Finance

How To Calculate Preferred Dividends

Modified: January 5, 2024

Learn how to calculate preferred dividends in finance with this step-by-step guide. Understand the importance of preferred stock and its impact on shareholder returns.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Preferred Dividends

- Types of Preferred Dividends

- Fixed Rate Preferred Dividends

- Adjustable Rate Preferred Dividends

- Participating Preferred Dividends

- Non-Participating Preferred Dividends

- How to Calculate Preferred Dividends

- Step 1: Determine the Dividend Rate or Percentage

- Step 2: Calculate the Preferred Dividend Amount

- Step 3: Consider Any Cumulative Features

- Step 4: Accounting for Preferred Dividends in Financial Statements

- Example Calculation of Preferred Dividends

- Conclusion

Introduction

Welcome to the world of preferred dividends! As an investor or someone interested in the finance industry, understanding how to calculate preferred dividends is essential. Preferred dividends play a crucial role in determining the return on investment for preferred shareholders.

Preferred dividends are a form of payment made to preferred shareholders of a company. Unlike common dividends, which are distributed based on the number of shares held, preferred dividends are typically paid out at a fixed rate or percentage.

In this article, we will dive into the intricacies of preferred dividends and explore the different types of preferred dividends that exist. We will also provide a step-by-step guide on how to calculate preferred dividends, taking into consideration various factors such as dividend rate, cumulative features, and financial statements.

Understanding how preferred dividends are calculated is not only vital for investors but also for businesses that issue preferred shares. Accurately calculating and accounting for preferred dividends ensures proper financial reporting and helps maintain transparency with shareholders.

So, whether you are an investor looking to analyze potential investments or a business seeking to understand how preferred dividends impact your financial statements, this article is here to provide you with a comprehensive understanding of calculating preferred dividends.

Understanding Preferred Dividends

Before we dive into the calculations, let’s first understand what preferred dividends are and why they are important. Preferred dividends are a type of payment that is made to the holders of preferred shares in a company. Preferred shares are a class of stock that generally comes with specific rights and privileges, including a fixed dividend rate.

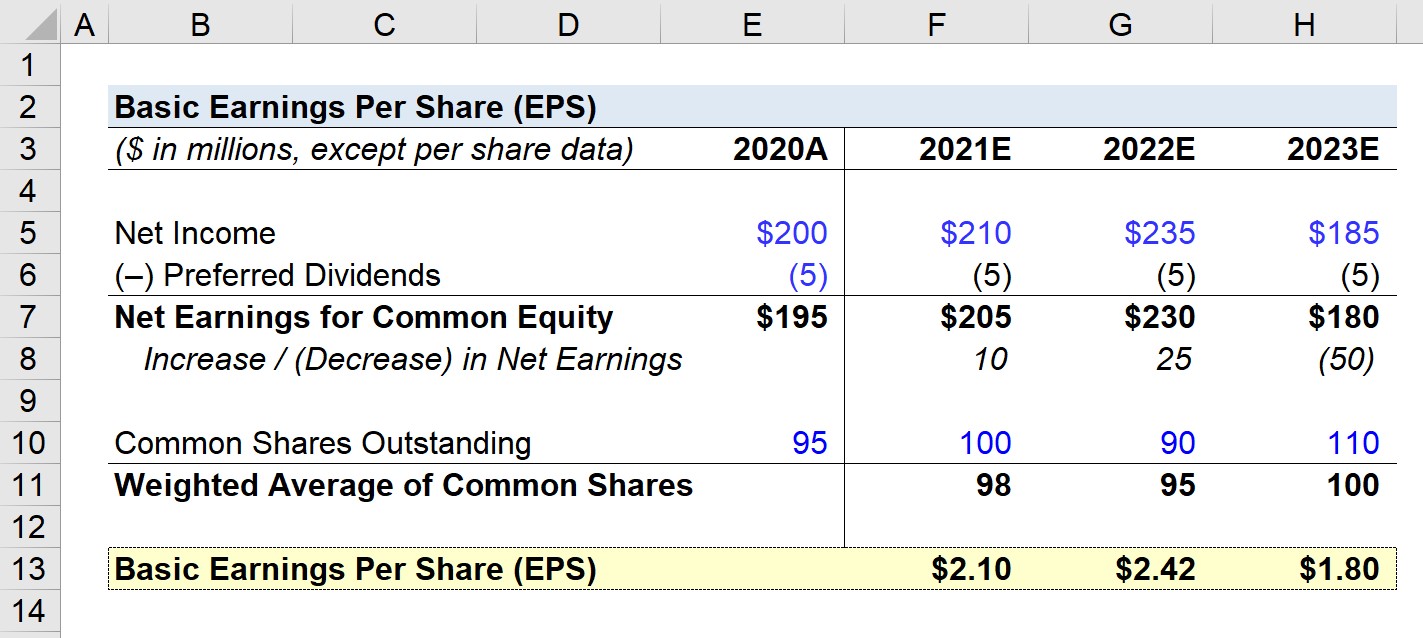

The primary distinction between preferred dividends and common dividends lies in the priority of payment. Preferred shareholders have a higher claim on the company’s earnings compared to common shareholders. This means that preferred dividends must be paid out before any dividends can be distributed to common shareholders.

The fixed dividend rate on preferred shares is typically expressed as a percentage of the par value of the shares. For example, if a company issues preferred shares with a 5% dividend rate and a par value of $100, each share would be entitled to receive $5 in dividends annually.

Preferred dividends can be seen as a way to reward preferred shareholders for their investment and provide them with a stable income stream. However, it’s important to note that preferred shareholders generally do not have voting rights in the company and have a more limited upside potential compared to common shareholders.

In addition to the fixed rate, there are other factors that can impact preferred dividends, such as the cumulative nature of the dividends and any adjustable or participating features. Cumulative preferred dividends allow for unpaid dividends to accumulate and be paid out in the future, whereas non-cumulative preferred dividends do not carry over any unpaid amounts to future periods.

Understanding the nuances of preferred dividends is crucial for investors and businesses alike. For investors, it helps them assess the potential return on investment and make informed decisions. For businesses, it ensures accurate financial reporting and compliance with the terms and conditions of preferred shares.

Now that we have a solid understanding of what preferred dividends are, let’s explore the different types of preferred dividends that exist in the market.

Types of Preferred Dividends

Preferred dividends come in various types, each with its own characteristics and implications. Understanding the different types of preferred dividends will allow investors and businesses to make more informed decisions. Let’s explore the main types of preferred dividends:

- Fixed Rate Preferred Dividends: This is the most common type of preferred dividend. It involves a fixed percentage or rate that is applied to the par value of the preferred shares. The fixed rate remains constant throughout the life of the shares, providing predictable income for the preferred shareholders.

- Adjustable Rate Preferred Dividends: Unlike fixed rate preferred dividends, adjustable rate preferred dividends fluctuate based on certain predetermined factors. These factors may include changes in interest rates, inflation rates, or the financial performance of the company. Adjustable rate preferred dividends provide a degree of flexibility to both the company and the shareholders.

- Participating Preferred Dividends: Participating preferred dividends give preferred shareholders the opportunity to receive additional dividends beyond their fixed rate. If the company achieves a certain level of profitability, the participating preferred shareholders are entitled to a share of the excess profits. This allows preferred shareholders to benefit from the company’s success and potentially earn a higher return on their investment.

- Non-Participating Preferred Dividends: Non-participating preferred dividends, on the other hand, do not provide the opportunity for preferred shareholders to receive additional dividends beyond their fixed rate. In this case, preferred shareholders are limited to the predetermined dividend rate and do not participate in any excess profits.

Each type of preferred dividend has its own advantages and considerations. It’s important for investors and businesses to carefully assess the terms and conditions of preferred shares to understand the implications of the chosen dividend structure.

Now that we have explored the different types of preferred dividends, let’s move on to the next section on how to calculate preferred dividends in practice.

Fixed Rate Preferred Dividends

Fixed rate preferred dividends are the most common type of preferred dividends. As the name suggests, they involve a fixed percentage or rate that is applied to the par value of the preferred shares. This fixed rate determines the amount of dividends that preferred shareholders will receive.

For example, let’s say a company issues preferred shares with a fixed rate of 6% and a par value of $100. This means that each preferred share will be entitled to receive $6 in dividends annually (6% of $100).

Calculating fixed rate preferred dividends is straightforward. All you need to know is the dividend rate and the par value of the preferred shares. The formula to calculate the dividend amount is:

Dividend Amount = Dividend Rate x Par Value

Let’s take another example to illustrate the calculation. Suppose a company issues preferred shares with a fixed rate of 8% and a par value of $50. To calculate the dividend amount, you would use the following formula:

Dividend Amount = 8% x $50 = $4

Therefore, each preferred share would be entitled to receive $4 in dividends annually.

It’s important to note that fixed rate preferred dividends provide preferred shareholders with a predictable income stream. The dividend amount remains constant throughout the life of the shares, regardless of the company’s financial performance or other market conditions.

Now that we have covered fixed rate preferred dividends, let’s proceed to the next section, where we will explore other types of preferred dividends.

Adjustable Rate Preferred Dividends

Unlike fixed rate preferred dividends, adjustable rate preferred dividends are not set at a fixed percentage or rate. Instead, they can fluctuate based on specific predetermined factors. These factors may include changes in interest rates, inflation rates, or the financial performance of the company.

The flexibility of adjustable rate preferred dividends allows for adjustments to be made to the dividend payment to reflect changes in economic conditions or the company’s financial health. This can be beneficial for both the company and the preferred shareholders.

To determine the dividend amount for adjustable rate preferred dividends, the specific formula or mechanism for adjusting the rate will need to be followed. This may involve using a reference rate, such as the prime rate or Treasury bill rate, and adding a predetermined spread or percentage above that rate.

For example, let’s suppose a company issues adjustable rate preferred shares with a reference rate of the Treasury bill rate plus a spread of 2%. If the current Treasury bill rate is 1.5%, the dividend rate for the preferred shares would be 3.5% (1.5% + 2%).

The calculation for adjustable rate preferred dividends will depend on the formula or mechanism outlined in the terms and conditions of the shares. It’s important for investors and businesses to carefully review and understand these provisions to accurately calculate and project the dividend payments.

Adjustable rate preferred dividends provide some degree of flexibility for both the company and the preferred shareholders. If economic conditions or the company’s financial performance improve, the dividend rate may increase, allowing preferred shareholders to benefit from the upside potential. Conversely, if conditions worsen, the dividend rate may decrease, thereby protecting the company’s financial stability.

Understanding the formula or mechanism for adjusting the dividend rate is essential for accurate calculations and informed decision-making. Now that we have covered adjustable rate preferred dividends, let’s move on to the next section where we will explore participating and non-participating preferred dividends.

Participating Preferred Dividends

Participating preferred dividends are a type of preferred dividend that provides preferred shareholders with the opportunity to receive additional dividends beyond their fixed rate. These additional dividends are granted if the company achieves a certain level of profitability or exceeds a specified threshold.

Under the participating preferred dividend structure, preferred shareholders have the right to “participate” in the profits of the company alongside common shareholders. This means that preferred shareholders not only receive their fixed rate dividends but also have the potential to earn additional dividends based on the company’s success.

The exact mechanism for calculating participating preferred dividends can vary depending on the terms and conditions outlined for the shares. In some cases, the additional dividends are calculated based on a percentage or ratio of the common dividends paid out. In other cases, the participating preferred shareholders may have a set percentage of the remaining profits allocated to them after the common shareholders have received their dividends.

For example, let’s consider a company that issues participating preferred shares with a fixed rate of 6% and a participation ratio of 20%. If the company declares $100,000 in common dividends, the participating preferred shareholders would be entitled to an additional $20,000 (20% of $100,000) in dividends.

Participating preferred dividends offer preferred shareholders the opportunity to benefit from the company’s success and potentially earn a higher return on their investment. However, it’s important to note that participating preferred shareholders typically have a cap on how much they can receive in total dividends.

The participation feature can vary between different classes of preferred shares, so it’s crucial for investors and businesses to carefully review the terms and conditions to understand the implications and potential returns of the participating preferred dividends.

Now that we have covered participating preferred dividends, let’s move on to the next section where we will explore non-participating preferred dividends.

Non-Participating Preferred Dividends

Non-participating preferred dividends are a type of preferred dividend where preferred shareholders do not have the opportunity to receive additional dividends beyond their fixed rate. Unlike participating preferred dividends, non-participating preferred shareholders are limited to the predetermined dividend rate and do not participate in any excess profits or earnings of the company.

Under the non-participating preferred dividend structure, preferred shareholders receive a fixed percentage or rate of dividends based on the par value of their shares. This fixed rate remains constant throughout the life of the shares, providing a predictable income stream for preferred shareholders.

For example, let’s consider a company that issues non-participating preferred shares with a fixed rate of 5% and a par value of $100. Each preferred share would then receive $5 in dividends annually (5% of $100), irrespective of the company’s financial performance or profitability.

Non-participating preferred dividends are often chosen by companies to protect their common shareholders’ interests and preserve the profits generated by the business. By setting a fixed rate without additional participation, non-participating preferred shareholders have a more limited upside potential compared to participating preferred shareholders.

While non-participating preferred dividends may offer less potential for additional returns, they can still be an attractive investment option for those seeking a stable and predictable income stream. The fixed rate provides preferred shareholders with a consistent dividend payment, shielding them from fluctuations in the company’s financial performance.

It’s important for investors and companies to carefully consider the implications of non-participating preferred dividends when evaluating investment opportunities or issuing preferred shares. Understanding the fixed rate and its impact on the overall dividend structure is essential for sound financial decision-making.

Now that we have covered non-participating preferred dividends, let’s move on to the next section where we will explore the step-by-step process of calculating preferred dividends.

How to Calculate Preferred Dividends

Calculating preferred dividends involves several steps to determine the dividend amount that preferred shareholders will receive. The process takes into consideration factors such as the dividend rate, par value, and any cumulative features. Here is a step-by-step guide on how to calculate preferred dividends:

- Step 1: Determine the Dividend Rate or Percentage: Review the terms and conditions of the preferred shares to identify the fixed or adjustable dividend rate. This rate is typically expressed as a percentage of the par value of the shares.

- Step 2: Calculate the Preferred Dividend Amount: Multiply the dividend rate by the par value of the preferred shares. This calculation will give you the preferred dividend amount per share. This amount represents the regular dividend payment that preferred shareholders are entitled to receive.

- Step 3: Consider Any Cumulative Features: Determine if the preferred dividends are cumulative or non-cumulative. If the dividends are cumulative, any unpaid dividends from past periods will accumulate and must be paid before any common dividends are distributed.

- Step 4: Accounting for Preferred Dividends in Financial Statements: Ensure that the preferred dividends are properly accounted for in the company’s financial statements. This includes recording the dividends as an expense and adjusting the retained earnings to reflect the dividend payments.

By following these steps, you can accurately calculate the preferred dividends for a given period. It’s important to thoroughly review the terms and conditions of the preferred shares to understand the specific calculations and any special provisions that may apply.

Let’s move on to the next section, where we will provide an example calculation of preferred dividends to further illustrate the process.

Step 1: Determine the Dividend Rate or Percentage

The first step in calculating preferred dividends is to determine the dividend rate or percentage. This rate is specified in the terms and conditions of the preferred shares and represents the fixed or adjustable rate at which dividends will be paid out.

The dividend rate is typically expressed as a percentage of the par value of the preferred shares. It represents the portion of the par value that will be paid out as dividends to preferred shareholders.

To determine the dividend rate, review the relevant documentation, such as the company’s articles of incorporation or preferred share prospectus. These will include the specifics of the dividend rate and any adjustments that may apply.

For example, if a company issues preferred shares with a par value of $100 and a dividend rate of 8%, the dividend rate is 8% of $100, which is $8. This means that each preferred share will be entitled to receive $8 in dividends annually.

It’s important to understand that the dividend rate may be fixed or adjustable. In the case of fixed rate preferred dividends, the rate remains constant throughout the life of the shares. However, adjustable rate preferred dividends may change based on certain predetermined factors, such as changes in interest rates or the company’s financial performance.

By determining the dividend rate or percentage, you establish the basis for calculating the preferred dividends for each period. This information will be used in subsequent steps to determine the dividend amount and account for preferred dividends in the company’s financial statements.

Now that we have covered step 1, let’s move on to step 2, where we will calculate the preferred dividend amount based on the determined rate.

Step 2: Calculate the Preferred Dividend Amount

After determining the dividend rate or percentage in step 1, the next step in calculating preferred dividends is to determine the preferred dividend amount. This calculation involves multiplying the dividend rate by the par value of the preferred shares.

The formula for calculating the preferred dividend amount is:

Preferred Dividend Amount = Dividend Rate x Par Value

Let’s take an example to illustrate this calculation. Suppose a company issues preferred shares with a dividend rate of 6% and a par value of $100. The calculation would be as follows:

Preferred Dividend Amount = 6% x $100 = $6

In this case, each preferred share would be entitled to receive $6 in dividends annually.

It’s important to note that this calculation assumes a fixed rate preferred dividend. If the preferred shares have an adjustable rate, the formula and inputs may vary based on the specific provisions outlined in the terms and conditions.

By calculating the preferred dividend amount, you have determined the specific dollar value that preferred shareholders will receive as dividends for each period. This amount represents the regular dividend payment that preferred shareholders are entitled to based on the dividend rate and the par value of their shares.

Now that we have completed step 2, let’s move on to step 3, where we will consider any cumulative features that may impact the preferred dividends.

Step 3: Consider Any Cumulative Features

When calculating preferred dividends, it’s important to consider whether the dividends are cumulative or non-cumulative. The cumulative feature determines whether unpaid dividends from previous periods accumulate and must be paid before any common dividends are distributed.

If the preferred dividends are cumulative, any unpaid dividends are carried forward and accumulate until they are fully paid. This means that if a company is unable to pay the full dividend amount in a particular period, the unpaid portion will accumulate and must be paid before any dividends are distributed to common shareholders.

On the other hand, if the preferred dividends are non-cumulative, any unpaid dividends from previous periods do not carry over. If a company fails to pay the full dividend amount in a period, the unpaid portion is not accumulated, and preferred shareholders are not entitled to receive those unpaid dividends in future periods.

Cumulative preferred dividends provide additional protection and assurance to preferred shareholders. It ensures that they are compensated for any missed dividend payments before any dividends are distributed to common shareholders. Non-cumulative preferred dividends, on the other hand, give more flexibility to the company by not requiring them to make up for previous missed payments.

When calculating preferred dividends, be sure to consider whether the dividends are cumulative or non-cumulative and adjust the calculations and financial statements accordingly. Understanding the cumulative feature of the preferred shares is crucial in accurately accounting for and reporting the dividend payments.

Now that we have considered any cumulative features in step 3, let’s move on to step 4, where we will discuss accounting for preferred dividends in the financial statements.

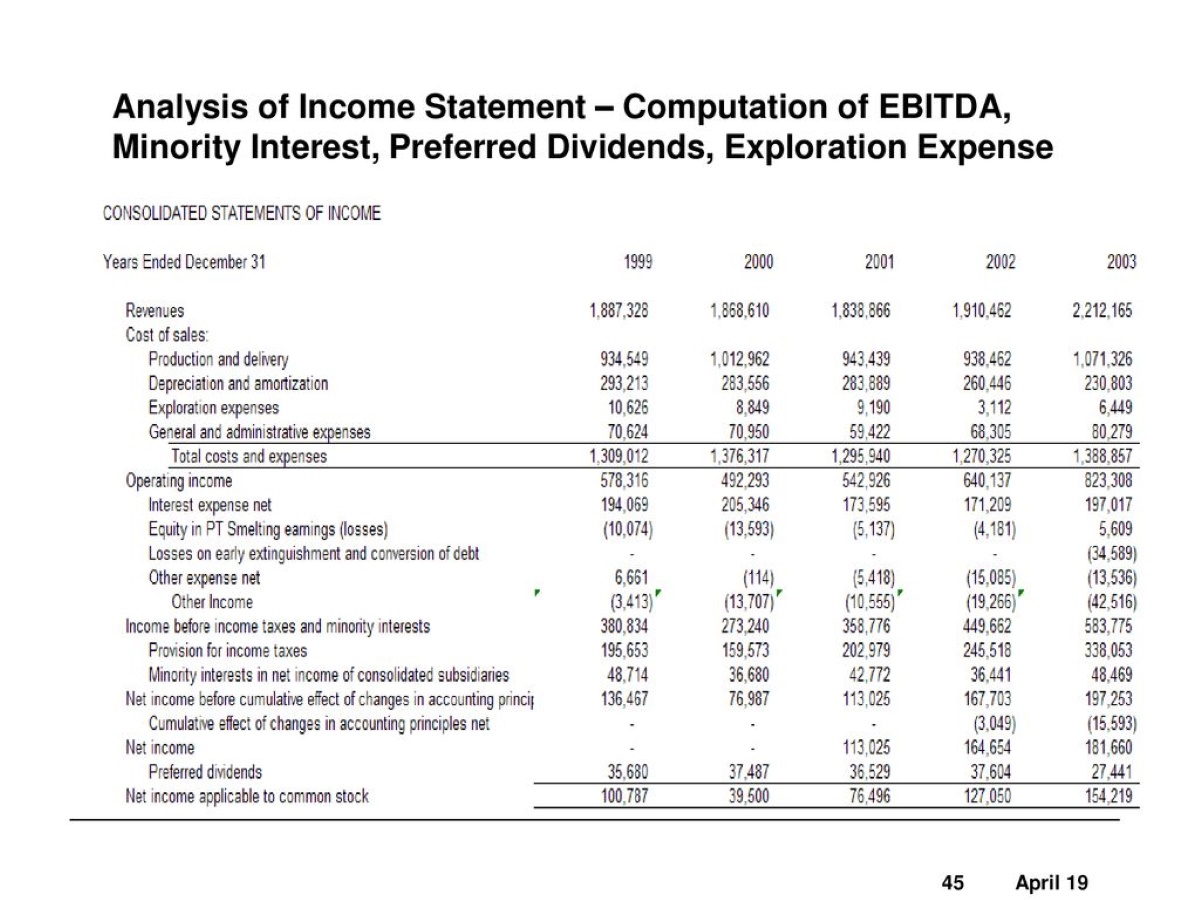

Step 4: Accounting for Preferred Dividends in Financial Statements

Accounting for preferred dividends in the financial statements is an essential step to ensure accurate reporting and compliance with accounting standards. It involves recording the preferred dividends as an expense and adjusting the company’s financial statements accordingly.

When preferred dividends are declared, they are classified as a liability on the company’s balance sheet since they represent an obligation to preferred shareholders. The amount of the preferred dividends is recorded in the appropriate liability account, such as “Preferred Dividends Payable.”

In the income statement, preferred dividends are recognized as an expense since they reduce the company’s net income. The expense is typically listed separately from other operating expenses to provide transparency in the financial statements.

Accounting for cumulative preferred dividends requires special attention. If preferred dividends are cumulative and have not been paid in previous periods, any unpaid dividends must be accounted for. The cumulative unpaid dividends should be recorded as a liability on the balance sheet and only cleared when the dividends are actually paid to the preferred shareholders.

It’s important to accurately account for preferred dividends in the financial statements to reflect the impact on the company’s overall financial position and performance. This information is vital for stakeholders, such as investors and creditors, as they analyze the company’s financial health.

Consulting with a qualified accountant is recommended to ensure proper accounting treatment and adherence to relevant accounting standards when dealing with preferred dividends. They can provide guidance tailored to the specific circumstances of the company and ensure compliance with applicable regulations.

With step 4 completed, we have accounted for preferred dividends in the financial statements. In the next section, we will provide an example calculation of preferred dividends to further illustrate the process.

Example Calculation of Preferred Dividends

Let’s walk through a practical example to illustrate how to calculate preferred dividends. Suppose Company XYZ has issued preferred shares with a dividend rate of 7% and a par value of $50 per share. The company has 1,000 preferred shares outstanding.

To calculate the preferred dividends for a given period:

- Step 1: Determine the Dividend Rate or Percentage: In this example, the dividend rate is 7%.

- Step 2: Calculate the Preferred Dividend Amount: Multiply the dividend rate by the par value of the preferred shares: 7% x $50 = $3.50. The preferred dividend amount per share is $3.50.

- Step 3: Consider Any Cumulative Features: Let’s assume that the preferred dividends are non-cumulative in this example.

- Step 4: Accounting for Preferred Dividends in Financial Statements: The company will record the preferred dividends as an expense in the income statement and as a liability on the balance sheet until they are paid.

Based on these calculations, the annual preferred dividend for each preferred share would be $3.50. So, if Company XYZ has 1,000 preferred shares outstanding, the total preferred dividends for the year would be:

Total Preferred Dividends = Preferred Dividend Amount per Share x Number of Preferred Shares

Total Preferred Dividends = $3.50 x 1,000 = $3,500

Therefore, Company XYZ would need to pay a total of $3,500 in preferred dividends to its preferred shareholders for the year.

It’s important to note that this example assumes non-cumulative preferred dividends. If the preferred dividends were cumulative, any unpaid dividends from previous periods would need to be accounted for and paid before any common dividends are distributed.

By following these steps and considering the specific terms and conditions of the preferred shares, you can accurately calculate the preferred dividends for a given period.

Now that we have explored the example calculation of preferred dividends, let’s conclude our article.

Conclusion

Calculating preferred dividends is an essential task for both investors and businesses. Understanding how to calculate preferred dividends provides insights into the return on investment for preferred shareholders and ensures accurate financial reporting for companies.

In this comprehensive guide, we have explored the concept of preferred dividends and the different types that exist, such as fixed rate preferred dividends, adjustable rate preferred dividends, participating preferred dividends, and non-participating preferred dividends. We have walked through the step-by-step process of calculating preferred dividends, considering factors such as the dividend rate, cumulative features, and accounting for preferred dividends in financial statements.

By following the outlined steps and understanding the specific provisions of the preferred shares, investors can make informed decisions about their investments, and businesses can accurately account for and report preferred dividends in compliance with accounting standards.

It’s significant to note that calculating preferred dividends should not be viewed in isolation but as part of a comprehensive analysis of an investment’s potential. Other factors like the company’s financial health, market conditions, and future payment obligations should also be considered when assessing the value of preferred shares.

In conclusion, understanding how to calculate preferred dividends is crucial for anyone involved in the finance industry. By grasping the nuances of preferred dividends and following the step-by-step process, investors can make informed investment decisions, and businesses can effectively manage their financial reporting obligations.

Remember, when it comes to calculating preferred dividends, seeking guidance from financial and taxation professionals is highly recommended to ensure accuracy and compliance with applicable regulations and standards.