Finance

What Is Token In Banking

Published: October 11, 2023

Discover the role of tokens in the world of finance and banking. Learn how these digital assets are revolutionizing the way transactions are conducted and recorded, providing increased security and efficiency.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of banking, where innovation constantly shapes the way financial transactions are carried out. In recent years, a term that has gained significant attention in the banking industry is “token”. While the concept of tokens may initially bring to mind digital assets or cryptocurrencies, in the context of banking, tokens hold a broader meaning.

In simple terms, a token in banking refers to a representation of an asset or a piece of information. It can be a digital representation, such as a virtual token stored on a computer system, or a physical token, such as a chip card or a key fob. Tokens play a crucial role in enhancing security, facilitating transactions, and improving the overall customer experience in the financial domain.

With the rapid growth of digital banking and the increasing prevalence of online transactions, the need for secure and efficient authentication methods has become paramount. Traditional methods of identification, such as passwords or personal identification numbers (PINs), have proven to be vulnerable to hacking and fraud. This is where the concept of tokenization comes into play.

Tokenization is the process of converting sensitive data, like credit card numbers or personal information, into unique tokens that are meaningless to anyone except the authorized parties involved in the transaction. These tokens act as substitutes for the original data, providing a layer of security by ensuring that sensitive information is not transmitted or stored in its original form.

In this article, we will explore the different types of tokens used in banking, delve into the tokenization process, discuss the benefits and challenges associated with tokenization in banking, and highlight some of the notable use cases of tokenization in the financial industry.

Definition of Token in Banking

In the context of banking, a token can be defined as a representation of an asset, a piece of information, or an entity within a digital ecosystem. Tokens serve as unique identifiers that can be used for various purposes, including authentication, authorization, and secure transaction processing. They can be either digital or physical in nature, depending on the specific use case and technology involved.

In the digital realm, tokens are often used to securely store and transmit sensitive information, such as payment card data or personally identifiable information (PII). These digital tokens act as stand-ins for the original data and are designed to be meaningless to anyone who does not possess the necessary encryption keys or authorization credentials.

Physical tokens, on the other hand, are tangible objects that individuals can physically possess, typically in the form of smart cards, key fobs, or hardware security tokens. These tokens usually contain embedded chips or other mechanisms that provide an additional layer of security and enable secure access to digital systems or physical locations.

Tokens in banking are widely used to facilitate secure transactions, protect sensitive data, enhance customer convenience, and prevent fraudulent activities. By replacing sensitive information with tokens, banking institutions can minimize the risk of data breaches and identity theft, creating a more secure environment for both customers and financial institutions.

The concept of tokens in banking is closely tied to the broader field of tokenization. Tokenization is the process of transforming sensitive data into unique tokens that have no inherent meaning or value. This process ensures that even if the tokens are intercepted by unauthorized individuals, they cannot be used to reconstruct the original data.

In summary, tokens in banking are representations of assets or information used to enhance security, enable transactions, and safeguard sensitive data. Whether in digital or physical form, tokens play a crucial role in the modern banking landscape by providing a secure and convenient framework for various financial activities.

Types of Tokens in Banking

There are several types of tokens that are commonly used in the banking industry, each serving a specific purpose and offering unique features. Let’s explore some of the main types of tokens:

- Authentication Tokens: These tokens are used to verify the identity of individuals accessing banking systems or conducting transactions. They can be in the form of physical objects, such as smart cards or key fobs, or digital tokens generated by authentication apps or software. Authentication tokens provide an extra layer of security by requiring users to provide something they have (the token) in addition to something they know (like a password or PIN).

- Transaction Tokens: Transaction tokens are temporary tokens generated for specific financial transactions. They are used to authorize and securely transmit the transaction details, such as account numbers and amounts, between the parties involved. Transaction tokens are often one-time-use tokens that expire after a single transaction to prevent replay attacks or unauthorized reuse.

- Mobile Tokens: With the rise of mobile banking and payments, mobile tokens have become increasingly popular. These tokens are typically generated and stored within a mobile banking application or a specialized mobile wallet. Mobile tokens can be used for various purposes, such as authenticating mobile banking sessions, authorizing mobile payments, or generating secure one-time passwords.

- Cryptographic Tokens: Cryptographic tokens utilize encryption techniques to ensure secure communications within banking systems. These tokens are often used to secure the transmission of sensitive data, such as account information, cardholder data, or personal identification, over networks. Cryptographic tokens help safeguard against unauthorized access or interception of data during transit.

- Biometric Tokens: Biometric tokens involve the use of unique biological characteristics, such as fingerprints, facial recognition, or iris scans, to verify identity and grant access to banking services. Biometric tokens provide a high level of security and convenience, as they rely on physical attributes that are difficult to forge or replicate.

These are just a few examples of the types of tokens used in banking. The specific types and implementations may vary depending on the banking institution, regulatory requirements, and technological advancements.

By incorporating various types of tokens into their systems, banks can enhance security, improve user authentication, safeguard sensitive data, and ensure seamless financial transactions for their customers.

Tokenization Process in Banking

The tokenization process in banking involves the conversion of sensitive data into unique tokens that can be securely used for various purposes without exposing the original information. This process follows a series of steps to ensure the integrity, confidentiality, and usability of the tokens. Let’s explore the general tokenization process in banking:

- Data Identification: The first step in the tokenization process is to identify the sensitive data that needs to be protected. This could include credit card numbers, bank account details, social security numbers, or any other personally identifiable information (PII).

- Data Encryption: Once the sensitive data is identified, it is encrypted using robust encryption algorithms. This ensures that the data is transformed into an unreadable format that can only be deciphered with the appropriate decryption key.

- Token Generation: After encryption, unique tokens are generated to represent the original data. These tokens are devoid of any meaningful correlation to the original data, making them meaningless to unauthorized users who may come in contact with them.

- Tokenization Vault: The generated tokens, along with their corresponding original data, are stored in a secure tokenization vault. This vault acts as a repository for the tokens and maintains a mapping between the tokens and their associated data in a secure and encrypted format.

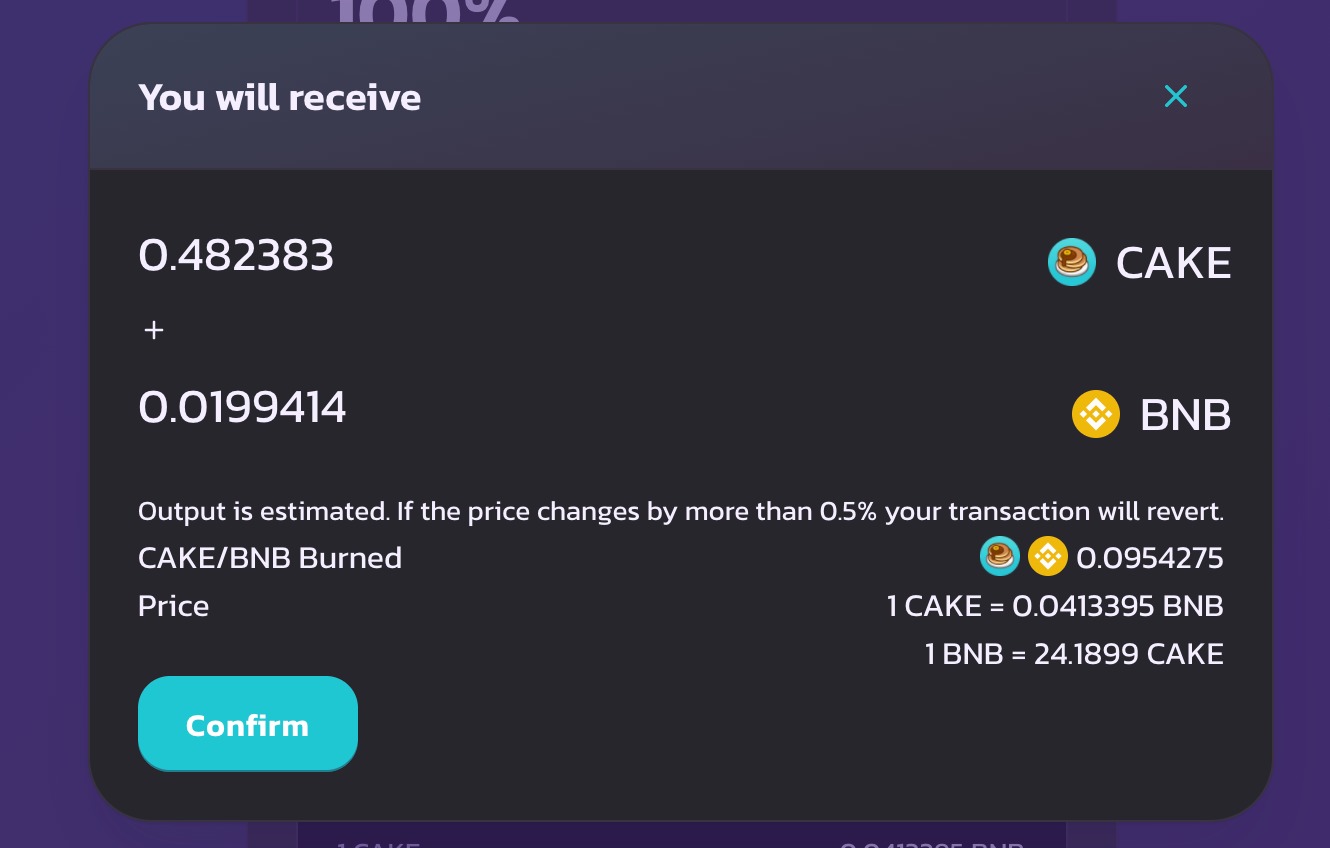

- Token Usage: When a transaction or request involving the original data occurs, the token is used in place of the sensitive information. The token is transmitted and processed instead of the actual data, ensuring that the sensitive information remains protected throughout the transaction.

- Token De-Tokenization: In certain scenarios, the original data may need to be retrieved from the token. This process, known as de-tokenization, involves mapping the token back to its original data using the secure tokenization vault and the corresponding decryption key. The original data is then made available for authorized use or processing.

The tokenization process provides several benefits for banking institutions and their customers. It significantly reduces the risk of data breaches and theft, as tokens are meaningless to attackers and cannot be used to directly access or reconstruct the original sensitive information. It also streamlines payment processing, as tokens can be securely transmitted and stored in systems without compromising security.

Overall, tokenization plays a crucial role in improving the security and efficiency of banking transactions by protecting sensitive data and providing a secure framework for authentication and authorization. By adopting tokenization, banks can enhance customer trust, comply with industry regulations, and stay at the forefront of secure financial service provision.

Benefits of Tokenization in Banking

Tokenization in banking offers a wide range of benefits, strengthening security, streamlining processes, and enhancing the overall customer experience. Let’s delve into some of the key advantages of tokenization in the banking industry:

- Enhanced Security: Tokenization replaces sensitive data, such as credit card numbers or account information, with tokens that have no meaningful value to unauthorized users. This significantly reduces the risk of data breaches and fraudulent activities, as even if the token is intercepted, it cannot be used to access the original data.

- Data Protection: By tokenizing sensitive information, banks can protect customer data from unauthorized access or misuse. Tokenization ensures that customer data is securely stored and transmitted while minimizing the chances of data theft or compromise.

- Streamlined Transactions: Tokenization simplifies the payment process by enabling the use of tokens instead of actual cardholder data. This eliminates the need to transmit and store sensitive information during transactions, reducing complexities and facilitating faster, smoother transactions for both customers and banks.

- Compliance with Regulations: Tokenization helps banks comply with industry regulations and data protection standards, such as the Payment Card Industry Data Security Standard (PCI DSS) and General Data Protection Regulation (GDPR). By tokenizing sensitive data, banks can mitigate the risk of non-compliance and potential penalties.

- Convenience for Customers: Tokenization enhances the customer experience by ensuring the security and privacy of their sensitive information. Customers no longer need to worry about manually entering their card details for each transaction as tokenization enables seamless and secure payments.

- Reduced Cardholder Data Footprint: With tokenization, banks can minimize the storage and transmission of actual cardholder data. This reduces the potential points of vulnerability and lessens the impact of a data breach, as tokens alone are of no value to attackers.

- Compatibility with Existing Systems: Tokenization can be seamlessly integrated into existing banking systems and processes. This means that banks can adopt tokenization without requiring significant changes to their infrastructure, making it a practical and efficient security solution.

These benefits highlight the importance of tokenization in the banking industry. By adopting tokenization, banks can enhance security, safeguard sensitive data, streamline transactions, and provide customers with a convenient and secure banking experience. Tokenization not only protects against data breaches and fraud but also enables banks to comply with regulations and build trust with their customers in an increasingly digital and interconnected world.

Challenges of Tokenization in Banking

While tokenization offers numerous benefits, it is not without its challenges. The implementation of tokenization in the banking industry can present certain obstacles that banks need to address. Let’s explore some of the main challenges of tokenization in banking:

- Implementation Complexity: Integrating tokenization into existing banking systems can be complex and require significant technical expertise. Banks may need to update or replace legacy systems to enable tokenization, which can be time-consuming and expensive.

- Token Vault Management: The management of the tokenization vault, which stores the mapping between tokens and original data, requires robust security measures. Banks must protect the vault from unauthorized access, maintain data integrity, and ensure proper backup and recovery procedures in case of system failure.

- Cost of Implementation: Implementing tokenization can involve substantial upfront costs, including infrastructure upgrades, security measures, and employee training. Banks must carefully evaluate the cost-effectiveness and return on investment of implementing tokenization in their specific context.

- Vendor Dependency: Banks may rely on third-party vendors for tokenization services, which can introduce a dependency on external entities. This reliance raises concerns about the vendor’s security measures, reliability, and long-term availability of services.

- Standardization and Interoperability: Achieving standardization and ensuring interoperability among different banking systems and tokenization solutions can be a challenge. Banks and industry stakeholders should work together to establish common frameworks and standards to enable seamless tokenization across platforms.

- Regulatory Compliance: Tokenization introduces new aspects of data handling and security, which banks need to navigate within the regulatory landscape. Ensuring compliance with regulations like GDPR, PCI DSS, and other data protection laws can pose a challenge, especially as regulations evolve.

- User Education and Adoption: Educating customers about tokenization and encouraging their adoption can be a hurdle. Some users may be unfamiliar with tokenization and may need reassurance about the security and privacy benefits it offers.

While these challenges exist, they can be addressed with careful planning, collaboration, and investment in appropriate technology and expertise. Overcoming these challenges allows banks to harness the advantages of tokenization while navigating the evolving landscape of data security and customer expectations.

Use Cases of Tokenization in Banking

Tokenization finds applications across various areas in the banking industry, enhancing security, simplifying processes, and improving customer experiences. Let’s explore some common use cases of tokenization in banking:

- Payment Card Tokenization: One prominent use case of tokenization is the tokenization of payment card data. Instead of transmitting and storing actual cardholder information, tokens are used in transactions. This reduces the risks associated with data breaches and fraud, making payments more secure for customers and merchants alike.

- Mobile Wallets and Payments: Tokenization is integral to the functionality of mobile wallets and payment systems. Tokens are utilized to replace sensitive card data and enable secure transactions via smartphones or wearable devices. This enables convenient and secure mobile payments without compromising cardholder data.

- Secure Identification and Access: Tokenization plays a vital role in ensuring secure identification and access control in banking systems. Tokens are used to authenticate users, authorize transactions, and protect sensitive data from unauthorized access. For example, tokens can be used in two-factor authentication processes, providing an extra layer of security beyond traditional passwords.

- Tokenized ATM Transactions: Tokenization is increasingly used in ATM transactions to enhance security. Tokens are generated for each transaction, allowing users to withdraw cash or perform other operations without directly exposing their sensitive banking credentials or card data. This mitigates the risk of card skimming and other fraudulent activities at ATMs.

- Fraud Detection and Prevention: Tokenization aids in fraud detection and prevention by enabling the monitoring and analysis of transaction patterns. Tokens can be used to identify unusual or suspicious activities without compromising the privacy of customers. Real-time analysis of tokenized transaction data helps banks proactively identify and mitigate potential fraudulent behavior.

- Secure Digital Identity: Tokenization can be utilized to securely store and transmit digital identity information, such as driver’s licenses, passports, or government-issued identification cards. Tokens can replace Personally Identifiable Information (PII) within digital identity systems, ensuring privacy and protection against identity theft.

- Data Sharing and Collaboration: Tokenization can facilitate secure data sharing and collaboration between banking institutions or other trusted parties. Tokens allow controlled access to specific datasets without sharing the actual sensitive information. This enables secure collaboration, compliance with data privacy regulations, and improved data governance.

These use cases demonstrate how tokenization is revolutionizing the banking industry by providing enhanced security, simplifying processes, and offering innovative customer experiences. The versatility and wide-ranging applications of tokenization make it a valuable tool for financial institutions as they adapt to the evolving demands of the digital era.

Conclusion

Tokenization has emerged as a powerful solution in the banking industry, offering enhanced security, streamlined transactions, and improved customer experiences. By substituting sensitive data with unique tokens, banks can protect customer information, reduce the risk of data breaches, and comply with industry regulations.

Throughout this article, we explored the definition of tokens in banking and examined the various types of tokens used, including authentication tokens, transaction tokens, mobile tokens, cryptographic tokens, and biometric tokens. We also discussed the tokenization process, which involves data identification, encryption, token generation, secure storage in a tokenization vault, token usage, and token de-tokenization.

Furthermore, we highlighted the benefits of tokenization in the banking sector, such as enhanced security, data protection, streamlined transactions, compliance with regulations, convenience for customers, reduced cardholder data footprint, and compatibility with existing systems.

However, it is important to acknowledge the challenges that banks may encounter when implementing tokenization, such as implementation complexity, token vault management, cost, vendor dependency, standardization, regulatory compliance, and user education and adoption. These challenges can be overcome with proper planning, collaboration, and investment in the necessary technology and expertise.

Lastly, we explored several use cases of tokenization in banking, including payment card tokenization, mobile wallets and payments, secure identification and access control, tokenized ATM transactions, fraud detection and prevention, secure digital identity, and data sharing and collaboration.

In conclusion, tokenization is a transformative technology that provides numerous benefits to the banking industry. By leveraging tokens, banks can enhance security, protect sensitive data, simplify transactions, comply with regulations, and deliver a seamless and secure banking experience for their customers. As the banking landscape continues to evolve, tokenization will undoubtedly play a pivotal role in shaping the future of financial services.