Finance

How Can You Get Rid Of A Credit Inquiry

Published: March 4, 2024

Learn effective strategies to remove credit inquiries and improve your financial health. Get expert advice on managing finance and boosting your credit score.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In today's fast-paced world, where financial decisions are made at the click of a button, credit inquiries have become an inevitable part of our lives. Whether you're applying for a credit card, a mortgage, or an auto loan, your credit report is often scrutinized by potential lenders. While these inquiries are necessary for lenders to assess your creditworthiness, they can also have an impact on your credit score.

Understanding the implications of credit inquiries and knowing how to manage them effectively is crucial for maintaining a healthy credit profile. In this comprehensive guide, we'll delve into the intricacies of credit inquiries, empowering you with the knowledge to navigate this aspect of personal finance with confidence.

From checking your credit report for accuracy to disputing erroneous inquiries and exploring negotiation strategies with creditors, we'll explore the actionable steps you can take to mitigate the impact of credit inquiries. Additionally, we'll discuss when it might be prudent to seek professional assistance in addressing challenging credit inquiry situations.

By the end of this guide, you'll be equipped with the insights and strategies to proactively manage credit inquiries, thereby safeguarding your financial standing and working towards a brighter financial future. So, let's embark on this enlightening journey to unravel the mysteries of credit inquiries and empower ourselves with the tools to mitigate their impact.

Understanding Credit Inquiries

Credit inquiries, also known as credit pulls or credit checks, occur when a third party, such as a lender or creditor, reviews your credit report to assess your creditworthiness. There are two types of credit inquiries: hard inquiries and soft inquiries.

Hard inquiries are initiated when you apply for credit, such as a loan or a credit card. These inquiries are recorded on your credit report and may impact your credit score. Lenders typically view hard inquiries as a sign that you may be taking on new debt, which could potentially affect your ability to repay existing obligations.

Soft inquiries, on the other hand, are not associated with credit applications. They may occur when you check your own credit report, when a potential employer conducts a background check, or when a lender pre-approves you for a credit offer. Importantly, soft inquiries do not impact your credit score.

It’s essential to recognize that while hard inquiries can affect your credit score, not all inquiries are treated equally. For instance, multiple inquiries within a short timeframe for the same type of credit (e.g., auto or mortgage loans) are typically consolidated into a single inquiry when calculating your credit score. This is to account for rate shopping and minimize the impact on your credit standing.

Understanding the distinction between hard and soft inquiries, as well as the nuances of how they are interpreted by credit scoring models, is fundamental to managing your credit effectively. By being mindful of when and why credit inquiries occur, you can make informed decisions that align with your financial goals and minimize any potential negative repercussions.

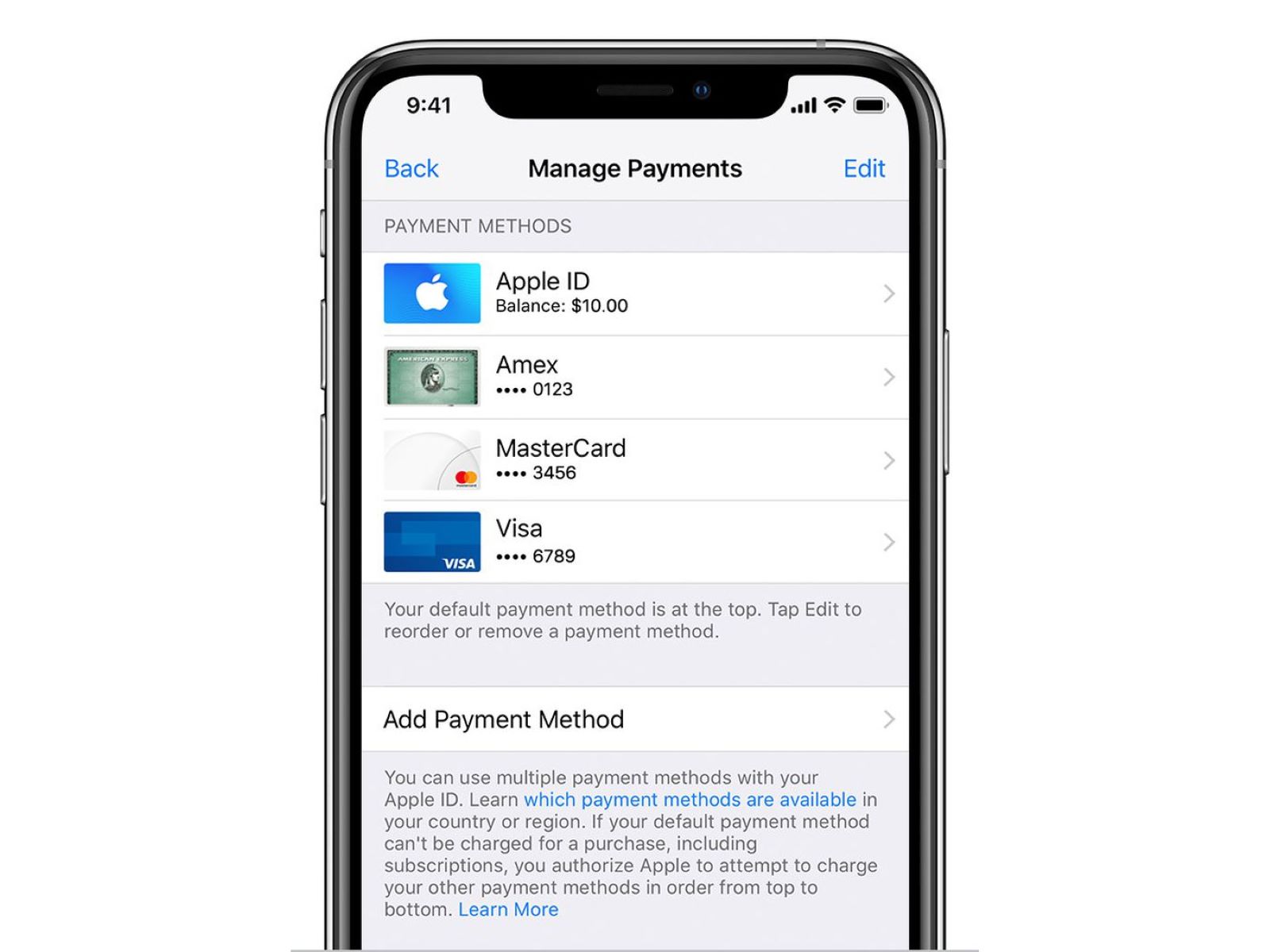

Checking Your Credit Report

Regularly reviewing your credit report is a proactive step in managing credit inquiries and ensuring the accuracy of the information contained therein. You are entitled to receive a free copy of your credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once every 12 months. Taking advantage of this opportunity enables you to monitor your credit profile and identify any unfamiliar or unauthorized inquiries.

When examining your credit report, pay close attention to the section that lists inquiries. Here, you can see a comprehensive record of the entities that have accessed your credit information. It’s important to verify that you recognize and understand the purpose of each inquiry listed. If you spot any inquiries that seem unfamiliar or unauthorized, it may be indicative of potential identity theft or unauthorized credit checks.

Furthermore, checking your credit report allows you to assess the impact of inquiries on your credit score. While hard inquiries typically remain on your report for about two years, their influence on your credit score diminishes over time. By staying informed about the inquiries on your credit report, you can gauge their impact and make informed decisions about future credit applications.

Additionally, monitoring your credit report empowers you to detect and address any errors or inaccuracies that may be adversely affecting your credit standing. Disputing inaccurate information, including unauthorized inquiries, can help rectify any discrepancies and mitigate any negative impact on your credit score.

By proactively checking your credit report, you demonstrate a commitment to maintaining a healthy credit profile and safeguarding your financial well-being. This practice not only enhances your awareness of your credit activity but also provides the opportunity to address any issues that may arise, thereby contributing to a more secure and stable financial future.

Disputing Inaccurate Inquiries

When reviewing your credit report, if you encounter inquiries that you believe are inaccurate or unauthorized, it’s crucial to take prompt action to dispute them. Inaccurate inquiries can arise due to identity theft, administrative errors, or unauthorized access to your credit information. By disputing these inquiries, you can seek their removal from your credit report and mitigate any adverse impact on your credit score.

The Fair Credit Reporting Act (FCRA) grants you the right to dispute any information on your credit report that you believe is inaccurate or incomplete. To initiate the dispute process for inaccurate inquiries, you can directly contact the credit bureau that issued the report containing the disputed inquiries. The credit bureau is then obligated to investigate the disputed items within a reasonable timeframe, typically 30 days, and inform you of the outcome of the investigation.

When disputing inaccurate inquiries, it’s essential to provide as much supporting documentation and detail as possible to substantiate your claim. This may include correspondence with the entity that allegedly initiated the inquiry, evidence of identity theft, or any other relevant information that supports your assertion that the inquiry is erroneous.

Upon receiving your dispute, the credit bureau will communicate with the entity that reported the inquiry and request verification of its legitimacy. If the entity fails to provide adequate verification within the stipulated timeframe, the credit bureau is required to remove the disputed inquiry from your credit report.

Successfully disputing inaccurate inquiries not only cleanses your credit report of erroneous information but also contributes to the preservation of your credit score. By actively addressing inaccuracies, you demonstrate a commitment to upholding the integrity of your credit profile and protecting yourself from potential repercussions of unauthorized inquiries.

Negotiating with Creditors

When facing challenging financial circumstances or seeking to mitigate the impact of negative credit inquiries, engaging in negotiations with creditors can offer a pathway to resolution and potential relief. Whether you’re dealing with past-due accounts, collections, or inquiries resulting from financial hardship, open communication and negotiation with creditors can yield mutually beneficial outcomes.

Initiating negotiations with creditors involves proactive communication and a willingness to explore options for addressing outstanding issues. If you’re contending with inquiries stemming from missed or late payments, for instance, reaching out to the respective creditors to discuss your situation can lead to potential solutions. Creditors may be open to adjusting the status of inquiries or even removing them from your credit report in exchange for a commitment to resolve outstanding obligations.

It’s important to approach negotiations with a clear understanding of your financial circumstances and a proposed plan for addressing any outstanding debts or delinquencies. Demonstrating a sincere intention to fulfill your financial responsibilities can foster goodwill and cooperation from creditors, potentially leading to favorable outcomes for your credit profile.

Moreover, when negotiating with creditors, it’s beneficial to maintain thorough documentation of all communications and agreements reached. This includes keeping records of any concessions offered by creditors, payment arrangements, or agreements to modify the status of inquiries. Having a documented trail of negotiations can provide clarity and protection in the event of any discrepancies or future disputes.

By engaging in constructive negotiations with creditors, you not only seek to address the immediate impact of credit inquiries but also work towards resolving underlying financial challenges. This proactive approach demonstrates a commitment to financial responsibility and can pave the way for improved credit standing and a more stable financial future.

Seeking Professional Help

When navigating complex credit inquiry scenarios or facing challenging credit-related issues, seeking professional assistance from credit counseling agencies or reputable financial advisors can provide valuable support and guidance. These professionals possess the expertise and resources to help you address credit inquiries, manage debt, and develop strategies to improve your overall financial well-being.

Credit counseling agencies offer personalized financial counseling and debt management services to individuals seeking assistance with credit-related challenges. By enlisting the services of a reputable credit counseling agency, you can benefit from expert guidance on managing credit inquiries, disputing inaccurate information, and devising effective strategies for improving your credit standing.

Additionally, financial advisors with expertise in credit and debt management can provide tailored recommendations and actionable insights to help you navigate the complexities of credit inquiries and their impact on your financial health. These professionals can offer personalized advice on disputing inaccurate inquiries, negotiating with creditors, and implementing sound financial practices to enhance your credit profile.

Furthermore, professional assistance can be particularly valuable when facing intricate credit-related issues, such as identity theft or fraudulent credit activity. Experienced professionals can offer support in navigating the necessary steps to address these challenges, including filing identity theft reports, working with credit bureaus to rectify inaccuracies, and implementing safeguards to prevent future unauthorized credit inquiries.

By seeking professional help, you can gain access to valuable resources, expertise, and support systems that empower you to address credit inquiries and proactively manage your financial well-being. These professionals can serve as trusted allies in your journey toward financial stability, providing the knowledge and guidance needed to navigate the complexities of credit management with confidence.

Conclusion

Managing credit inquiries is an integral aspect of maintaining a healthy credit profile and securing a stable financial future. By understanding the nuances of credit inquiries, regularly monitoring your credit report, and taking proactive steps to address inaccuracies, you can effectively mitigate their impact and safeguard your credit standing.

Empowered with the knowledge of distinguishing between hard and soft inquiries, as well as their implications, you can make informed decisions when applying for credit and minimize any potential negative effects on your credit score. Regularly checking your credit report enables you to stay vigilant against unauthorized inquiries and inaccuracies, providing the opportunity to address any issues that may arise promptly.

Disputing inaccurate inquiries and engaging in negotiations with creditors demonstrate a proactive approach to managing credit inquiries and addressing any associated challenges. By advocating for the accuracy of your credit report and seeking resolution with creditors, you actively work towards preserving the integrity of your credit profile.

For individuals facing complex credit-related issues or seeking comprehensive guidance, professional assistance from credit counseling agencies or financial advisors can offer invaluable support. These experts can provide tailored strategies, resources, and insights to help you navigate credit inquiries and develop sustainable financial practices.

Ultimately, by proactively managing credit inquiries and seeking assistance when needed, you pave the way for a more secure financial future. Empower yourself with the knowledge and tools to navigate credit inquiries effectively, and embark on a journey towards financial stability and well-being.