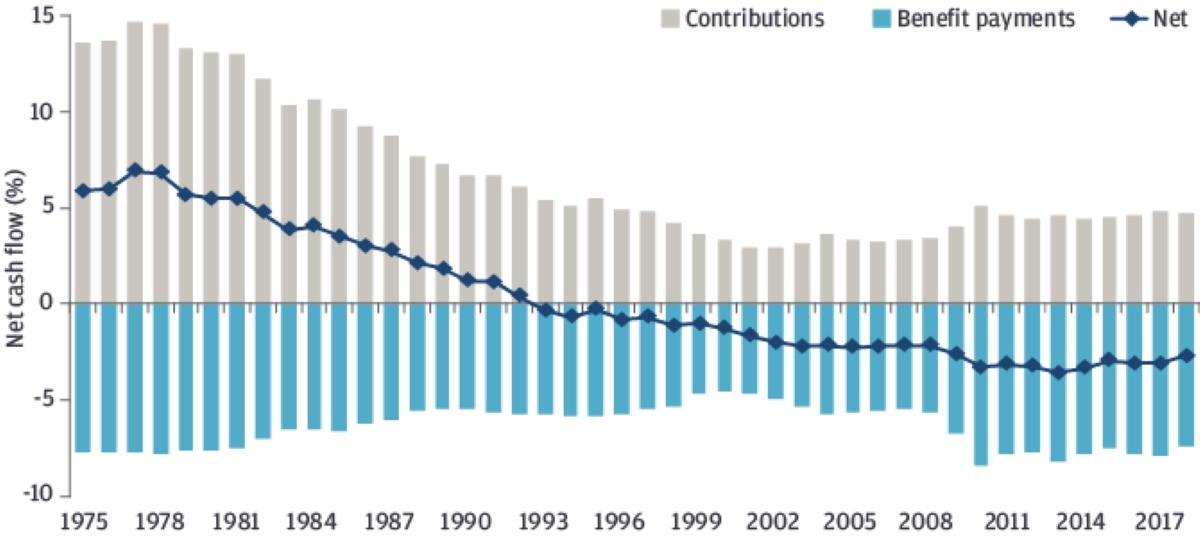

Over the years, state public pension funds have faced challenges stemming from factors such as demographic shifts, economic fluctuations, and investment volatility. Demographic changes, including an aging population and shifts in workforce dynamics, have influenced the fund’s obligations and funding requirements. Economic downturns and market volatility can impact the fund’s investment portfolio, leading to periods of negative returns and portfolio losses.

Furthermore, the financial health of state public pension funds has garnered attention due to concerns about unfunded liabilities – the difference between the funds’ assets and the present value of their future benefit obligations. Addressing these liabilities and ensuring the long-term solvency of pension funds are critical priorities for state governments and pension fund administrators.

Given the integral role of state public pension funds in supporting retired public servants, the management of these funds is subject to regulatory oversight, financial analysis, and public accountability. Policymakers, financial experts, and stakeholders closely monitor the performance and sustainability of these funds, seeking to implement strategies that uphold their fiduciary responsibilities and safeguard the retirement security of public employees.

Understanding the foundational principles and operational dynamics of state public pension funds provides essential context for comprehending the challenges and considerations associated with amortizing portfolio losses. By examining the historical and structural aspects of these funds, we can appreciate the significance of prudent financial management and strategic decision-making in preserving the integrity of public pension systems.

Amortization of Portfolio Losses

Amortization of portfolio losses refers to the process through which state public pension funds address and mitigate the impact of investment downturns on their overall financial position. When the fund’s investment portfolio experiences losses, it can have implications for the fund’s ability to meet its long-term obligations to retirees. Amortization strategies are designed to spread the recognition of these losses over a defined period, thereby moderating their immediate effect on the fund’s financial health.

This approach is rooted in the recognition that investment performance can fluctuate over time, and sudden or severe losses can strain the fund’s resources, potentially leading to funding gaps and financial instability. By amortizing portfolio losses, pension funds aim to navigate through these challenges while maintaining a sustainable path towards fulfilling their commitments to retirees.

Amortization methods are instrumental in shaping the fund’s financial trajectory and influencing its capacity to withstand market volatility. These methods are designed to balance the need for short-term stability with the long-term objective of ensuring the fund’s solvency and ability to provide retirement benefits to public employees.

Key considerations in the amortization of portfolio losses include the duration of the amortization period, the calculation of actuarial values, and the impact on the fund’s funding requirements. The selection of an amortization method involves evaluating various factors, including the fund’s investment strategy, risk tolerance, and the regulatory framework governing pension fund management.

It is important to note that the amortization of portfolio losses is a dynamic and nuanced process, influenced by market conditions, demographic trends, and legislative measures aimed at pension fund reform. The effectiveness of amortization methods is evaluated based on their ability to strike a balance between short-term financial stability and the long-term sustainability of the fund.

As we delve into the methods used by state public pension funds to amortize portfolio losses, we will gain insights into the intricate interplay between investment management, actuarial principles, and financial stewardship. Understanding the nuances of amortization strategies is essential for comprehending the broader landscape of pension fund management and the implications of these methods on the fund’s financial resilience and capacity to fulfill its obligations to retirees.

Methods Used by State Public Pension Funds

State public pension funds employ various methods to amortize portfolio losses, each with distinct characteristics and implications for the fund’s financial position. These methods are designed to address the impact of investment downturns and manage the fund’s funding requirements over time. Understanding the key approaches used by pension funds sheds light on the diverse strategies employed to navigate investment challenges and uphold the fund’s long-term sustainability.

One common method is the level dollar amortization, which involves spreading the recognition of portfolio losses in equal annual installments over a specified period. This method provides a predictable and consistent approach to addressing losses, enabling the fund to manage its financial obligations while mitigating the immediate impact of investment downturns.

Another approach is the level percentage of payroll method, which links the amortization of losses to the fund’s payroll base. By incorporating a percentage of the fund’s payroll into the amortization calculation, this method aligns the recognition of losses with the fund’s workforce-related financial dynamics, offering a mechanism that reflects the fund’s demographic and employment characteristics.

Additionally, state public pension funds may utilize the amortization base method, which involves setting a target amortization base and adjusting the annual amortization amount based on the fund’s funding ratio and other relevant factors. This method allows for flexibility in addressing portfolio losses, adapting the amortization approach to the fund’s financial position and funding requirements.

Furthermore, the entry age normal method is employed by some pension funds, basing the amortization of losses on the age of plan participants when they enter the pension system. This method considers the long-term implications of portfolio losses in relation to the participants’ entry into the fund, aiming to distribute the recognition of losses in a manner that reflects the participants’ tenure and expected benefit accrual.

Each of these methods offers a distinct perspective on how state public pension funds amortize portfolio losses, reflecting considerations such as financial predictability, workforce dynamics, funding ratio adjustments, and participant demographics. The selection of an amortization method is influenced by the fund’s specific characteristics, investment objectives, and regulatory requirements, underscoring the need for a tailored approach that aligns with the fund’s long-term financial objectives.

By examining the diverse methods used by state public pension funds to address portfolio losses, we can gain a comprehensive understanding of the nuanced strategies employed to navigate investment challenges and uphold the fund’s fiscal responsibilities. These methods serve as pivotal mechanisms in shaping the financial trajectory of pension funds and ensuring the sustainable provision of retirement benefits to public employees.

Implications of Amortization Methods

The selection of amortization methods by state public pension funds carries significant implications for the fund’s financial stability, funding requirements, and long-term capacity to fulfill retirement obligations. These methods influence the fund’s ability to navigate investment challenges, manage funding shortfalls, and uphold its fiduciary responsibilities to current and future retirees.

One key implication of amortization methods is their impact on the fund’s financial predictability. The choice of a specific method can shape the fund’s ability to anticipate and manage future funding requirements, providing clarity on the recognition of portfolio losses and their gradual amortization over time. Methods that offer greater predictability can enhance the fund’s financial planning and risk management, enabling stakeholders to make informed decisions based on a more stable funding trajectory.

Furthermore, amortization methods have implications for the fund’s contribution dynamics. The chosen method can influence the allocation of contributions from employees and employers, as well as the potential need for additional funding to address amortized losses. Methods that align the recognition of losses with the fund’s demographic and payroll dynamics can impact contribution levels and funding stability, shaping the financial responsibilities of both the pension fund and its participants.

Another implication lies in the long-term financial impact of amortization methods. The manner in which portfolio losses are recognized and amortized can have lasting effects on the fund’s funding ratio, asset allocation decisions, and overall financial resilience. Methods that effectively balance short-term stabilization with long-term sustainability can contribute to the fund’s ability to withstand market volatility and demographic shifts, safeguarding its capacity to meet future benefit obligations.

Moreover, amortization methods can influence the fund’s regulatory compliance and reporting requirements. The chosen method must align with regulatory standards and actuarial principles, ensuring transparency and accountability in the fund’s financial management. Adhering to regulatory guidelines and best practices is essential for maintaining public trust and demonstrating the fund’s commitment to responsible stewardship of pension assets.

Additionally, the implications of amortization methods extend to the fund’s ability to adapt to changing economic and demographic conditions. Methods that offer flexibility and responsiveness to evolving financial landscapes can position the fund to address emerging challenges and opportunities, fostering resilience in the face of dynamic market forces and demographic transitions.

By comprehensively examining the implications of amortization methods, stakeholders, policymakers, and fund administrators can gain valuable insights into the multifaceted considerations that underpin pension fund management. Understanding the far-reaching effects of these methods is essential for making informed decisions that uphold the financial integrity of state public pension funds and secure the retirement well-being of public employees.

Conclusion

The management of portfolio losses through effective amortization methods is a critical aspect of ensuring the long-term financial sustainability and integrity of state public pension funds. As these funds play a pivotal role in providing retirement security to public employees, the selection and implementation of amortization strategies carry far-reaching implications for the fund’s ability to fulfill its obligations and navigate investment challenges.

By delving into the diverse methods used by state public pension funds to address portfolio losses, we gain a comprehensive understanding of the nuanced approaches employed to manage funding shortfalls and stabilize the fund’s financial trajectory. The implications of these methods extend to financial predictability, contribution dynamics, long-term financial impact, regulatory compliance, and adaptability to changing economic and demographic conditions.

It is evident that the selection of an amortization method is a multifaceted decision that requires careful consideration of the fund’s unique characteristics, investment objectives, and regulatory framework. The method chosen must align with the fund’s long-term financial objectives, providing a balance between short-term stabilization and sustainable funding practices.

As state public pension funds navigate the complexities of amortizing portfolio losses, it is imperative for stakeholders, policymakers, and fund administrators to collaborate in making informed decisions that uphold the fund’s fiduciary responsibilities and secure the retirement well-being of public employees. Transparency, accountability, and a forward-looking approach to financial management are essential elements in safeguarding the integrity of pension assets and ensuring the long-term solvency of state public pension funds.

Ultimately, the effective amortization of portfolio losses contributes to the fund’s ability to weather market volatility, demographic shifts, and economic uncertainties, fostering a resilient and sustainable foundation for providing retirement benefits to public servants. By recognizing the significance of amortization methods and their implications, we can advance the collective efforts to preserve the essential role of state public pension funds in supporting the financial security and well-being of retirees.

Through ongoing dialogue, informed decision-making, and a commitment to prudent financial stewardship, state public pension funds can navigate investment challenges with resilience and uphold their fundamental mission of providing reliable and sustainable retirement benefits to public employees.