Home>Finance>Cryptocurrency Security Token: Definition, Forms, Investing In

Finance

Cryptocurrency Security Token: Definition, Forms, Investing In

Published: November 6, 2023

Learn about cryptocurrency security tokens, their various forms, and how to invest in them. Get a comprehensive understanding of finance in the world of blockchain and digital assets.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Cryptocurrency Security Token: Definition, Forms, Investing In

Welcome to our finance blog! In this article, we will dive into the world of cryptocurrency security tokens, exploring their definition, different forms, and potential investment opportunities. If you’ve been curious about this rapidly evolving space, you’ve come to the right place! So, what exactly are cryptocurrency security tokens? Let’s find out.

Key Takeaways:

- Cryptocurrency security tokens represent ownership or investment in an underlying asset, such as shares in a company, real estate, or even artwork.

- Unlike utility tokens, security tokens are subject to regulatory oversight and comply with securities laws.

Cryptocurrency security tokens are digital tokens that are issued on a blockchain and represent ownership or investments in real-world assets. These assets can range from equity in a company to fractional ownership of real estate or even fine art. Unlike utility tokens, which primarily offer access to a product or service, security tokens derive their value from the underlying assets they are connected to, making them more closely resemble traditional securities regulated by financial authorities.

Security tokens have gained attention in recent years due to their ability to offer investors access to previously illiquid assets, as well as the potential for increased transparency, liquidity, and efficiency in the investment process. Let’s take a look at some common forms of cryptocurrency security tokens:

Forms of Cryptocurrency Security Tokens:

- Equity Tokens: These represent ownership shares in a company and provide token holders with voting rights and potential dividend payments.

- Debt Tokens: These tokens represent debt obligations, such as bonds or loans, typically offering fixed interest payments to token holders.

- Asset-Backed Tokens: These tokens are backed by physical assets like real estate, commodities, or artwork, allowing investors to gain fractional ownership.

- Revenue-Sharing Tokens: These tokens entitle holders to a portion of the revenue generated by a particular project or business.

Now that we understand what cryptocurrency security tokens are and the different forms they can take, let’s explore the potential investment opportunities they offer. Investing in security tokens provides several advantages to both issuers and investors:

Investing in Cryptocurrency Security Tokens:

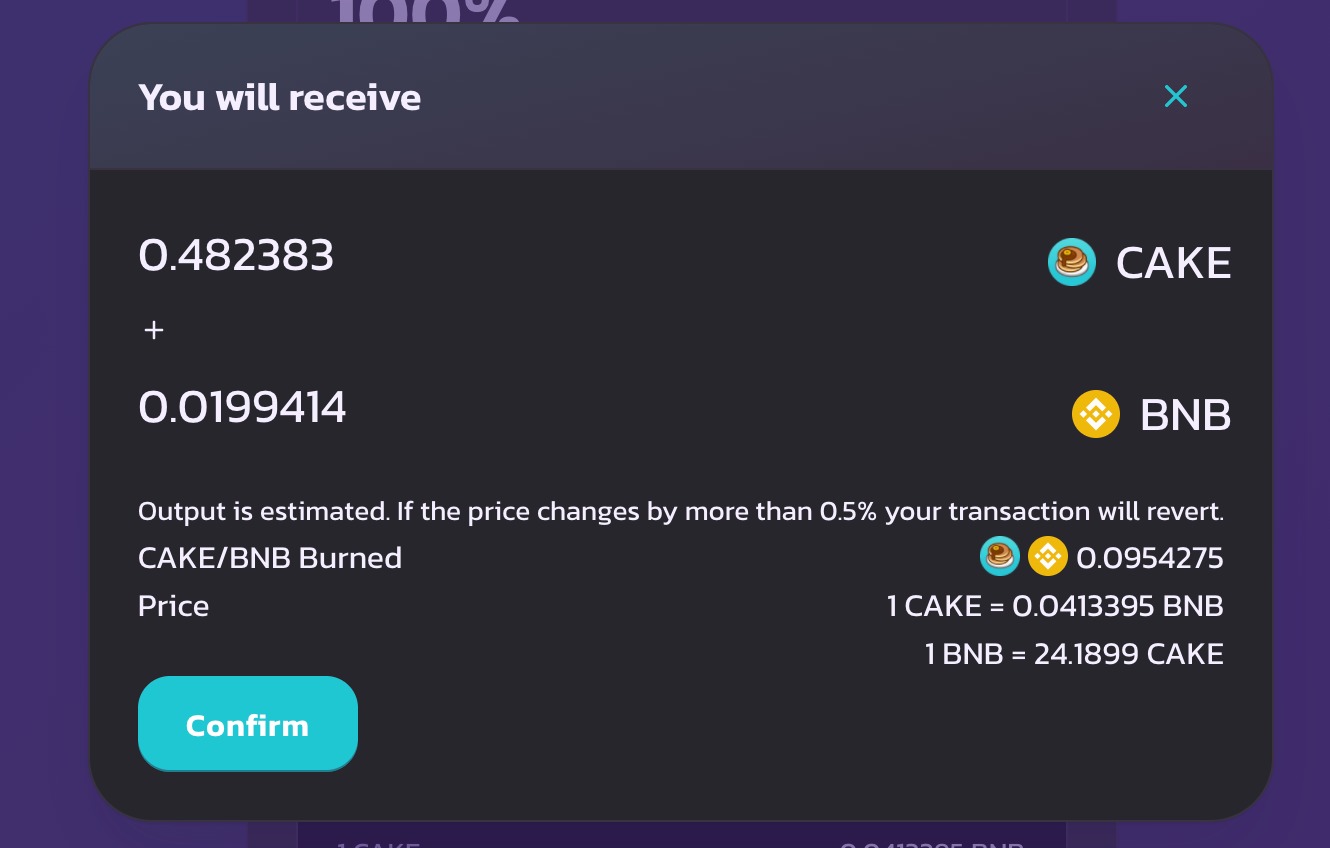

- Enhanced Liquidity: Compared to traditional securities, security tokens offer increased liquidity, allowing for easier buying and selling.

- Access to Previously Inaccessible Assets: Security tokens enable investors to gain exposure to assets that were previously difficult to access, such as real estate or high-value artwork.

- Fractional Ownership: By tokenizing assets, security tokens allow investors to easily acquire fractional ownership, lowering the entry barrier and diversifying investment portfolios.

- Regulatory Compliance: Security tokens are subject to securities regulations, providing investors with a higher level of investor protection.

As with any investment, it’s crucial to conduct thorough research and consider your risk tolerance before investing in cryptocurrency security tokens. Consulting with a financial advisor or industry expert can also be beneficial to ensure that your investment aligns with your financial goals and objectives.

In conclusion, cryptocurrency security tokens represent a new and exciting frontier in the world of finance. With their ability to tokenize real-world assets and improve liquidity, they open up new investment opportunities for individuals and businesses alike. As the industry continues to evolve, it will be fascinating to see how security tokens reshape the traditional financial landscape.