Home>Finance>Diluted Normalized Earnings Per Share Definition

Finance

Diluted Normalized Earnings Per Share Definition

Published: November 11, 2023

Learn the definition of diluted normalized earnings per share in finance and understand its importance in financial analysis.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Diluted Normalized Earnings Per Share: A Complete Definition

Welcome to another informative blog post in our FINANCE category. Today, we will delve into the world of financial metrics and explore the concept of Diluted Normalized Earnings Per Share (EPS). If you have ever wondered what Diluted Normalized EPS is and why it is important, you’re in the right place. In this article, we will define Diluted Normalized EPS, discuss its significance in financial analysis, and provide real-world examples to help you grasp the concept. So, let’s get started!

Key Takeaways:

- Diluted Normalized EPS is a financial metric used to determine the profitability of a company by taking into account potential dilution from outstanding stock options, convertible securities, and other instruments.

- It is an essential measure for investors as it provides a more accurate representation of a company’s earnings potential, considering all possible scenarios.

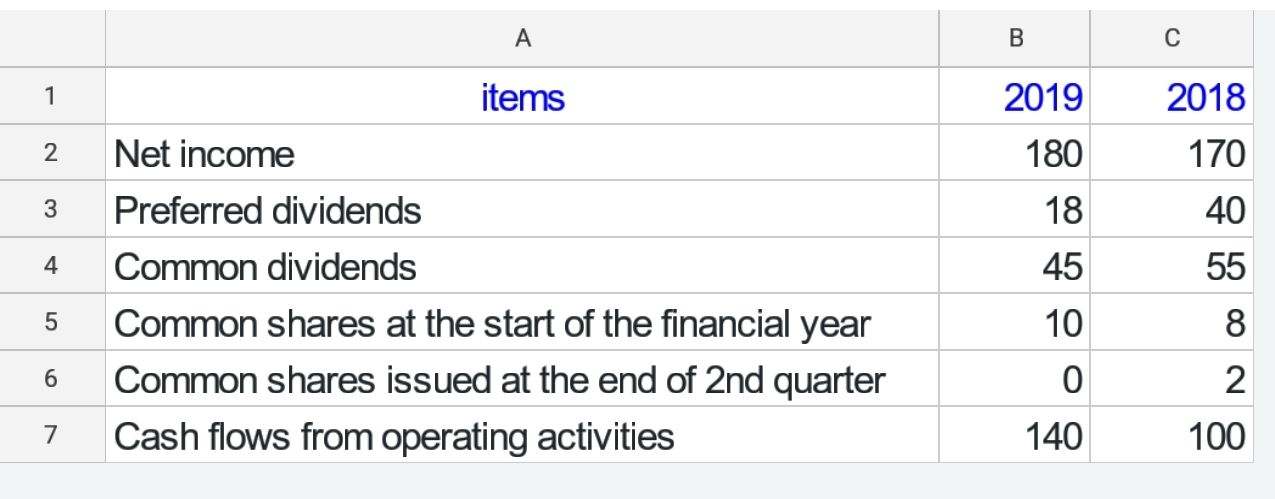

Before we dive into the specifics of Diluted Normalized EPS, let’s take a step back and understand the concept of Earnings Per Share (EPS) in general. EPS is a widely used financial metric that calculates the portion of a company’s profit allocated to each outstanding share of common stock. It gives investors an idea of how profitable a company is and helps in comparing the earnings between different companies.

Now, let’s add complexity and introduce the concept of “dilution.” Dilution occurs when a company issues additional shares, convertible securities, or stock options, potentially lowering the EPS. To account for this potential dilution and provide a clearer picture of a company’s earnings per share, we use Diluted Normalized EPS.

So what does “normalized” mean in Diluted Normalized EPS? Normalization refers to adjusting the financial figures to account for any unusual or non-recurring items that might distort the earnings calculation. By normalizing the earnings, we eliminate any temporary fluctuations and create a more accurate representation of a company’s underlying profitability.

A real-world example can illustrate the importance of Diluted Normalized EPS. Consider a publicly traded company that has shares outstanding, but also has outstanding stock options that could be exercised in the future. These stock options, when exercised, would increase the number of shares outstanding and potentially lower the EPS. By calculating Diluted Normalized EPS, investors can assess the potential impact of the exercise of stock options on the company’s profitability.

In conclusion, Diluted Normalized EPS is a crucial financial metric that provides a more accurate measure of a company’s earnings potential by considering the potential dilution created by outstanding stock options, convertible securities, and other instruments. By normalizing the earnings, investors can obtain a realistic view of a company’s profitability, free from any temporary fluctuations or non-recurring items. Now that you have a solid understanding of Diluted Normalized EPS, you can use this knowledge to make informed investment decisions.