Home>Finance>Accrued Dividend Definition, How To Calculate It

Finance

Accrued Dividend Definition, How To Calculate It

Published: September 28, 2023

Discover the definition of accrued dividend and learn how to calculate it in the world of finance. Gain insight into this important financial concept.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Accrued Dividend: What Is It and How to Calculate It

When it comes to the world of finance, there are numerous terms and concepts that can sometimes be confusing. One such term is “accrued dividend.” If you’re not familiar with this term, you’re not alone. In this blog post, we’ll provide a clear definition of accrued dividend, and we’ll guide you on how to calculate it. By the end of this post, you’ll have a better understanding of this concept and be able to apply it to your financial decisions.

Key Takeaways:

- An accrued dividend refers to a portion of a company’s earnings that have been declared by the board of directors but have not been paid out to shareholders yet.

- Accrued dividends are recorded as a liability on the company’s balance sheet until they are paid out to shareholders.

What Is an Accrued Dividend?

Before diving into the calculations, let’s clarify what an accrued dividend actually is. When a company’s board of directors declares a dividend, it means that a portion of the company’s earnings will be distributed to its shareholders. This declaration usually comes in the form of a resolution during a board meeting.

However, the dividend amount declared by the board of directors does not immediately go into the hands of the shareholders. Instead, it takes some time for the dividend to be paid out. During this interval, the dividend is said to be “accrued” or “due” to the shareholders. The accumulated amount of these accruals is known as the accrued dividend.

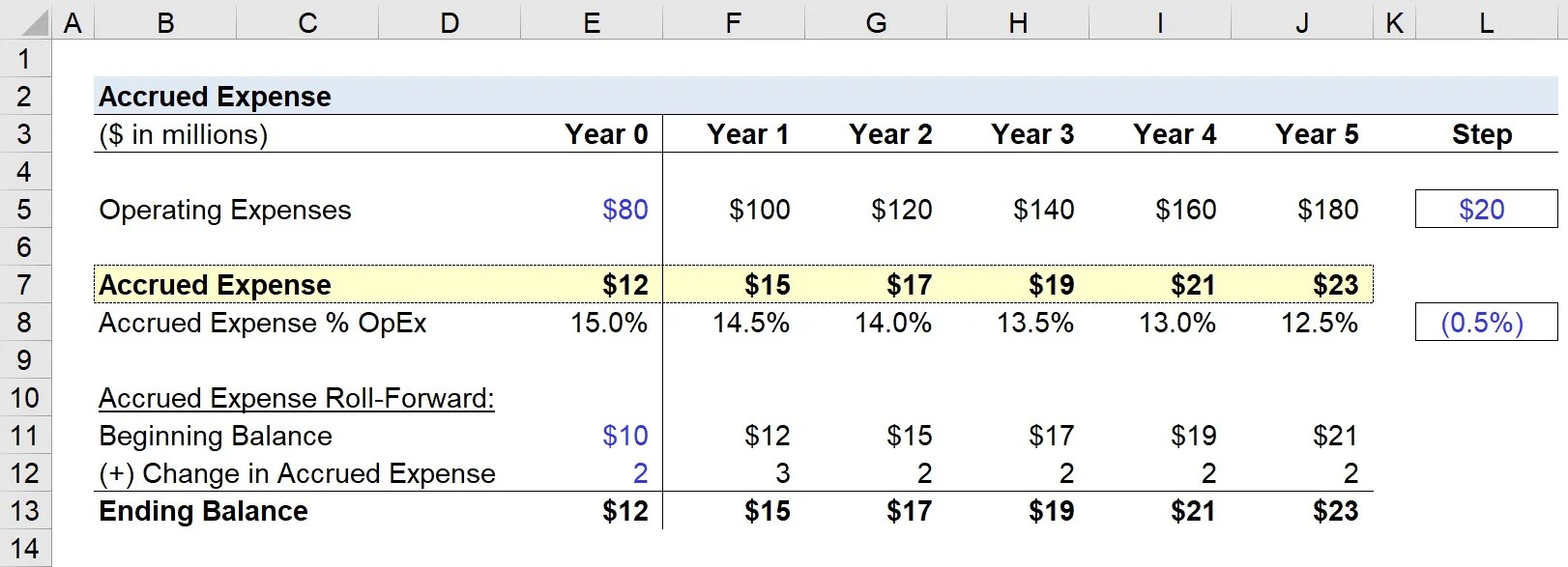

How to Calculate Accrued Dividend

To calculate the accrued dividend, you need to know the dividend rate and the number of shares held by each shareholder. Here’s a step-by-step guide:

- Determine the dividend rate: The dividend rate is expressed as a percentage and represents the amount of dividend each shareholder is entitled to receive.

- Find the number of shares held: Each shareholder’s portion of the accrued dividend depends on the number of shares they hold.

- Multiply the dividend rate by the number of shares held: Multiply the dividend rate by the number of shares held by each shareholder to calculate their individual accrued dividend.

- Sum up the individual accrued dividends: Add up the individual accrued dividends to find the total accrued dividend for the company.

Once the accrued dividend is calculated, it is recorded as a liability on the company’s balance sheet, as it represents an obligation to pay the shareholders in the future. When the dividend is eventually paid out to the shareholders, the accrued dividend liability is reduced accordingly.

Conclusion

In conclusion, an accrued dividend is an amount of dividend that has been declared by a company’s board of directors but has not yet been paid out to the shareholders. It is essential to calculate the accrued dividend accurately to ensure proper financial reporting and to meet the company’s obligations to its shareholders.

By understanding the concept of accrued dividend and how to calculate it, you can make informed decisions regarding your investments and financial planning.