Finance

What Is O&P On Insurance Estimate

Published: November 21, 2023

Learn about O&P on insurance estimates in the world of finance. Understand what it means and how it affects your insurance claims.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

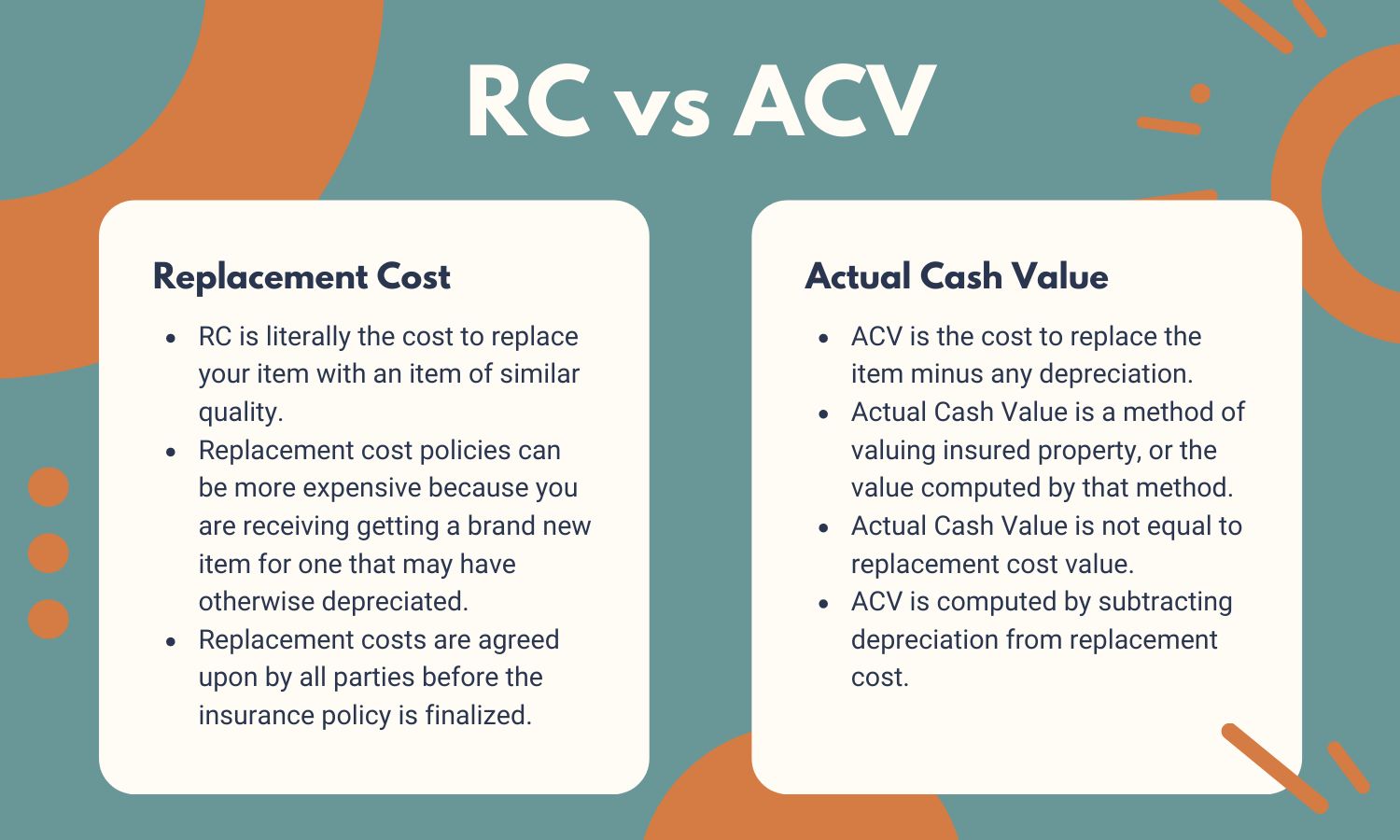

When it comes to insurance estimates, you may have come across the term “O&P” or “Overhead and Profit.” But what exactly does it mean? O&P refers to the additional costs that are factored into an insurance claim estimate, covering the overhead expenses and profit margin for contractors and service providers. Whether you’re dealing with a home insurance claim, a car insurance claim, or any other type of insurance, understanding O&P is crucial.

Insurance estimates are essential in determining the costs involved in repairing or replacing damaged property. They provide a breakdown of the materials, labor, and other expenses required to restore the insured property to its pre-loss condition. O&P represents the added costs that go beyond the direct expenses, compensating contractors for their expertise and profitability. It is important to grasp the significance of O&P and how it affects insurance claims.

Throughout this article, we will explore the ins and outs of O&P on insurance estimates. We will delve into the calculation methods, discuss the importance of O&P, address common misconceptions, and provide key considerations for insurance claimants. By the end, you will have a comprehensive understanding of O&P and its impact on your insurance claim.

Understanding O&P on Insurance Estimates

O&P, or Overhead and Profit, is a crucial component of insurance estimates. It represents the additional costs that cover the overhead expenses and profit margin for contractors and service providers involved in the restoration or repair of damaged property. Let’s break down these two elements to get a clearer understanding.

Overhead refers to the indirect costs incurred during the completion of a project. This includes expenses such as office rent, utilities, insurance, equipment, and other administrative costs associated with running a contracting or service-based business. Overhead costs are essential for contractors to maintain their operations and ensure the successful completion of projects.

Profit is the amount earned by contractors as compensation for their expertise, skills, and risk-taking involved in performing the required repairs or restoration. It serves as a reward for their work and also allows businesses to grow and invest in improving their services. Profit margins can vary depending on factors such as the complexity of the project, market conditions, and competition.

When insurance adjusters prepare estimates, they typically include O&P as a separate line item. This ensures that contractors are adequately compensated for their overhead costs and have room to generate a reasonable profit. It is worth noting that some insurance policies may have specific guidelines or limits on the amount of O&P that can be included in an estimate.

O&P is generally calculated as a percentage of the direct repair costs. The specific percentage can vary depending on various factors, including the size and complexity of the project, the type of property, and the prevailing market rates. It is important to note that the percentage for O&P is negotiated or determined by agreement between the insurance company and the contractor or service provider.

Now that we have a better understanding of O&P on insurance estimates, let’s explore why it is important in the insurance claims process.

Importance of O&P on Insurance Estimates

The inclusion of O&P on insurance estimates is vital for several reasons. It ensures that contractors and service providers are adequately compensated for their overhead expenses and have the opportunity to earn a fair profit. Let’s explore the importance of O&P in more detail:

1. Fair Compensation: O&P allows contractors to cover their indirect costs, such as administrative expenses and overhead, which are necessary for the successful completion of a project. It ensures that contractors are fairly compensated for their expertise, time, and resources involved in restoring or repairing damaged property.

2. Quality of Work: A fair profit margin incentivizes contractors to deliver high-quality workmanship and utilize quality materials. It encourages them to invest in skilled labor, training, and equipment to ensure that the repairs or restoration meet or exceed industry standards.

3. Timely Completion: Adequate compensation through O&P enables contractors to complete the project within the expected timeframe. It helps cover the costs of managing the project, coordinating various trades, and addressing any unforeseen challenges that may arise during the restoration process.

4. Contractor Selection: By including O&P on insurance estimates, insurance companies can attract a wider range of experienced and reputable contractors. Contractors who have the opportunity to earn a fair profit are more likely to accept insurance projects, ensuring that policyholders have access to qualified professionals who can efficiently restore their property.

5. Market Rates: O&P on insurance estimates reflects the prevailing market rates for contractors and service providers. It ensures that the estimate accurately accounts for the costs associated with hiring skilled professionals and avoids pricing that may be unrealistically low or high, which can lead to potential issues during the claims process.

It is important for policyholders to understand the importance of O&P and advocate for its inclusion in insurance estimates. By recognizing its significance, policyholders can ensure that they receive fair compensation and have their damaged property properly restored.

Next, let’s explore how O&P is calculated in insurance estimates.

How O&P is Calculated

The calculation of O&P, or Overhead and Profit, on insurance estimates involves determining the percentage of the direct repair costs that will be allocated to cover these additional expenses. While the specific method of calculation may vary between insurance companies and contractors, there are some key considerations to keep in mind.

The percentage used for O&P calculation is typically negotiated or agreed upon between the insurance company and the contractor or service provider. This negotiation may take into account factors such as the complexity of the project, the type of property being repaired or restored, and the prevailing market rates for contractors in the area.

It is common for insurance companies to consider industry standards when determining the appropriate percentage for O&P. These standards may vary, but a typical range for O&P is around 10% to 20% of the direct repair costs. However, it is important to note that this percentage can be adjusted based on the specific circumstances of each claim.

Once the percentage for O&P is agreed upon, it is applied to the direct repair costs outlined in the insurance estimate. For example, if the direct repair costs are estimated to be $10,000, and the agreed-upon percentage for O&P is 15%, the O&P amount would be $1,500 ($10,000 x 0.15).

It is important to understand that O&P is separate from the direct repair costs. The inclusion of O&P as a line item on the estimate ensures transparency and clearly distinguishes between the direct expenses and the additional costs associated with overhead and profit.

Insurance companies may have specific guidelines or limits on the amount of O&P that can be included in an estimate. These guidelines may be influenced by internal policies, industry standards, or state regulations. It is important for policyholders to review their insurance policy and consult with their insurance adjuster or contractor to understand any limitations or requirements related to O&P.

The calculation of O&P on insurance estimates is a collaborative process between the insurance company and the contractor or service provider. It aims to ensure that contractors are fairly compensated for their overhead expenses and profitability, while policyholders receive accurate and transparent estimates for the repair or restoration of their damaged property.

Now that we have explored the calculation of O&P, let’s address some common misunderstandings that people may have about O&P on insurance estimates.

Common Misunderstandings about O&P on Insurance Estimates

When it comes to O&P on insurance estimates, there are several common misunderstandings that policyholders may have. These misconceptions can lead to confusion and frustration during the claims process. Let’s address some of these misunderstandings:

1. O&P is an unnecessary additional cost: Some policyholders may perceive O&P as an unnecessary expense and question its inclusion in the insurance estimate. However, it is important to understand that O&P covers the contractor’s overhead and profit, which are essential for a successful and quality repair or restoration. Without adequate compensation for these costs, contractors may cut corners or be unable to complete the project to the desired standard.

2. O&P is solely for the benefit of the contractor: Another common misunderstanding is that O&P only benefits the contractor or service provider. While contractors do earn a profit, O&P also ensures that policyholders receive high-quality workmanship, timely completion, and access to experienced professionals. O&P is crucial for attracting reputable contractors and maintaining industry standards.

3. O&P is a fixed percentage for all claims: Some may assume that the percentage for O&P is fixed across all insurance claims. However, the percentage is typically negotiated or agreed upon based on various factors, such as the complexity of the project and prevailing market rates. The percentage for O&P can vary between insurance companies and even between different claims within the same company.

4. O&P is automatically included in every insurance claim: O&P is not automatically included in every insurance estimate. Its inclusion is often subject to policy terms, guidelines, and specific negotiations between the insurance company and the contractor or service provider. It is important for policyholders to review their policy and discuss O&P with their insurance adjuster to understand how it applies to their claim.

5. O&P is an opportunity for excessive charges: There is a misconception that contractors may take advantage of O&P to inflate the costs of a project. However, insurance companies have guidelines and oversight to ensure that O&P is reasonable and aligned with industry standards. Policyholders can also obtain multiple estimates and review the breakdown of costs to ensure transparency and fair pricing.

By addressing these common misunderstandings, policyholders can have a clearer understanding of the purpose and importance of O&P on insurance estimates. It is important to communicate openly and seek clarification from insurance adjusters and contractors to ensure a smooth claims process and fair compensation.

Now, let’s explore some key considerations for policyholders when dealing with O&P on insurance estimates.

Key Considerations for O&P on Insurance Estimates

When dealing with O&P (Overhead and Profit) on insurance estimates, policyholders should keep several key considerations in mind. These considerations will help navigate the claims process and ensure fair compensation. Let’s explore them:

1. Review your insurance policy: Familiarize yourself with the terms and conditions of your insurance policy. Look for any specific guidelines or limitations related to O&P. Understanding your policy will help you advocate for your rights and ensure that you receive the appropriate compensation.

2. Discuss O&P with your insurance adjuster: Engage in open and clear communication with your insurance adjuster. Seek clarification on how O&P is calculated and what factors are taken into consideration. Ask for transparency in the estimate breakdown and inquire about any negotiation or agreement with the contractor regarding the O&P percentage.

3. Obtain multiple estimates: When dealing with larger claims, it is advisable to obtain multiple estimates from different contractors. This will allow you to compare the breakdown of costs, including O&P, and ensure that they are reasonable and aligned with industry standards. Be cautious of estimates with substantially lower or higher O&P percentages.

4. Consider the expertise and reputation of contractors: Look for experienced and reputable contractors who have a track record of delivering quality work. Quality craftsmanship and timely completion are essential for a successful restoration. A fair profit margin through O&P attracts skilled professionals and ensures that your property is restored to its pre-loss condition.

5. Be aware of cost-cutting measures: Insufficient O&P can result in cost-cutting measures by contractors, which may compromise the quality of the repair or restoration. Discuss with your insurance adjuster the potential consequences of reducing or excluding O&P from the estimate, as it may affect the long-term durability and value of the repairs.

6. Engage in the negotiation process: If you have concerns or questions about the O&P percentage in the estimate, discuss them with your insurance adjuster. Negotiation is often possible, especially if you have obtained multiple estimates or can provide evidence of prevailing market rates. Advocate for fair compensation that covers the necessary overhead expenses and allows for a reasonable profit margin.

7. Seek professional advice: If you’re uncertain about the claims process or feel that your rights are not being adequately addressed, consider seeking professional advice from a public adjuster or an attorney who specializes in insurance claims. They can provide guidance and advocate for your best interests during the negotiation and settlement phases.

By considering these important factors, policyholders can make informed decisions and ensure that O&P is calculated and included appropriately in their insurance estimates. It is important to advocate for fair compensation and the successful restoration of your damaged property.

Now, let’s wrap up our discussion.

Conclusion

Understanding O&P (Overhead and Profit) on insurance estimates is crucial for policyholders navigating the claims process. O&P represents the additional costs that cover contractors’ overhead expenses and profit margins. It ensures fair compensation for contractors and allows policyholders to have their damaged property properly repaired or restored.

Throughout this article, we have covered various aspects of O&P on insurance estimates. We discussed the definition of O&P and its importance in ensuring fair compensation and maintaining industry standards. We also explored how O&P is calculated, addressing common misconceptions that policyholders may have. It is important to communicate openly with insurance adjusters and seek transparency in the estimate breakdown.

Key considerations for policyholders when dealing with O&P include reviewing the insurance policy, obtaining multiple estimates, and considering the expertise and reputation of contractors. Engaging in the negotiation process and seeking professional advice, if necessary, can also be beneficial.

By understanding the significance of O&P and advocating for fair compensation, policyholders can ensure that their damaged property is properly restored, providing peace of mind and timely recovery from the loss.

Remember, O&P is not an unnecessary expense, but a crucial element that ensures quality workmanship, timely completion, and access to experienced professionals. By appreciating the importance of O&P on insurance estimates, policyholders can navigate the claims process with confidence and achieve a successful outcome.