Home>Finance>How Is A Cryptocurrency Exchange Different From A Cryptocurrency Wallet

Finance

How Is A Cryptocurrency Exchange Different From A Cryptocurrency Wallet

Modified: December 30, 2023

Discover the key differences between a cryptocurrency exchange and a cryptocurrency wallet in the world of finance. Learn how each plays a vital role in managing digital assets.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Cryptocurrency Exchange

- Definition of Cryptocurrency Wallet

- Key Differences between a Cryptocurrency Exchange and a Cryptocurrency Wallet

- Security Measures of Cryptocurrency Exchanges

- Security Measures of Cryptocurrency Wallets

- Types of Cryptocurrency Exchanges

- Types of Cryptocurrency Wallets

- Functionality of Cryptocurrency Exchanges

- Functionality of Cryptocurrency Wallets

- Advantages and Disadvantages of Cryptocurrency Exchanges

- Advantages and Disadvantages of Cryptocurrency Wallets

- Conclusion

Introduction

Welcome to the fascinating world of cryptocurrencies! As digital currencies continue to gain mainstream adoption, it’s important to understand the different aspects of the cryptocurrency ecosystem. Two key components of this ecosystem are cryptocurrency exchanges and cryptocurrency wallets.

Cryptocurrency exchanges and wallets play distinct and vital roles in the cryptocurrency market. While they both deal with cryptocurrencies, they serve different purposes and offer unique features and functionalities. Understanding the differences between the two is crucial for anyone looking to engage with cryptocurrencies.

In this article, we will delve into the differences between a cryptocurrency exchange and a cryptocurrency wallet. We will explore their definitions, security measures, types, functionality, and advantages and disadvantages. By the end, you’ll have a clear understanding of how these two entities differ and what role they play in the world of cryptocurrencies.

Whether you are an investor, trader, or simply curious about cryptocurrencies, learning about exchanges and wallets will give you the knowledge and confidence to navigate this exciting digital landscape.

Definition of Cryptocurrency Exchange

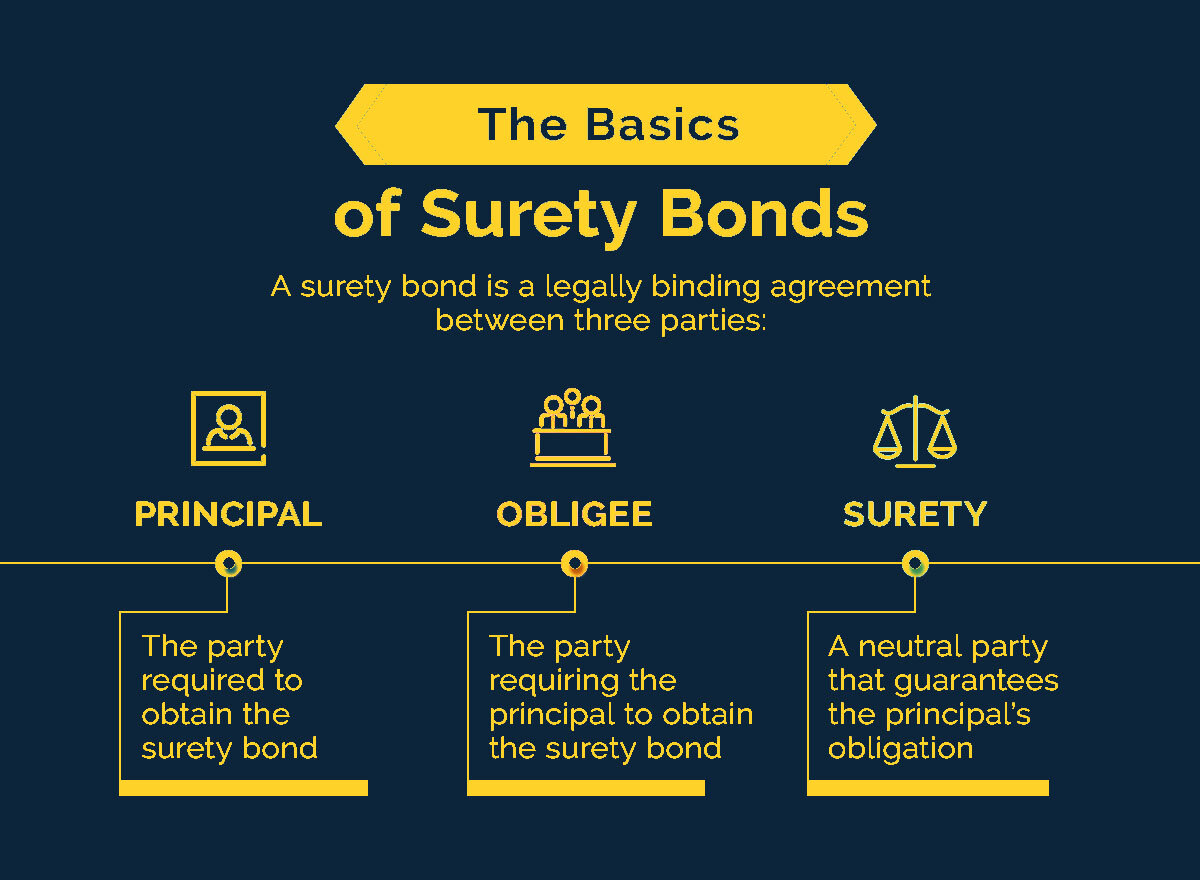

A cryptocurrency exchange is a digital platform that allows users to buy, sell, and trade cryptocurrencies. It acts as an intermediary between buyers and sellers, facilitating the exchange of digital assets. These exchanges function similarly to traditional stock exchanges, where users can place orders, set prices, and execute transactions.

At its core, a cryptocurrency exchange provides a marketplace for individuals to trade different cryptocurrencies such as Bitcoin, Ethereum, Ripple, and many others. It offers a wide range of trading pairs, allowing users to exchange one cryptocurrency for another. For instance, you can trade your Bitcoin for Ethereum or vice versa.

Cryptocurrency exchanges provide various features and tools to facilitate seamless trading. They typically offer order books, price charts, and other analytical tools to help users make informed trading decisions. Some exchanges also provide advanced trading options such as margin trading and futures trading, catering to traders with different strategies and risk appetites.

It’s important to note that cryptocurrency exchanges can be either centralized or decentralized. Centralized exchanges are operated by a single entity and act as custodians of users’ funds. Users need to create an account and deposit their cryptocurrencies into the exchange’s wallet to start trading. On the other hand, decentralized exchanges (DEXs) operate on a peer-to-peer network, eliminating the need for a central authority. DEXs allow users to trade directly from their wallets, giving them control over their funds.

In summary, a cryptocurrency exchange is a digital platform that facilitates the buying, selling, and trading of cryptocurrencies. It provides a marketplace where users can exchange different cryptocurrencies and offers a range of features and tools to support the trading process. Whether centralized or decentralized, exchanges play a crucial role in the cryptocurrency ecosystem, enabling users to enter and exit positions in cryptocurrencies.

Definition of Cryptocurrency Wallet

A cryptocurrency wallet is a digital tool that allows users to securely store, send, and receive cryptocurrencies. It serves as a virtual wallet for holding and managing digital assets. While the name “wallet” may evoke thoughts of a physical wallet, a cryptocurrency wallet is purely digital.

Think of a cryptocurrency wallet as a software application or an online service that provides users with a unique address for each cryptocurrency they hold. These addresses are similar to a bank account number, and they enable users to send and receive digital currencies.

There are different types of cryptocurrency wallets available, including:

- Software Wallets: These wallets come in the form of desktop applications, mobile apps, or web-based clients. They provide users with direct control over their private keys, allowing them to access and manage their cryptocurrencies. Software wallets are convenient and widely used.

- Hardware Wallets: These wallets are physical devices that securely store private keys offline. They provide an extra layer of security by keeping the private keys away from internet-connected devices. Hardware wallets are considered one of the safest options for storing cryptocurrencies.

- Online Wallets: Also known as web wallets, these wallets run on cloud-based servers and can be accessed through a web browser. While online wallets offer convenience, they are considered less secure compared to other wallet types since users do not have direct control over their private keys.

- Paper Wallets: A paper wallet is a physical printout or a handwritten copy of a user’s private and public keys. It provides an offline method for storing cryptocurrencies and is typically used as a backup option. Paper wallets can be generated using specialized tools.

- Multi-Signature Wallets: These wallets require multiple signatures to authorize transactions. They add an extra layer of security by involving multiple parties in the transaction approval process. Multi-signature wallets are often used by businesses and organizations.

Regardless of the type, every cryptocurrency wallet consists of two important components: a public key and a private key. The public key is used for receiving funds, while the private key is required to access and transfer the cryptocurrencies stored in the wallet. It’s crucial to keep the private key secure and never share it with anyone to maintain control over your digital assets.

In summary, a cryptocurrency wallet is a digital tool that allows users to store, send, and receive cryptocurrencies. It provides users with unique addresses for different cryptocurrencies and comes in various forms, including software, hardware, online, paper, and multi-signature wallets. Understanding the different types of wallets and their features is essential for safely managing and transacting with cryptocurrencies.

Key Differences between a Cryptocurrency Exchange and a Cryptocurrency Wallet

While a cryptocurrency exchange and a cryptocurrency wallet are both integral parts of the cryptocurrency ecosystem, they serve distinct purposes and offer different functionalities. Understanding the key differences between the two is crucial for anyone looking to navigate the world of cryptocurrencies.

Here are the main differences between a cryptocurrency exchange and a cryptocurrency wallet:

- Function: A cryptocurrency exchange primarily functions as a marketplace where users can buy, sell, and trade cryptocurrencies. It provides a platform for users to exchange one cryptocurrency for another, set prices, and execute transactions. On the other hand, a cryptocurrency wallet serves as a digital tool for securely storing, sending, and receiving cryptocurrencies. It provides users with unique addresses for each cryptocurrency they hold.

- Ownership of Cryptocurrencies: When using a cryptocurrency exchange, users typically entrust their cryptocurrencies to the exchange as they deposit them into their exchange wallet. The exchange acts as the custodian of the funds until the user decides to withdraw them. In contrast, a cryptocurrency wallet gives users direct control and ownership of their cryptocurrencies. Users hold their private keys and have the ability to access and manage their digital assets.

- Security: Cryptocurrency exchanges implement various security measures to protect the funds stored on their platforms. This includes encryption, two-factor authentication, and cold storage of funds. However, exchanges have historically been targeted by hackers, leading to instances of funds being compromised. Cryptocurrency wallets, especially hardware wallets, offer a higher level of security as they store private keys offline, away from potential online threats. Users are solely responsible for the security of their wallet, including choosing strong passwords and protecting private keys.

- Availability of Trading Features: Cryptocurrency exchanges offer a wide range of trading features and tools to facilitate trading activities. These include order books, price charts, indicators, and advanced trading options like margin trading and futures trading. Whereas cryptocurrency wallets prioritize the secure storage and transfer of cryptocurrencies, they typically do not offer trading features.

- Level of Privacy: When using a cryptocurrency exchange, users often need to provide personal information and comply with Know Your Customer (KYC) regulations. This is to ensure regulatory compliance and prevent illicit activities. Cryptocurrency wallets, especially those that do not require registration, offer a higher level of privacy as they do not require extensive personal information. However, it’s worth noting that some wallet transactions are still publicly visible on the blockchain.

In summary, a cryptocurrency exchange and a cryptocurrency wallet have distinct functions and characteristics. Exchanges serve as marketplaces for buying, selling, and trading cryptocurrencies, while wallets focus on securely storing, sending, and receiving digital assets. Exchanges provide trading features but require users to entrust their funds to the platform, whereas wallets prioritize ownership and control over cryptocurrencies with higher levels of security and privacy.

Security Measures of Cryptocurrency Exchanges

Ensuring the security of funds is of paramount importance in the cryptocurrency space. Cryptocurrency exchanges recognize the need for robust security measures to protect the assets held on their platforms. While no security system is foolproof, exchanges implement several measures to safeguard user funds and mitigate the risks associated with hacking and theft.

Here are some common security measures employed by cryptocurrency exchanges:

- Encryption: Exchanges use advanced encryption algorithms to protect user data and transactions. Encryption ensures that sensitive information transmitted between users and the exchange cannot be intercepted or deciphered by unauthorized individuals.

- Two-Factor Authentication (2FA): Many exchanges enforce 2FA as an additional layer of security during login attempts. This requires users to provide a second form of verification, usually through a mobile app or SMS, to confirm their identity.

- Cold Wallet Storage: To minimize the risk of hacking, exchanges often store the majority of user funds in offline cold wallets. Cold wallets are not connected to the internet, making them inaccessible to potential hackers. By keeping funds offline, exchanges reduce the attack surface and protect against online security breaches.

- Asset Segregation: Cryptocurrency exchanges implement protocols to segregate user funds from their operational expenses. By separating user funds, exchanges provide an additional layer of protection against internal mismanagement or theft.

- Penetration Testing: To identify vulnerabilities in their systems, exchanges conduct regular penetration testing. This involves employing ethical hackers to test the platform’s security defenses and identify any potential weaknesses that need to be addressed.

- Insurance Coverage: Some exchanges offer insurance coverage for user funds, providing an additional layer of protection in case of hacks or theft. This insurance typically covers the funds stored in hot wallets, which are relatively more vulnerable than cold storage.

- Regulatory Compliance: Many reputable exchanges comply with regulatory requirements and protocols in the jurisdictions they operate in. Adhering to regulations helps ensure that strict security measures and anti-money laundering (AML) procedures are in place.

While cryptocurrency exchanges strive to implement robust security measures, it’s important for users to take proactive steps to protect their accounts. This includes setting strong and unique passwords, enabling 2FA, regularly updating software, and avoiding suspicious links or phishing attempts.

Despite these security measures, it’s crucial to acknowledge that cryptocurrency exchanges are not immune to breaches. Users should carefully research and choose reputable and well-established exchanges with a strong track record of security. Additionally, considering the option of storing cryptocurrencies in personal wallets for added security is advisable.

In summary, cryptocurrency exchanges utilize various security measures such as encryption, two-factor authentication, cold wallet storage, asset segregation, penetration testing, insurance coverage, and regulatory compliance to safeguard user assets. However, it’s essential for users to remain vigilant and take necessary precautions to protect their accounts and personal information.

Security Measures of Cryptocurrency Wallets

Security is a paramount concern when it comes to cryptocurrency wallets, as they are responsible for safeguarding users’ precious digital assets. Wallet providers understand the importance of implementing robust security measures to protect against unauthorized access, hacks, and other forms of threats. Here are some common security measures employed by cryptocurrency wallets:

- Private Key Encryption: Cryptocurrency wallets use strong encryption algorithms to secure users’ private keys. This encryption ensures that the private keys are stored in an encrypted format, making it extremely difficult for hackers or unauthorized individuals to decipher the keys and gain access to the wallet.

- Offline Storage (Cold Wallets): Many wallets, particularly hardware wallets, utilize cold storage solutions to keep private keys offline. Cold storage ensures that the private keys are not connected to the internet, making them virtually impervious to online hacking attempts. By keeping private keys offline, wallets provide an additional layer of security against potential threats.

- Backup and Recovery Options: Cryptocurrency wallets typically provide users with the ability to create backups of their wallets. This backup option allows users to easily recover their wallets in case of device loss, damage, or theft. Wallets often use mnemonic phrases or seed words that can be used to restore wallets on new devices securely.

- Multifactor Authentication: Wallets offer the option to enable multifactor authentication (MFA) to provide an extra layer of security during login attempts. Users can enable MFA via authenticator apps, biometric authentication, or hardware tokens. This adds an additional step in the authentication process, making it harder for unauthorized individuals to access the wallet.

- Regular Software Updates: Wallet providers continuously work towards enhancing security by releasing regular software updates. These updates often address any known vulnerabilities, bugs, or potential security risks. Users are advised to keep their wallets up to date to benefit from the latest security improvements.

- Open-Source Audits: Wallets that are open-source undergo regular code audits by security experts and the wider community. This helps to ensure the integrity and transparency of the wallet’s code, making it less susceptible to hidden vulnerabilities or backdoors.

- User Education: Wallet providers emphasize user education by offering comprehensive guides and resources on best security practices. This includes educating users on the importance of keeping their private keys secure, avoiding suspicious links or phishing attempts, and practicing strong password hygiene.

While cryptocurrency wallets implement stringent security measures, users must also take responsibility for their wallet’s security. This includes choosing strong passwords, enabling additional security features like biometric authentication or PIN codes, and using reputable wallet providers from trusted sources.

It’s worth noting that no security system is completely infallible, and it’s always advisable to diversify and spread cryptocurrency holdings across multiple wallets for added protection. By not keeping all digital assets in a single wallet, users can reduce the potential impact if one wallet is compromised.

In summary, cryptocurrency wallets employ various security measures such as private key encryption, offline storage, backup and recovery options, multifactor authentication, regular software updates, open-source audits, and user education. Users should diligently follow recommended security practices and exercise caution to ensure the safety of their cryptocurrency holdings.

Types of Cryptocurrency Exchanges

Cryptocurrency exchanges come in different forms, each offering unique features and catering to various user needs. Understanding the different types of exchanges is essential for selecting the one that aligns with your trading preferences and requirements. Here are the main types of cryptocurrency exchanges:

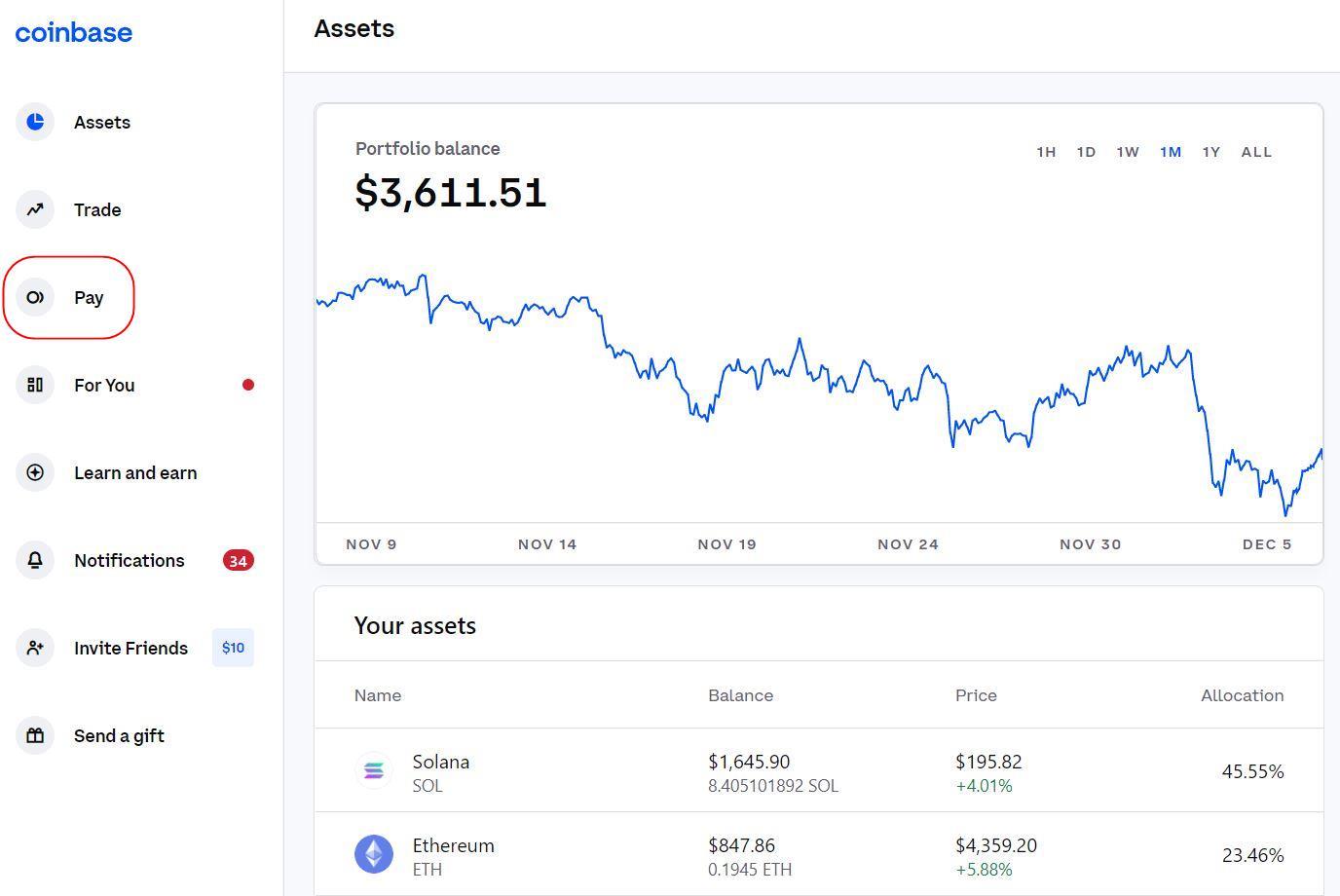

- Centralized Exchanges (CEX): Centralized exchanges are the most common type and operate as intermediaries between buyers and sellers. These exchanges have a central governing authority that manages the platform and holds users’ funds in custodial wallets. CEX platforms offer various trading features, including order books, liquidity, and advanced trading options. They typically require user registration, KYC compliance, and may charge trading fees. Examples of popular centralized exchanges include Coinbase, Binance, and Kraken.

- Decentralized Exchanges (DEX): Decentralized exchanges, on the other hand, operate on a peer-to-peer network without a central authority. DEX platforms facilitate direct transactions between users through smart contracts or atomic swaps, eliminating the need for a middleman. Users retain control of their funds and conduct transactions directly from their wallets. DEX platforms prioritize privacy and security but may have limitations in terms of liquidity and trading features. Examples of decentralized exchanges include Uniswap, SushiSwap, and PancakeSwap.

- Hybrid Exchanges: Hybrid exchanges combine the features of both centralized and decentralized exchanges. They leverage the benefits of a centralized platform, such as liquidity and advanced trading options, while also providing users with control over their funds. These exchanges typically use decentralized technologies, such as blockchain and smart contracts, to enhance security and transparency. Hybrid exchanges are gaining popularity for their ability to offer a balance between convenience and user control.

- Fiat-to-Crypto Exchanges: Fiat-to-crypto exchanges allow users to buy cryptocurrencies using traditional fiat currencies like USD, EUR, or GBP. These exchanges bridge the gap between cryptocurrencies and traditional financial systems. Fiat-to-crypto exchanges usually require user registration, KYC compliance, and often support bank transfers or credit/debit card payments. These exchanges enable users to easily convert fiat currencies into cryptocurrencies and vice versa. Examples include Coinbase, Gemini, and Bitstamp.

- Crypto-to-Crypto Exchanges: Crypto-to-crypto exchanges solely focus on facilitating the trading of one cryptocurrency for another. These exchanges do not support fiat currencies and require users to possess the desired cryptocurrencies to start trading. Crypto-to-crypto exchanges offer vast selections of trading pairs and are popular among experienced traders and investors looking to diversify their portfolios. Binance, Bittrex, and Poloniex are well-known examples of crypto-to-crypto exchanges.

It’s important to note that while each type of exchange has its own advantages and disadvantages, users should consider factors such as security, liquidity, fees, supported cryptocurrencies, user experience, and regulatory compliance when choosing an exchange.

Ultimately, the type of cryptocurrency exchange that best suits your needs will depend on your trading goals, preferences, and level of trust in the exchange’s infrastructure. It’s also important to stay informed about the evolving landscape of exchanges as new types and innovations continue to emerge.

In summary, cryptocurrency exchanges can be categorized into centralized exchanges (CEX), decentralized exchanges (DEX), hybrid exchanges, fiat-to-crypto exchanges, and crypto-to-crypto exchanges. Each type offers different features and characteristics, catering to various user demands and trading preferences.

Types of Cryptocurrency Wallets

Cryptocurrency wallets come in various forms, each with its own unique features and security considerations. Understanding the different types of wallets is essential for selecting the one that best suits your needs and provides the desired level of security for your digital assets. Here are the main types of cryptocurrency wallets:

- Software Wallets: Software wallets are digital wallets that come in various forms, including desktop applications, mobile apps, or web-based clients. They offer a convenient way to store, send, and receive cryptocurrencies. Software wallets can be further divided into:

- Online Wallets: Also known as web wallets, these wallets run on cloud-based servers and can be accessed through a web browser. They offer easy accessibility but may be considered less secure since the private keys are stored online.

- Desktop Wallets: These wallets are installed on a user’s computer or laptop. They provide control and security by storing private keys locally, enabling offline access to funds.

- Mobile Wallets: Mobile wallets are installed as applications on smartphones or tablets. They offer convenience and on-the-go access to digital assets.

- Hardware Wallets: Hardware wallets are physical devices designed specifically for storing cryptocurrencies securely. These wallets store private keys offline on the device and require physical interaction to initiate transactions. Hardware wallets are considered one of the most secure options as they offer protection against online threats such as malware or keyloggers.

- Paper Wallets: Paper wallets provide an offline method to store cryptocurrencies. They involve generating a paper printout or writing down the private and public keys on paper. Paper wallets are highly secure as they are not susceptible to online attacks. However, users must take extra precautions to keep the physical copies safe and protected from damage or loss.

- Brain Wallets: Brain wallets are a type of software wallet that allows users to store their private keys in their memory. Users generate private keys based on a passphrase or mnemonic phrase that is easy to remember. While brain wallets offer convenience, the reliance on human memory introduces potential weaknesses, such as the risk of forgetting or guessing the passphrase.

Each type of wallet offers its own balance between convenience and security. Software wallets provide easy access to digital assets but may be more vulnerable to online threats. Hardware wallets prioritize security by storing private keys offline but may come at the cost of convenience. Paper wallets and brain wallets are highly secure, but users must take responsibility for safeguarding the physical copies or remembering the passphrase.

It’s important to consider factors such as security, ease of use, compatibility with different cryptocurrencies, and the level of control you desire when selecting a wallet. Additionally, keeping backups of wallets and regularly updating wallet software are crucial steps to ensure the safety of your digital assets.

In summary, cryptocurrency wallets can be classified into software wallets (online, desktop, and mobile), hardware wallets, paper wallets, and brain wallets. Each type provides different security features and user experiences, allowing individuals to choose the wallet that best fits their security requirements and usability preferences.

Functionality of Cryptocurrency Exchanges

Cryptocurrency exchanges serve as essential platforms for users to buy, sell, and trade digital currencies. They provide a range of functionalities that enable users to engage in various activities within the cryptocurrency market. Understanding the functionalities of cryptocurrency exchanges is key to navigating these platforms and effectively executing trades. Here are the main functionalities of cryptocurrency exchanges:

- Marketplace for Trading: Cryptocurrency exchanges function as marketplaces where users can place buy or sell orders for different cryptocurrencies. They provide an order book that displays current bids and asks, facilitating the matching of orders between buyers and sellers. This functionality enables users to enter and exit positions in various digital assets.

- Trading Pairs: Exchanges offer a wide range of trading pairs, allowing users to exchange one cryptocurrency for another. For example, users can trade Bitcoin for Ethereum or Ripple for Litecoin. Trading pairs give users flexibility in diversifying their holdings and taking advantage of price movements in different cryptocurrencies.

- Price Charts and Analysis: Cryptocurrency exchanges provide price charts that display historical price data for different cryptocurrencies. These charts often include various technical analysis tools and indicators, aiding users in analyzing market trends, identifying patterns, and making informed trading decisions.

- Order Types: Exchanges offer different order types to accommodate various trading strategies. Common order types include market orders, limit orders, stop orders, and trailing orders. These order types allow users to specify their desired execution prices or set up automated triggers for buying or selling cryptocurrencies.

- Advanced Trading Features: Some exchanges cater to more experienced traders by offering advanced trading features such as margin trading and futures trading. Margin trading allows users to trade with borrowed funds, amplifying potential gains or losses. Futures contracts enable users to speculate on the future price of cryptocurrencies without owning the underlying assets.

- Liquidity: Cryptocurrency exchanges play a crucial role in providing liquidity to the market. By bringing together a large number of buyers and sellers, exchanges ensure that there is a continuous flow of trading activity, making it easier for users to execute trades at their desired prices.

- Security and Wallet Services: Many exchanges provide wallet services, allowing users to store their cryptocurrencies directly on the exchange. While this offers convenience, it also poses security risks as users entrust their funds to the exchange. Exchanges implement various security measures like encryption, two-factor authentication, and cold storage to safeguard user funds.

- Regulatory Compliance: Established exchanges adhere to regulatory guidelines and implement measures to ensure compliance. This includes setting up Know Your Customer (KYC) processes, anti-money laundering (AML) procedures, and following jurisdiction-specific regulations to prevent illicit activities within the cryptocurrency market.

It’s important to note that the specific functionalities may vary between different exchanges. Some platforms may focus on providing a robust trading experience, while others may prioritize security or cater to specific trading needs. It’s crucial to research and choose exchanges that align with your preferences and requirements.

In summary, cryptocurrency exchanges offer a marketplace for users to trade cryptocurrencies and provide functionalities such as trading pairs, price charts, order types, advanced trading features, liquidity, security and wallet services, as well as regulatory compliance. Understanding and utilizing these functionalities empowers users to participate effectively in the dynamic cryptocurrency market.

Functionality of Cryptocurrency Wallets

Cryptocurrency wallets play a crucial role in the management and security of digital assets. They offer a range of functionalities that enable users to securely store, send, and receive cryptocurrencies. Understanding the functionalities of cryptocurrency wallets is essential for effectively managing and utilizing digital currencies. Here are the main functionalities of cryptocurrency wallets:

- Secure Storage: The primary functionality of a cryptocurrency wallet is to securely store digital assets. Wallets generate a unique address for each cryptocurrency held, which serves as a destination for receiving funds. The wallet’s secure storage ensures that private keys, which grant access to the funds, are protected from unauthorized access.

- Sending and Receiving: Cryptocurrency wallets enable users to send and receive digital assets to and from other wallets. Users can initiate transactions by specifying the recipient’s wallet address and the amount of cryptocurrency to be sent. Wallets create and sign the transaction, broadcasting it to the respective blockchain network for confirmation and inclusion in the ledger.

- Transaction History: Wallets maintain a comprehensive record of all incoming and outgoing transactions, allowing users to track their transaction history. This transaction history provides transparency and enables users to monitor their balances and review past transactions for auditing purposes.

- Multiple Cryptocurrency Support: Many wallets support a wide range of cryptocurrencies, allowing users to manage multiple digital assets within a single platform. Wallets provide separate balances and addresses for each supported cryptocurrency, facilitating easy management and organization of a diverse portfolio.

- QR Code Integration: Wallets often integrate QR code functionality, simplifying the process of sending and receiving cryptocurrencies. Users can scan QR codes associated with wallet addresses, eliminating the need to manually enter lengthy cryptographic addresses, which reduces the potential for error.

- Backup and Recovery: To mitigate the risk of losing access to funds, cryptocurrency wallets offer backup and recovery options. Wallets typically provide users with a mnemonic phrase or seed that can be used to restore the wallet on another device. This ensures that even if a wallet is lost, stolen, or a device malfunctions, funds can be recovered.

- Compatibility with Different Platforms: Cryptocurrency wallets are designed to be compatible with various platforms and operating systems. They are available as software wallets for desktop computers, mobile wallets for smartphones, and even web-based wallets that can be accessed through a web browser. This versatility allows users to access and manage their digital assets conveniently.

- Security Features: Wallets implement different security features to protect funds. These features may include password encryption, two-factor authentication (2FA), biometric authentication, or other methods to prevent unauthorized access. Wallets prioritize the protection of private keys to ensure the safety and integrity of users’ digital assets.

It’s important for users to carefully select a cryptocurrency wallet that aligns with their security needs and offers the necessary functionality for their intended use. Factors to consider include security measures, user experience, multi-currency support, platform compatibility, and the reputation of the wallet provider.

In summary, cryptocurrency wallets provide functionalities such as secure storage, sending and receiving of cryptocurrencies, transaction history tracking, support for multiple digital assets, QR code integration, backup and recovery options, compatibility with different platforms, and various security features. Understanding and utilizing these functionalities enable users to effectively manage their digital assets in a secure and convenient manner.

Advantages and Disadvantages of Cryptocurrency Exchanges

Cryptocurrency exchanges provide a range of advantages and benefits when it comes to trading and interacting with digital currencies. However, it’s important to consider the potential drawbacks that come with using these platforms. Here are the advantages and disadvantages of cryptocurrency exchanges:

Advantages:

- Marketplace for Trading: Cryptocurrency exchanges offer a convenient platform for users to buy, sell, and trade a wide variety of digital currencies. They provide access to a global market, enabling users to engage in cryptocurrency transactions easily.

- Liquidity: Exchanges facilitate liquidity by bringing together a large number of buyers and sellers in one marketplace. High liquidity means that users can typically buy or sell their cryptocurrencies quickly and at competitive market prices.

- Wide Range of Trading Pairs: Exchanges provide numerous trading pairs, allowing users to exchange one cryptocurrency for another. This enables diversification of holdings and the flexibility to take advantage of price movements in different digital assets.

- Advanced Trading Features: Many exchanges offer advanced trading features such as margin trading, futures contracts, and options trading. These features allow users to leverage their positions, speculate on future price movements, and employ various trading strategies.

- Price Discovery: The continuous trading activity on exchanges contributes to price discovery for cryptocurrencies. Users can monitor price charts and analyze market trends to make informed trading decisions based on real-time data.

- Security Measures: Reputable cryptocurrency exchanges implement robust security measures to protect user funds. These can include encryption, two-factor authentication, cold storage of funds, and regular security audits. By choosing a reliable exchange, users can benefit from enhanced security features.

- Fiat-to-Crypto Conversion: Many exchanges support fiat-to-crypto trading, allowing users to convert traditional fiat currencies like USD or EUR into cryptocurrencies. This makes it easier for new users to enter the cryptocurrency market without relying solely on crypto-to-crypto exchanges.

Disadvantages:

- Security Risks: While exchanges implement security measures, they are not immune to security breaches and hacking attempts. Exchanges have been targeted in the past, and users’ funds have been compromised. It’s crucial for users to exercise caution and choose exchanges with strong security protocols in place.

- Regulatory Challenges: Cryptocurrency exchanges need to adhere to varying regulatory requirements in different jurisdictions. Compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations may limit privacy and require users to provide personal information for registration.

- Volatility and Market Manipulation: Cryptocurrency markets are known for their volatility and susceptibility to market manipulation. Price fluctuations can be substantial, and users may experience significant gains or losses in a short period. Traders should be aware of these risks before engaging in cryptocurrency trading.

- Limited Control over Funds: When using centralized exchanges, users typically deposit their funds into the exchange’s wallet and entrust their assets to a third party. This means that users do not have direct control over their funds. If an exchange experiences issues or goes offline, users may face difficulties accessing or withdrawing their funds.

- Dependence on Exchange Performance: Users’ trading experiences, including order execution and platform performance, depend on the reliability and efficiency of the exchange. Technical issues, server downtimes, or high trading volumes can impact user experience and the ability to execute trades in a timely manner.

- Limited Anonymity: While some exchanges offer anonymous trading options, many exchanges require users to register and provide personal information for compliance purposes. This can compromise user privacy and anonymity in cryptocurrency transactions.

Considering both the advantages and disadvantages is crucial for individuals partaking in cryptocurrency trading. Users should conduct thorough research, choose reputable exchanges, and take necessary precautions to protect their funds and personal information.

In summary, while cryptocurrency exchanges offer convenient trading platforms, liquidity, advanced features, and security measures, it’s important to be mindful of potential security risks, regulatory challenges, volatility, limited control over funds, dependence on exchange performance, and potential compromises to privacy and anonymity.

Advantages and Disadvantages of Cryptocurrency Wallets

Cryptocurrency wallets play a critical role in securely storing and managing digital assets. While they offer numerous benefits, it is important to be aware of the potential drawbacks associated with using cryptocurrency wallets. Here are the advantages and disadvantages of cryptocurrency wallets:

Advantages:

- Security: Cryptocurrency wallets provide a high level of security for digital assets. They use encryption and secure storage methods to protect private keys, ensuring that funds are safe from unauthorized access or online threats.

- Control and Ownership: With cryptocurrency wallets, users have complete control over their digital assets. They hold their private keys, enabling them to access, manage, and transfer funds at their discretion. This eliminates the need to rely on third-party custodians or intermediaries.

- Privacy: Cryptocurrency wallets prioritize user privacy. Transactions made through wallets typically only reveal the wallet addresses involved, providing a certain level of anonymity. Some wallets also offer the option of using Tor or other privacy-enhancing technologies to further protect user identities.

- Portability and Accessibility: Cryptocurrency wallets are designed to be portable and accessible, allowing users to manage their digital assets from various devices. Users can access their wallets through desktop applications, mobile apps, or web interfaces, providing flexibility and convenience.

- Different Wallet Types: Cryptocurrency wallets offer various options to suit different users’ needs. Software wallets come in different forms, including desktop, mobile, and online wallets, catering to diverse preferences. Hardware wallets provide an additional layer of security by keeping private keys offline, while paper wallets offer offline storage options.

- Compatibility with Multiple Cryptocurrencies: Most cryptocurrency wallets support a wide range of digital currencies, allowing users to hold and manage various cryptocurrencies within a single wallet. This simplifies the process of managing a diversified portfolio.

- Backup and Recovery Options: Wallets often provide backup and recovery mechanisms, such as mnemonic phrases or seed words. This allows users to restore their wallets on new devices or recover access to their funds in case of hardware failures or loss.

Disadvantages:

- Security Risks: While wallets prioritize security, they can still be vulnerable to hacking, malware, or phishing attacks. Users must implement strong security measures, keep their software up to date, and be cautious of potential threats or malicious actors.

- Loss of Access: If users forget their wallet passwords, lose their backup phrases, or experience hardware failures without proper backup, they may permanently lose access to their funds. The responsibility lies with users to maintain the security and integrity of their wallet and backup information.

- Technical Complexity: Cryptocurrency wallets often require some level of technical understanding. Dealing with cryptographic addresses, transactions fees, and managing private keys may be challenging for new users who are unfamiliar with the concepts and processes involved.

- Irreversibility of Transactions: Cryptocurrency transactions made through wallets are typically irreversible. While this immutability offers security, it also means that users need to exercise caution and verify transaction details before finalizing them.

- Limited Customer Support: Wallet providers may have limited customer support capabilities, especially for open-source or community-developed wallets. Users may have to rely on online forums or community resources for assistance, which can be time-consuming and less reliable.

- Dependency on Internet Connection: Most cryptocurrency wallets require an internet connection to access and manage funds. In the absence of an internet connection, users may not be able to make transactions or access their wallet information, which can be a limitation for some users.

Considering both the advantages and disadvantages of cryptocurrency wallets is crucial for users to make informed choices about secure storage and management of their digital assets. Users should carefully research and choose wallets that align with their security needs, technical capabilities, and preferences for accessibility and control.

In summary, while offering security, control, privacy, portability, and compatibility with various cryptocurrencies, cryptocurrency wallets can also present potential risks such as security vulnerabilities, loss of access, technical complexities, irreversibility of transactions, limited customer support, and dependency on internet connectivity.

Conclusion

Cryptocurrency exchanges and wallets are indispensable components of the cryptocurrency ecosystem, each serving distinct but interconnected purposes. Understanding the differences between exchanges and wallets is crucial for individuals looking to engage with cryptocurrencies effectively and safely.

Cryptocurrency exchanges provide a platform for users to buy, sell, and trade digital currencies. They offer a marketplace with advanced trading features, liquidity, and a wide range of trading pairs. However, users should be mindful of potential security risks, regulatory challenges, and the reliance on exchange performance.

Cryptocurrency wallets, on the other hand, enable users to securely store and manage their digital assets. They offer control, ownership, and privacy, allowing users to send and receive cryptocurrencies with ease. However, users must also consider security risks, the need for backup and recovery options, and the responsibility to safeguard private keys.

To navigate the cryptocurrency space effectively, users should prioritize security by choosing reputable exchanges and wallets, implementing strong security measures, and staying informed about best practices. It is also essential to consider individual needs, such as trading preferences, accessibility, ease of use, and desired levels of control and privacy.

Ultimately, the successful integration of exchanges and wallets ensures seamless interaction with cryptocurrencies, empowering users to take advantage of the unique opportunities and potential offered by digital assets. By considering the advantages and disadvantages of exchanges and wallets, individuals can make informed decisions to enhance their participation in the ever-evolving world of cryptocurrencies.