Finance

What Is Cash Flow Real Estate

Published: December 20, 2023

Learn how cash flow real estate can help you achieve financial freedom and build wealth. Explore the ins and outs of finance in this lucrative investment strategy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Cash Flow Real Estate

- Importance of Cash Flow in Real Estate Investing

- Factors Affecting Cash Flow in Real Estate

- Benefits of Cash Flow Real Estate Investments

- Strategies for Generating Cash Flow in Real Estate

- Risks and Challenges of Cash Flow Real Estate Investing

- How to Evaluate the Cash Flow Potential of a Real Estate Investment

- Conclusion

Introduction

Welcome to the world of real estate investing, where the potential for financial growth and stability awaits. When it comes to investing in real estate, one key concept that every investor should understand is cash flow. In simple terms, cash flow refers to the amount of money that is generated from a real estate investment after deducting all expenses.

As an investor, cash flow is crucial because it not only provides a consistent income stream but also acts as a measure of the investment’s profitability. Investing in cash flow real estate can be a smart strategy for building long-term wealth, generating passive income, and achieving financial freedom.

Whether you’re a seasoned investor or just starting out, understanding cash flow real estate is essential for making informed decisions. In this article, we will explore what cash flow real estate is, its importance in real estate investing, factors affecting cash flow, benefits and strategies for generating cash flow, as well as the risks and challenges involved. By the end, you’ll have a solid grasp of the key elements that define this exciting investment strategy.

Definition of Cash Flow Real Estate

Cash flow real estate refers to an investment property that generates positive cash flow through rental income or other revenue streams. In simple terms, it’s a property that brings in more money than it costs to own and operate. The goal of cash flow real estate investing is to generate a consistent stream of income that exceeds the property’s expenses, allowing the investor to make a profit.

Positive cash flow is achieved when the rental income from tenants, after deducting all expenses such as mortgage payments, property taxes, insurance, maintenance, and management fees, exceeds the property’s monthly expenses. This surplus cash flow can then be reinvested, saved, or used for personal expenses, providing financial stability and flexibility.

On the other hand, negative cash flow occurs when the expenses of owning and operating the property exceed the rental income, resulting in a loss. While negative cash flow properties are typically not desirable for investors in the short term, they may still hold potential for long-term appreciation or other investment strategies.

It’s important to note that cash flow real estate investments can take different forms. It can include residential properties such as single-family homes, multi-family apartment buildings, or commercial properties like office spaces, retail complexes, or industrial warehouses. The key factor that distinguishes cash flow real estate is its ability to generate positive cash flow consistently.

Investing in cash flow real estate offers a way for individuals to generate passive income and build wealth over time. By carefully selecting properties that have the potential to generate positive cash flow, investors can benefit from steady earnings, provide long-term financial security, and even attain early retirement.

Importance of Cash Flow in Real Estate Investing

Cash flow plays a vital role in real estate investing, as it serves as a key metric for measuring the profitability and sustainability of an investment. Let’s explore some of the reasons why cash flow is important in real estate:

1. Regular Income Stream:

Cash flow real estate investments provide investors with a predictable and regular income stream. Rental income from tenants contributes to monthly cash flow, allowing investors to cover expenses and potentially generate excess funds. This steady income can provide stability and financial security.

2. Return on Investment (ROI):

Cash flow is a crucial factor in calculating the return on investment for a real estate property. By subtracting the expenses associated with owning and operating the property from the rental income, investors can determine the net cash flow and assess the return on their investment. Positive cash flow indicates a profitable investment, while negative cash flow may signal a need for adjustments or further evaluation.

3. Debt Service Coverage:

Positive cash flow offers a safeguard when it comes to servicing debts associated with the property. Cash flow can help cover mortgage payments, property taxes, and other financial obligations, reducing the risk of default. Lenders often consider cash flow as an important factor when assessing a borrower’s ability to repay a loan.

4. Expansion of Investment Portfolio:

Generating cash flow from real estate investments can provide the means for expanding an investment portfolio. The positive cash flow earned from one property can be reinvested to acquire additional properties, allowing investors to grow their real estate holdings and increase their overall cash flow.

5. Hedge Against Inflation:

Cash flow real estate can serve as a hedge against inflation. As rental rates and property values tend to increase over time, rental income can be adjusted accordingly, providing protection against the eroding effects of inflation. This allows investors to maintain and potentially increase their purchasing power.

6. Financial Freedom and Passive Income:

Cash flow real estate investing can be a pathway to financial freedom and the creation of passive income streams. By building a portfolio of cash flow properties, investors can generate consistent income without being actively involved in day-to-day operations. This passive income can enable individuals to achieve their financial goals and have more time for other pursuits.

In summary, cash flow is crucial in real estate investing as it provides investors with a regular income stream, helps determine the return on investment, enables debt service coverage, allows for portfolio expansion, acts as a hedge against inflation, and offers the potential for financial freedom. Understanding the importance of cash flow is essential for making informed investment decisions and maximizing the benefits of real estate investing.

Factors Affecting Cash Flow in Real Estate

Several factors can impact the cash flow of a real estate investment. Understanding these factors is crucial for investors to accurately assess and project the potential cash flow of a property. Let’s explore some of the key factors that can affect cash flow:

1. Rental Income:

The primary source of cash flow in real estate investing is rental income. The amount of rental income generated by a property is influenced by various factors, including location, property size, amenities, market demand, and rental market conditions. Higher rental income typically results in greater cash flow.

2. Vacancy Rate:

Vacancy rate refers to the percentage of time a property remains unoccupied. High vacancy rates can significantly impact cash flow as there is no rental income during these periods. Investors should consider the local rental market, demand for the property type, and the property’s desirability when assessing potential vacancies.

3. Operating Expenses:

Operating expenses play a critical role in determining cash flow. These expenses include property taxes, insurance premiums, repairs and maintenance, utilities, property management fees, and other costs associated with owning and operating the property. Higher operating expenses reduce the cash flow, while lower expenses increase it.

4. Financing Costs:

If a property is financed through a mortgage or other forms of debt, the financing costs can impact cash flow. Monthly mortgage payments, interest rates, and loan terms affect the amount of cash flow available after deducting mortgage expenses. Higher interest rates or longer loan terms can reduce cash flow, while lower rates can increase it.

5. Property Appreciation:

Property appreciation, or the increase in the value of the property over time, can impact cash flow indirectly. As property values increase, investors may have the opportunity to increase rental rates, resulting in higher rental income and improved cash flow. Additionally, appreciation can provide potential profit when selling the property in the future.

6. Economic Conditions:

Overall economic conditions, including factors such as inflation, interest rates, employment rates, and market conditions, can influence cash flow. A strong economy and favorable market conditions can lead to increased rental demand and higher rental rates, positively impacting cash flow. Conversely, a weak economy or unfavorable market conditions can have a negative impact on cash flow.

7. Tax Implications:

Tax implications can affect the cash flow of a real estate investment. Factors such as property tax rates, tax deductions, and tax incentives can impact the overall cash flow. Investors should consider tax implications when evaluating the potential cash flow of a property to ensure accurate financial projections.

It’s important to note that each property and market is unique, and the impact of these factors can vary. Investors should conduct thorough research, analyze market conditions, and carefully assess all relevant factors to make informed decisions and project the potential cash flow of a real estate investment accurately.

Benefits of Cash Flow Real Estate Investments

Investing in cash flow real estate offers numerous benefits for investors seeking to build wealth, generate passive income, and achieve long-term financial goals. Let’s explore some of the key advantages of investing in cash flow real estate:

1. Passive Income:

Cash flow real estate investments provide a steady and passive income stream. Rental income generated from tenants can serve as a reliable source of monthly cash flow, allowing investors to supplement their current income, cover expenses, and build wealth over time without active involvement.

2. Long-Term Wealth Building:

Cash flow real estate investments have the potential to generate long-term wealth. Positive cash flow allows investors to accumulate and reinvest surplus funds, potentially acquiring additional properties over time. By building a portfolio of cash flow properties, investors can benefit from increasing rental income and property appreciation, resulting in wealth accumulation.

3. Financial Stability and Security:

Investing in cash flow real estate can provide financial stability and security. Positive cash flow ensures a consistent income stream that can help cover expenses, including mortgage payments, property taxes, and other financial obligations. This stability can reduce financial stress and provide a sense of security for investors.

4. Diversification of Investment Portfolio:

Cash flow real estate investments offer a diversification strategy for investors. By diversifying their investment portfolio to include real estate, investors can spread risk across different asset classes. Cash flow properties can act as a hedge against market volatility and fluctuations in the stock market, providing a more balanced and diversified investment approach.

5. Inflation Hedge:

Cash flow real estate investments can act as a hedge against inflation. As rental rates and property values tend to increase over time, rental income can be adjusted accordingly, keeping pace with inflation. Real estate has historically shown the potential for appreciation, allowing investors to maintain and potentially increase their purchasing power.

6. Tax Advantages:

Investing in cash flow real estate can offer several tax advantages. Rental income is typically treated as passive income, which may be subject to lower tax rates. Additionally, investors can take advantage of tax deductions for expenses such as mortgage interest, property taxes, insurance, and depreciation, reducing the overall tax liability and enhancing cash flow.

7. Potential for Early Retirement:

Cash flow real estate investments have the potential to generate enough passive income to allow for early retirement. By building a portfolio of cash flow properties, investors can create a sustainable income stream that covers their living expenses, providing the flexibility to retire early and enjoy financial freedom.

In summary, investing in cash flow real estate offers the benefits of passive income, long-term wealth building, financial stability, portfolio diversification, inflation hedge, tax advantages, and the potential for early retirement. These advantages make cash flow real estate an attractive investment strategy for individuals looking to build wealth, achieve financial goals, and secure their financial future.

Strategies for Generating Cash Flow in Real Estate

Generating cash flow in real estate involves implementing effective strategies that maximize rental income and minimize expenses. Here are some tried and tested strategies for generating cash flow in real estate:

1. Rental Property Analysis:

Thoroughly analyze rental properties to ensure they have the potential to generate positive cash flow. Consider factors such as location, market demand, rental rates, property condition, and expenses. Conduct a detailed financial analysis, including estimating rental income and projecting expenses, to determine the cash flow potential of a property before investing.

2. Rent Optimization:

Set rental rates competitively to attract tenants while maximizing rental income. Research the local rental market to understand market demand and rental trends. Regularly review rental rates and adjust them according to market conditions, property improvements, and tenant satisfaction. Consider offering incentives to attract and retain high-quality tenants.

3. Reduce Operating Expenses:

Identify opportunities to reduce operating expenses without compromising the property’s quality or tenant satisfaction. Implement cost-effective maintenance and repair strategies, negotiate vendor contracts and services, and consider energy-efficient upgrades to save on utility costs. Regularly review insurance policies to ensure appropriate coverage at competitive rates.

4. Implement Value-Add Strategies:

Consider value-add strategies to increase rental income and property value. This includes renovating units, improving common areas, updating amenities, adding in-demand features such as laundry facilities or parking spaces, or converting underutilized spaces for additional rental income. Value-add strategies can attract higher-quality tenants willing to pay higher rents.

5. Effective Tenant Screening:

Screening tenants thoroughly can help reduce vacancies, expenses, and potential rental income loss. Perform background and credit checks, verify employment and income, and contact previous landlords for references. Selecting reliable and responsible tenants reduces the risk of late payments, damage to the property, or eviction, ensuring consistent cash flow.

6. Short-Term Rentals and Vacation Rentals:

Consider utilizing short-term rentals or vacation rentals through platforms like Airbnb or VRBO, particularly in high-demand areas. Short-term rentals can offer higher rental rates and flexibility, allowing owners to adjust occupancy and rates strategically to maximize income. However, be mindful of local regulations and potential seasonality impacts.

7. Property Management Efficiency:

Efficient property management can streamline operations, reduce vacancies, and increase cash flow. Consider hiring a professional property management company to handle tenant-related issues, property maintenance, and administrative tasks. Proper management ensures timely rent collection, property upkeep, and proactive tenant communication.

It’s important to note that every property and market is unique, and the effectiveness of these strategies may vary depending on various factors. Tailor these strategies to suit your specific investment goals, property type, and target market. Regularly review and adjust these strategies based on market conditions and tenant needs to optimize cash flow and achieve long-term success in real estate investing.

Risks and Challenges of Cash Flow Real Estate Investing

While cash flow real estate investing offers many benefits, it’s essential to be aware of the potential risks and challenges that come with it. Understanding and mitigating these risks is crucial for long-term success. Here are some common risks and challenges associated with cash flow real estate investing:

1. Market Volatility:

The real estate market can experience periods of volatility and fluctuations. Economic downturns or changes in market conditions can impact rental demand, rental rates, and property values, potentially affecting cash flow. Investing in stable markets and diversifying your portfolio can help mitigate market volatility risks.

2. Vacancy and Tenant Turnover:

Vacancy and tenant turnover can significantly impact cash flow. Extended periods of vacancy lead to the loss of rental income and increase expenses associated with finding new tenants. Effective tenant screening, maintaining property conditions, and promptly addressing tenant concerns can help minimize vacancies and turnover.

3. Property Maintenance and Repair Costs:

Owning and managing a property involves ongoing maintenance and repair costs. Unexpected repairs and maintenance issues can strain cash flow. Regularly inspecting and addressing maintenance needs, setting aside reserves for repairs, and working with reliable contractors can minimize the impact of these costs.

4. Financing and Interest Rate Risks:

If your property is financed, changes in interest rates or difficulty in securing favorable financing terms can affect the cash flow. Rising interest rates can increase mortgage payments, reducing cash flow. Mitigate this risk by carefully evaluating financing options, locking in favorable rates, and considering long-term fixed-rate loans.

5. Regulatory and Legal Compliance:

Real estate investing is subject to various regulations and legal requirements. Non-compliance can result in fines, penalties, or legal disputes that impact cash flow. Stay informed about local laws, landlord-tenant regulations, and property-related compliance requirements to avoid potential legal issues.

6. Economic and Market Conditions:

Economic factors, such as inflation, unemployment, and changes in consumer spending, can impact cash flow. A weak economy can lead to reduced rental demand and lower rental rates. Conduct thorough market research, diversify your portfolio, and adopt proactive strategies to mitigate the impact of economic fluctuations.

7. Management and Time Commitment:

Managing rental properties requires time, effort, and expertise. Handling tenant concerns, collecting rents, and coordinating maintenance can be time-consuming. Property management can become challenging if you own multiple properties or have other commitments. Consider hiring a professional property management company to alleviate the management burden.

It’s important to conduct thorough due diligence, stay informed about market conditions, and seek professional advice to mitigate these risks and address the challenges associated with cash flow real estate investing. Having a well-thought-out investment plan, building reserves, and maintaining good relationships with tenants and professionals in the field can help navigate these risks and achieve long-term success in cash flow real estate investing.

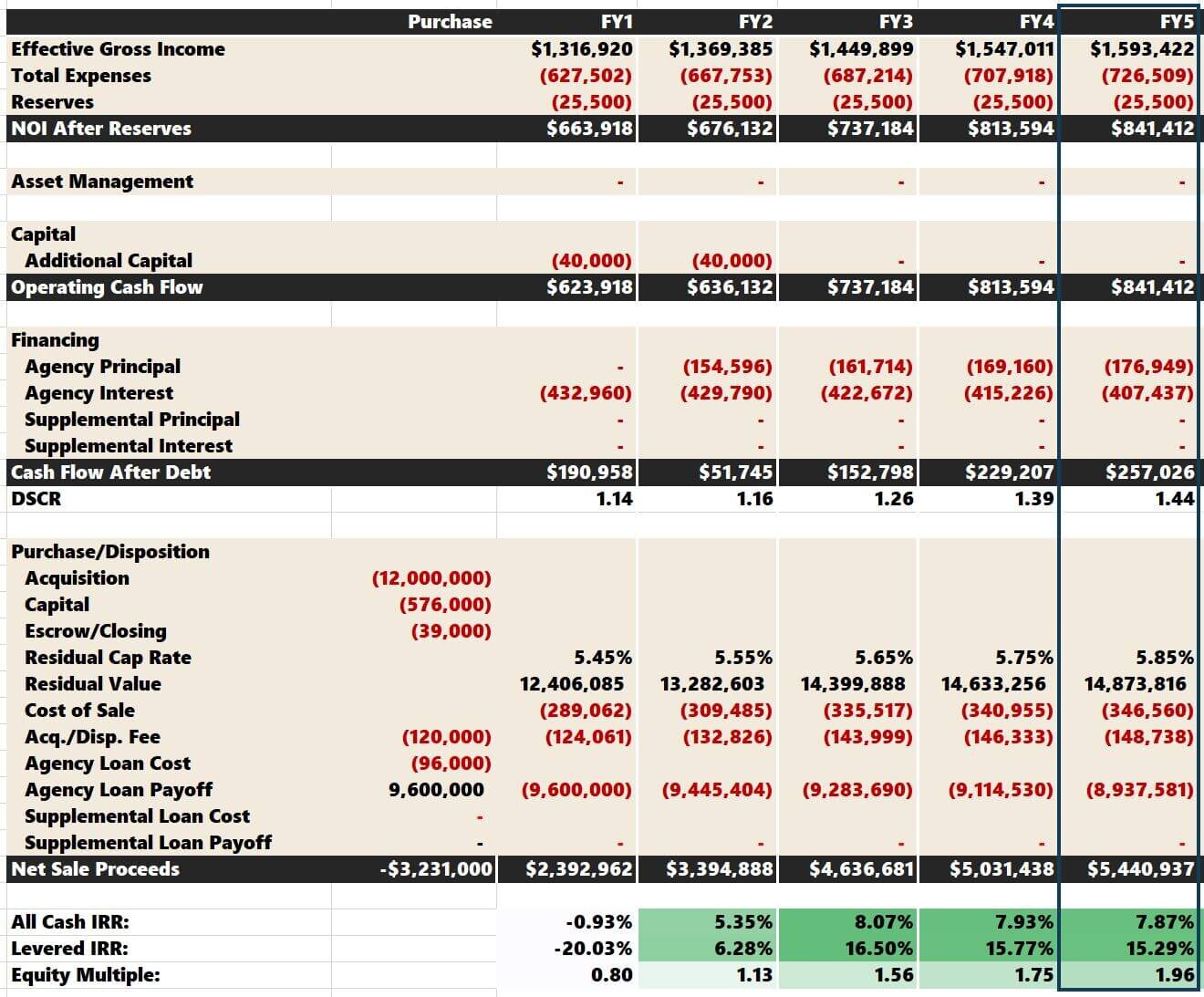

How to Evaluate the Cash Flow Potential of a Real Estate Investment

Evaluating the cash flow potential of a real estate investment is a crucial step in making informed investment decisions. Here are some key factors to consider when assessing the cash flow potential of a property:

1. Rental Income:

Examine the rental income potential of the property. Research comparable rental rates in the area to determine a realistic expected rental income. Consider factors such as location, property size, amenities, and demand to estimate rental income accurately. Keep in mind that rental income should exceed expenses to generate positive cash flow.

2. Operating Expenses:

Thoroughly evaluate the operating expenses associated with the property. Consider expenses such as property taxes, insurance, utilities, maintenance, repairs, property management fees, and vacancy allowances. Factor in all potential expenses to accurately assess the cash flow potential and ensure that the rental income comfortably covers these costs.

3. Vacancy Rate:

Estimate the potential vacancy rate for the property. Research local rental market conditions to determine typical vacancy rates in the area. Consider factors such as location, demand, and property condition to assess the likelihood of vacancies. Account for potential vacancies when evaluating the cash flow, ensuring that the rental income can sustain periods without tenants.

4. Financing Costs:

If financing the property, evaluate the financing costs and their impact on cash flow. Consider factors such as interest rates, loan terms, and down payment requirements. Calculate the mortgage payments and other financing expenses to determine the net cash flow after deducting these costs. Ensure that the cash flow remains positive even after accounting for financing expenses.

5. Appreciation Potential:

Assess the potential for property appreciation over time. Research historical market trends and forecasted growth in the area. Property appreciation can positively impact cash flow by allowing for increased rental rates and potential profit upon future property sale. However, it’s important not to solely rely on appreciation to achieve positive cash flow, as it is uncertain and can vary depending on market conditions.

6. Cash-on-Cash Return:

Calculate the cash-on-cash return to evaluate the investment’s cash flow potential. This ratio compares the annual cash flow to the amount of cash invested in the property. The formula is: Cash-on-Cash Return = (Net Annual Cash Flow / Total Cash Investment) x 100. A higher cash-on-cash return indicates stronger cash flow potential.

7. Market and Neighborhood Analysis:

Conduct a thorough analysis of the market and the neighborhood where the property is located. Consider factors such as job growth, population trends, infrastructure development, and amenities. A strong market with favorable conditions can contribute to higher rental demand and rental rates, increasing the cash flow potential.

By evaluating these factors and conducting comprehensive financial analysis, you can assess the cash flow potential of a real estate investment. Remember to consider both the short-term cash flow and the long-term potential for wealth accumulation. It’s crucial to conduct due diligence, consult with professionals, and make informed decisions to achieve successful cash flow real estate investments.

Conclusion

Investing in cash flow real estate provides the opportunity to generate consistent income, build long-term wealth, and achieve financial freedom. By understanding the concept of cash flow, evaluating market conditions, and implementing effective strategies, investors can maximize the potential of their real estate investments.

Cash flow real estate investments offer a range of benefits, including passive income, long-term wealth building, financial stability, portfolio diversification, inflation hedge, tax advantages, and the possibility of early retirement. These advantages make cash flow real estate an attractive investment option for individuals looking to secure their financial futures.

However, it’s important to be aware of the risks and challenges associated with cash flow real estate investing. Market volatility, vacancy rates, maintenance expenses, financing costs, and regulatory compliance are factors that require careful consideration. By conducting thorough research, employing effective management strategies, and staying updated on market trends, investors can mitigate these risks and address the challenges that may arise.

To evaluate the cash flow potential of a real estate investment, factors such as rental income, operating expenses, vacancy rates, financing costs, appreciation potential, cash-on-cash return, and market analysis should all be carefully assessed. Conducting comprehensive due diligence and financial analysis will help investors make informed decisions and predict the cash flow potential of a property accurately.

In conclusion, cash flow real estate investing offers a pathway to financial growth, stability, and wealth creation. By understanding the fundamentals, implementing sound strategies, and staying informed, investors can leverage the cash flow potential of real estate to achieve their financial goals and secure a prosperous future.