Home>Finance>How Long Do Consumer Finance Loans Stay On Your Credit Report

Finance

How Long Do Consumer Finance Loans Stay On Your Credit Report

Modified: March 10, 2024

Stay informed about the duration of consumer finance loans on your credit report. Discover how long finance loans can impact your credit history and financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What are consumer finance loans?

- How do consumer finance loans affect your credit report?

- How long do consumer finance loans stay on your credit report?

- Factors that determine the duration of consumer finance loans on your credit report

- Impact of consumer finance loans on your credit score

- Tips for managing consumer finance loans and improving your credit report

- Conclusion

Introduction

Welcome to the world of consumer finance loans! If you’ve ever taken out a loan to purchase a car, pay for a wedding, or cover unexpected expenses, then you’re familiar with the concept of consumer finance loans. These loans provide individuals with the financial resources they need to meet their short-term or long-term goals.

Consumer finance loans play a crucial role in the financial industry, allowing people to access funds when they need them the most. However, understanding how these loans can impact your credit report is essential for maintaining a healthy financial profile.

In this article, we will explore consumer finance loans in detail and delve into their influence on your credit report. We will also address the question of how long consumer finance loans stay on your credit report and offer tips on managing these loans to improve your creditworthiness.

So, without further ado, let’s dive into the world of consumer finance loans and gain a better understanding of their role in shaping your financial future.

What are consumer finance loans?

Consumer finance loans, also known as personal loans or installment loans, are financial products that are designed to cater to the specific needs of individuals. These loans are typically unsecured, meaning they do not require collateral such as a house or car to secure the loan.

Consumer finance loans are different from traditional bank loans as they are often offered by specialized financial institutions or online lenders. The loan amount can range from a few hundred to several thousand dollars, depending on the lender, the borrower’s creditworthiness, and their financial needs.

These loans can be used for a variety of purposes, including emergency expenses, debt consolidation, home improvements, education, or even a dream vacation.

When applying for a consumer finance loan, lenders will consider several factors such as your credit score, income, employment history, and debt-to-income ratio. This information helps them assess your creditworthiness and determine the loan amount, interest rate, and repayment terms.

One notable feature of consumer finance loans is their fixed interest rates and installment repayment plans. This means that borrowers will make regular monthly payments over a specific period of time until the loan is fully repaid. This predictable payment schedule makes it easier for borrowers to manage their finances and plan their budget accordingly.

It’s important to note that consumer finance loans come with interest charges and fees, which can vary depending on the lender and the borrower’s credit profile. Therefore, it’s crucial to carefully review the terms and conditions of the loan before signing any agreements.

Overall, consumer finance loans provide individuals with the flexibility and financial freedom to address their personal needs and goals. However, it’s essential to use these loans responsibly and only borrow what you can comfortably repay within the agreed-upon terms.

How do consumer finance loans affect your credit report?

Consumer finance loans can have a significant impact on your credit report. Your credit report is a detailed record of your credit history, including information about your borrowing habits and payment history. It is used by lenders, landlords, and other financial institutions to assess your creditworthiness.

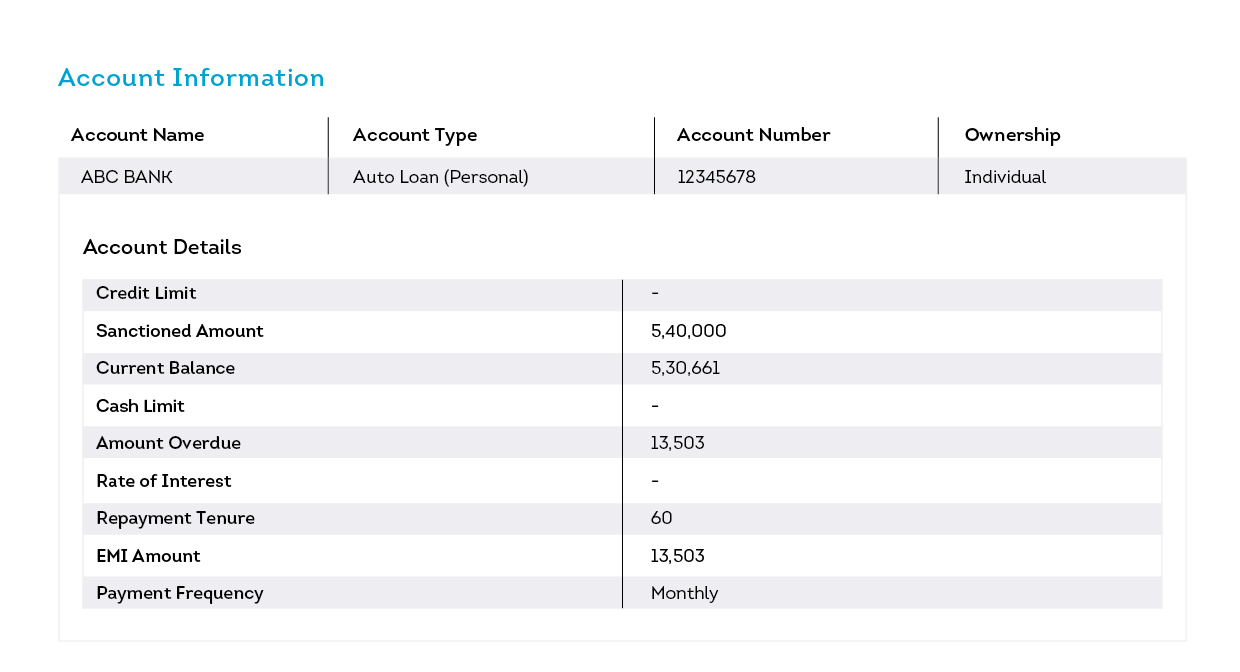

When you take out a consumer finance loan, the loan account will be listed on your credit report. This account will provide information such as the loan amount, the date it was opened, the current balance, and your payment history.

The most crucial factor that affects your credit report is your payment history. Making timely and consistent payments on your consumer finance loan will have a positive impact and show that you are a responsible borrower. On the other hand, missing payments or defaulting on your loan can significantly damage your credit score and make it challenging to secure future credit.

In addition to payment history, other factors such as the length of your credit history and the amount of debt you owe also come into play. Taking out a consumer finance loan can impact these factors in different ways.

When you apply for a consumer finance loan, the lender will perform a credit inquiry, which can be a hard inquiry or a soft inquiry. A hard inquiry occurs when you apply for credit, and it can slightly lower your credit score in the short term. However, the impact is temporary, and as long as you continue to make your loan payments on time, your credit score will improve over time.

As for the amount of debt you owe, a consumer finance loan will increase your overall debt load. This can have a negative impact on your credit utilization ratio, which is the amount of credit you have used compared to the total amount available to you. A high credit utilization ratio can lower your credit score. However, if you manage your loan payments well and keep your debt levels under control, the positive payment history associated with the loan can outweigh the negative impact of increased debt.

Overall, consumer finance loans can affect your credit report in both positive and negative ways. It’s important to borrow responsibly, make your payments on time, and maintain a manageable amount of debt to ensure a healthy credit score and financial profile.

How long do consumer finance loans stay on your credit report?

Consumer finance loans can have a long-lasting impact on your credit report. The duration that these loans remain on your credit report is an important factor to consider, as it can affect your overall creditworthiness and financial profile.

In general, consumer finance loans and other types of installment loans will stay on your credit report for a significant period of time. The specific duration can vary depending on several factors, including the type of loan and the credit reporting agency’s policies.

Most consumer finance loans will remain on your credit report for approximately seven years. This is the standard reporting period for most negative information, such as missed payments or defaulting on the loan. However, it’s important to note that the positive payment history associated with the loan will also remain on your credit report, which can have a positive impact on your credit score.

It’s worth mentioning that if you successfully pay off the consumer finance loan before the seven-year mark, the account will still be listed on your credit report, but it will be marked as closed or paid in full. This demonstrates to future lenders that you have met your financial obligations and can be regarded as a responsible borrower.

It’s important to understand that even though the loan may stay on your credit report for a certain duration, its impact on your credit score diminishes over time. As long as you consistently make your payments on time and maintain a positive credit history, the negative impact of the loan will lessen over the years.

It’s essential to regularly monitor your credit report to ensure that the information is accurate and up to date. If you find any errors or discrepancies related to your consumer finance loan, it’s important to dispute them with the credit reporting agency to have them corrected.

Remember, while consumer finance loans can have a lasting impact on your credit report, they also provide an opportunity for you to build a positive credit history and demonstrate your creditworthiness to future lenders. By managing your loans responsibly and making timely payments, you can establish a solid financial foundation for your future borrowing needs.

Factors that determine the duration of consumer finance loans on your credit report

The duration that consumer finance loans stay on your credit report can vary depending on several factors. Understanding these factors can help you navigate your credit journey and plan accordingly. Here are some key determinants:

Reporting Policies of Credit Bureaus: Credit reporting agencies, such as Equifax, Experian, and TransUnion, have their own policies regarding how long they report different types of information on your credit report. The industry standard is typically seven years for most negative information, including missed payments or defaulting on loans.

Loan Repayment Status: The status of your loan repayment plays a crucial role in determining how long it will appear on your credit report. Generally, if you fully repay your consumer finance loan before the reporting timeframe lapses, it will still remain on your credit report but will be marked as “closed” or “paid in full.”

Loan Type: The specific type of consumer finance loan you have taken out can also impact the duration it stays on your credit report. Different loan types may have varying reporting periods. For example, a mortgage loan may remain on your credit report for up to ten years or more, while a personal loan may follow the standard seven-year reporting period.

State Regulations: State laws can also influence the duration of consumer finance loans on your credit report. Some states have laws that govern the reporting period for certain types of debts, and these laws can override the standard reporting periods set by credit bureaus.

Credit Reporting Agency Policies: Each credit reporting agency may have slightly different policies regarding the duration of consumer finance loans on your credit report. It’s important to note that discrepancies can exist between credit reports from different agencies, so it’s essential to review reports from all major bureaus for accuracy.

It’s important to understand that while negative information, such as missed payments or defaulting on loans, can negatively impact your credit report for several years, the impact diminishes over time as long as you maintain a positive credit history. On the other hand, positive information, such as timely payments and successful loan repayments, can continue to have a positive impact on your credit report even after the loan is fully repaid.

To ensure the accuracy of your credit report and to address any errors or discrepancies related to the duration of consumer finance loans, it’s crucial to regularly review your credit report from all credit reporting agencies. If you find any inaccuracies, you can dispute them with the respective credit bureaus to have them corrected.

By understanding the factors that determine the duration of consumer finance loans on your credit report, you can make informed decisions about managing your credit and building a solid financial foundation.

Impact of consumer finance loans on your credit score

Consumer finance loans can have a direct impact on your credit score, which is a numerical representation of your creditworthiness. Understanding how these loans affect your credit score is crucial for maintaining a healthy financial profile. Here are some key points to consider:

Payment History: One of the most significant factors in calculating your credit score is your payment history. Making timely and consistent payments on your consumer finance loan demonstrates responsible borrowing and can positively impact your credit score. On the other hand, missing payments or defaulting on your loan can have a severe negative impact on your credit score.

Credit Utilization: Consumer finance loans can also impact your credit utilization ratio, which measures the amount of credit you have used compared to your total available credit. Taking out a new loan increases your overall debt load, which can raise your credit utilization ratio. Keeping this ratio low is important for maintaining a healthy credit score. Therefore, it’s essential to consider how the loan will impact your credit utilization before taking on additional debt.

Length of Credit History: The duration of your credit history is another important factor in calculating your credit score. Consumer finance loans, especially if you make timely payments, can help establish a positive credit history over time. Having a long and positive credit history can benefit your credit score, as it demonstrates your ability to manage credit responsibly.

New Credit Inquiries: Whenever you apply for a consumer finance loan, the lender will perform a credit inquiry to assess your creditworthiness. Each hard inquiry can have a slight negative impact on your credit score. However, the impact is typically minimal and temporary. It’s important to be mindful of multiple loan applications within a short period of time, as numerous inquiries can signal risk to lenders.

Mix of Credit: Having a diverse mix of credit accounts, including installment loans like consumer finance loans, can have a positive impact on your credit score. Lenders like to see a responsible mix of credit types, as it demonstrates your ability to manage different types of debt.

It’s important to note that the impact of consumer finance loans on your credit score can vary depending on your individual financial situation and overall credit history. While taking out a new loan can initially cause a slight dip in your score, making timely payments and demonstrating responsible credit management can improve your score over time.

It’s crucial to manage your consumer finance loans wisely, making all payments on time and in full. By doing so, you can build a solid credit history, improve your credit score, and increase your chances of securing favorable credit terms in the future.

Remember to regularly monitor your credit report to ensure accuracy and address any discrepancies. By maintaining a good credit score, you can enjoy better access to credit and financial opportunities in the long run.

Tips for managing consumer finance loans and improving your credit report

Managing your consumer finance loans responsibly is key to improving your credit report and maintaining a healthy financial profile. Here are some valuable tips to help you effectively manage your loans and enhance your creditworthiness:

1. Make timely payments: Paying your consumer finance loan installments on time is crucial for a positive credit history. Set up automatic payments or create reminders to ensure you never miss a payment. Late or missed payments can have a detrimental effect on your credit score.

2. Pay more than the minimum: Whenever possible, try to pay more than the minimum required payment. By paying more, you can reduce your outstanding balance faster and save on interest charges. It also demonstrates your ability to handle debt responsibly.

3. Avoid taking on too much debt: Before applying for a new consumer finance loan, carefully consider your current financial situation and ability to repay. Taking on excessive debt can strain your budget and harm your creditworthiness. Only borrow what you genuinely need and can comfortably afford to repay.

4. Monitor your credit report: Regularly review your credit report from all major credit bureaus to check for inaccuracies or discrepancies. If you find any errors, report them immediately to the respective credit agency and have them rectified. A clean and accurate credit report is essential for maintaining a good credit score.

5. Diversify your credit mix: Having a diverse mix of credit accounts, including consumer finance loans, can positively impact your credit score. If you currently only have one type of credit, such as credit cards, consider adding an installment loan to your credit mix to demonstrate your ability to manage different types of debt.

6. Avoid unnecessary credit inquiries: Be selective when applying for new credit. Each hard inquiry on your credit report can temporarily lower your credit score. Only apply for new credit when necessary and when you are confident in your ability to qualify.

7. Pay attention to credit utilization: Keep your credit utilization ratio low by managing your overall debt responsibly. Aim to use less than 30% of your available credit. High credit utilization can negatively impact your credit score, so make efforts to pay down outstanding balances and keep credit card balances low.

8. Communicate with your lender: If you are facing financial difficulties and are unable to make your loan payments, reach out to your lender as soon as possible. They may be able to offer temporary relief or work out a modified payment plan to help you stay on track and avoid negative credit consequences.

By implementing these tips, you can effectively manage your consumer finance loans and improve your credit report over time. Consistency in making timely payments, maintaining a diverse credit portfolio, and keeping your debt levels in check will help you build a strong credit history and enhance your overall financial well-being.

Conclusion

Consumer finance loans can be powerful tools for achieving your financial goals, but it’s important to understand their impact on your credit report. By managing your loans responsibly and making timely payments, you can build a positive credit history and improve your creditworthiness.

Understanding how long consumer finance loans stay on your credit report is essential. Typically, these loans remain on your credit report for around seven years, but their impact diminishes over time as long as you maintain a positive credit history.

Factors like payment history, credit utilization, length of credit history, new credit inquiries, and the mix of credit types all play a role in determining how your consumer finance loans affect your credit score. By staying aware of these factors and implementing good credit management practices, you can minimize negative impacts and maximize positive ones.

Remember to regularly monitor your credit report for accuracy and address any errors promptly. Engaging in responsible borrowing, making timely payments, and avoiding excessive debt will contribute to an improved credit report and a healthier financial future.

By following the tips provided for managing consumer finance loans and improving your credit report, you can establish a solid credit foundation and open doors to future financial opportunities. Remember, building and maintaining good credit is a journey that requires patience and consistency, but the rewards are well worth the effort.

So, take control of your finances, manage your consumer finance loans wisely, and watch your credit report flourish. With proper planning and responsible financial habits, you can achieve your goals while maintaining a strong credit profile.