Finance

Discover FICO Score From Which Credit Bureau

Published: March 6, 2024

Discover your FICO score from a credit bureau and take control of your finances with valuable insights into your credit health. Understand how your financial decisions impact your credit score.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding your creditworthiness is crucial in today's financial landscape. A key component of this assessment is your FICO score, a three-digit number that reflects your credit risk based on your credit history. Lenders, such as banks and credit card companies, use this score to evaluate your creditworthiness, determining whether to extend credit to you and at what interest rate.

Your FICO score is derived from information in your credit reports, which are maintained by the three major credit bureaus: Equifax, Experian, and TransUnion. These bureaus collect and maintain data on consumers' credit behavior, which is used to generate credit reports and, subsequently, FICO scores.

In this article, we will delve into the significance of the FICO score, its impact on your financial life, and how to obtain your score from each credit bureau. Understanding this information will empower you to make informed financial decisions and take control of your credit health. Let's explore the world of FICO scores and credit bureaus to unlock the secrets of your creditworthiness.

What is a FICO Score?

A FICO score is a numeric representation of an individual’s credit risk, which is used by lenders to assess the likelihood of the borrower repaying their debts. The term “FICO” is derived from the Fair Isaac Corporation, the company that developed the FICO scoring model. This three-digit number, ranging from 300 to 850, provides a snapshot of a person’s creditworthiness based on their credit history and various financial behaviors.

The factors that contribute to a FICO score include payment history, amounts owed, length of credit history, new credit, and types of credit used. Payment history carries the most significant weight in the calculation, as it reflects whether an individual has consistently made on-time payments for their debts. The amounts owed, including credit card balances and loan amounts, also play a crucial role, as excessively high debt levels can indicate financial distress. The length of credit history accounts for how long an individual has been using credit, while new credit and types of credit used provide insight into recent credit inquiries and the diversity of credit accounts.

It’s important to note that FICO scores are dynamic and can change over time based on an individual’s financial behaviors. Regularly monitoring your FICO score can help you gauge your credit standing and identify areas for improvement. Additionally, understanding the key factors that influence your score can empower you to make informed decisions to positively impact your creditworthiness.

Importance of FICO Score

The FICO score holds significant importance in the realm of personal finance and lending. It serves as a pivotal tool for lenders to assess the credit risk of potential borrowers, influencing the terms and conditions of credit offers extended to individuals. Here are several key reasons highlighting the importance of the FICO score:

- Lending Decisions: When you apply for a mortgage, auto loan, credit card, or any other form of credit, lenders utilize your FICO score to evaluate your creditworthiness. A higher FICO score often translates to more favorable terms, such as lower interest rates and higher credit limits, while a lower score may result in less favorable terms or even denial of credit.

- Interest Rates: Your FICO score significantly influences the interest rates you are offered. Individuals with higher scores are typically offered lower interest rates, leading to reduced borrowing costs over time. Conversely, lower scores may result in higher interest rates, leading to increased borrowing expenses.

- Insurance Premiums: In some cases, insurance companies may use credit-based insurance scores, which are closely related to FICO scores, to determine premiums for auto and home insurance. A higher credit score can potentially lead to lower insurance premiums.

- Employment Opportunities: While not all employers check credit scores, some positions, particularly those involving financial responsibilities, may require a credit check as part of the hiring process. A strong FICO score can positively influence employment opportunities in certain industries.

- Access to Credit: A healthy FICO score can broaden your access to credit, providing opportunities to secure favorable financing for major purchases and unexpected expenses. It can also facilitate access to higher credit limits and better credit card offers.

Understanding the importance of the FICO score empowers individuals to take proactive steps to maintain and improve their creditworthiness. By managing financial obligations responsibly and monitoring their FICO score regularly, individuals can enhance their financial well-being and unlock opportunities for better lending terms and financial stability.

Which Credit Bureaus Provide FICO Scores?

Equifax, Experian, and TransUnion are the three major credit bureaus that collect and maintain consumer credit information. While these bureaus compile credit reports, it’s important to note that they do not generate FICO scores themselves. Instead, they provide the data used to calculate FICO scores to the Fair Isaac Corporation, which applies its proprietary scoring model to generate the three-digit FICO score.

Each credit bureau may have slightly different information in their credit reports, as they receive data from various sources, such as lenders, credit card companies, and public records. This variance in data can result in differences in FICO scores obtained from each bureau.

It’s essential for individuals to recognize that the FICO scores provided by each credit bureau are equally valuable, as lenders may use any of these scores when making credit decisions. As a result, it’s prudent for consumers to monitor their FICO scores from all three bureaus to gain a comprehensive understanding of their credit standing and ensure the accuracy of the information being reported.

By obtaining FICO scores from each of the major credit bureaus, individuals can proactively manage their credit profiles and address any discrepancies that may exist within their credit reports. This proactive approach can help individuals maintain healthy credit and make informed financial decisions based on a comprehensive view of their creditworthiness.

How to Discover Your FICO Score from Each Credit Bureau

Discovering your FICO score from each credit bureau is a proactive step toward understanding and managing your credit health. Here’s a guide to obtaining your FICO score from Equifax, Experian, and TransUnion:

Equifax:

To access your FICO score from Equifax, you can utilize their online platform or contact them directly. Equifax offers credit monitoring services that provide access to your FICO score and credit report. Additionally, individuals are entitled to one free credit report annually from Equifax through AnnualCreditReport.com, which can also provide insight into their credit standing.

Experian:

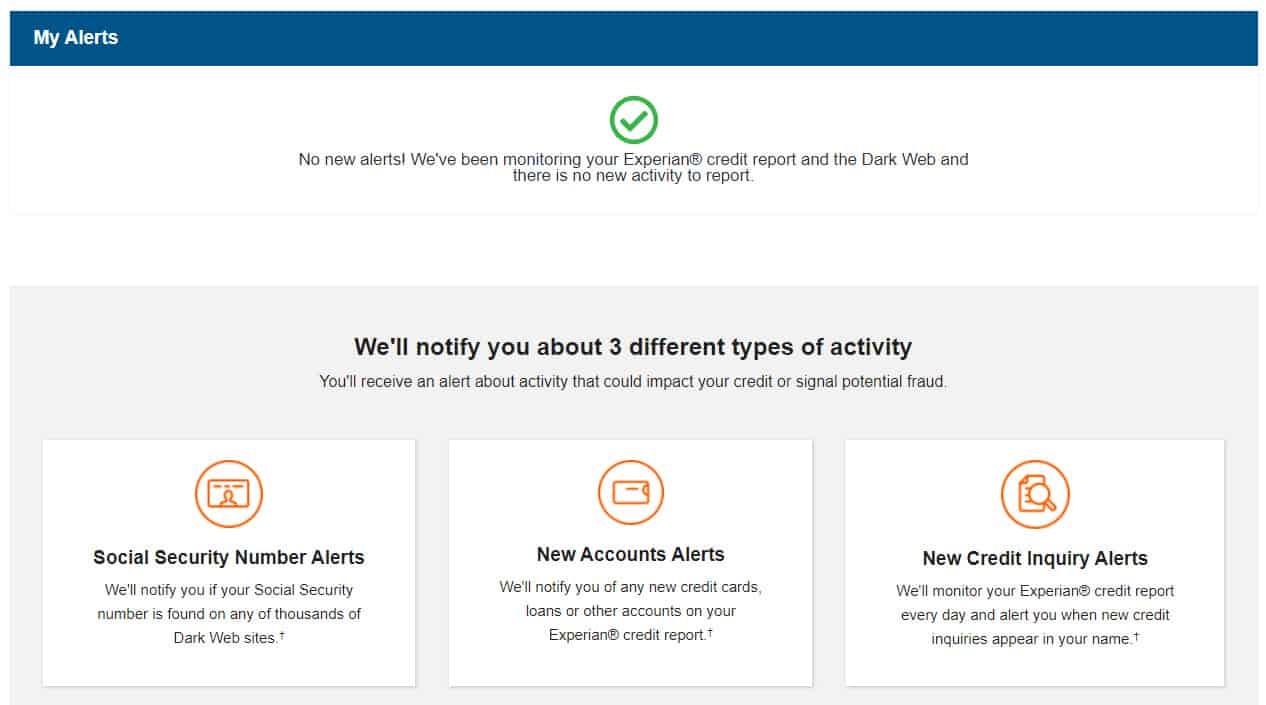

Similar to Equifax, Experian offers credit monitoring services that grant access to your FICO score and credit report. Additionally, individuals can obtain their FICO score through various financial institutions that provide credit score access to their customers. Furthermore, Experian also offers a free credit report through AnnualCreditReport.com, allowing individuals to review their credit information from the bureau.

TransUnion:

TransUnion provides avenues for individuals to access their FICO score through credit monitoring services and financial institutions that offer credit score access. Additionally, like Equifax and Experian, TransUnion offers a free credit report through AnnualCreditReport.com, enabling individuals to review their credit information and gain insight into their credit standing.

It’s important to note that while credit monitoring services typically offer convenient access to FICO scores and credit reports, some may involve subscription fees. However, individuals are entitled to one free credit report annually from each of the major credit bureaus through AnnualCreditReport.com, as mandated by federal law. This provides an opportunity to review credit reports from Equifax, Experian, and TransUnion at no cost.

Regularly monitoring your FICO scores from all three credit bureaus empowers you to stay informed about your credit standing, identify any discrepancies, and take proactive steps to maintain or improve your credit health. By leveraging the available resources, individuals can gain a comprehensive understanding of their creditworthiness and make informed financial decisions based on their FICO scores from each credit bureau.

Conclusion

Understanding the significance of the FICO score and its impact on your financial well-being is essential in navigating the world of credit and lending. Your FICO score serves as a critical factor in determining the terms of credit offers, including interest rates and credit limits, and can influence various aspects of your financial life, from securing loans to obtaining insurance and even certain employment opportunities.

While Equifax, Experian, and TransUnion are the primary sources of credit information, it’s important to recognize that they do not generate FICO scores themselves. Instead, they provide the data used to calculate FICO scores to the Fair Isaac Corporation, which applies its proprietary scoring model to generate the three-digit FICO score. This underscores the value of obtaining your FICO score from each credit bureau, as the information provided by each bureau may vary, potentially impacting credit decisions made by lenders.

By utilizing the resources offered by the major credit bureaus, such as credit monitoring services and free annual credit reports, individuals can access their FICO scores and credit reports, gaining valuable insights into their credit standing. Regularly monitoring FICO scores from all three bureaus enables individuals to stay informed about their credit health, identify any discrepancies, and take proactive steps to maintain or enhance their creditworthiness.

Ultimately, being proactive in managing your credit profile, understanding your FICO scores from each credit bureau, and addressing any inaccuracies can empower you to make informed financial decisions and pursue opportunities that align with your financial goals. By leveraging the tools and information provided by Equifax, Experian, and TransUnion, individuals can take charge of their credit health and work toward achieving greater financial stability and flexibility.

Armed with a comprehensive understanding of your FICO scores from each credit bureau, you are better equipped to navigate the financial landscape, secure favorable credit terms, and pursue your aspirations with confidence.