Finance

Accrued Interest Definition & Example

Modified: October 11, 2023

Learn the meaning of accrued interest in finance and discover a practical example. Understand how it impacts investments and financial calculations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Accrued Interest: Definition & Example

When it comes to managing your finances, it’s important to have a clear understanding of various financial terms. One such term is accrued interest. In this blog post, we will explore what accrued interest is, provide an example to illustrate its application, and explain why it is important to be aware of it. So, let’s dive in!

Key Takeaways:

- Accrued interest refers to the interest that has accumulated on a financial instrument but has not yet been paid or received.

- It is important to be aware of accrued interest, as it can impact the overall return on investment and affect financial decisions.

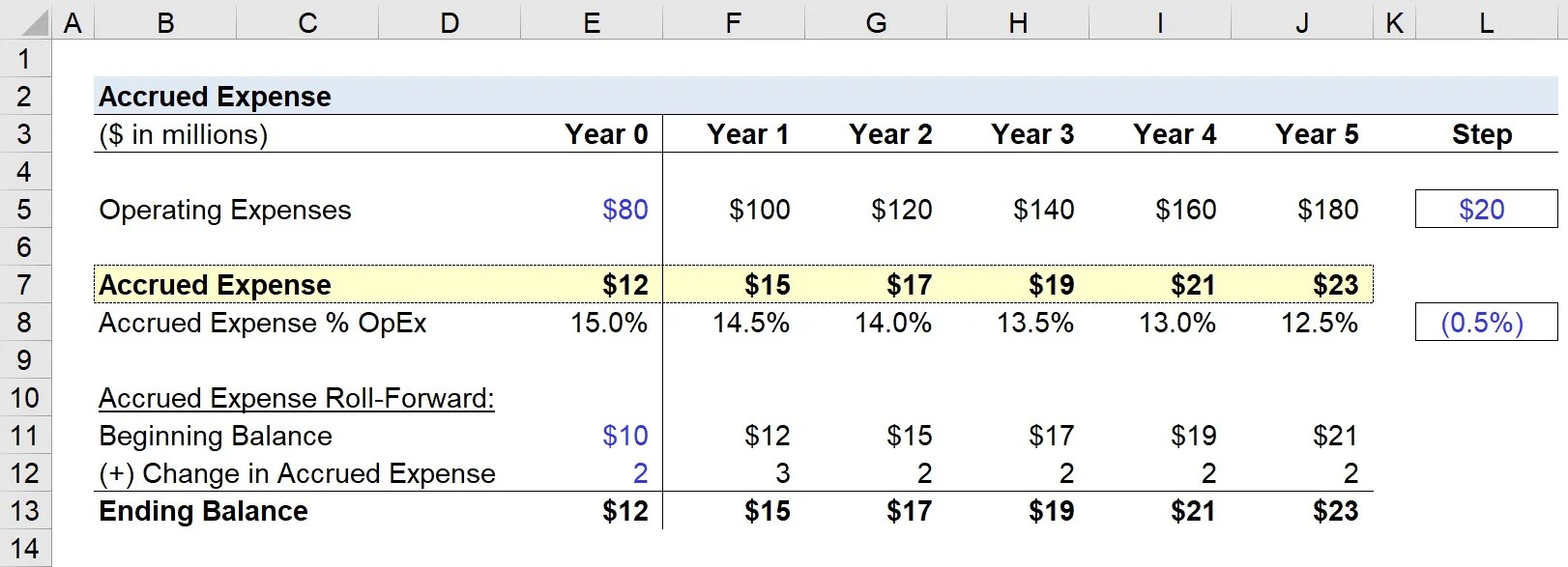

What is Accrued Interest?

Accrued interest can be defined as the interest that has been earned on a financial instrument but has not been paid or received yet. It is the interest that accumulates over time and is added to the principal amount. Accrued interest is generally calculated based on the interest rate and the length of time the investment has been held for.

Example of Accrued Interest:

Let’s say you decide to invest in a bond that pays an annual interest of 5%. The bond has a maturity period of one year, and you purchased it halfway through the year. After six months of holding the bond, the accrued interest would be calculated based on the time you held it.

If the bond has a face value of $10,000, the accrued interest at the end of six months would be $250. This is calculated by multiplying the face value ($10,000) by the interest rate (5%) and dividing it by the number of periods in a year (2).

Why is Accrued Interest Important?

Understanding accrued interest is crucial for several reasons:

- It affects the actual return on investment: By accounting for the accrued interest, investors can accurately calculate the total gain or loss from an investment.

- It impacts financial decisions: Accrued interest can influence whether to buy or sell a bond or other interest-bearing instruments, as the accrued interest must be considered in the transaction.

- It affects tax liability: Accrued interest is subject to taxation in many countries. Hence, being aware of accrued interest helps in accurate tax reporting and planning.

Accrued interest is an important concept to grasp when managing your finances. Whether you are a seasoned investor or someone just beginning to explore the world of finance, having a clear understanding of accrued interest will empower you to make informed financial decisions.

Keep in mind that the examples provided in this blog post are simplified for illustrative purposes. To get accurate calculations, it’s always recommended to consult with a financial advisor or refer to the specific terms and conditions of your investment.