Finance

Per-Share Basis Definition

Published: January 7, 2024

Learn what per-share basis means in finance and how it impacts financial calculations and investments. Expand your understanding of finance jargon.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Ins and Outs of Per-Share Basis

Welcome to our Finance blog category, where we aim to provide you with valuable insights and knowledge about various financial concepts. In today’s post, we will be shedding light on the topic of Per-Share Basis, a term often encountered in the realm of investments and finance. Have you ever wondered what this term truly means and how it can influence your investment decisions? Well, you’re in the right place. Let’s dive in!

Key Takeaways:

- Per-share basis refers to the allocation of financial figures on a per-share basis, providing a clearer understanding of an investment’s value.

- Understanding per-share basis is crucial for investors to make informed decisions and compare the value and performance of different investment options.

When it comes to investing, it’s important to analyze and compare different investment opportunities to make informed decisions. One common method used to evaluate investments is by looking at their per-share basis. But what exactly does per-share basis mean?

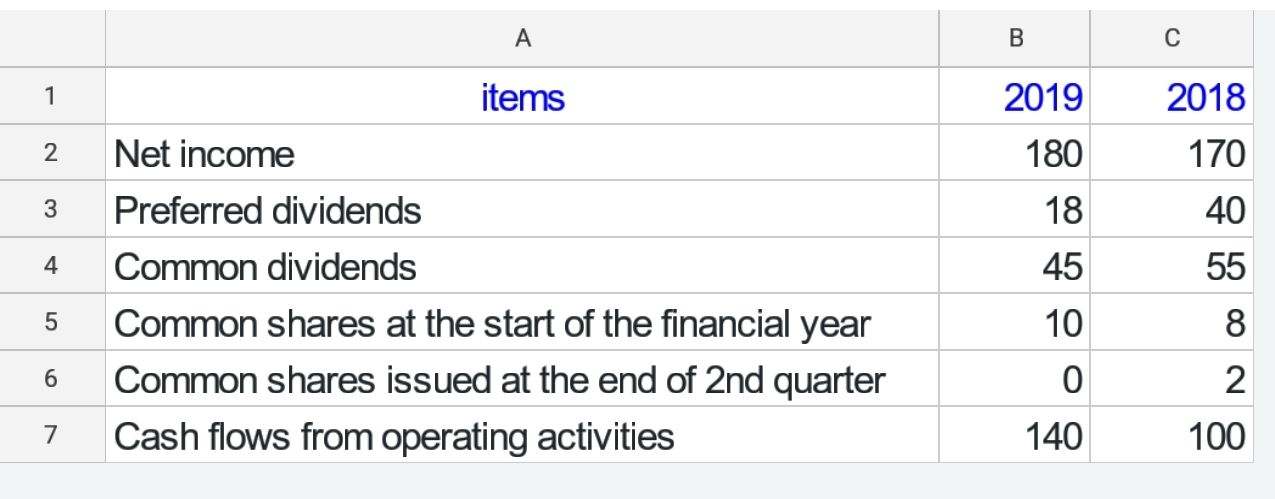

In simple terms, per-share basis is a way of expressing financial figures on a per-share basis. It allows investors to assess the value of an investment by dividing the financial figures by the number of outstanding shares. This approach provides a clear and easy-to-understand perspective on the financial standing and performance of a particular investment.

Now that we have a general understanding of per-share basis, let’s explore how it can be used and its significance in the world of finance. Here are a few key points to consider:

1. Comparing Investments:

When analyzing different investment options, per-share basis allows investors to compare the value and financial performance of various securities or assets. By looking at the per-share basis price or earnings, investors can assess which investments might provide better returns or have more favorable valuation metrics.

2. Gauging Ownership:

Per-share basis is not limited to evaluating investment opportunities. It also helps investors understand their ownership stakes in a company. By dividing the total equity value by the number of outstanding shares, investors can determine their proportional ownership in a business. This information is crucial for decision-making processes and understanding the potential impact of corporate actions on their investment.

To sum it up, per-share basis is a valuable concept in the world of finance that provides investors with a clear and insightful view of an investment’s value. By evaluating financial figures on a per-share basis, investors can compare investments, assess valuations, and better understand their ownership stakes in a company.

We hope this blog post provided you with a solid understanding of per-share basis and its significance. Remember to consider per-share basis when analyzing investments and making financial decisions. Stay tuned for more informative posts in our Finance category as we continue to explore diverse topics to empower your financial journey.