Home>Finance>Basic Earnings Per Share (EPS): Definition, Formula, Example

Finance

Basic Earnings Per Share (EPS): Definition, Formula, Example

Published: October 14, 2023

Learn the definition, formula, and example of Basic Earnings Per Share (EPS) in finance. Understand how EPS can indicate a company's profitability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Basic Earnings Per Share (EPS): Definition, Formula, Example

If you’ve ever wondered about the financial performance of a company, Basic Earnings Per Share (EPS) is a key metric that can provide valuable insights. Understanding EPS can help investors, analysts, and financial experts evaluate a company’s profitability and assess its potential for growth. In this article, we will explore the definition, formula, and provide an example of Basic Earnings Per Share.

Key Takeaways:

- Basic Earnings Per Share (EPS) is a financial metric used to measure a company’s profitability and performance.

- EPS is calculated by dividing a company’s net income by the weighted average number of common shares outstanding during a specific period.

What is Basic Earnings Per Share (EPS)?

Basic Earnings Per Share (EPS) is a financial ratio that provides the amount of net income attributable to each outstanding common share of a company. It allows investors to evaluate the profitability of their investment based on their ownership percentage. A higher EPS indicates that the company is generating more profit per share, which is generally viewed as positive and may attract more investors.

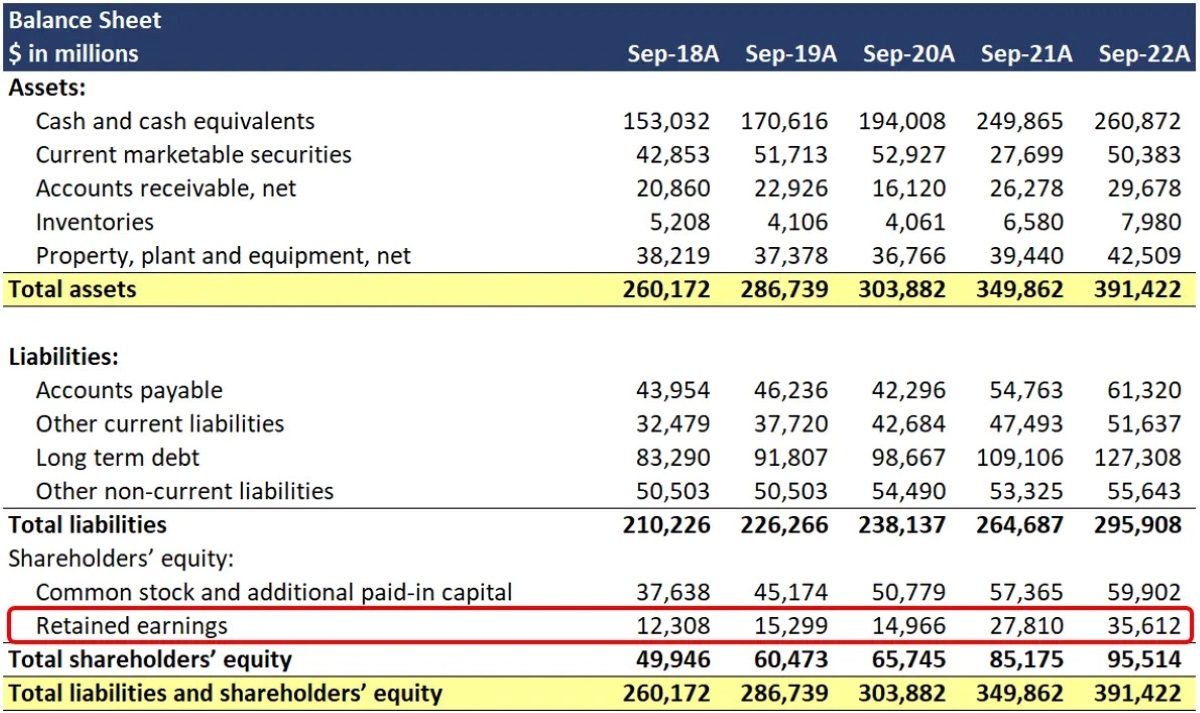

How is Basic Earnings Per Share (EPS) Calculated?

Calculating Basic Earnings Per Share involves dividing a company’s net income by the weighted average number of common shares outstanding during a specific period, typically a quarter or a year. The formula for Basic EPS is as follows:

Basic EPS = Net Income / Weighted Average Number of Common Shares Outstanding

The net income used in the formula is the company’s after-tax profit, which can be found in its income statement. The weighted average number of common shares outstanding represents the average number of shares outstanding during the period, taking into account any changes in the number of shares.

Example Calculation of Basic Earnings Per Share:

Let’s consider a hypothetical company named ABC Inc. for an example calculation of Basic Earnings Per Share.

- ABC Inc. reports a net income of $1,000,000 for the fiscal year.

- The weighted average number of common shares outstanding during the year is 500,000.

To calculate the Basic Earnings Per Share for ABC Inc., we divide the net income by the weighted average number of common shares outstanding:

Basic EPS = $1,000,000 / 500,000 = $2.00 per share

Therefore, ABC Inc. has a Basic Earnings Per Share of $2.00 per share.

Why is Basic Earnings Per Share (EPS) Important?

Basic Earnings Per Share is an important metric for investors, analysts, and financial experts as it provides insights into a company’s profitability and performance. By comparing EPS to previous periods or industry standards, stakeholders can gauge whether a company is growing, maintaining, or declining in profitability. It is crucial to consider other factors such as revenue growth, industry trends, and market conditions when interpreting EPS results to gain a comprehensive understanding of a company’s financial health.

In conclusion, Basic Earnings Per Share (EPS) is a key financial ratio that measures a company’s profitability by dividing its net income by the weighted average number of common shares outstanding. By understanding EPS and its calculation, investors can make informed decisions about their investments. As with any financial metric, EPS should be considered within the context of other relevant factors to gain a complete picture of a company’s financial performance.