Finance

How To Increase Cash Flow In Business

Modified: December 29, 2023

Learn practical strategies and tips to increase cash flow in your business. Improve your finance management skills and boost profitability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Importance of Cash Flow in Business

- Analyzing Current Cash Flow

- Reducing Expenses

- Increasing Sales

- Implementing Effective Invoicing and Payment Systems

- Negotiating Better Terms with Suppliers and Customers

- Managing Inventory Efficiently

- Utilizing Technology for Streamlining Cash Flow

- Building Relationships with Lenders and Investors

- Conclusion

Introduction

Welcome to our comprehensive guide on how to increase cash flow in business. Cash flow is the lifeblood of any business, fueling its day-to-day operations, growth, and sustainability. It represents the movement of money in and out of a company, encompassing revenues, expenses, investments, and financing activities. Maintaining a healthy cash flow is essential for ensuring smooth operations, meeting financial obligations, and seizing growth opportunities.

In this article, we will explore the importance of cash flow in business and provide practical strategies to increase it. We will discuss how to analyze your current cash flow, identify areas of improvement, and implement effective measures to enhance your financial position. Whether you are a small startup or an established enterprise, the insights and techniques shared here can benefit your cash flow management.

Effective cash flow management can help you navigate through challenging times, capitalize on opportunities, and ultimately drive business success. By optimizing your cash flow, you can improve your financial stability, reduce the reliance on external financing, and enhance your overall profitability.

Throughout this guide, we will focus on various strategies to increase cash flow in business, including reducing expenses, increasing sales, implementing efficient invoicing and payment systems, negotiating better terms with suppliers and customers, managing inventory effectively, utilizing technology for streamlining cash flow processes, and building relationships with lenders and investors.

However, it’s important to note that increasing cash flow is not a one-size-fits-all approach. Every business is unique, and the strategies that work for one may not be as effective for another. Therefore, it’s crucial to adapt these techniques to your specific industry, business model, and financial goals.

So, whether you are looking to overcome temporary cash shortages, improve working capital management, or fuel your expansion plans, read on to discover valuable insights that can help you increase cash flow in your business. By implementing these strategies, you can strengthen your financial position and set your business on a path to long-term success.

Importance of Cash Flow in Business

Cash flow plays a critical role in the financial health and stability of a business. It is often referred to as the “lifeblood” of a company, as it determines its ability to meet day-to-day expenses, invest in growth opportunities, and weather unforeseen challenges.

Here are some key reasons why cash flow is crucial in business:

- Meeting Financial Obligations: Regular cash flow is necessary to cover expenses such as rent, payroll, utilities, and supplier payments. Without sufficient cash on hand, a business may struggle to meet these obligations, leading to late payments, damaged relationships, and even legal consequences.

- Fueling Growth and Investment: Cash flow enables businesses to invest in growth opportunities, such as expanding product lines, entering new markets, or acquiring assets. It provides the financial resources needed to implement strategic initiatives and secure a competitive edge.

- Managing Working Capital: Effective cash flow management allows businesses to maintain optimal levels of working capital. This includes having enough cash to cover inventory costs, manage accounts receivable and payables, and address any unexpected fluctuations in demand or supply.

- Reducing Reliance on Debt: A healthy cash flow position reduces the need for external borrowing, minimizing interest payments and debt obligations. This improves a company’s overall financial stability and reduces its vulnerability to economic downturns or credit constraints.

- Seizing Opportunities: Having a strong cash flow allows businesses to take advantage of time-sensitive opportunities, such as bulk purchasing discounts, early payment incentives, or investments in emerging technologies. This agility enables companies to stay ahead of their competitors and adapt to market changes.

By understanding the importance of cash flow, businesses can prioritize effective cash flow management strategies. By maintaining a positive and steady flow of cash, businesses can not only survive but thrive in today’s dynamic and competitive marketplace.

Analyzing Current Cash Flow

In order to improve the cash flow of your business, it is crucial to first analyze your current cash flow situation. This involves gaining a clear understanding of where your money is coming from and where it is going. By conducting a thorough analysis, you can identify areas for improvement and implement targeted strategies to optimize your cash flow.

Here are the key steps to analyzing your current cash flow:

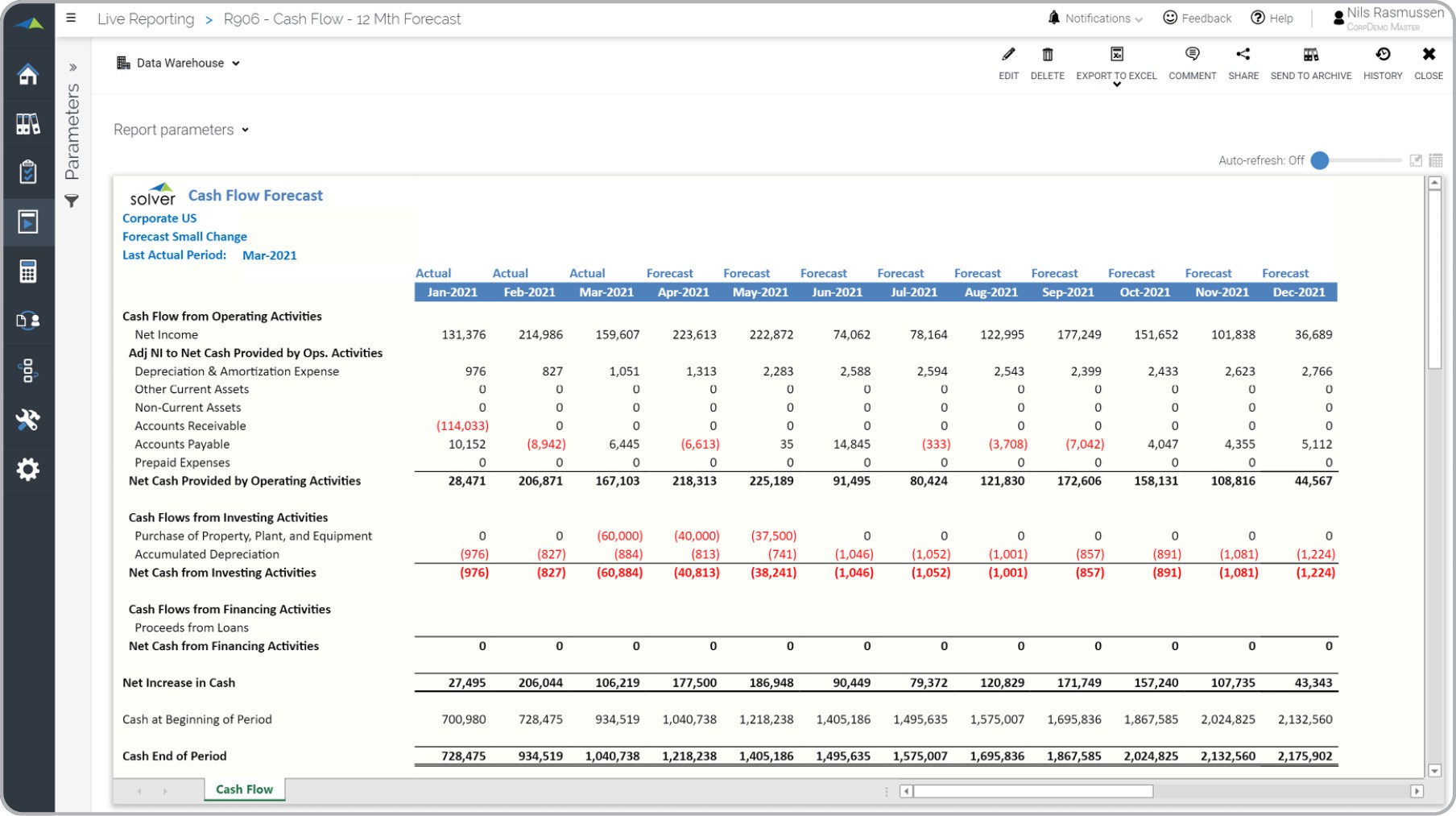

- Create a Cash Flow Statement: Start by preparing a cash flow statement, which outlines the inflows and outflows of cash over a specific period of time. This statement should include your operating activities, such as revenue from sales and payments to suppliers and employees, as well as financing and investing activities, such as loan repayments and equipment purchases. This statement will provide valuable insights into your cash flow patterns and can help identify any potential cash flow gaps.

- Examine Cash Flow Trends: Review your cash flow statements from multiple periods to identify any trends or patterns. Look for consistent positive or negative cash flows, seasonal variations, or any irregularities that may be impacting your cash flow. This analysis will help you understand the underlying factors affecting your cash flow and identify areas that need improvement.

- Identify Cash Flow Sources: Determine the primary sources of cash inflows in your business. This may include revenue from sales, investments, loans, or other sources of income. By understanding where your cash is coming from, you can focus on maximizing these revenue streams and exploring new opportunities for generating cash.

- Evaluate Cash Flow Uses: Analyze how and where your cash is being used within the business. This includes examining your expenses, such as rent, utilities, salaries, inventory, and debt repayments. Identify areas where you may be overspending or where expenses can be reduced without compromising the quality or efficiency of your operations.

- Assess Cash Conversion Cycle: Evaluate the time it takes for cash to flow into and out of your business. This includes the time it takes to convert inventory into sales, collect accounts receivable, and pay off accounts payable. By shortening this cycle, you can accelerate cash inflows and delay cash outflows, improving your overall cash flow position.

- Compare to Industry Benchmarks: Benchmark your cash flow metrics against industry standards to gain a better understanding of how your business is performing in relation to peers. This comparison can help identify areas where you may be underperforming and provide insights into industry best practices that can be applied to your own cash flow management.

By analyzing your current cash flow, you can gain valuable insights into the financial health of your business. This analysis serves as the foundation for implementing targeted strategies that will enhance your cash flow and position your business for long-term success.

Reducing Expenses

One effective way to increase cash flow in your business is by reducing expenses. By identifying areas where you can cut costs without sacrificing quality or efficiency, you can free up cash that can be reinvested in your business or used to improve your financial position. Here are some strategies to consider when reducing expenses:

- Review and Negotiate Supplier Contracts: Take a close look at your current supplier contracts and negotiate better terms. This includes renegotiating prices, seeking volume discounts, or exploring alternative suppliers who offer more competitive rates. Consolidating suppliers can also help streamline operations and reduce administrative costs.

- Trim Unnecessary Expenses: Analyze your expenses and identify any non-essential or redundant costs. This could include subscriptions, memberships, software licenses, or marketing strategies that are not generating a strong return on investment. By cutting these expenses, you can allocate resources more efficiently and improve your cash flow.

- Optimize Energy Usage: Identify opportunities to reduce energy consumption and utility costs. This can include upgrading to energy-efficient equipment, implementing smart technology to monitor and control energy usage, or simply encouraging employees to adopt energy-saving practices. Lowering your energy bills can have a significant impact on your bottom line.

- Minimize Paper Usage: Embrace digital solutions to reduce paper usage and associated expenses. Implement electronic document management systems, encourage digital communication and collaboration, and transition from physical mail to email or online platforms. Not only will this reduce costs, but it will also enhance efficiency and environmental sustainability.

- Implement Telecommuting or Remote Work: If feasible for your business, consider implementing telecommuting or remote work options. This can help reduce overhead costs associated with office space, utilities, and commuting expenses. It can also improve employee satisfaction and productivity.

- Negotiate Insurance Premiums: Review your insurance policies and seek competitive quotes from different providers. Discuss your coverage needs with insurance brokers to ensure you have the right level of protection at the most cost-effective rates. Over time, regular evaluations and negotiations can result in significant savings.

- Streamline Business Processes: Identify areas where operational efficiencies can be improved to reduce costs. This may involve implementing automation and technology solutions to streamline repetitive tasks, optimizing inventory management to minimize waste, or reevaluating your workflow to eliminate bottlenecks and improve productivity.

Remember that reducing expenses is a continual process. Regularly monitor your expenses, identify new ways to save, and maintain open communication with your team to encourage cost-conscious behavior. By actively managing your expenses, you can increase your cash flow and position your business for long-term financial success.

Increasing Sales

In order to boost your cash flow, increasing sales is a fundamental strategy. Generating more revenue not only brings in more cash but also contributes to the overall growth and profitability of your business. Here are some effective strategies to consider when aiming to increase sales:

- Identify and Target Your Ideal Customers: Conduct market research to understand your target audience and their needs. This will help you tailor your products or services to better meet their demands, resulting in increased sales. Develop targeted marketing campaigns and messages that resonate with your ideal customers and differentiate your business from competitors.

- Improve Your Sales and Customer Service Processes: Enhance your sales process by providing exceptional customer service at every touchpoint. Train your sales team to effectively communicate the value of your products or services, address customer objections, and build long-term relationships. Happy customers are more likely to become repeat buyers and recommend your business to others.

- Launch Promotional Campaigns: Offer special promotions, discounts, or bundled packages to incentivize customers to make a purchase. These limited-time offers create a sense of urgency and can attract new customers while encouraging existing ones to buy more. Leverage various marketing channels, such as social media, email marketing, and paid advertising, to get the word out about your promotions.

- Expand Your Product or Service Line: Consider diversifying your offerings to capture a wider customer base. Evaluate market trends and identify opportunities for new products or services that align with your business’s core strengths. This expansion can attract new customers and provide additional revenue streams.

- Implement Cross-Selling and Upselling: Encourage customers to add complementary products or upgrade their purchases through cross-selling and upselling techniques. Train your sales team to identify these opportunities and make relevant suggestions during the buying process. This strategy increases the average transaction value and maximizes revenue per customer.

- Invest in Online Sales Channels: Establish a strong online presence to reach a larger audience and facilitate online sales. Develop a user-friendly e-commerce website, optimize it for search engines, and leverage various digital marketing strategies to drive traffic and convert leads into paying customers. Embrace social media platforms to engage with your audience and promote your products or services effectively.

- Build Referral and Affiliate Programs: Encourage your satisfied customers to refer their friends, family, or colleagues to your business. Implement a referral program that rewards customers for successful referrals, providing them with discounts, special offers, or other incentives. Additionally, explore affiliate partnerships with complementary businesses where you can earn a commission for referring customers to each other.

Remember that increasing sales requires ongoing effort and adaptability. Continuously analyze customer feedback, monitor market trends, and refine your sales strategies to stay competitive. By effectively increasing sales, you can drive cash flow growth and propel your business towards long-term success.

Implementing Effective Invoicing and Payment Systems

An efficient invoicing and payment system is essential for maintaining a healthy cash flow in your business. It ensures that your customers are billed accurately and promptly, and that payments are received in a timely manner. By implementing effective invoicing and payment systems, you can streamline your cash flow processes and reduce the risk of late or missed payments. Here are some strategies to consider:

- Create Clear and Accurate Invoices: Develop professional and easy-to-understand invoices that clearly outline the products or services provided, the quantities, prices, and any applicable taxes or discounts. Include your payment terms, due date, and accepted payment methods. By presenting clear and accurate invoices, you minimize the chances of disputes or delays in payment.

- Send Invoices Promptly: Invoice your customers as soon as the products are delivered or services are rendered. Delayed invoicing can lead to delays in payment, impacting your cash flow. Consider automating your invoicing process to ensure timely dispatch and reduce administrative overhead.

- Offer Multiple Payment Options: Provide your customers with a variety of payment methods to make it convenient for them to settle their invoices. Accepting credit cards, debit cards, electronic bank transfers, and digital wallets can ensure flexibility and cater to different customer preferences. This reduces the barriers to payment and increases the likelihood of prompt remittance.

- Implement Digital Invoicing and Payment Systems: Transition from traditional paper-based invoices to digital invoicing platforms. These systems allow for faster invoice creation, delivery, and tracking, reducing manual errors and ensuring smoother payment processes. Additionally, integrate online payment gateways into your invoicing system to enable quick and secure online payments.

- Follow up on Overdue Invoices: Monitor and track unpaid invoices regularly. Implement a system for sending payment reminders to customers as the due date approaches or when invoices become overdue. Take a proactive approach to recover outstanding payments, either through direct communication with customers or by utilizing debt collection services if necessary.

- Offer Early Payment Incentives: Encourage prompt payment by offering incentives such as early payment discounts. By providing a small discount to customers who settle their invoices before the due date, you can motivate them to prioritize your payments and accelerate your cash flow.

- Establish Clear Credit and Collection Policies: Develop credit policies that define your terms for extending credit to customers. Conduct thorough credit checks on new customers to ensure their ability to pay. Clearly communicate your collection policies, including any late payment penalties or consequences, to establish expectations and mitigate payment delays.

Remember to regularly evaluate and update your invoicing and payment systems to adapt to changing customer needs and emerging technologies. By implementing efficient invoicing and payment processes, you can minimize payment delays, reduce administrative efforts, and optimize your cash flow management.

Negotiating Better Terms with Suppliers and Customers

Effective negotiation with suppliers and customers can significantly impact your cash flow and overall business profitability. By securing favorable terms, you can lower costs, improve payment terms, and strengthen relationships. Here are some strategies to consider when negotiating with suppliers and customers:

- Research and Understand Market Prices: Before entering into negotiations, gather information on market prices for the products or services you are seeking. This knowledge will provide you with leverage and help you negotiate more effectively.

- Consolidate Suppliers: Consider consolidating your purchasing by reducing the number of suppliers you work with. Consolidation enables you to negotiate better volume discounts, streamline procurement processes, and establish long-term partnerships with suppliers.

- Request Extended Payment Terms: Negotiate longer payment terms with your suppliers. This can help improve your cash flow by allowing you to hold onto your funds for a longer period before payment is due. However, ensure that the extended terms do not impact your relationship or ability to access essential goods or services.

- Seek Discounts for Early Payments: Offer to pay your suppliers earlier than the agreed-upon due date in exchange for a discount. This benefits both parties: your supplier gets paid sooner, and your business retains cash by reducing the total amount owed.

- Negotiate Bulk Purchase Discounts: If your business requires a significant volume of supplies, negotiate bulk purchase discounts with your suppliers. By committing to larger orders upfront, you can secure lower pricing and improve your profit margins.

- Request Price Adjustments: Monitor market fluctuations and negotiate price adjustments with suppliers when necessary. If the cost of raw materials or goods decreases, request a reduction in pricing to reflect the changes. This can help you maintain competitiveness and improve your cash flow position.

- Implement Dynamic Pricing: For businesses that sell products, implement a dynamic pricing strategy that adjusts prices based on factors such as demand, seasonality, or customer segments. This enables you to maximize your revenue potential and improve your profit margins.

- Offer Incentives for Prompt Payment: Encourage your customers to make timely payments by offering incentives for early or prompt settlement. This can include discounts, rewards programs, or exclusive offers for customers who consistently pay their invoices on time.

- Implement Credit Checks: Before extending credit to customers, conduct thorough credit checks to assess their creditworthiness and ability to make timely payments. This reduces the risk of late or non-payment and improves your cash flow predictability.

- Establish Clear Payment Policies: Communicate payment policies and expectations to your customers upfront. Clearly outline due dates, late payment penalties, and consequences for non-payment. This transparency encourages timely payments and reduces the likelihood of payment delays.

Remember, negotiation is a mutually beneficial process. It is essential to maintain open communication with your suppliers and customers, build trust, and seek win-win outcomes. By effectively negotiating better terms, you can improve your cash flow, reduce costs, and enhance the overall financial health of your business.

Managing Inventory Efficiently

Effective inventory management is crucial for optimizing cash flow in your business. Properly managing your inventory ensures that you have the right amount of stock on hand to meet customer demand while minimizing carrying costs and potential stockouts. Here are some strategies to consider when managing your inventory:

- Analyze Demand and Forecast: Use historical data and market trends to forecast future demand for your products. This allows you to make accurate purchasing decisions and avoid overstocking or understocking inventory. Utilize inventory management software to help you track and analyze sales data effectively.

- Implement Just-in-Time (JIT) Inventory: JIT inventory management aims to have inventory delivered just in time for production or sale, reducing the need for excess inventory storage. This strategy helps minimize carrying costs and frees up cash that can be directed towards other critical areas of your business.

- Monitor and Reduce Deadstock: Regularly review your inventory for items that are not selling or have become obsolete. Identify opportunities to liquidate or discount these products to minimize losses and free up valuable storage space for more profitable items.

- Establish Stock Replenishment Systems: Implement automated replenishment systems, such as economic order quantity (EOQ) or reorder point (ROP) methods, to ensure that you restock inventory at optimal levels. This helps prevent stockouts and minimizes the risk of lost sales opportunities.

- Optimize Warehouse Layout and Processes: Organize your warehouse in a way that promotes efficient picking, packing, and storage of inventory. Implement labeling and tracking systems to easily locate and manage your inventory. Streamline processes to minimize handling time and reduce the risk of errors.

- Implement Vendor-Managed Inventory (VMI) System: Collaborate with key suppliers to implement a VMI system. With this arrangement, the supplier takes responsibility for managing and replenishing your inventory based on agreed-upon levels. This can help improve inventory accuracy, reduce stockouts, and enhance overall efficiency.

- Consider Dropshipping: If feasible for your business model, explore dropshipping arrangements, where the supplier directly ships products to customers. This eliminates the need to hold inventory, reducing carrying costs and the risk of overstocking.

- Utilize Just-in-Case (JIC) Inventory: While JIT inventory management is generally preferred, it’s essential to balance it with a small safety stock of critical items. This just-in-case inventory acts as a buffer to mitigate unforeseen disruptions in supply chain or unexpected spikes in demand.

- Invest in Inventory Tracking Technology: Leverage technology, such as barcode systems or RFID (radio-frequency identification), to streamline inventory tracking and minimize errors. This allows for real-time visibility of inventory levels and reduces the chances of stock discrepancies.

- Optimize SKU Rationalization: Regularly assess your product SKU (stock-keeping unit) portfolio and identify items with low sales volume or low-profit margins. Consider discontinuing or combining these SKUs to simplify inventory management and focus on higher-performing products.

Efficient inventory management is an ongoing process that requires continuous monitoring, analysis, and adjustment. By implementing these strategies, you can optimize your inventory levels, reduce carrying costs, minimize stockouts, and improve your overall cash flow.

Utilizing Technology for Streamlining Cash Flow

Technology plays a significant role in streamlining cash flow management processes within a business. By leveraging the right tools and software, you can automate tasks, improve efficiency, and gain better visibility into your cash flow. Here are some ways to utilize technology for streamlining cash flow:

- Accounting Software: Implement a robust accounting software system that can automate various financial processes, including invoicing, expense tracking, and financial reporting. These tools provide real-time insights into your cash flow, helping you make informed decisions and optimize your financial management.

- Cloud-Based Solutions: Utilize cloud-based technologies for storing and accessing financial data. Cloud-based software allows for seamless collaboration and makes it easier to access and analyze financial information from anywhere, at any time. This enhances productivity and enables faster decision-making.

- Automated Invoicing and Payment Systems: Implement automated invoicing systems that generate and send invoices with a few clicks. This can help streamline the invoicing process, reduce errors, and improve the speed of payment collection. Integration with online payment gateways facilitates faster and more secure transactions.

- Expense Management Tools: Utilize expense management tools that automate the tracking, approval, and reimbursement of business expenses. This eliminates the manual processing of receipts, reduces paperwork, and ensures accurate expense reporting, resulting in better cash flow visibility.

- Cash Flow Forecasting Software: Implement cash flow forecasting software that uses historical data and predictive analytics to forecast future cash flow. These tools provide insights into your expected cash inflows and outflows, helping you make proactive financial decisions and plan for any potential shortfalls.

- Inventory Management Systems: Utilize inventory management software that integrates with your sales and purchasing processes. These systems enable real-time tracking of inventory levels, streamline order fulfillment, and help optimize stock levels, reducing carrying costs and minimizing stockouts.

- Automated Bank Reconciliation: Employ automated bank reconciliation tools that match your bank transactions with your accounting records. This minimizes errors, saves time, and ensures accurate financial reporting, providing a clear picture of your cash position.

- Cash Flow Dashboards and Reporting: Use technology to generate visual dashboards and reports that provide an at-a-glance view of your cash flow. This enables you to quickly identify trends, spot potential issues, and make data-driven decisions to improve cash flow management.

- Mobile Payment Solutions: Incorporate mobile payment solutions into your business to offer convenience to your customers and facilitate faster payment processing. Mobile payment systems allow for secure transactions on-the-go, improving cash flow by reducing payment processing time.

- Data Analytics and Business Intelligence: Leverage data analytics and business intelligence tools to gain deeper insights into your cash flow patterns, customer behavior, and market trends. This helps you identify opportunities to optimize cash flows, target new markets, and make strategic business decisions.

By embracing technology and utilizing the right tools, you can streamline your cash flow processes, improve efficiency, and gain better control and visibility into your financial position. Investing in technology not only saves time but also empowers you to make data-driven decisions that promote long-term financial success.

Building Relationships with Lenders and Investors

Establishing strong relationships with lenders and investors is vital for ensuring a consistent and reliable source of financing, which can greatly impact your cash flow management. Building these relationships can provide access to capital during times of growth, help navigate financial challenges, and facilitate strategic investments. Here are some strategies for building strong relationships with lenders and investors:

- Research and Identify Potential Partners: Research lenders and investors who specialize in your industry or have a history of supporting businesses with similar characteristics. Seek those who align with your business values and long-term objectives.

- Cultivate Trust and Transparency: Openly communicate with lenders and investors, providing them with accurate and up-to-date financial information. Establishing trust and transparency fosters confidence in your business’s financial stability and enhances the likelihood of securing financing.

- Develop a Solid Business Plan: Create a comprehensive business plan that outlines your vision, objectives, and strategies. This plan should provide a clear roadmap for potential lenders and investors, demonstrating your understanding of market dynamics, competitive advantage, and growth potential.

- Highlight Key Financial Metrics: Emphasize key financial metrics, such as revenue growth, profitability, and cash flow projections, to showcase your business’s financial stability and potential return on investment. Demonstrating a solid financial foundation increases your credibility.

- Attend Networking Events: Participate in industry events, conferences, and networking opportunities to connect with lenders and investors. Engage in meaningful conversations, share insights about your business, and build relationships that can lead to potential financing opportunities.

- Seek Referrals and Recommendations: Leverage your professional network to seek referrals and recommendations for lenders or investors. Recommendations from trusted sources can help establish credibility and accelerate the relationship-building process.

- Maintain Regular Communication: Keep lenders and investors informed about your business’s progress by providing updates on key milestones, financial performance, and growth initiatives. Regular communication helps maintain strong relationships and demonstrates your commitment to transparency.

- Showcase Strong Management Team: Highlight the expertise and track record of your management team. Lenders and investors are often more willing to provide financing when they have confidence in the capabilities of your leadership team.

- Evaluate Various Financing Options: Explore different financing options, such as term loans, lines of credit, venture capital, or angel investment, to identify the most suitable sources of funding for your business’s unique needs. Tailor your approach when approaching different types of lenders and investors.

- Deliver on Commitments: Honor your financial commitments and demonstrate your ability to meet loan repayments or deliver expected returns on investment. Consistently meeting or exceeding expectations builds trust and strengthens your relationships with lenders and investors.

Remember, building relationships with lenders and investors is an ongoing process. Continuously nurture these relationships, seek their guidance and feedback, and maintain open lines of communication. By cultivating strong partnerships, you can secure the financing needed to support your business’s growth and maintain a healthy cash flow.

Conclusion

Managing cash flow is essential for the success and sustainability of any business. The strategies outlined in this comprehensive guide provide practical approaches to maximize your cash flow while maintaining financial stability. By implementing these strategies, you can enhance your business’s overall financial health and position it for long-term growth and profitability.

We began by emphasizing the importance of cash flow in business and how it impacts everyday operations, growth opportunities, and financial stability. Recognizing the significance of cash flow sets the foundation for implementing effective cash flow management strategies.

We then explored various strategies to increase cash flow, such as reducing expenses and increasing sales. By carefully reviewing your expenses and identifying areas for cost reduction, you can optimize your spending and allocate resources more efficiently. Increasing sales through targeted marketing, improved customer service, and strategic pricing allows you to generate more revenue and boost your cash flow.

Focusing on cash flow also entails implementing efficient invoicing and payment systems. By streamlining your invoicing processes, offering multiple payment options, and ensuring timely collection, you can expedite cash inflows and minimize payment delays.

Furthermore, negotiating better terms with suppliers and customers can improve your cash flow position. By securing favorable pricing, extended payment terms, or early payment discounts, you can optimize your expenses and enhance your working capital management.

Managing inventory efficiently is another crucial aspect of cash flow management. By implementing inventory management systems, forecasting demand, and optimizing stock levels, you can minimize carrying costs and reduce the risk of stockouts or excess inventory.

Leveraging technology is a powerful tool for streamlining cash flow processes. Through accounting software, automated invoicing and payment systems, and cash flow forecasting tools, you can automate tasks, improve accuracy, and gain better visibility into your financial position.

Lastly, building strong relationships with lenders and investors provides access to critical financing when needed. By establishing trust, maintaining transparency, and showcasing your financial stability, you can develop valuable partnerships that support your business’s growth and contribute to a healthy cash flow.

In conclusion, managing cash flow requires a holistic approach, encompassing expense reduction, sales growth, efficient processes, technology utilization, and strong financial partnerships. By implementing the strategies outlined in this guide, you can optimize your cash flow, strengthen your financial position, and pave the way for long-term success in your business.