Home>Finance>Downside Risk: Definition, Example, And How To Calculate

Finance

Downside Risk: Definition, Example, And How To Calculate

Published: November 14, 2023

Learn about downside risk in finance, including its definition, examples, and how to calculate it. Gain insights into managing potential losses and safeguarding your investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Downside Risk: Definition, Example, and How To Calculate

Welcome to our Finance category, where we dive into the world of financial concepts and strategies to help you make informed decisions and achieve your goals. In this article, we will explore downside risk – an important aspect of investing and risk management. We’ll define what downside risk is, provide an example, and even show you how to calculate it. So, let’s get started!

Key Takeaways:

- Downside risk refers to the potential loss or negative deviation from an expected return on an investment.

- Investors analyze downside risk to assess the potential downside of an investment and determine if it aligns with their risk tolerance.

What is Downside Risk?

Downside risk measures the potential loss or negative deviation from an expected return on an investment. It helps investors evaluate the potential downside of an investment and make informed decisions based on their risk tolerance. Understanding downside risk is crucial for managing portfolios and implementing risk management strategies.

Investments are inherently subject to fluctuations in value, and downside risk is essentially a way to quantify the potential loss an investor may face. By evaluating downside risk, investors can assess the likelihood of their portfolio or investment dropping below a certain threshold.

Example of Downside Risk

Let’s say you are considering investing in Company XYZ’s stock. Upon analyzing the stock’s historical data, you find that the stock has experienced significant price drops in the past. Its worst-performing year saw a decline of 40%. As an investor, this information gives you an idea of the potential downside risk associated with investing in Company XYZ.

By understanding the historical downside risk, you can make a more informed decision on whether to invest in Company XYZ, considering your risk tolerance and investment goals.

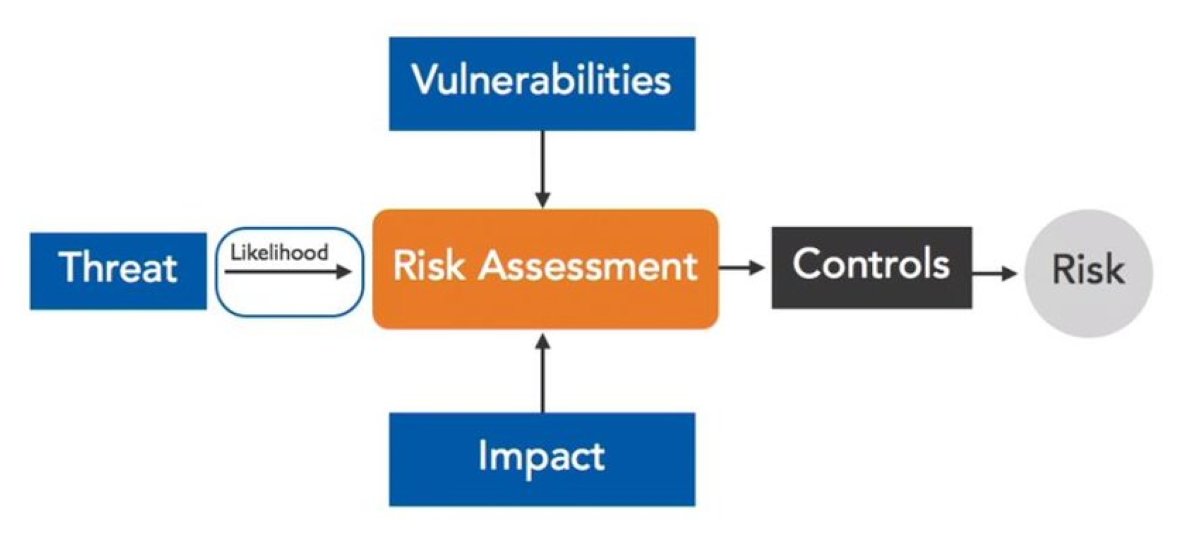

How To Calculate Downside Risk

There are several methods to calculate downside risk, but one common approach is to use the standard deviation of returns. The steps are as follows:

- Gather historical return data for your investment.

- Calculate the average return (mean) using the historical data.

- Calculate the standard deviation of the returns, which measures the dispersion of the returns around the mean.

- Estimate the threshold below which you want to evaluate the downside risk. This threshold could be a specific percentage loss that you are comfortable with.

- Calculate the downside risk by multiplying the standard deviation by the probability of returns falling below the threshold. This probability can be estimated using statistical techniques.

By following these steps, you can obtain a numerical measure of downside risk specific to your investment and risk tolerance.

In Conclusion

Understanding downside risk is vital for investors who seek to make informed decisions and manage their portfolios effectively. By evaluating the potential loss or negative deviation from an expected return, investors can gauge the downside risk associated with their investments.

Ultimately, the key to successful investing lies in finding the right balance between risk and reward. By analyzing downside risk, you can assess whether an investment aligns with your risk tolerance, helping you make sound financial decisions.

We hope this article has provided you with a clear understanding of downside risk – a crucial concept in finance. If you have any further questions or would like guidance on other financial topics, feel free to explore our Finance category for more valuable insights!