Finance

What Is Capital Surplus On The Balance Sheet

Modified: December 30, 2023

Discover what capital surplus means on a balance sheet and its significance in finance. Gain insights into how this term affects financial statements and company operations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance, understanding the intricacies of a company’s balance sheet is crucial. One important component that plays a significant role in analyzing a company’s financial health is capital surplus. Capital surplus refers to the amount of funds that a company raises through stock issuances, stock buybacks, or revaluation of assets, exceeding the par value of the stock. This surplus represents a source of additional capital for the company, allowing it to pursue growth opportunities, invest in new projects, or strengthen its financial position.

Capital surplus is an essential concept for investors, analysts, and financial professionals, as it provides insights into a company’s ability to generate and manage its capital. By understanding how capital surplus is generated and how it is utilized, stakeholders can better evaluate a company’s financial strength, growth prospects, and potential risks.

In this article, we will delve deeper into the meaning of capital surplus, explore the components that contribute to its creation, and examine its significance in financial analysis. By the end, you will have a clearer understanding of the role capital surplus plays on a company’s balance sheet and its implications for investors.

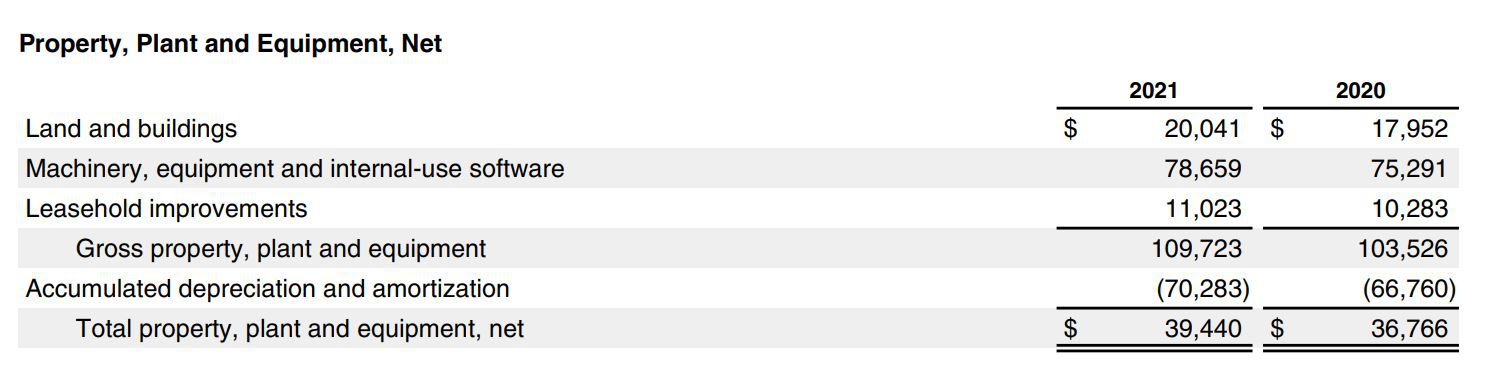

Definition of Capital Surplus

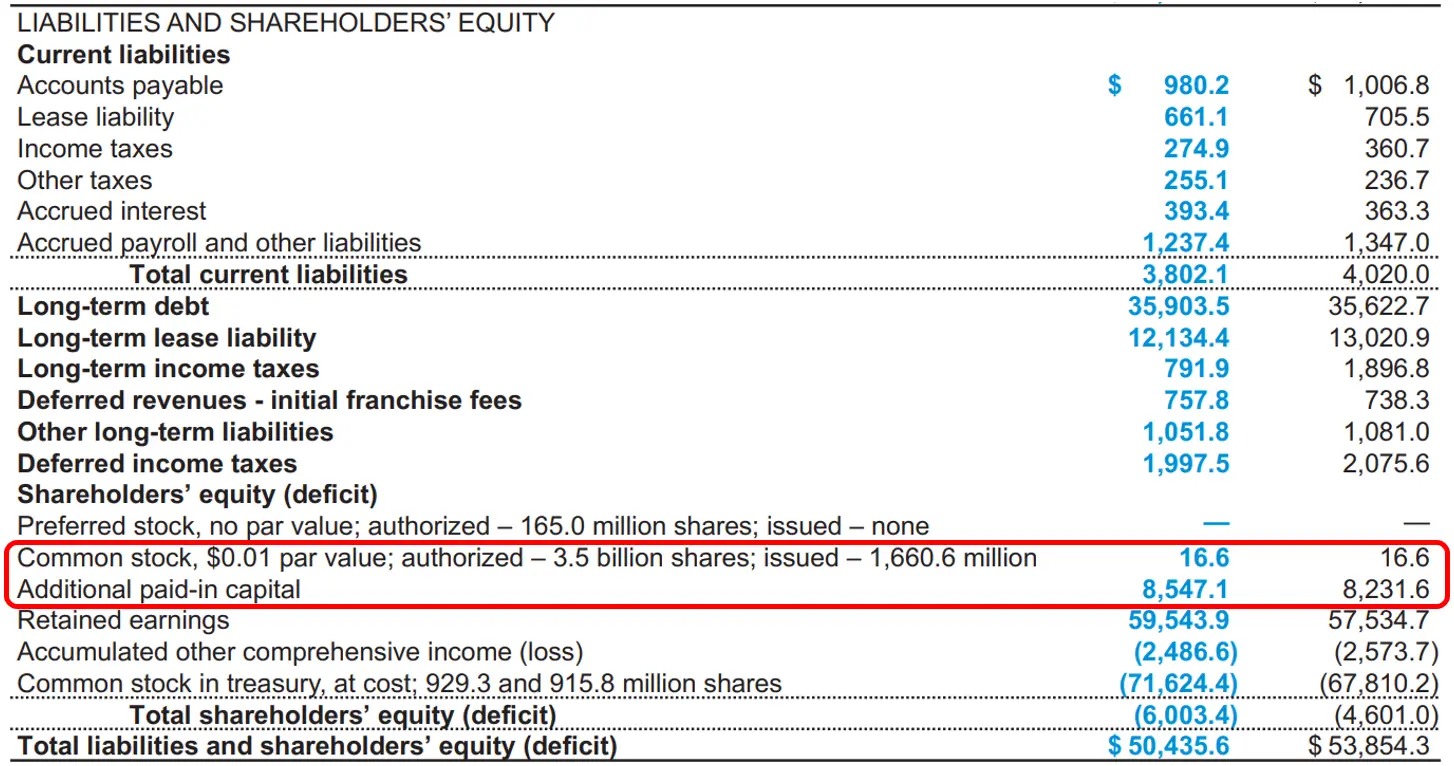

Capital surplus, also known as additional paid-in capital, is the amount of funds that a company raises through stock issuances or revaluation of assets, beyond the par value of the stock. Par value refers to the nominal or face value assigned to each share of stock when it is first issued. When investors purchase shares of stock, they typically pay an amount that exceeds the par value, and this difference is considered as capital surplus.

Capital surplus represents the equity capital that exceeds the nominal value of a company’s shares and is recorded in the shareholders’ equity section on the balance sheet. It reflects the additional contribution made by shareholders, which can be utilized by the company to support its growth initiatives, strengthen its financial position, or meet future obligations.

The capital surplus figure is calculated by subtracting the par value of the stock from the total amount of funds raised through stock issuances or revaluation of assets. It is important to note that while the par value remains constant over time, the capital surplus can fluctuate based on various factors, such as stock buybacks, dividend payments, or changes in the market value of assets.

Capital surplus is considered a part of shareholders’ equity and plays a crucial role in assessing a company’s financial position. It represents the shareholders’ initial investment, as well as any additional contributions made by them. This surplus acts as a buffer that provides flexibility and financial stability to the company, allowing it to pursue growth opportunities, invest in research and development, or navigate through challenging economic conditions.

Components of Capital Surplus

The capital surplus on a company’s balance sheet is composed of various components that contribute to its overall value. These components include:

- Stock Issuances: When a company issues new shares of stock, the amount received from investors that exceeds the par value is considered as additional paid-in capital or capital surplus. This component represents the equity capital contributed by shareholders during the initial public offering (IPO) or subsequent stock offerings.

- Stock Buybacks: Sometimes, companies repurchase their own shares from the market. The excess amount paid over the par value in these buyback transactions is considered as capital surplus. Share buybacks can be a strategic move to indicate confidence in the company’s performance or to reduce the number of outstanding shares, leading to an increase in earnings per share.

- Dividend Payments: When a company pays dividends to its shareholders, the amount distributed is typically sourced from the company’s profits. However, if the dividends paid exceed the company’s accumulated profits, the excess is considered as capital surplus. Dividend payments in excess of accumulated profits are usually funded from other sources, such as retained earnings or capital reserves.

- Revaluation of Assets: At times, companies may revalue their assets, such as property, plant, and equipment, to reflect their fair market value. If the revalued amount exceeds the historical cost of the assets, the difference is recorded as a capital surplus. This component captures the increase in the value of the company’s assets, which enhances its overall net worth.

These components of capital surplus can vary significantly based on a company’s financial activities and market conditions. They represent the inflow of additional capital into the company, allowing it to bolster its financial position, expand its operations, or make strategic investments.

Issuance of Stock

The issuance of stock is one of the primary ways in which companies raise capital. When a company decides to go public or issue additional shares, it offers these shares to investors in exchange for capital. The price at which the shares are sold is determined by the market demand and the company’s perceived value.

When investors purchase shares of stock, they typically pay an amount that exceeds the par value, which results in the creation of capital surplus. The par value represents the nominal or face value assigned to each share of stock and is usually set at a low amount, such as $0.01 per share. The difference between the selling price and the par value is considered as additional paid-in capital or capital surplus.

The issuance of stock allows companies to raise funds for various purposes, such as financing growth initiatives, expanding operations, acquiring other companies, or strengthening the company’s balance sheet. The capital surplus generated from stock issuances provides the company with additional financial flexibility and resources to pursue these objectives.

It’s important to note that the capital surplus from stock issuances can vary depending on the demand for the company’s shares and the price set for the offering. If there is high demand and investors are willing to pay a premium for the company’s stock, it can result in a larger capital surplus. Conversely, if the demand is low or the stock price is set conservatively, the capital surplus may be relatively smaller.

Issuing stock is considered a significant milestone for a company, as it opens up opportunities for growth and expansion. It allows the company to tap into the capital market and attract investors who believe in the company’s potential. The capital surplus generated from stock issuances serves as a testament to the confidence investors have in the company’s prospects and its ability to create value over time.

Stock Buybacks

Stock buybacks, also known as share repurchases, occur when a company purchases its own shares from the market. This is done either through open market transactions or by conducting a tender offer to shareholders. Stock buybacks can be a strategic financial move undertaken by companies to manage their capital structure and allocate excess cash.

When a company buys back its own shares, it reduces the number of outstanding shares in the market. This has several implications, one of which is an increase in the ownership stake of existing shareholders. With fewer shares available, each remaining share represents a larger ownership percentage in the company.

From a capital surplus perspective, the excess amount paid by the company to repurchase its shares over the par value is considered as additional paid-in capital or capital surplus. This surplus can accrue over time as the company conducts multiple stock buyback programs.

Stock buybacks have several potential benefits for a company. Firstly, they can signal to the market that the company’s management believes its shares are undervalued, leading to increased investor confidence. Additionally, by reducing the number of shares outstanding, stock buybacks can lead to an increase in earnings per share, which may attract more investment from shareholders.

Moreover, stock buybacks offer a tax-efficient way for companies to return capital to shareholders. Instead of paying dividends, which can be subject to higher tax rates for certain investors, buybacks allow shareholders who choose to sell their shares to potentially benefit from the capital gains tax rate.

Despite the potential benefits, there is ongoing debate around the efficacy of stock buybacks. Critics argue that sometimes companies prioritize buybacks over other investments, such as research and development or employee initiatives, which may hinder long-term growth. Additionally, poorly timed or excessive buybacks can deplete a company’s cash reserves and increase its debt-to-equity ratio.

Overall, stock buybacks can impact a company’s capital surplus by reducing the number of outstanding shares and potentially leading to an increase in excess paid-in capital. However, it is essential for companies to carefully evaluate the potential benefits and risks associated with stock buybacks to ensure they align with the company’s long-term strategic objectives and financial stability.

Dividend Payments

Dividend payments are one of the ways in which companies distribute a portion of their profits to shareholders as a return on their investment. Dividends are typically declared and paid out on a regular basis, such as quarterly or annually, and are based on a predetermined dividend per share or as a percentage of the stock’s market price.

When a company pays dividends to its shareholders, the amount paid is usually allocated from the company’s accumulated profits. However, in some cases, dividends paid can exceed the accumulated profits. In such situations, the excess amount is considered as additional paid-in capital or capital surplus.

The capital surplus resulting from dividend payments represents the portion of dividends that is in excess of the company’s accumulated profits. This surplus is recorded in the shareholders’ equity section of the balance sheet, reflecting the additional capital invested by shareholders in the company.

It’s important to note that dividend payments in excess of accumulated profits are typically funded from other sources, such as retained earnings or capital reserves. Retained earnings are the portion of a company’s profits that have not been distributed as dividends or utilized for other purposes, while capital reserves are funds set aside for specific purposes, such as for investment in new ventures or acquisitions.

Dividend payments are a way for companies to reward shareholders for their investment and provide them with a tangible return. By sharing profits with shareholders, companies aim to attract and retain investors who value a consistent income stream. Dividends can be particularly attractive for income-oriented investors, such as retirees or those seeking regular cash flow from their investments.

Importantly, the decision to pay dividends is at the discretion of a company’s board of directors. This decision is based on various factors, including the company’s financial performance, cash flow position, future growth prospects, and capital allocation strategy. Companies may choose to increase, decrease, or suspend dividend payments based on their assessment of these factors.

Dividend payments can have an impact on a company’s capital surplus, especially when dividends exceed the company’s accumulated profits. The excess amount is considered as additional paid-in capital, thereby increasing the capital surplus. This surplus represents the additional equity capital invested by shareholders and contributes to the company’s overall financial strength and stability.

Revaluation of Assets

Revaluation of assets refers to the process of assessing and adjusting the recorded value of a company’s assets to reflect their current fair market value. This reassessment is done periodically to ensure that the asset values presented on the balance sheet are reflective of their true worth. The revaluation of assets can impact a company’s capital surplus, as it captures any increase in the value of the assets.

When assets are revalued, such as property, plant, and equipment, the increase in their value is recorded as a capital surplus. This surplus represents the additional equity capital that is created as a result of the revaluation and is recorded in the shareholders’ equity section of the balance sheet.

Revaluation of assets can occur due to various reasons, including changes in market conditions, improvements made to the assets, or new information that affects their valuation. For example, if the real estate market experiences a significant increase in property values, a company may choose to revalue its real estate assets to reflect the higher market prices.

It’s important to note that the revaluation of assets can also result in a decrease in their value. In such cases, the decrease is typically recorded as an impairment, rather than a reduction in capital surplus. Impairments represent a decline in the value of an asset, often due to factors such as obsolescence, damage, or changes in market demand.

The revaluation of assets can have several implications for a company. Firstly, it can enhance the company’s net worth by increasing the value of its assets and, in turn, its shareholders’ equity. This can improve the company’s financial standing and provide a stronger foundation for future growth and investment opportunities.

Additionally, the revaluation of assets can impact financial ratios, such as the debt-to-equity ratio. As the value of the assets increases, the equity portion of the ratio increases, potentially improving the company’s creditworthiness and ability to secure financing on favorable terms.

However, it’s important to exercise caution when revaluing assets, as it can also have potential drawbacks. Revaluation can lead to higher property taxes or depreciation expenses, impacting the company’s profitability. Moreover, excessive or frequent revaluations can create volatility in financial statements and make it challenging for stakeholders to assess the true performance of the company.

Overall, the revaluation of assets provides companies with the opportunity to reflect the true market value of their assets on the balance sheet. The resulting capital surplus represents the additional equity capital created as a result of the revaluation and contributes to the overall financial position and strength of the company.

Accounting Treatment of Capital Surplus

The accounting treatment of capital surplus depends on the financial reporting framework followed by a company, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). However, there are some general principles that guide the accounting treatment of capital surplus.

Under both GAAP and IFRS, capital surplus is recorded as part of shareholders’ equity on the balance sheet. It represents the additional equity capital contributed by shareholders, beyond the par value of the stock. This surplus is commonly classified as an item within the equity section, specifically as “additional paid-in capital.”

Capital surplus is typically disclosed separately from other components of equity, such as retained earnings or other comprehensive income. This transparency allows stakeholders to understand the historical contributions made by shareholders and the availability of additional capital that can be utilized for future growth or other corporate purposes.

Any changes in capital surplus, such as an increase from stock issuances or a decrease from stock buybacks, are recorded in the equity section of the balance sheet. The specific accounting entries may vary based on the type of transaction and the reporting requirements of the applicable financial framework.

When it comes to dividend payments, any excess dividends paid beyond the accumulated profits are typically charged against retained earnings rather than capital surplus. This is because retained earnings represent the cumulative profits of the company that have not been distributed to shareholders in the form of dividends.

The revaluation of assets, which can result in an increase in capital surplus, is recorded by adjusting the values of the assets on the balance sheet. The increase in the asset value is offset by an increase in the capital surplus account, reflecting the additional equity capital created by the revaluation.

It is important for companies to accurately record and disclose capital surplus in their financial statements to provide transparency and comply with the applicable accounting standards. This allows stakeholders, such as investors, lenders, and regulators, to assess the company’s financial performance and its ability to utilize the surplus for future growth and value creation.

It is worth noting that accounting regulations and standards may evolve over time. Therefore, it is always important for companies to stay updated with the latest accounting requirements and seek professional guidance to ensure accurate and compliant reporting of capital surplus.

Importance of Capital Surplus

Capital surplus plays a pivotal role in assessing a company’s financial health and prospects. It represents the excess capital raised by a company through stock issuances, stock buybacks, or revaluation of assets, beyond the par value of the stock. The presence of capital surplus is significant for several reasons:

1. Financial Flexibility: Capital surplus provides a company with financial flexibility, allowing it to pursue growth opportunities, invest in research and development, or make strategic acquisitions. This surplus acts as a cushion and a source of additional capital that the company can utilize to further its expansion plans or navigate through challenging economic conditions.

2. Increased Shareholders’ Equity: Capital surplus enhances shareholders’ equity, increasing their ownership stake in the company. This can potentially lead to higher valuations and investor confidence as shareholders perceive the company to be financially strong and capable of generating long-term value.

3. Strengthens the Balance Sheet: A healthy capital surplus strengthens a company’s balance sheet by increasing its overall net worth. This can improve the company’s ability to obtain favorable financing terms, attract investors, and withstand economic downturns more effectively.

4. Signals Confidence to Investors: Capital surplus generated through stock buybacks can signal to the market that the company’s management believes its shares are undervalued. This can enhance investor confidence and attract new investors who see the company’s commitment to creating value for shareholders.

5. Supports Dividend Payments: Capital surplus can provide a stable source of funds to support dividend payments. Companies that consistently generate a surplus can distribute a portion of it as dividends to reward shareholders for their investment, potentially attracting income-oriented investors.

6. Encourages Future Investment: Capital surplus can be used to fund future investments and strategic initiatives. It provides the company with the resources to explore new markets, develop new products, or invest in research and development, helping to fuel future growth and profitability.

Overall, capital surplus is an important financial metric that showcases a company’s ability to generate and manage its capital effectively. It provides insight into a company’s financial flexibility, strength, and potential for future growth. Investors, analysts, and stakeholders consider capital surplus as a key indicator of a company’s financial health and its ability to create value for shareholders over the long term.

Conclusion

Capital surplus is a critical component of a company’s balance sheet that represents the excess capital raised through stock issuances, stock buybacks, or revaluation of assets. This surplus provides the company with additional financial flexibility, strengthens its balance sheet, and signals confidence to investors.

Understanding the components and accounting treatment of capital surplus is essential for investors, analysts, and financial professionals. Stock issuances, stock buybacks, dividend payments, and revaluation of assets are the key drivers that contribute to the creation and fluctuations of capital surplus.

Capital surplus plays a vital role in supporting a company’s growth initiatives, strategic investments, and financial stability. It increases shareholders’ equity, enhances the net worth of the company, and strengthens its creditworthiness. Additionally, capital surplus supports dividend payments, serves as a buffer during economic downturns, and attracts investor confidence in the company’s long-term prospects.

However, it is important for companies to exercise caution when managing capital surplus. While it represents additional capital, companies must strike a balance between using the surplus to drive growth and maintaining appropriate levels of cash reserves or retained earnings for financial stability.

In conclusion, capital surplus is a valuable asset for companies that have successfully raised additional capital, either through stock issuances, stock buybacks, or revaluation of assets. It contributes to a company’s financial strength, flexibility, and growth potential. Understanding capital surplus is crucial for stakeholders to evaluate a company’s financial health and make informed investment decisions.