Home>Finance>How Much Do Credit Card Charges Add To Merchant Fees?

Finance

How Much Do Credit Card Charges Add To Merchant Fees?

Published: February 24, 2024

Discover the impact of credit card charges on merchant fees and learn how they affect your finances. Find out more about managing financial costs effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The world of finance is a complex and ever-evolving landscape, with various elements playing pivotal roles in shaping its dynamics. One such element that significantly impacts financial transactions is credit card charges. These charges, often overlooked by the average consumer, have far-reaching implications, particularly for merchants. In this article, we will delve into the intricate web of credit card charges and their influence on merchant fees. By understanding the nuances of these charges and their implications, both consumers and merchants can make informed decisions to navigate the financial realm more effectively.

Credit card charges encompass a spectrum of fees imposed on merchants for processing card payments. While consumers enjoy the convenience and flexibility of using credit cards for transactions, merchants bear the brunt of associated charges. These charges, often overlooked by consumers, can substantially impact a merchant's bottom line. Therefore, gaining insight into the intricacies of credit card charges is crucial for both merchants and consumers.

Understanding the factors that influence credit card charges and their subsequent impact on merchant fees is essential for navigating the financial terrain effectively. By shedding light on these intricacies, this article aims to empower readers with comprehensive knowledge, enabling them to make informed decisions and adopt strategies to mitigate the impact of credit card charges on merchant fees. Let's embark on this enlightening journey to unravel the complexities of credit card charges and their profound implications.

Understanding Credit Card Charges

Credit card charges encompass a range of fees that merchants incur for processing credit card transactions. These fees typically include interchange fees, assessment fees, and processing fees. Interchange fees, set by credit card networks like Visa and Mastercard, are paid by the merchant’s bank to the cardholder’s bank to cover the cost of risk and fraud, as well as the use of the card network. Assessment fees, also determined by the card networks, contribute to the overall cost of processing transactions. Additionally, processing fees are charged by the merchant service provider for handling the transaction.

It’s crucial to comprehend that credit card charges are not fixed and can vary based on numerous factors, including the type of credit card used, the nature of the transaction (in-person or online), and the merchant’s industry. For instance, rewards cards and business cards often carry higher interchange fees, impacting the overall credit card charges for merchants. Furthermore, online transactions, which are deemed riskier due to the potential for fraud, may incur higher processing fees.

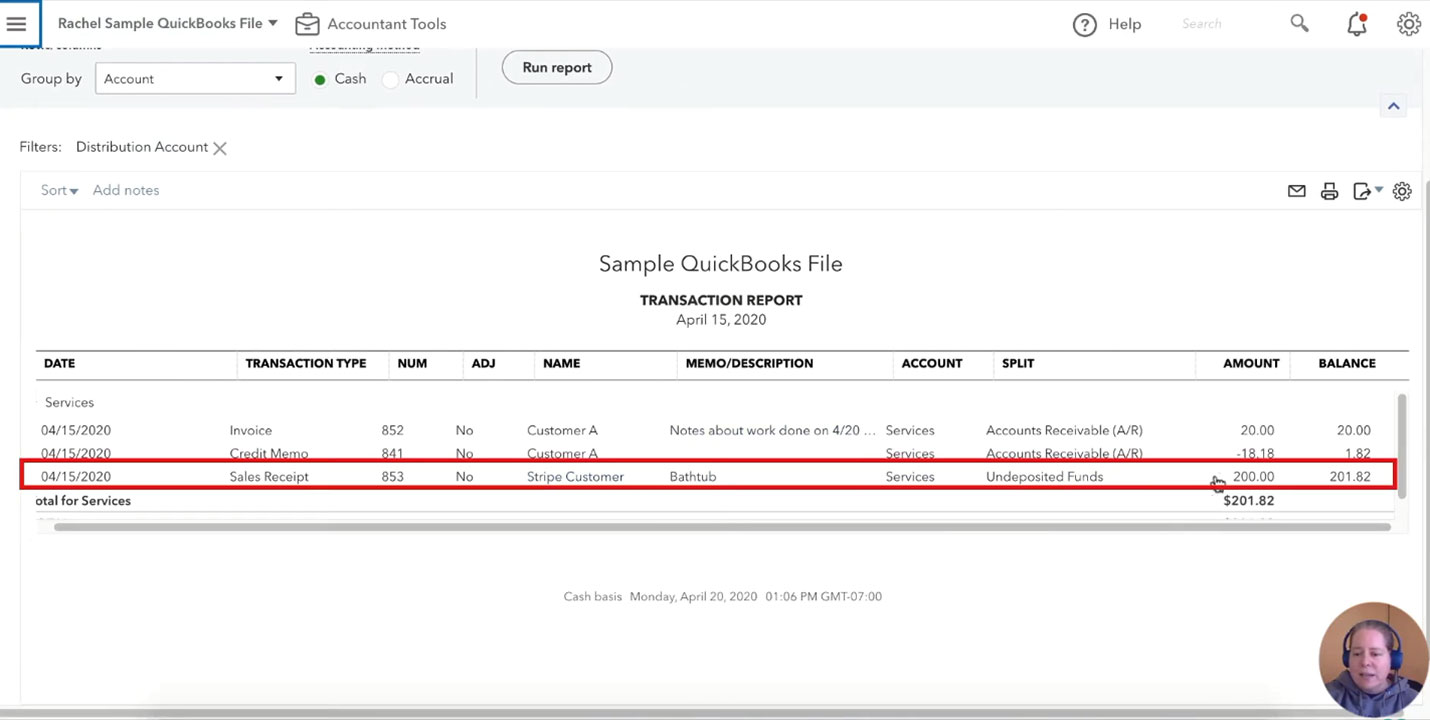

Merchants must also navigate the complexities of flat-rate pricing versus interchange-plus pricing models. Under a flat-rate model, merchants pay a fixed percentage and a per-transaction fee, offering simplicity but potentially resulting in higher costs for certain transactions. In contrast, the interchange-plus model involves a transparent breakdown of interchange fees and processing costs, offering more flexibility and potential cost savings for merchants.

By comprehending the multifaceted nature of credit card charges, merchants can make informed decisions regarding their payment processing strategies. Understanding the various components of credit card charges equips merchants with the knowledge needed to assess and negotiate fees effectively, ultimately impacting their bottom line.

Factors Affecting Credit Card Charges

Credit card charges are influenced by a multitude of factors that contribute to the complex fee structures imposed on merchants. Understanding these factors is crucial for merchants seeking to optimize their payment processing costs. One significant factor is the type of credit card used for the transaction. Different card types, such as rewards cards, corporate cards, and standard consumer cards, carry varying interchange fees, directly impacting the overall credit card charges for merchants. Rewards cards, for instance, often entail higher interchange fees due to the associated benefits and perks for cardholders.

Moreover, the method of transaction, whether it’s conducted in-person or online, plays a pivotal role in determining credit card charges. Online transactions, perceived as riskier due to the potential for fraud, may result in higher processing fees for merchants. The nature of the merchant’s industry also influences credit card charges. Certain industries, such as travel and hospitality, are categorized as high-risk, leading to elevated interchange fees and processing costs.

Another crucial factor is the pricing model employed by the merchant service provider. The choice between flat-rate pricing and interchange-plus pricing significantly impacts credit card charges. Under a flat-rate model, merchants pay a fixed percentage and a per-transaction fee, offering simplicity but potentially resulting in higher costs for certain transactions. In contrast, the interchange-plus model provides a transparent breakdown of interchange fees and processing costs, offering flexibility and potential cost savings for merchants.

Additionally, the merchant’s negotiation prowess and processing volume can influence credit card charges. Merchants with substantial processing volumes may have the leverage to negotiate lower fees with their payment processors, thereby mitigating the impact of credit card charges on their overall expenses.

By comprehending the intricate interplay of these factors, merchants can devise strategies to optimize their payment processing costs and minimize the impact of credit card charges on their bottom line. Navigating these complexities empowers merchants to make informed decisions regarding their payment processing strategies, ultimately contributing to enhanced financial efficiency and profitability.

Impact of Credit Card Charges on Merchant Fees

The impact of credit card charges on merchant fees is profound, significantly influencing the overall cost structure for businesses that accept card payments. These charges directly contribute to the merchant’s cost of processing transactions, thereby impacting their bottom line and profitability. The intricate fee structures, comprising interchange fees, assessment fees, and processing fees, collectively contribute to the total credit card charges borne by the merchant.

One notable impact of credit card charges on merchant fees is the erosion of profit margins. The accumulation of interchange fees, often varying based on the type of credit card used and the nature of the transaction, can substantially diminish a merchant’s profitability. Additionally, assessment fees levied by card networks and processing fees imposed by merchant service providers further compound the financial burden on merchants, ultimately reducing their net earnings.

Moreover, the impact of credit card charges on merchant fees extends to the overall cost structure of the business. For small and medium-sized enterprises, the burden of credit card charges can be particularly onerous, affecting cash flow and operational viability. These charges directly contribute to the cost of goods sold and operating expenses, thereby influencing pricing strategies and financial planning for merchants.

The impact of credit card charges on merchant fees also extends to consumer pricing and purchasing behavior. Merchants often factor in credit card charges when determining pricing strategies, potentially leading to higher prices for goods and services. Additionally, the prevalence of credit card charges may influence consumer payment preferences, impacting the choice of payment methods at the point of sale.

Understanding the profound impact of credit card charges on merchant fees is crucial for businesses seeking to optimize their financial efficiency. By comprehending the intricate relationship between credit card charges and merchant fees, businesses can adopt strategic measures to mitigate the impact, negotiate favorable terms with payment processors, and optimize their payment processing strategies. Ultimately, this understanding empowers merchants to make informed decisions that enhance their financial sustainability and operational resilience in an increasingly competitive marketplace.

Strategies for Managing Credit Card Charges

Implementing effective strategies for managing credit card charges is essential for merchants aiming to optimize their payment processing costs and mitigate the impact of fees on their bottom line. By adopting proactive measures and leveraging industry best practices, merchants can navigate the complexities of credit card charges more effectively, ultimately enhancing their financial efficiency and profitability.

One pivotal strategy for managing credit card charges is to negotiate favorable terms with payment processors. Merchants, especially those with substantial processing volumes, can leverage their bargaining power to secure lower interchange fees and processing costs. Engaging in negotiations with payment processors and exploring competitive offers can yield cost-saving opportunities, thereby minimizing the impact of credit card charges on merchant fees.

Furthermore, adopting a strategic approach to pricing and payment acceptance can help merchants manage credit card charges more effectively. By implementing dynamic pricing strategies that account for credit card charges, merchants can optimize their pricing models to reflect the cost of processing transactions. Additionally, offering incentives for alternative payment methods, such as cash or ACH transfers, can encourage customers to opt for lower-cost payment options, thereby reducing the reliance on credit card transactions.

Embracing technology and leveraging advanced payment processing solutions can also aid merchants in managing credit card charges. Implementing point-of-sale systems and payment gateways that offer transparent fee structures and advanced reporting capabilities empowers merchants to gain visibility into their credit card charges and transaction costs. This insight enables informed decision-making and facilitates the identification of cost-saving opportunities.

Moreover, educating staff and customers about the impact of credit card charges and the associated costs of processing transactions can foster a collaborative approach to managing fees. By raising awareness and promoting financial literacy within the organization and among customers, merchants can cultivate a shared understanding of the challenges posed by credit card charges and collaborate to optimize payment processing costs.

By implementing these strategies and embracing a proactive approach to managing credit card charges, merchants can enhance their financial resilience and operational efficiency. Navigating the complexities of credit card charges requires a multifaceted approach that encompasses negotiation, strategic pricing, technological integration, and stakeholder engagement. By leveraging these strategies, merchants can optimize their payment processing costs and mitigate the impact of credit card charges on their overall financial performance.

Conclusion

As we conclude our exploration of credit card charges and their impact on merchant fees, it becomes evident that these fees are pivotal elements in the financial landscape, significantly influencing the cost structure for businesses that accept card payments. The intricate web of credit card charges, comprising interchange fees, assessment fees, and processing fees, presents multifaceted challenges and opportunities for merchants seeking to optimize their payment processing costs.

Understanding the nuances of credit card charges and their profound implications is essential for both merchants and consumers. Merchants must navigate the complexities of fee structures, negotiation strategies, and payment acceptance methods to effectively manage credit card charges and minimize their impact on merchant fees. By adopting proactive measures, leveraging industry best practices, and embracing technological advancements, merchants can optimize their payment processing costs and enhance their financial efficiency.

Consumers, on the other hand, can benefit from gaining insight into the intricate world of credit card charges, enabling them to make informed decisions regarding payment methods and understanding the potential impact of credit card charges on merchants and pricing strategies.

Ultimately, the management of credit card charges necessitates a collaborative effort between merchants, consumers, and payment processors. By fostering transparency, promoting financial literacy, and embracing innovative solutions, stakeholders can collectively navigate the complexities of credit card charges and cultivate a more efficient and sustainable financial ecosystem.

As the financial landscape continues to evolve, the management of credit card charges remains a dynamic and critical aspect of business operations. By embracing strategic approaches, leveraging technology, and fostering collaboration, merchants can effectively manage credit card charges and optimize their payment processing costs, ultimately contributing to enhanced financial resilience and operational efficiency.