Home>Finance>How To Record Employee Retention Credit In Quickbooks Desktop

Finance

How To Record Employee Retention Credit In Quickbooks Desktop

Modified: January 5, 2024

Learn how to record the employee retention credit in Quickbooks Desktop with this comprehensive guide. Maximize your finance management and optimize your tax savings.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Employee Retention Credit

- Requirements for Eligibility

- Steps to Set Up Employee Retention Credit in QuickBooks Desktop

- Recording Employee Retention Credit in QuickBooks Desktop

- Allocating Employee Retention Credit to Payroll Expenses

- Utilizing the Employee Retention Credit against Payroll Taxes

- Reporting and Documentation Requirements

- Conclusion

Introduction

In today’s competitive job market, companies strive to attract and retain top talent. Employee retention is crucial for the success and growth of any organization. However, the COVID-19 pandemic has presented unique challenges, resulting in businesses facing unprecedented disruptions.

To help businesses navigate through these challenging times and encourage employee retention, the U.S. government introduced the Employee Retention Credit (ERC) as part of the COVID-19 relief measures. The ERC is a refundable tax credit aimed at encouraging eligible employers to retain employees on their payroll.

For businesses using QuickBooks Desktop, it is essential to understand how to properly record the Employee Retention Credit. This article will provide a step-by-step guide on setting up and recording the Employee Retention Credit in QuickBooks Desktop.

By understanding and implementing the correct procedures, businesses can effectively utilize the Employee Retention Credit to offset payroll expenses and reduce their tax liabilities.

In the following sections, we will explain the eligibility requirements for the Employee Retention Credit, provide detailed instructions on setting up the credit in QuickBooks Desktop, and guide you through the process of recording the credit and allocating it to payroll expenses.

With this comprehensive guide, you’ll be equipped with the knowledge to navigate the complexities of the Employee Retention Credit in QuickBooks Desktop, ensuring accurate record-keeping and compliance.

Let’s dive in and uncover the steps to effectively record Employee Retention Credit in QuickBooks Desktop!

Understanding Employee Retention Credit

The Employee Retention Credit (ERC) is a tax credit introduced by the U.S. government to encourage eligible employers to keep employees on their payroll during periods of economic hardship, such as the COVID-19 pandemic. The credit was initially implemented as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020 and has been extended and expanded under subsequent legislation.

The ERC aims to provide financial support to businesses that have experienced significant revenue losses or had to partially or fully suspend their operations due to government orders related to COVID-19. By offering a tax credit, the government incentivizes employers to retain their workforce, promoting economic stability and recovery.

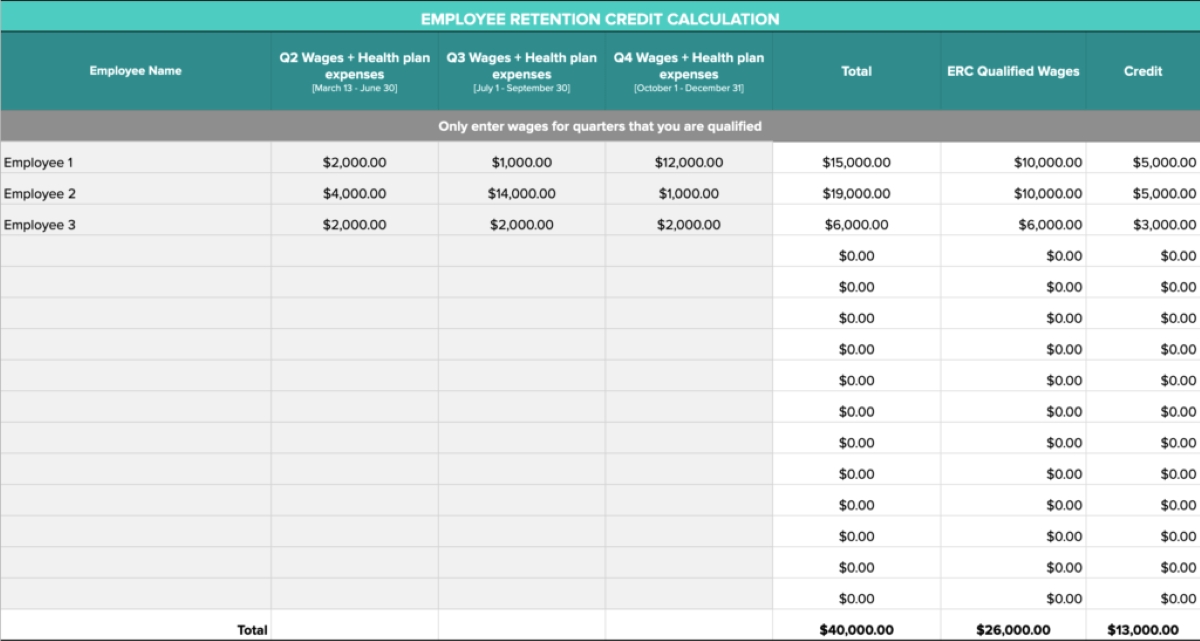

Eligible employers can claim the credit against their payroll taxes, with the potential to receive a refund if the credit exceeds their tax liability. The credit is equal to a percentage of qualified wages paid to eligible employees during specific periods.

It is important to note that the ERC is available to both for-profit and non-profit organizations, as well as certain governmental entities, provided they meet the eligibility criteria.

The ERC has undergone several changes and updates since its inception, and it is essential for employers to stay informed about the latest guidelines and modifications. Consulting with a tax professional or accessing official resources from the Internal Revenue Service (IRS) can help businesses understand the specific requirements and take full advantage of the credit.

Next, we will explore the eligibility requirements for the Employee Retention Credit, ensuring that your business meets the necessary criteria to claim the credit.

Requirements for Eligibility

In order to qualify for the Employee Retention Credit (ERC), businesses must meet specific eligibility requirements. Understanding these requirements is crucial to determine if your company is eligible to claim the credit.

The eligibility criteria for the ERC include:

- Significant decline in gross receipts: To qualify for the credit, businesses must demonstrate a significant decline in gross receipts. For 2020, the decline must be at least 50% compared to the same quarter in 2019. For 2021, the threshold has been reduced to 20% compared to the corresponding quarter in 2019.

- Suspended operations: Businesses that are partially or fully suspended due to governmental orders related to COVID-19 can also be eligible for the credit. This includes businesses that had to limit their operations or close entirely due to safety concerns or compliance with government guidelines.

- Employee count: The eligibility criteria also depend on the size of the business. For 2020, businesses with 100 or fewer full-time employees can claim the credit for wages paid to all employees. For 2021, this threshold has been increased to businesses with 500 or fewer full-time employees.

- Qualified wages: The ERC can be claimed for qualified wages paid to eligible employees during specific periods. For 2020, qualified wages are those paid between March 13, 2020, and December 31, 2020. For 2021, the eligible period is extended from January 1, 2021, to December 31, 2021. The maximum credit amount is $5,000 per employee for 2020 and $7,000 per employee per quarter for 2021.

It is important to note that the eligibility requirements and guidelines for the Employee Retention Credit may change over time. Staying updated with the latest information from the Internal Revenue Service (IRS) or consulting with a tax professional can ensure compliance with the current regulations.

Now that you understand the eligibility requirements, let’s proceed to the next section, where we will guide you through the process of setting up the Employee Retention Credit in QuickBooks Desktop.

Steps to Set Up Employee Retention Credit in QuickBooks Desktop

Setting up the Employee Retention Credit (ERC) in QuickBooks Desktop involves a few key steps to ensure accurate tracking and recording of the credit. Follow these steps to set up the ERC in QuickBooks Desktop:

- Update QuickBooks Desktop: Ensure that you are using the latest version of QuickBooks Desktop. Regularly updating your software ensures that you have access to the most up-to-date features and functionality related to the ERC.

- Create a new payroll item: In QuickBooks Desktop, navigate to the Payroll Item List and create a new payroll item for the ERC. Name the item “Employee Retention Credit” or any relevant name that helps you identify the credit.

- Set the payroll item type: Assign the appropriate payroll item type to the ERC item. Choose the “Credit” option to reflect that it is a credit item.

- Set the calculation type: Determine how the ERC will be calculated. If you are using a percentage-based calculation, select the option that allows you to enter a percentage. Alternatively, if you have a fixed amount for the credit, choose the option that allows you to enter a specific amount.

- Specify the tax tracking type: Select the tax tracking type for the payroll item. Choose the appropriate option that aligns with the tax implications of the ERC. Consult with a tax professional or refer to official guidelines to ensure correct tax tracking.

- Set the liability account: Assign the liability account where the ERC will be recorded. This account should be specific to the ERC and separate from other payroll liabilities.

- Assign the expense account: Specify the expense account where the wages associated with the ERC will be recorded. This allows you to track the impact of the credit on your financial statements.

- Set the Vendor/Payee: Assign the vendor or payee for the ERC payment. This step helps in accurately recording the payment and ensuring proper documentation for reporting purposes.

By following these steps, you will be able to set up the Employee Retention Credit in QuickBooks Desktop and ensure proper tracking and recording of the credit.

Next, we will move on to the process of recording the Employee Retention Credit in QuickBooks Desktop. Stay tuned!

Recording Employee Retention Credit in QuickBooks Desktop

Once you have set up the Employee Retention Credit (ERC) in QuickBooks Desktop, you can proceed with recording the credit for accurate tracking and reporting. Here is a step-by-step guide on how to record the Employee Retention Credit in QuickBooks Desktop:

- Create a paycheck: Start by creating a regular paycheck for the employee who is eligible for the ERC.

- Select the Employee Retention Credit item: In the Earnings section of the paycheck, select the “Employee Retention Credit” item that you created earlier from the payroll item list.

- Enter the amount: Enter the appropriate amount of the Employee Retention Credit for that employee in the Amount field. This amount should reflect the credit amount based on the guidelines and calculations.

- Save the paycheck: Save the paycheck to record the Employee Retention Credit for that employee.

By following these steps, you can accurately record the Employee Retention Credit for each eligible employee in QuickBooks Desktop. This ensures proper documentation and tracking of the credit.

Now, let’s move on to the next section, where we will explore the process of allocating the Employee Retention Credit to payroll expenses in QuickBooks Desktop.

Allocating Employee Retention Credit to Payroll Expenses

Once you have recorded the Employee Retention Credit (ERC) for eligible employees in QuickBooks Desktop, it is important to allocate the credit to the appropriate payroll expenses. Allocating the ERC to payroll expenses correctly ensures accurate financial reporting and tracking. Here’s how you can allocate the Employee Retention Credit to payroll expenses in QuickBooks Desktop:

- Create a new expense account: Start by creating a new expense account in QuickBooks Desktop specifically for the Employee Retention Credit. This account will be used to track the impact of the credit on your financial statements.

- Assign the expense account to the ERC: Go to the Payroll Item List and select the “Employee Retention Credit” item. Edit the item and assign the newly created expense account as the default account for the credit.

- Edit the paycheck: Open the paycheck for an employee who has received the ERC and go to the Expenses section. Edit the liability account associated with the ERC to the specific expense account created for the credit.

- Save the changes: Save the changes to the paycheck, ensuring that the Employee Retention Credit is now allocated to the designated expense account.

By following these steps, you can allocate the Employee Retention Credit to the appropriate payroll expenses in QuickBooks Desktop. This allows for accurate tracking of the credit’s impact on your financial statements and ensures compliance with reporting requirements.

Next, we will explore how to utilize the Employee Retention Credit against payroll taxes in QuickBooks Desktop. Stay tuned!

Utilizing the Employee Retention Credit against Payroll Taxes

The Employee Retention Credit (ERC) can be utilized by eligible employers to offset their payroll taxes. By reducing the amount of payroll taxes owed, businesses can effectively reduce their tax liabilities and free up funds for other business needs. Here’s how you can utilize the Employee Retention Credit against payroll taxes in QuickBooks Desktop:

- Calculate the total ERC amount: Determine the total amount of Employee Retention Credit available to your business for a specific period. This is calculated based on the qualified wages and the percentage set for the ERC.

- Assess the payroll tax liability: Calculate your regular payroll tax liability for the same period. This includes federal income tax withholding, Social Security tax, Medicare tax, and any other applicable state or local taxes.

- Apply the ERC against payroll taxes: In QuickBooks Desktop, access the Pay Liabilities feature and select the period for which you want to apply the ERC. Enter the total ERC amount in the appropriate field or allocate the credit to specific tax liabilities as per the guidelines.

- Record the adjustment: Save the adjustment to apply the Employee Retention Credit against your payroll taxes. QuickBooks Desktop will automatically update your payroll tax liabilities and reflect the reduction due to the ERC.

Utilizing the Employee Retention Credit against payroll taxes can provide significant financial relief for businesses. It is important to accurately calculate the credit amount and follow the correct procedures in QuickBooks Desktop to ensure compliance and accurate record-keeping.

Now that you understand how to utilize the Employee Retention Credit against payroll taxes, let’s move on to the reporting and documentation requirements associated with the ERC.

Reporting and Documentation Requirements

Reporting and documentation are essential when it comes to the Employee Retention Credit (ERC). Proper reporting ensures compliance with tax regulations and enables businesses to provide accurate information to the Internal Revenue Service (IRS) if required. Here are the reporting and documentation requirements for the ERC:

- Form 941: Employers must report the Employee Retention Credit on Form 941, the Employer’s Quarterly Federal Tax Return. Report the credit on Line 11c of Form 941 for the applicable quarter. Ensure that the credit amount is accurately recorded on the form.

- Retaining documentation: It is crucial to maintain all necessary documentation related to the ERC. This includes records of eligible employees, payroll records, documentation of the significant decline in gross receipts or suspended operations, and any other documentation required by the IRS. Keep these records organized and accessible for future reference or potential IRS audits.

- Consulting with a tax professional: Due to the complexities and ever-changing nature of tax laws, it is advisable to consult with a tax professional. They can provide guidance on the specific reporting and documentation requirements for your business based on the ERC and related regulations.

- Reviewing IRS guidelines: Stay updated with the latest guidelines and instructions issued by the IRS regarding the reporting and documentation of the ERC. Regularly check the IRS website for updates and resources to ensure compliance with the requirements.

Proper reporting and documentation are essential for businesses utilizing the Employee Retention Credit. By adhering to these requirements, you can avoid penalties and efficiently manage your tax obligations.

Now that you are familiar with the reporting and documentation requirements, let’s conclude our discussion on the Employee Retention Credit in QuickBooks Desktop.

Conclusion

The Employee Retention Credit (ERC) is a valuable tax credit that provides financial support to eligible businesses during challenging times, such as the COVID-19 pandemic. By understanding and utilizing the ERC, businesses can offset payroll expenses and reduce their tax liabilities, ultimately promoting employee retention and economic stability.

In this comprehensive guide, we have explored the steps to set up and record the ERC in QuickBooks Desktop. We discussed the eligibility requirements, including the significant decline in gross receipts, suspended operations, and employee count. Understanding these requirements is crucial to determine if your business qualifies for the credit.

We provided step-by-step instructions on how to set up the ERC in QuickBooks Desktop, record the credit for eligible employees, and allocate it to the appropriate payroll expenses. By following these procedures accurately, businesses can ensure compliance, accurate record-keeping, and reliable financial reporting.

We also highlighted the importance of utilizing the ERC against payroll taxes, reducing tax liabilities, and the associated reporting and documentation requirements. Staying updated with the latest guidelines from the IRS and consulting with a tax professional can help businesses navigate the complexities of the ERC.

Remember that the ERC may be subject to changes and updates over time, so it is crucial to stay informed and adapt accordingly. Regularly check official resources and consult with professionals to ensure you are taking full advantage of the credit.

By effectively utilizing the Employee Retention Credit in QuickBooks Desktop, businesses can not only retain valuable employees but also alleviate financial burdens during unprecedented times. Take the necessary steps to understand, set up, record, and report the ERC, and position your business for success.

Make sure to consult with a tax professional or refer to the official guidelines from the IRS for the most accurate and up-to-date information regarding the Employee Retention Credit.