Finance

Primary Earnings Per Share (EPS) Definition

Published: January 11, 2024

Learn the definition of Primary Earnings Per Share (EPS) in finance and understand its significance in evaluating a company's profitability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Primary Earnings Per Share (EPS) Definition: A Key Metric in Finance

Finance is a vast field, with numerous metrics and indicators used to evaluate the performance of companies. One such metric that holds great importance for investors is Primary Earnings Per Share (EPS). But what exactly is Primary EPS, and why is it crucial in the world of finance? In this blog post, we will dive deeper into the definition of Primary EPS and explore why it matters.

Key Takeaways:

- Primary Earnings Per Share (EPS) is a metric used to determine a company’s profitability and its ability to generate returns for shareholders.

- Primary EPS excludes certain extraordinary items, providing a more accurate representation of a company’s ongoing operations.

The Definition of Primary Earnings Per Share (EPS)

Earnings Per Share (EPS) is a financial ratio that measures the portion of a company’s profit allocated to each outstanding share of common stock. It is a widely used metric to assess a company’s profitability and is often a key factor in determining stock prices. However, Primary EPS takes this calculation one step further by excluding certain extraordinary items that are not representative of a company’s ongoing operations.

Calculating Primary EPS

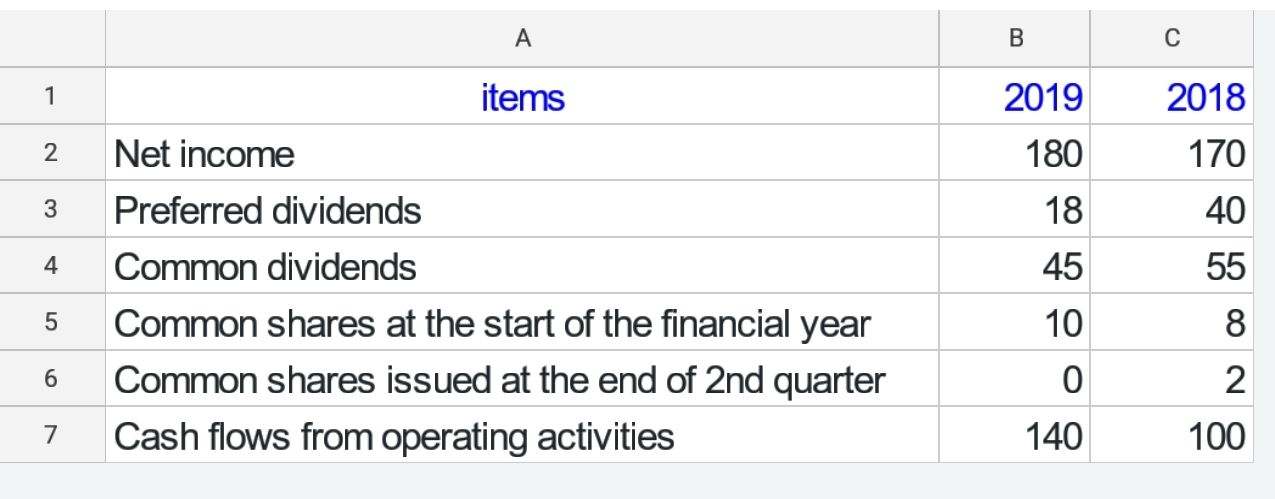

To calculate Primary EPS, you need to start with the basic EPS formula, which is:

EPS = (Net Income – Preferred Dividends) / Average Outstanding Shares

Next, you exclude any extraordinary items that may skew the company’s earnings. Extraordinary items could include one-time gains or losses, discontinued operations, or any other non-recurring events that significantly impact the company’s profitability. By eliminating these items, Primary EPS provides a clearer picture of a company’s core earnings.

Why Primary EPS Matters

Primary EPS is an important metric for investors for several reasons:

- Evaluating Financial Performance: By focusing on the company’s ongoing operations, Primary EPS allows investors to assess its true financial performance over a given period. This helps in making informed investment decisions.

- Comparing Companies: Primary EPS offers a useful tool for comparing the profitability of different companies within the same industry. It provides a standardized measure to evaluate performance and identify potential investment opportunities.

- Influencing Stock Prices: Investors often use Primary EPS as a key factor in determining the value and potential growth of a company. Positive Primary EPS growth is typically associated with higher stock prices, while negative or stagnant growth may lead to a decline in stock value.

In Conclusion

Primary Earnings Per Share (EPS) is a vital financial metric that helps investors evaluate a company’s profitability and make informed investment decisions. By excluding extraordinary items, Primary EPS provides a clearer representation of a company’s ongoing operations and core earnings. Understanding and analyzing Primary EPS can significantly enhance your understanding of a company’s financial health and its potential for future growth.