Home>Finance>How To Make Purchases At End Of Billing Cycle Without Accruing Interest

Finance

How To Make Purchases At End Of Billing Cycle Without Accruing Interest

Published: March 7, 2024

Learn how to make purchases at the end of your billing cycle without incurring interest. Discover smart finance tips to manage your credit card effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Welcome to the world of credit card management, where strategic financial decisions can make a substantial difference in your overall financial well-being. One common concern among credit card users is how to make purchases at the end of the billing cycle without accruing interest. This article will provide valuable insights into understanding billing cycles, making purchases strategically, and utilizing interest-free periods to maximize the benefits of your credit card while avoiding unnecessary interest charges.

When it comes to managing your credit card, knowledge is power. Understanding the intricacies of billing cycles and interest calculations empowers you to make informed decisions that can save you money and enhance your financial stability. By learning how to time your purchases and payments effectively, you can take full advantage of the interest-free grace period provided by most credit cards.

In the following sections, we will delve into the nuances of billing cycles, explore the optimal timing for making purchases, and discuss the importance of paying off your balance in full. Additionally, we will uncover the potential benefits of leveraging interest-free periods to make the most of your credit card usage. By the end of this article, you will be equipped with the knowledge and strategies to navigate your credit card billing cycle with confidence and financial prudence. So, let's embark on this enlightening journey to unravel the secrets of making purchases at the end of the billing cycle without accruing interest.

**

Understanding the Billing Cycle

**

Before diving into the specifics of making purchases at the end of the billing cycle, it’s crucial to grasp the fundamental concept of the billing cycle itself. The billing cycle refers to the period between credit card statements, typically lasting around 28 to 31 days. During this time frame, all transactions made with the credit card are compiled to generate the statement balance, which reflects the total amount owed to the credit card issuer.

Understanding the billing cycle is essential for several reasons. Firstly, it determines the timeframe within which your credit card transactions are consolidated into a single statement. This statement includes details of all purchases, payments, fees, and interest charges incurred during the billing cycle. Secondly, the billing cycle directly influences the due date for your payment. The statement balance must be paid in full by the due date to avoid accruing interest on the remaining balance.

Moreover, comprehending the billing cycle enables you to strategize your spending and payment patterns effectively. By being mindful of the timing of your purchases in relation to the billing cycle, you can optimize your credit card usage to minimize interest costs and maximize interest-free periods.

It’s important to note that the billing cycle may not align precisely with the calendar month, as it is determined by the credit card issuer. Therefore, staying informed about the specific billing cycle dates for your credit card is crucial for accurate financial planning and decision-making.

As we proceed, we will explore how to leverage this understanding of the billing cycle to make purchases at the opportune time, manage your balance effectively, and make the most of interest-free periods to avoid accruing interest on your credit card transactions.

**

Making Purchases at the End of the Billing Cycle

**

Timing your purchases strategically within the billing cycle can significantly impact the interest you accrue on your credit card balance. Making purchases at the end of the billing cycle offers a distinct advantage, especially if you aim to maximize the interest-free grace period provided by your credit card issuer.

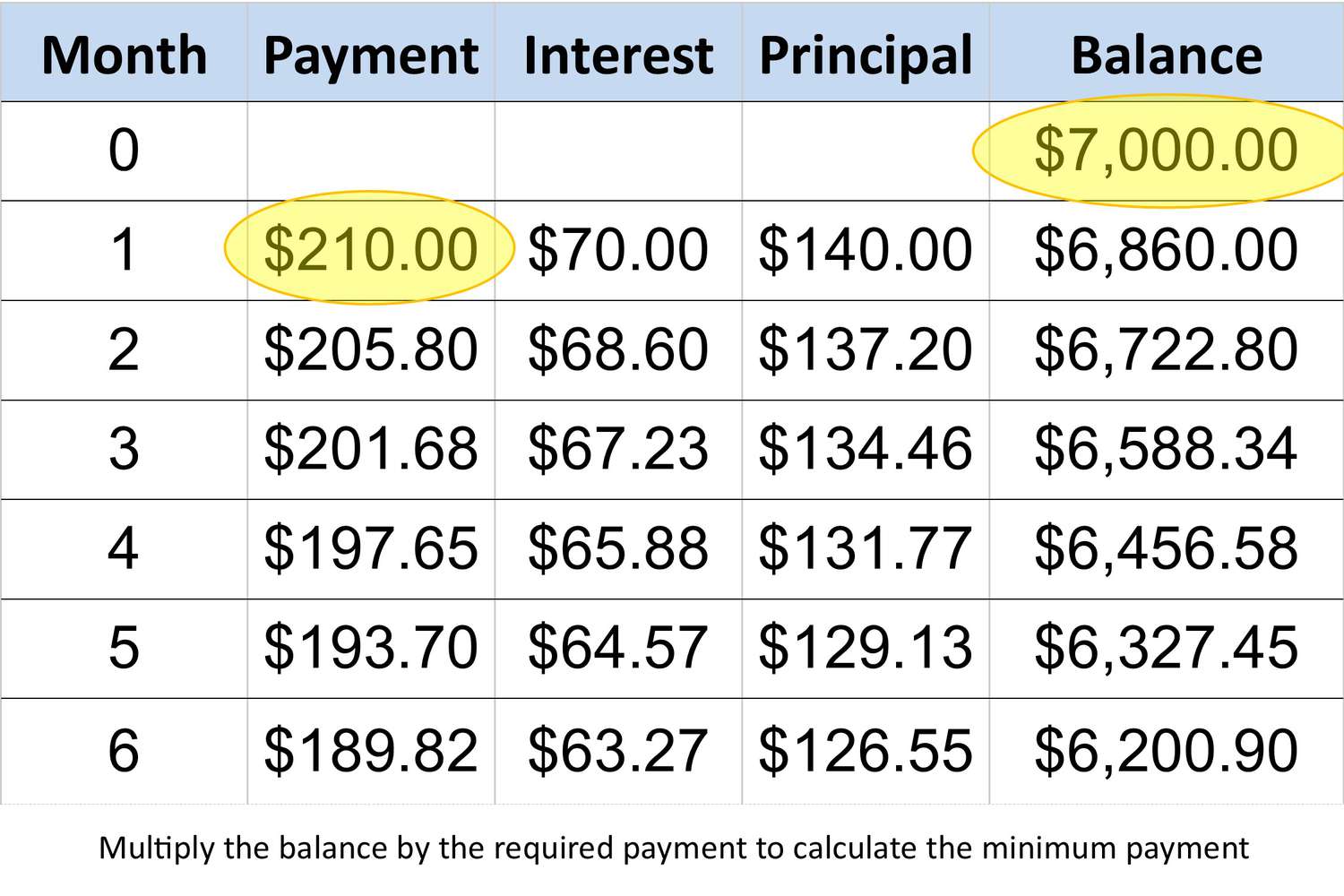

When you make a purchase near the end of the billing cycle, it may not appear on your current statement but will be included in the subsequent billing cycle. This timing can work to your advantage, as it effectively extends the interest-free period for the new purchase. For example, if your billing cycle ends on the 15th of the month and you make a purchase on the 14th, that transaction will not be due for payment until the end of the following billing cycle, potentially granting you an extended interest-free period of up to 45 days, depending on the length of the billing cycle.

By strategically timing your purchases toward the end of the billing cycle, you can optimize the grace period and align your payment schedule to cover these transactions without incurring interest. However, it’s essential to exercise prudence and avoid overspending or accumulating a balance that cannot be comfortably repaid in full by the due date.

Furthermore, making purchases at the end of the billing cycle allows you to consolidate expenses and manage your cash flow more effectively. By leveraging the additional time before the new transactions are due, you can allocate your financial resources efficiently and ensure that you have the necessary funds to settle the upcoming payment in full.

As we delve deeper into the intricacies of managing credit card transactions, we will explore the importance of paying off the balance in full and the potential benefits of utilizing interest-free periods to optimize your credit card usage.

**

Paying Off the Balance in Full

**

One of the most effective strategies for avoiding interest charges on credit card purchases is to pay off the balance in full before the due date. When you receive your credit card statement, it reflects the total amount owed at the end of the billing cycle. To evade interest on your purchases, it’s imperative to settle this balance in its entirety by the specified due date.

By paying off the entire statement balance, you effectively reset the interest clock for the upcoming billing cycle. This proactive approach ensures that you are not carrying over any balance from the previous cycle, thereby preventing the accrual of interest on the outstanding amount. Moreover, paying the full statement balance demonstrates responsible credit management and helps maintain a favorable credit utilization ratio, which can positively impact your credit score.

When it comes to making purchases at the end of the billing cycle, the commitment to paying off the balance in full becomes even more crucial. By doing so, you capitalize on the interest-free grace period provided by your credit card issuer, effectively leveraging the additional time before the new purchases become due for payment. This approach allows you to enjoy the benefits of your credit card without incurring unnecessary interest expenses, contributing to a more financially prudent and sustainable usage of credit.

Furthermore, paying off the balance in full affords you greater control over your finances and helps prevent the accumulation of revolving debt. It promotes disciplined spending habits and mitigates the risk of falling into the cycle of revolving credit, where interest charges can compound rapidly, leading to long-term financial strain.

As we proceed, we will explore the concept of interest-free periods and how they can be utilized to optimize your credit card usage, providing you with additional opportunities to manage your purchases strategically while maintaining financial prudence.

**

Utilizing Interest-Free Periods

**

Understanding and leveraging interest-free periods is a valuable strategy for managing credit card purchases without incurring interest charges. The interest-free period, also known as the grace period, is the duration between the date of a purchase and the date the payment is due, during which no interest is applied to the transaction. This period typically ranges from 21 to 25 days, depending on the credit card issuer and the terms of the card agreement.

By making purchases early in the billing cycle, you can maximize the interest-free period and allocate sufficient time to plan for the payment of these transactions. However, it’s essential to consider the billing cycle end date and the timing of your purchases to fully capitalize on this grace period. As mentioned earlier, making purchases toward the end of the billing cycle can extend the interest-free period for those transactions, granting you additional time to manage your finances and settle the balance without incurring interest.

Moreover, understanding the nuances of interest-free periods empowers you to optimize your cash flow and allocate funds strategically. By aligning your purchase timing with the billing cycle and grace period, you can synchronize your payment schedule to cover these expenses without compromising your financial stability. This approach allows you to make the most of your credit card’s interest-free benefits while maintaining control over your budget and expenditures.

Furthermore, the prudent utilization of interest-free periods enables you to make essential purchases or manage unexpected expenses without incurring immediate interest costs. This flexibility can be particularly advantageous in situations where timing is critical, providing you with the necessary breathing room to address financial needs without falling into the cycle of revolving debt and interest accumulation.

As we continue to explore the dynamics of credit card management, we will delve into additional strategies for optimizing interest-free periods, making informed financial decisions, and harnessing the full potential of your credit card while safeguarding your financial well-being.

**

Conclusion

**

Mastering the art of making purchases at the end of the billing cycle without accruing interest is a testament to astute credit management and financial prudence. By comprehending the intricacies of billing cycles, strategically timing your purchases, and leveraging interest-free periods, you can navigate your credit card usage with confidence and foresight.

Understanding the billing cycle is foundational to optimizing your credit card transactions. It provides the framework for strategic planning, allowing you to make purchases at opportune times and align your payment schedule to maximize interest-free periods. By making purchases toward the end of the billing cycle, you can extend the grace period for these transactions, granting you additional time to manage your finances and settle the balance without incurring interest.

Moreover, the commitment to paying off the balance in full before the due date is paramount. It not only prevents the accrual of interest on your purchases but also fosters disciplined financial habits and contributes to a positive credit profile. By proactively managing your credit card balance, you can avoid the pitfalls of revolving debt and maintain control over your financial well-being.

Utilizing interest-free periods strategically empowers you to make informed financial decisions and address essential expenses without immediate interest costs. This flexibility provides breathing room to manage your cash flow effectively and navigate unforeseen financial obligations with prudence and foresight.

In essence, the key to making purchases at the end of the billing cycle without accruing interest lies in informed decision-making, disciplined financial management, and the strategic utilization of interest-free benefits. By applying these principles, you can harness the full potential of your credit card while safeguarding your financial stability and long-term well-being.

Armed with this knowledge, you are now equipped to navigate the intricacies of credit card usage with confidence, making informed choices that align with your financial goals and priorities. By leveraging the insights shared in this article, you can embark on a journey of prudent credit management, empowered by the wisdom to make purchases at the end of the billing cycle without accruing interest.