Finance

Why An Income Property Is A Good Investment

Published: October 18, 2023

Looking to diversify your investment portfolio? Discover why an income property can be a lucrative and reliable option for long-term financial growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Benefits of Investing in Income Property

- Potential for Passive Income

- Appreciation of Property Value

- Tax Advantages

- Diversification of Investment Portfolio

- Control over Investment

- Potential for Long-Term Wealth Building

- Risks and Considerations of Investing in Income Property

- Property Management and Maintenance

- Market and Tenant Risk

- Financing and Cash Flow Considerations

- Conclusion

Introduction

Investing in income property is a smart financial move that can provide numerous benefits to investors. Whether you’re a seasoned investor or just starting out, income property offers a unique opportunity to generate passive income, gain tax advantages, and build long-term wealth. In this article, we will explore why income property is a good investment and discuss the potential risks and considerations that come with it.

Income property refers to real estate that is purchased with the intention of generating rental income. This can include residential properties like single-family homes, multi-unit apartment buildings, or commercial properties such as office spaces or retail locations. The appeal of investing in income property lies in its ability to provide consistent cash flow and the potential for property value appreciation over time.

While there are risks involved, income property has proven to be a stable and profitable investment option for many individuals. With the right strategy and careful planning, income property can serve as an excellent addition to your investment portfolio. In the following sections, we will delve into the specific benefits of investing in income property and address some of the potential risks.

Benefits of Investing in Income Property

Investing in income property offers a range of benefits that make it an attractive option for both novice and experienced investors. Let’s explore some of the key advantages:

- Potential for Passive Income: Income property provides an opportunity for investors to earn regular passive income through rental payments from tenants. This cash flow can help offset the expenses associated with the property, such as mortgage payments, maintenance costs, and property management fees.

- Appreciation of Property Value: Over time, income properties have the potential to appreciate in value. This appreciation can result from factors such as increased demand in the rental market, neighborhood development, or improvements made to the property itself. As the property value increases, so does the owner’s equity, providing a long-term wealth-building opportunity.

- Tax Advantages: Income property owners can take advantage of various tax benefits. Rental income is generally considered passive income and may qualify for lower tax rates. Additionally, owners can deduct expenses associated with the property, such as mortgage interest, property taxes, insurance, maintenance, and depreciation. Consult with a tax professional to understand the specific tax advantages available in your region.

- Diversification of Investment Portfolio: Investing in income property allows for diversification of your investment portfolio. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can decrease the overall risk of your portfolio. Income property can act as a hedge against market volatility, providing stability and potential returns even in uncertain times.

- Control over Investment: Unlike other investment options such as stocks or mutual funds, income property provides investors with more control over their investment. Property owners have the ability to make decisions regarding rental rates, property improvements, and tenant selection. This level of control allows for strategic management and optimization of returns.

- Potential for Long-Term Wealth Building: Investing in income property offers the potential to build long-term wealth. As property values appreciate and rental income increases over time, the property owner’s net worth can grow significantly. Additionally, as the mortgage is paid down, the owner’s equity in the property increases, providing additional financial stability and potential for future investment opportunities.

These benefits make income property an attractive investment option for individuals looking to generate passive income, build wealth, and diversify their investment portfolio. However, it’s important to consider the potential risks and challenges associated with income property investment, which we will discuss in the next section.

Potential for Passive Income

One of the primary benefits of investing in income property is the potential for generating passive income. Passive income is income that is earned with minimal effort or active involvement on the part of the investor. In the case of income property, this passive income is generated through rental payments from tenants.

When you invest in income property, you become the landlord or property owner. Tenants pay rent to live or operate a business in your property, and this rental income becomes a steady source of passive cash flow. With the right investment and property management strategies, you can create a reliable income stream that grows over time.

There are several factors that contribute to the potential for passive income with income property:

- Occupancy Rate: Maintaining a high occupancy rate is crucial for maximizing your rental income. By attracting and retaining quality tenants, you can ensure a consistent flow of rental payments, reducing the risk of vacancies and associated lost income.

- Rental Rates: Setting competitive rental rates is essential for attracting tenants while ensuring your income property remains profitable. Conducting market research and considering factors such as location, property features, and local rental market conditions will help you determine the optimal rental rates.

- Property Management: Efficient property management plays a key role in generating passive income. From handling tenant inquiries and collecting rent to maintenance and repairs, effective property management ensures a smooth operation and enhances tenant satisfaction, leading to longer tenancies and stable rental income.

- Long-Term Rental Market Demand: Evaluating the demand for rental properties in your desired location is crucial. Researching factors such as population growth, job opportunities, and rental market trends can help assess the long-term viability and potential for sustained rental income.

- Property Appreciation: While passive income is generated through rental payments, income property also has the potential for property appreciation. This occurs when the value of the property increases over time due to factors such as market demand, improvements made to the property, or neighborhood development. Appreciation can provide additional financial benefits when you decide to sell the property.

It’s important to note that generating passive income from income property does require initial efforts in property acquisition, setting up rental agreements, and property management. However, once the property is established and tenants are in place, the income generated can provide a steady and long-term source of passive cash flow.

However, it is essential to conduct proper due diligence, including analyzing potential risks and challenges, and consulting with real estate professionals, to ensure that the income property is a suitable investment for your financial goals and risk tolerance.

Appreciation of Property Value

Investing in income property not only provides a potential source of passive income but also offers the opportunity for property value appreciation over time. Property value appreciation refers to the increase in the market value of the property, resulting in a higher selling price or increased equity for the investor.

Several factors contribute to the appreciation of income property value:

- Market Demand: The demand for rental properties in a particular location plays a significant role in property value appreciation. Strong market demand, driven by factors such as population growth, job opportunities, and economic development, can result in increased rental rates and property values.

- Neighborhood Development: Positive changes in the neighborhood surrounding your income property can boost its value. Factors such as new infrastructure, improved amenities, and revitalization projects can attract more tenants and potential buyers, driving property values upward.

- Property Improvements: Making strategic improvements and upgrades to your income property can have a direct impact on its value. Renovations, modern amenities, energy-efficient upgrades, and landscaping enhancements can make your property more attractive to tenants and increase its market value.

- Supply and Demand Imbalance: If demand for rental properties exceeds the available supply in a particular area, property values can appreciate as competition among renters drives rental rates higher. This can result in increased rental income and a higher overall property value.

- Inflation: Over time, inflation can contribute to property value appreciation. As the value of goods and services increases, so does the value of real estate. Income property owners can benefit from this general upward trend in prices, which can lead to higher rental rates and increased property values.

It’s worth noting that property value appreciation is not guaranteed and can fluctuate depending on various market conditions. Real estate markets can experience cycles of growth, stability, or decline. Conducting thorough market research, understanding local trends, and working with experienced real estate professionals can help you make informed decisions and capitalize on potential property value appreciation.

While property value appreciation can provide significant returns on your investment, it’s important to approach income property investment with a long-term perspective. Property values may not experience immediate or substantial appreciation, and market conditions can vary. However, over time, income property has historically shown resilience and the potential for steady growth in value.

In addition to the potential for passive income, property value appreciation can significantly contribute to the overall growth of your investment portfolio and long-term wealth-building goals. However, it’s essential to carefully analyze the local market, consider the property’s location and condition, and assess the demand and growth potential before investing in income property for the purpose of value appreciation.

Tax Advantages

One of the significant benefits of investing in income property is the various tax advantages it provides. These tax benefits can help increase your overall return on investment and improve your cash flow. Here are some key tax advantages of income property:

- Depreciation: The Internal Revenue Service (IRS) allows income property owners to claim depreciation as an expense. Depreciation is a non-cash expense that reflects the wear and tear, deterioration, or obsolescence of the property over time. By deducting depreciation, you can reduce your taxable income, resulting in lower tax liability.

- Mortgage Interest Deduction: If you have a mortgage on your income property, you can deduct the interest paid on that mortgage from your taxable income. This deduction can reduce your overall tax liability and increase your cash flow. It’s important to keep accurate records of your mortgage interest payments for tax purposes.

- Property Taxes Deduction: Property taxes paid on your income property are generally tax-deductible. You can deduct the full amount of property taxes paid from your taxable income, reducing your tax liability. Be sure to keep track of your property tax payments and consult with a tax professional to ensure you are maximizing this deduction.

- Repairs and Maintenance Deduction: Expenses incurred for repairs, maintenance, and upkeep of your income property can be deducted from your taxable income. This includes costs for routine repairs, painting, plumbing, landscaping, and other necessary maintenance expenses. Keeping detailed records of these expenses is essential for claiming this deduction.

- Operating Expenses Deduction: You can deduct various operating expenses associated with your income property, such as insurance premiums, property management fees, advertising costs, utilities, and fees for professional services. These deductions can help lower your taxable income and increase your cash flow from the property.

- 1031 Exchange: The IRS allows income property owners to defer capital gains taxes through a 1031 exchange. This provision allows you to sell a property and reinvest the proceeds in a like-kind property, deferring the capital gains taxes until a future sale. This strategy can be a powerful tool for maximizing your investment returns and building long-term wealth.

It’s important to note that tax laws and regulations can vary depending on your jurisdiction. Consulting with a qualified tax professional or real estate attorney is crucial when it comes to understanding and maximizing the tax advantages available to you as an income property investor. They can help you navigate the complexities of tax laws and ensure compliance with relevant regulations.

By taking advantage of the various tax deductions and provisions available to income property owners, you can significantly reduce your tax liability, increase your cash flow, and enhance the overall return on your investment.

Diversification of Investment Portfolio

Investing in income property offers the opportunity to diversify your investment portfolio, which is essential for mitigating risk and maximizing potential returns. Diversification involves spreading your investments across different asset classes to reduce the impact of any single investment’s performance on your overall portfolio.

Here are some key reasons why income property can contribute to the diversification of your investment portfolio:

- Low Correlation: Income property has shown a historically low correlation with other traditional asset classes, such as stocks and bonds. This means that during certain market conditions, income property values and returns may move independently from other investments, reducing the overall risk of your portfolio.

- Stability: Real estate, including income property, tends to exhibit lower volatility compared to other financial investments. While the value of stocks and bonds can fluctuate dramatically in response to market conditions, income property values generally have a more stable and predictable growth pattern over the long term, providing a reliable anchor for your investment portfolio.

- Inflation Hedge: Income property has the potential to act as an inflation hedge, meaning that its value and rental income can increase in response to inflation. As the general price level rises, rental rates typically increase, providing a potential revenue stream that can keep pace with inflation. This can help protect your investment portfolio against the eroding effects of inflation.

- Cash Flow: Income property can generate steady cash flow through rental income, which is typically less affected by market fluctuations compared to other investments. This consistent income stream can help offset any losses or underperformance in other areas of your investment portfolio, providing stability and cash flow during challenging economic times.

- Long-Term Appreciation: Income property has the potential for long-term appreciation in value. Over time, with proper management and market conditions, the value of your income property can increase, contributing to the growth of your investment portfolio. This long-term wealth-building potential can complement the shorter-term volatility of other investments in your portfolio.

By including income property in your investment portfolio, you can enjoy the benefits of diversification and reduce the overall risk exposure. Even in times of economic downturn, rental income from income property can continue to provide a stable and reliable source of cash flow, helping you weather market volatility.

It’s important to note that diversification does not guarantee profits or protect against losses, as all investments carry some level of risk. Proper due diligence and careful consideration of your overall investment strategy is crucial when incorporating income property into your portfolio. Consult with a reputable financial advisor or investment professional to assess your risk tolerance, financial goals, and the optimal allocation of assets within your overall investment portfolio.

Control over Investment

Investing in income property provides investors with a unique advantage – the ability to have control over their investment. Unlike other investment options, such as stocks or mutual funds, income property offers a hands-on approach where investors have control over various aspects of their investment. Here are some key ways in which income property provides control:

- Property Selection: With income property, investors have the freedom to choose the properties they invest in. This allows for careful consideration of factors such as location, property type, market demand, and potential for appreciation. Investors can conduct thorough research, visit properties, and analyze market data to make informed decisions that align with their investment goals and risk tolerance.

- Strategic Management: As an income property owner, you have control over the management and operations of the property. This includes setting rental rates, screening and selecting tenants, and enforcing lease agreements. Strategic management decisions can help maximize rental income, minimize vacancies, and ensure tenant satisfaction, ultimately leading to better returns on your investment.

- Property Improvements: Another aspect of control is the ability to make property improvements or renovations. By investing in property upgrades, you can enhance the desirability of your income property and potentially increase its market value. From cosmetic changes like painting and landscaping to more significant renovations, you have the power to make decisions that align with your investment strategy and goals.

- Financial Planning and Financing: Income property investment allows you to have control over the financial aspects of your investment. You can determine the financing options that best suit your needs, negotiate loan terms, and manage your cash flow. By carefully planning your finances and keeping track of income and expenses, you have a level of control over the financial success of your investment.

- Tax Planning: Income property owners have control over tax planning strategies to optimize their tax benefits. By working closely with a tax professional, you can identify deductions and credits, better understand tax laws, and make informed decisions to minimize your tax liability. Utilizing tax advantages available to income property owners can significantly impact your overall return on investment.

Having control over your investment allows for flexibility and customization, which can lead to better outcomes and increased investor satisfaction. You have the ability to make informed decisions based on your individual circumstances, preferences, and financial goals.

However, with control comes responsibility. Successful income property investment requires research, ongoing management, and a commitment to staying informed about market trends and regulations. It’s important to be prepared to dedicate time, effort, and resources to effectively manage your investment.

By having control over the various aspects of your income property investment, you can strategically shape your investment to align with your financial objectives. This level of control is a unique advantage of income property investment that attracts many investors seeking a more hands-on approach to building wealth.

Potential for Long-Term Wealth Building

Investing in income property offers the potential for long-term wealth building, making it an attractive option for individuals looking to secure their financial future. Through a combination of rental income, property value appreciation, and strategic management, income property can serve as a powerful wealth-building tool. Here are some key elements that contribute to the long-term wealth-building potential of income property:

- Steady Rental Income: Rental income from income property provides a reliable cash flow stream. As tenants pay rent, you can use that income to cover mortgage payments, property expenses, and generate additional cash flow. The consistent rental income can help build wealth over time and provide a stable source of funds to reinvest or support your financial goals.

- Property Value Appreciation: Income property has the potential to appreciate in value over the long term. While property values can fluctuate in the short term, historically, real estate tends to appreciate over time, keeping pace with inflation and even outperforming other investment options. As property values increase, your equity stake in the property grows, contributing to long-term wealth accumulation.

- Mortgage Paydown: Another avenue for wealth building with income property is through the gradual paydown of your mortgage. As you make mortgage payments, you are building equity in the property. Over time, as the mortgage balance decreases, your ownership stake increases, and your net worth grows. This equity can be leveraged for future investment opportunities or provide financial security and stability.

- Tax Advantages: The various tax advantages available to income property owners can further enhance long-term wealth building. Deductions for mortgage interest, property taxes, depreciation, and operating expenses can reduce your taxable income, resulting in lower tax liabilities. This increased cash flow can be reinvested, accelerating wealth accumulation.

- Leverage: Income property allows for leverage, meaning you can control a valuable asset with a relatively small investment. By utilizing financing options, such as mortgages, you can leverage your capital to acquire income properties that have the potential for significant returns. As property values and rental income increase, the leverage can amplify the growth of your overall wealth.

- Portfolio Diversification: Including income property in your investment portfolio provides diversification, reducing risk and enhancing long-term wealth building potential. Real estate tends to have a low correlation with other assets such as stocks and bonds, providing a buffer against market volatility. By diversifying your portfolio, you can spread the risks and capitalize on different investment opportunities.

It’s important to note that while income property has the potential for long-term wealth building, it is not without risks and challenges. Factors such as property management, market conditions, and economic fluctuations can impact the overall performance of your investment. Conducting thorough research, staying informed, and working with professionals in the real estate industry can help mitigate risks and optimize wealth-building opportunities.

By capitalizing on the steady rental income, property value appreciation, and tax advantages that income property offers, you can steadily build wealth over time. Income property investment can act as a foundation for your financial future, providing a pathway towards financial independence and long-term prosperity.

Risks and Considerations of Investing in Income Property

While investing in income property can be a lucrative endeavor, it’s important to be aware of the risks and considerations associated with this type of investment. Understanding and carefully evaluating these factors will help you make informed decisions and minimize potential pitfalls. Here are some key risks and considerations to keep in mind:

- Property Management and Maintenance: Effective property management is crucial for the success of income property investment. The responsibilities of managing tenants, handling repairs and maintenance, and ensuring compliance with regulations can be time-consuming and challenging. From tenant disputes to unexpected maintenance costs, being prepared to handle the day-to-day management of the property is essential.

- Market and Tenant Risk: Income property values and rental demand can be influenced by factors such as economic conditions, changes in local housing markets, and tenant turnover. A decline in the rental market or a prolonged vacancy can affect the cash flow and overall profitability of your investment. Conducting market research and evaluating the stability of the local rental market is crucial to minimizing these risks.

- Financing and Cash Flow Considerations: Securing financing for income property investment can have its challenges. Lenders may have stricter requirements and higher interest rates compared to residential mortgages. It’s important to carefully consider the cash flow needs of the property, including mortgage payments, property taxes, insurance, maintenance costs, and unexpected expenses. Adequate cash reserves and financial planning can help alleviate potential financial strain.

- Regulatory and Legal Compliance: Income property investment is subject to various laws and regulations, including local zoning ordinances, building codes, tenant-landlord laws, and fair housing regulations. Failure to comply with these regulations can lead to legal issues, fines, or damage to your reputation as an investor. Staying informed and seeking legal advice when necessary can help ensure compliance and mitigate legal risks.

- Property Value Volatility: While income property has the potential for appreciation, property values can also fluctuate based on market conditions and external factors. Unforeseen events such as economic recessions, changes in neighborhood dynamics, or shifts in local real estate trends can impact property values. It’s important to have a long-term investment horizon and be prepared for potential fluctuations in property value.

- Insurance and Liability: As an income property owner, it’s essential to have proper insurance coverage to protect against potential risks and liability. This includes liability insurance, property insurance, and coverage for any additional rental units or features of the property. Adequate insurance coverage can provide financial protection in the event of accidents, injuries, or property damage.

While these risks and considerations may seem daunting, being aware of them and addressing them proactively can help mitigate potential negative impacts on your investment. Thorough research, financial planning, and seeking advice from real estate professionals, property managers, and legal experts will contribute to a more successful income property investment journey.

Despite the risks involved, income property has a proven track record of providing long-term financial stability and wealth building. By carefully evaluating and managing these risks, you can position yourself for a rewarding investment experience and reap the potential rewards that income property offers.

Property Management and Maintenance

Effective property management and maintenance are crucial aspects of income property investment. Proper management ensures the smooth operation and long-term profitability of your investment while maintenance preserves and enhances the property’s value. Here are some important considerations in property management and maintenance:

Tenant Relations and Responsibilities: Managing tenant relations is a key responsibility for income property owners. This includes tenant screening and selection, lease agreement negotiation and enforcement, addressing tenant concerns and complaints, and collecting rent. Building positive and professional relationships with tenants can contribute to tenant satisfaction, longer lease terms, and increased cash flow.

Property Maintenance and Repairs: Regular maintenance and timely repairs are essential for preserving the value and attractiveness of your income property. This includes addressing both structural and cosmetic issues, performing routine inspections, and promptly addressing repair requests. Proactive maintenance can help prevent larger problems down the line, reduce vacancy rates, and ensure compliance with health and safety regulations.

Property Upgrades and Renovations: Strategic property upgrades and renovations can enhance the property’s appeal and market value. This may include cosmetic improvements like fresh paint, landscaping enhancements, updating fixtures and appliances, or performing more substantial renovations to modernize the property. However, careful consideration of return on investment and local market trends is necessary to avoid over-improvements that may not yield a significant financial return.

Tenant Communication and Support: Maintaining open lines of communication with tenants is essential for successful property management. Promptly responding to tenant inquiries, addressing concerns, and providing clear communication about policies and expectations can contribute to tenant satisfaction and a positive rental experience. Building a good rapport with tenants can also lead to their cooperation in reporting maintenance issues promptly.

Financial Management: Sound financial management is critical for income property owners. This includes maintaining accurate records of income and expenses, budgeting for regular maintenance and repairs, tracking rental payments and expenses, and ensuring timely payment of property-related bills. Effective financial management helps maximize profitability, optimize cash flow, and simplify tax reporting and monitoring.

Hiring Property Managers: Property owners who prefer a more hands-off approach or lack the time and expertise to manage their income property may choose to hire professional property management companies. These companies handle day-to-day operations, tenant relations, maintenance, and rent collection on behalf of owners. However, it’s important to carefully research and select reputable property management companies that align with your investment goals and priorities.

Successful property management and maintenance require dedication, organization, and a proactive approach. As an income property owner, it’s vital to stay informed about relevant laws and regulations, keep up with property maintenance best practices, and continually evaluate the performance of your property management strategy. By implementing effective property management and maintenance practices, you can optimize the returns on your income property investment and ensure its long-term success.

Market and Tenant Risk

Market and tenant risk are key considerations when investing in income property. Understanding these risks and actively managing them is crucial for a successful and profitable investment. Here are the main factors to consider:

Rental Market Volatility: The rental market can be subject to fluctuations in demand, which can impact the vacancy rates and rental prices of income properties. Economic downturns, changes in job markets, or shifts in local housing supply can all influence rental market conditions. Conducting thorough market research and staying informed about local trends can help identify potential risks and opportunities.

Tenant Turnover: Tenant turnover can affect cash flow and property profitability. Frequent turnover means increased vacancy periods and the need to invest time and resources in finding new tenants. Minimizing tenant turnover can be achieved through fair lease agreements, responsive tenant communication, and maintaining well-maintained and attractive properties that meet the needs of renters.

Tenant Screening and Quality: Selecting reliable and responsible tenants is crucial for income property success. Failing to properly screen potential tenants can lead to issues such as late or unpaid rent, property damage, or legal disputes. Performing rigorous tenant background checks, including credit history, employment verification, and rental references, can help reduce the risk of problematic tenants.

Regulatory Changes: Changes in local, state, or federal regulations can impact income property investment. Landlord-tenant laws, zoning regulations, health and safety codes, and rent control ordinances are examples of regulations that can affect property operations and financial returns. Staying informed about regulatory changes and working with legal professionals can help navigate potential risks and ensure compliance with the applicable laws.

Property Location: The location of an income property plays a significant role in its market risk. Factors such as neighborhood desirability, proximity to amenities, schools, transportation, and employment centers can influence tenant demand and property value. Evaluating the local market dynamics and future development plans can help gauge the potential risks and benefits associated with a specific location.

Economic Stability: Macroeconomic conditions and the overall stability of the economy can impact the rental market. In times of recession or economic downturn, rental demand may decline, leading to increased vacancy rates and potential rental price reductions. Understanding the economic conditions of the area in which you are investing is crucial for assessing market risk and making informed decisions.

While market and tenant risks do exist in income property investment, conducting thorough research, monitoring market conditions, and employing proper property management strategies can help mitigate these risks. It is beneficial to stay informed about local rental market trends, establish strong tenant screening processes, and maintain open lines of communication with tenants to minimize risks and optimize returns.

Working with experienced real estate professionals, property managers, and legal advisors can provide valuable guidance to navigate the challenges associated with market and tenant risks. By actively managing and monitoring these risks, you can position your income property for long-term success and profitability.

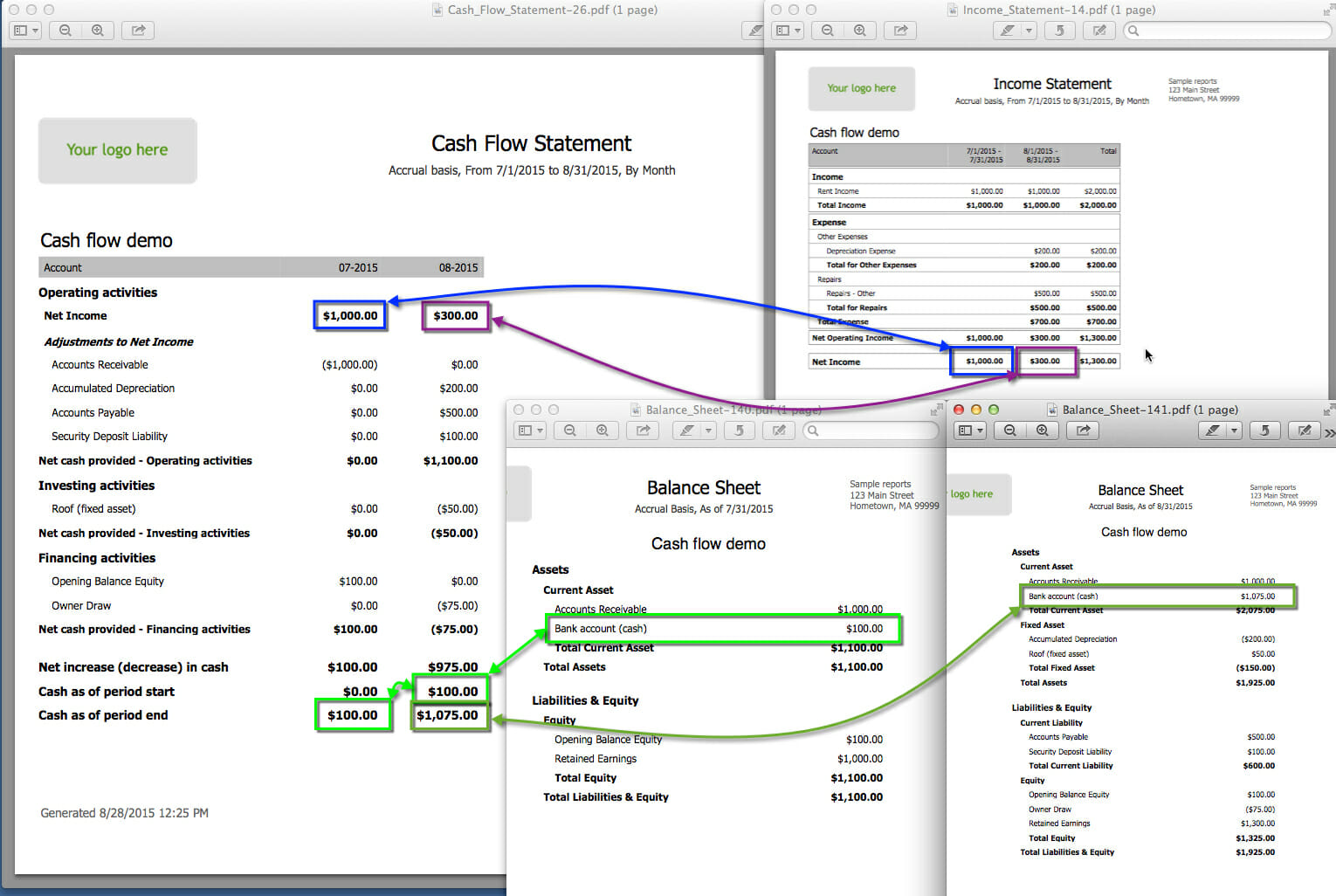

Financing and Cash Flow Considerations

When investing in income property, financing and cash flow considerations play a significant role in determining the financial viability and success of the investment. Careful planning and understanding of these factors are essential. Here are key financing and cash flow considerations for income property investors:

Mortgage Options and Rates: Financing an income property typically involves securing a mortgage loan. It’s important to research and compare different mortgage options, including interest rates, loan terms, and down payment requirements. Mortgage rates can have a substantial impact on cash flow, as higher rates increase monthly payments and affect overall profitability. Working with lenders who specialize in income property mortgages can help secure the most favorable terms.

Down Payment and Reserves: Income properties often require a larger down payment compared to primary residences. Lenders typically require a down payment of 20% or more, depending on the type of property and the borrower’s financial profile. Additionally, it’s wise to have sufficient cash reserves to cover unexpected expenses, repairs, and potential vacancy periods. Having a financial buffer helps maintain positive cash flow and ensures you can meet your financial obligations as a property owner.

Cash Flow Analysis: Conducting a thorough cash flow analysis is crucial to evaluate the financial viability of an income property investment. This involves analyzing expected rental income and estimating expenses such as mortgage payments, property taxes, insurance, maintenance costs, and property management fees. It is important to ensure that the rental income exceeds the expenses to achieve positive cash flow. A conservative estimate should be considered to account for potential fluctuations in rental income and unexpected expenses.

Vacancy Rates and Rental Market: Vacancy rates directly impact cash flow, as periods of no rental income can put pressure on profitability. Analyzing historical vacancy rates in the area and considering local rental market conditions can help estimate potential vacancy periods and adjust cash flow expectations accordingly. Conducting market research to gauge rental demand and setting competitive rental rates can help minimize vacancies and maximize cash flow.

Operating and Maintenance Expenses: Income property owners are responsible for various operating expenses such as property taxes, insurance premiums, property management fees, routine maintenance, repairs, and utilities. These expenses can significantly affect cash flow. It’s crucial to estimate these costs accurately and ensure sufficient funds are allocated for ongoing property management, maintenance, and repairs. Planning for these expenses helps avoid unexpected financial strain and preserves the overall profitability of the investment.

Tax Implications: Understanding the tax implications of income property investment is vital. Rental income is typically considered taxable income, while specific deductions and depreciation can help offset the tax liability. Consult with a tax professional to understand the specific tax implications in your jurisdiction and explore available deductions and tax strategies to optimize the financial benefits of your income property investment.

By carefully considering financing options, conducting thorough cash flow analyses, and accounting for factors such as vacancy rates, operating expenses, and tax implications, you can ensure the sustainability and profitability of your income property investment. It’s important to continually monitor and reassess your cash flow to make informed decisions and adjust your strategies if necessary. A well-managed cash flow leads to greater financial stability, increased returns, and long-term success in income property investment.

Conclusion

Investing in income property can be a rewarding and lucrative venture, offering a range of benefits for investors seeking long-term financial growth and stability. The potential for passive income, property value appreciation, tax advantages, diversification, and control over the investment make income property an attractive option for wealth building.

However, it is important to consider the risks and challenges associated with income property investment. Property management and maintenance, market and tenant risks, financing considerations, and cash flow management require careful planning and ongoing attention. Being aware of these factors and actively managing them can help mitigate risks and optimize returns.

To maximize the benefits of income property investment, conducting thorough market research, performing due diligence on properties, and seeking guidance from professionals in real estate, finance, and taxation are essential. They can provide valuable insights and help navigate the complexities of income property ownership.

Ultimately, income property investment requires a long-term perspective and a commitment to ongoing management and maintenance. With diligent research, proper financial planning, and an understanding of the local market dynamics, income property has the potential to provide a steady stream of passive income, long-term appreciation, and wealth-building opportunities.

Remember to assess your own financial goals, risk tolerance, and resources before embarking on an income property investment journey. By doing so, you can determine if income property aligns with your investment strategy and can contribute to your overall financial success.

In conclusion, income property offers a pathway to generate passive income, build equity, and diversify your investment portfolio. It is an investment option that warrants careful consideration and informed decision-making. With prudence and strategic management, income property has the potential to help you achieve your financial goals and secure a prosperous future.