Finance

What Is The Highest Credit Score You Can Get?

Modified: March 4, 2024

Discover the highest credit score you can achieve, the benefits of having one, and how you can improve your current credit score.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Do you wonder what the highest credit score you can achieve is? By definition, a credit score refers to the statistical number evaluating your creditworthiness and probability of repaying your debts. It is also based on a consumer’s credit history. The higher the credit score, the more financially trustworthy an individual is considered to be.

Understanding Credit Scores

The Fair Isaac Corporation (also known as FICO) created the credit score model that is used by financial institutions. The FICO score is the most commonly used among other credit scoring systems. In offering credit, the credit score plays a key role in a lender’s decision. It also determines the size of an initial deposit required to buy products, avail services, or rent properties.

Lenders review the borrowers’ scores frequently, especially when deciding to change the credit limit or interest rate on a credit card.

Consumers can possess high scores by maintaining a long history of paying their bills on time and keeping their debt low.

Photo from Wikimedia Commons

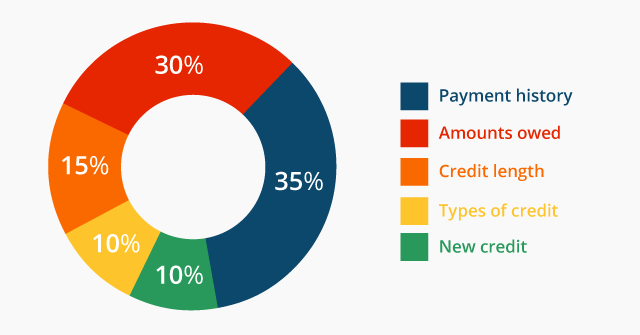

Factors Of Credit Score

Major credit reporting agencies in the United States evaluate these five main factors when calculating credit scores.

1. Payment history – It shows whether an individual pays his obligations on time and counts for 35% of a credit score.

2. Total amount owed – It takes into account the percentage of credit currently being used and is available to a person. It is also known as credit utilization and counts for 30%.

3. Length of credit history – Because there is more data to determine payment history, longer credit histories are less risky. The length of credit history counts for 15% of credit history.

4. Types of credit – It shows if a person has a mix of instalment credit such as car loans, mortgage loans, revolving credit like credit cards. It counts for 10% of a credit score.

5. New credit – It factors in how many new accounts a person has, how many they have applied for recently, and when they opened the most recent account. It also counts for 10%.

Photo by CafeCredit.com from Flickr

What Is The Highest Credit Score?

The highest credit score you can get depends on the scoring model. Lenders use two primary credit-scoring models to judge your creditworthiness: the FICO and VantageScore. Using the FICO model, the highest credit score you can achieve is 850 (under perfect circumstances), and the lowest is 300. The average FICO score is 704 out of 200 million consumers with credit scores.

The average FICO score range is as follows:

Excellent: 800 to 850

Very Good: 740 to 799

Good: 670 to 739

Fair: 580 to 669

Poor: 300 to 579

But, every creditor can define their own ranges for credit scores. Many of them think anything over 800 is excellent. Also, any score over 740 is generally considered to be great and places you in range for the best interest rates on car loans, mortgages, and credit cards.

Benefits Of A High Credit Score

Working towards a high credit score involves several benefits, and all of them can help you save money. These are the following:

Qualify for credit cards with great rewards

You can get a credit card with any type of credit. But to get the best credit cards with rewards and benefits, it typically requires good to exceptional credit scores.

Negotiate lower interest rates on credit card

If you are carrying a balance, a great credit score could help you negotiate with your lender to lower your interest rate. You could save a lot of money by getting a lower interest rate.

Photo from Max Pixel

Score lower rates on auto loans

You will most likely need to get a car loan unless you have enough money to buy a car. With having a good credit score comes securing a loan with the best possible terms.

According to Experian data, a consumer with the highest credit score qualifies for an average interest rate of 4.2% on a new car. This is in comparison with 14.97% of people with the lowest credit scores.

Get better insurance rates

Having a great credit score may help you qualify a lower monthly premium if you are looking around for homeowners or auto insurance rates.

Photo from MaxPixel

Get the lowest rate on a mortgage

Your mortgage is the loan you would want to get the lowest interest possible on because of the amount of money it involves. Even a small increase in the percentage can cost you tens of thousands of dollars. It is an essential step in the home buying process to get your credit ready for a mortgage.

Refinance your loans

You may also refinance your loans at a lower rate and save money. Given that you have improved your credit scores since opening one of your loan accounts.

How To Improve Your Credit Score

If you are looking to improve your score, here are some tips you can follow and work on.

Keep low credit card balances

One of the big factors in your credit score is your credit utilization rate. This is the amount of available credit you are using. By dividing your total credit card balances by your total credit limits, you can figure out your utilization rate.

Photo by flyerwerk on Pixabay

If your credit utilization rate is 30% or higher, it can affect your credit score negatively. Your utilization rate should be under 6% for the top scores. Keep your credit card balances low and relative to its credit limit to help improve your credit score.

Make payments on time

You should make it a goal to pay your bills on time every month. Also, take care of your account in collections quickly especially if you are behind on payments. Making on-time payments carry the most weight in your credit scores.

Check credit scores and report

Be informed by checking your credit scores and getting a copy of your credit reports from the credit reporting agencies. This information will give you a better idea of the areas in your credit history you might need to address.

Photo by CafeCredit.com from Flickr

Let negative information fall off your credit reports

You cannot do much but wait until your negative information falls off on your credit reports. This can take several years depending on the information. But also take note that new and positive information carries more weight than the old and negative ones.

Dispute inaccurate information

Errors in a credit report are not common, but it can possibly contain something fraudulent or erroneous. File a dispute with the credit reporting agencies if you find inaccurate information. This may include doubled information, clerical errors, or fraud.

Photo from pxfuel

Avoid new hard inquiries on your credit reports

A hard inquiry on your credit report results from the lender running a credit check every time you apply for credit. It can have a compounding negative effect on your credit score, even though it will not stay on your reports for long. In contrast, a soft inquiry results from checking your own credit results. It does not affect your credit.

Realistically, you need not get the highest credit score to qualify for great rates on mortgages and loans. What’s most important is that you remain patient while maintaining the right credit habits. In the long run, these will help you improve your scores and achieve your financial goals.