Finance

What Is Accrued Expenses On A Balance Sheet

Modified: December 30, 2023

Learn all about accrued expenses on a balance sheet in finance. Understand how they impact financial statements and overall business operations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to understanding the financial health and performance of a company, the balance sheet is a crucial document. It provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. However, not all expenses are reflected on the balance sheet in the same way. Accrued expenses are a specific type of liability that appears on the balance sheet, and understanding them is essential for a comprehensive analysis of a company’s financial standing.

Accrued expenses, also known as accrued liabilities, are costs that a company has incurred but has not yet paid. These expenses can include salaries, interest, rent, utilities, and any other outstanding obligations. Although the company has not yet paid for these expenses, they are still recognized as a liability because the company is obligated to settle them in the future.

Accrued expenses play a crucial role in financial reporting as they help provide a more accurate and complete representation of a company’s financial situation. By recognizing and recording these expenses on the balance sheet, stakeholders can have a better understanding of the company’s obligations and liabilities.

In the following sections, we will explore in more detail what accrued expenses are, provide examples of common accrued expenses, highlight their importance on a balance sheet, discuss how to record them, and examine their impact on financial statements.

Definition of Accrued Expenses

Accrued expenses refer to any costs that a company has incurred but has not yet paid for. These expenses are recognized as liabilities on the balance sheet because the company has an obligation to settle them in the future. While some expenses are paid immediately, such as utility bills or office supplies, accrued expenses are those that have been incurred but not yet paid within the accounting period.

Accrued expenses can arise from various sources within a company, including employee wages, interest expenses, rent, utilities, and vendor invoices. These expenses often accrue over time, adding to the overall financial obligations of the company. It is important to note that accrued expenses are different from accounts payable, as accounts payable represent expenses that have been invoiced but have not yet been paid.

Accrued expenses are recorded on the balance sheet as a current liability since they are expected to be paid within one year or one operating cycle, whichever is longer. This classification is important for financial analysis and reporting purposes, as it provides stakeholders with a clear understanding of the short-term obligations of a company.

Accrued expenses are crucial to consider when evaluating the financial health of a company. They provide insight into the company’s outstanding financial obligations and can impact liquidity and overall financial stability. By properly recognizing and accounting for accrued expenses, companies can ensure accurate financial reporting and decision-making.

Examples of Accrued Expenses

A wide range of expenses can be classified as accrued expenses. Here are some common examples:

- Employee Salaries: When a company’s pay period ends near the end of a month, employees may not be paid until the beginning of the following month. The accrued salary expense represents the amount owed to employees for the work performed during the current accounting period.

- Interest Expenses: If a company has borrowed money or issued bonds, it may have to pay interest on those loans periodically. If the interest payment falls outside the accounting period, it is accrued as an expense and recorded as a liability on the balance sheet.

- Rent: If a company leases office or retail space, the rent for that period may be incurred before the actual payment is due. The accrued rent expense represents the outstanding portion of rent that needs to be paid.

- Utilities: Utility bills, such as electricity, water, and gas, are usually paid monthly or quarterly. If the payment period falls outside the accounting period, the expenses will be accrued and recorded as a liability.

- Vendor Invoices: In some cases, a company may receive goods or services from suppliers before they issue an invoice. The expense is still recorded as an accrued liability based on an estimation of the invoice amount.

These are just a few examples of accrued expenses, but it is important to note that each company’s specific list of accrued expenses may vary depending on its industry, operations, and payment terms.

By properly identifying and recording accrued expenses, companies can ensure that their financial statements accurately reflect their obligations and provide stakeholders with a clearer picture of the company’s financial health and performance.

Importance of Accrued Expenses on a Balance Sheet

Accrued expenses play an essential role in providing a comprehensive and accurate representation of a company’s financial position on the balance sheet. Here are some reasons why accrued expenses are important:

- Accurate Financial Reporting: Including accrued expenses on the balance sheet ensures that the financial statements reflect the company’s true financial obligations. By recognizing and recording these expenses, stakeholders can have a more accurate understanding of the company’s liabilities and can make informed decisions based on the complete financial picture.

- Transparency and Compliance: Accrued expenses contribute to transparency and compliance with accounting standards. By properly recording and disclosing these liabilities, companies provide stakeholders, such as investors and regulators, with the necessary information to evaluate the company’s financial performance and compliance with reporting requirements.

- Evaluation of Short-Term Obligations: Accrued expenses are classified as current liabilities on the balance sheet, indicating that they are expected to be paid within one year or one operating cycle, whichever is longer. This classification helps assess a company’s short-term obligations, liquidity, and ability to meet its financial commitments.

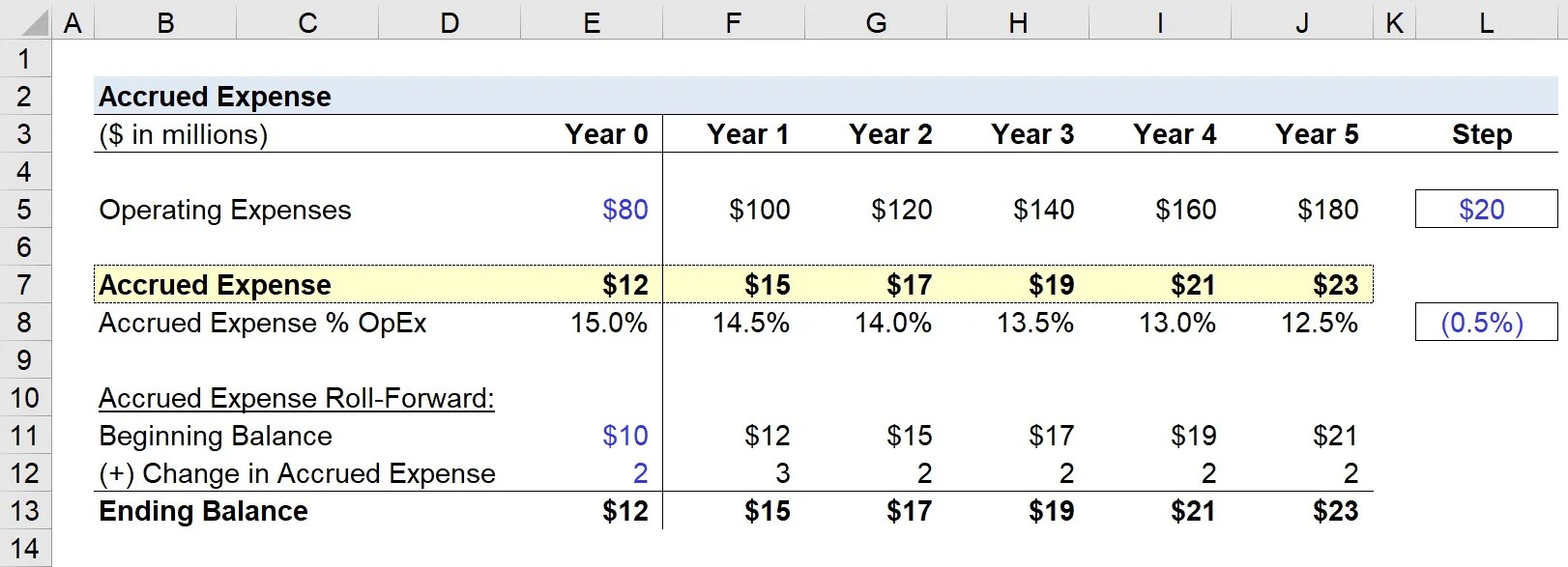

- Accurate Financial Analysis: Accrued expenses are crucial for accurate financial analysis. They help analyze a company’s cash flow, working capital, and financial stability. For example, a company with high levels of accrued expenses relative to its revenue may indicate potential cash flow challenges or financial strain.

- Budgeting and Forecasting: Accrued expenses provide insights into future cash outflows, allowing companies to more accurately budget and forecast their financial resources. By understanding these obligations in advance, companies can manage their cash flow effectively and plan for upcoming expenses.

By recognizing and disclosing accrued expenses on the balance sheet, companies can ensure financial transparency, facilitate informed decision-making, and comply with accounting standards. It is crucial for stakeholders, including investors, creditors, and management, to have a complete understanding of a company’s financial obligations and liabilities to make sound financial decisions and evaluate the financial health of the company.

Recording Accrued Expenses

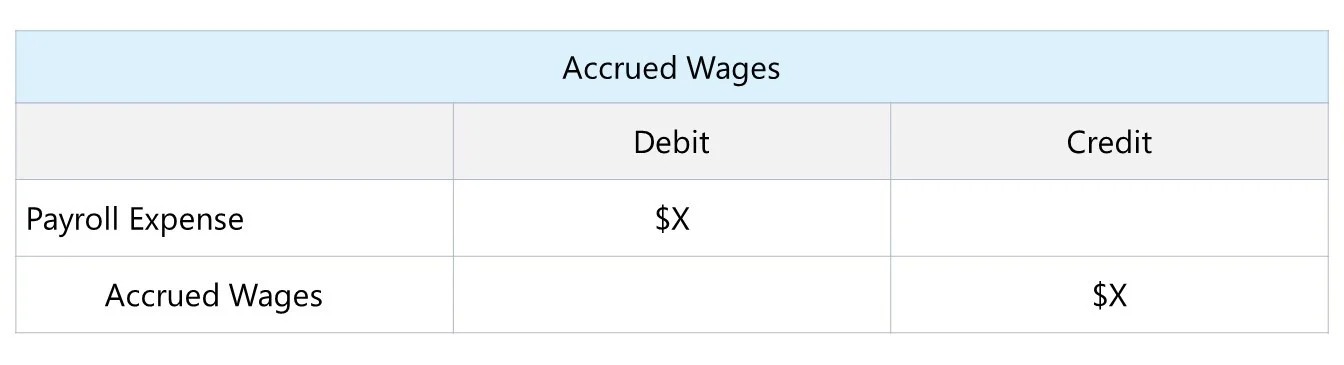

Accrued expenses are recorded to reflect the company’s outstanding obligations that have been incurred but not yet paid. The process of recording accrued expenses involves two steps: recognizing the expense and recording the corresponding liability.

Step 1: Recognizing the Expense: The first step in recording accrued expenses is to recognize the expense in the accounting period in which it is incurred. This is typically done by debiting the corresponding expense account (e.g., salaries expense, rent expense) and crediting the accrued expense account.

Step 2: Recording the Liability: After recognizing the expense, the next step is to record the corresponding liability on the balance sheet. This is done by debiting the accrued expense account and crediting the corresponding liability account (e.g., accrued salaries, accrued rent).

Once the accrued expenses are recorded, they will appear as current liabilities on the balance sheet until they are paid. As the payment is made, the liability is reduced, and the cash account is debited to reflect the cash outflow.

It is important to note that the exact process for recording accrued expenses may vary depending on the accounting system and specific accounting policies of the company. Some companies may also use estimates to record accrued expenses if the exact amount is not known at the time of entry. These estimates may be adjusted during the subsequent accounting period once the actual amount is determined.

Properly recording accrued expenses ensures that the company’s financial statements accurately reflect its outstanding obligations. It provides transparency and clarity regarding the timing and amount of future cash disbursements, allowing stakeholders to evaluate the company’s financial position and make informed decisions.

Impact of Accrued Expenses on Financial Statements

Accrued expenses have a significant impact on a company’s financial statements, particularly the balance sheet and income statement. Let’s explore how these liabilities affect the financial statements:

Balance Sheet: Accrued expenses appear as liabilities on the balance sheet and are classified as current liabilities if they are expected to be settled within one year or one operating cycle. The accrued expense amount is reported under the liabilities section, providing a clear indication of the company’s outstanding obligations. This information is crucial for assessing the company’s liquidity, short-term financial health, and ability to meet its financial obligations.

Income Statement: Accrued expenses impact the income statement by increasing expenses and reducing net profit. When the expenses are recognized as they are incurred, they are recorded in the respective expense accounts, such as salaries expense or rent expense. This reduces the net profit for the accounting period, reflecting the true cost of running the business. It is important to note that accrued expenses are not considered as cash outflows, so they do not impact the cash flow statement.

Statement of Cash Flows: Accrued expenses, being non-cash items, do not directly impact the operating activities section of the statement of cash flows. However, they can indirectly affect cash flow through the payment of the accrued expenses. Once the accrued expenses are paid, it is reflected as a cash outflow in the operating activities section of the cash flow statement.

Footnotes and Disclosures: Companies are often required to provide additional information about accrued expenses in the footnotes accompanying the financial statements. This includes details about the nature of the expenses, their timing, and any significant estimates involved in their calculation. These disclosures help provide transparency and clarity to stakeholders, enabling them to make informed decisions based on a complete understanding of the company’s financial position.

The impact of accrued expenses on the financial statements is essential for stakeholders, including investors, creditors, and analysts, as it provides a more comprehensive view of the company’s financial performance, obligations, and cash flow. By recognizing and properly disclosing these liabilities, companies can ensure accurate financial reporting and provide stakeholders with meaningful information for decision-making.

Conclusion

Accrued expenses are an integral component of a company’s financial management and reporting. They represent costs that have been incurred but not yet paid, and they play a crucial role in accurately portraying a company’s financial position on the balance sheet. By recognizing and recording these liabilities, companies provide stakeholders with a complete picture of their obligations and financial health.

Accrued expenses can encompass a variety of costs, including salaries, interest expenses, rent, utilities, and vendor invoices. By properly identifying and recording these expenses, companies can ensure transparency, compliance with accounting standards, and accurate financial reporting.

Accrued expenses impact both the balance sheet and income statement. On the balance sheet, they appear as current liabilities, reflecting the company’s short-term obligations. On the income statement, they increase expenses, reducing the net profit for the accounting period.

Properly recording accrued expenses allows stakeholders to evaluate a company’s financial position, liquidity, and ability to meet its financial commitments. It also aids in budgeting, forecasting, and accurate financial analysis. The information provided by accrued expenses enables stakeholders to make informed decisions and assess the overall financial health and performance of a company.

In conclusion, understanding and properly managing accrued expenses are essential for any company’s financial well-being. By recognizing and accounting for these liabilities, companies can provide transparency, comply with reporting requirements, and provide stakeholders with the necessary information to make informed decisions. Accrued expenses are a vital piece of the financial puzzle, allowing for a comprehensive assessment of a company’s financial position and ensuring accuracy in financial reporting.