Home>Finance>Excess Cash Flow: Definition, Calculation Formulas, Example

Finance

Excess Cash Flow: Definition, Calculation Formulas, Example

Published: November 20, 2023

Learn the definition of excess cash flow in finance, along with calculation formulas and an example. Enhance your understanding of financial concepts.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is Excess Cash Flow?

In the world of finance, excess cash flow refers to the surplus funds generated by a company’s operations that are not needed for regular business expenses and obligations. This extra cash can be used for various purposes, such as investing in new projects, paying down debt, or distributing dividends to shareholders.

Key Takeaways:

- Excess cash flow is the additional cash generated by a company’s operations that is not required for regular expenses.

- This surplus cash can be utilized for investments, debt reduction, or distribution to shareholders.

How is Excess Cash Flow Calculated?

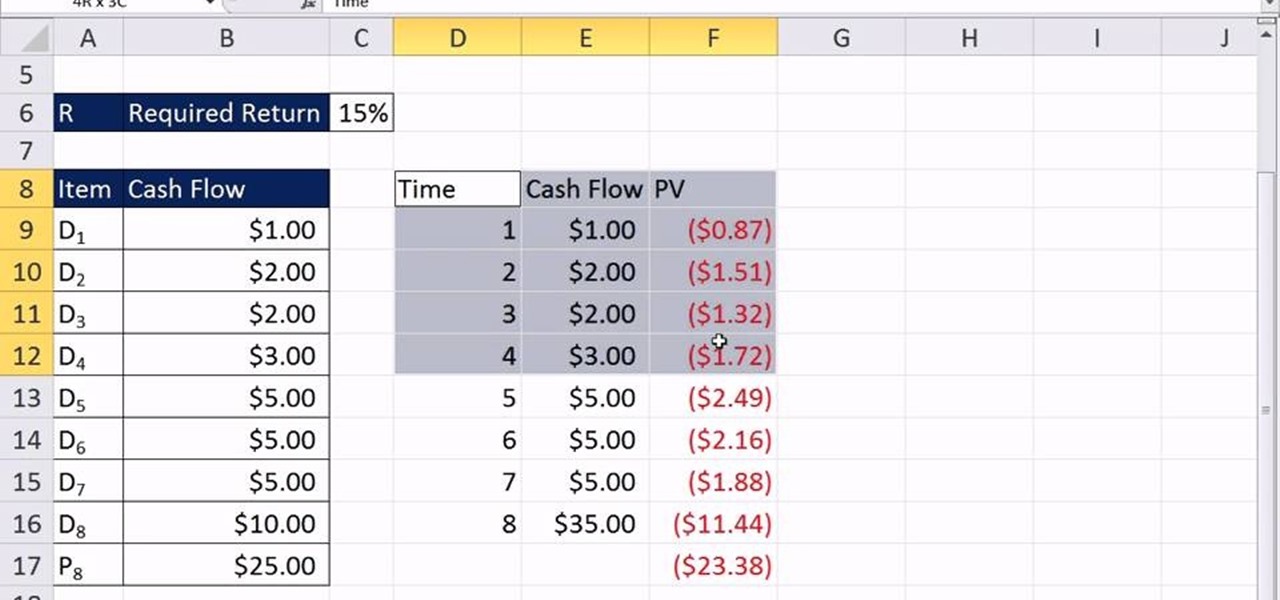

To calculate excess cash flow, you need to consider the cash inflows and outflows from a company’s operating activities, investing activities, and financing activities. Here’s a simplified formula:

Excess Cash Flow = Cash Inflows – Cash Outflows

Cash inflows typically include revenue from sales, investments, and financing, while cash outflows consist of expenses like salaries, rent, and loan repayments. By subtracting the total cash outflows from the total cash inflows, you can determine the excess cash flow.

Example of Excess Cash Flow Calculation:

Let’s say ABC Corporation generated $5 million in cash inflows from operations, received $2 million from investments, and obtained $1 million from financing activities. Meanwhile, the company had $6 million in cash outflows for various expenses.

To calculate the excess cash flow, you subtract the cash outflows from the cash inflows:

Excess Cash Flow = ($5 million + $2 million + $1 million) – $6 million

Excess Cash Flow = $8 million – $6 million

Excess Cash Flow = $2 million

In this example, ABC Corporation has $2 million in excess cash flow, which can be used for other purposes beyond its regular expenses.

Why is Excess Cash Flow Important?

Excess cash flow is significant as it provides a company with the flexibility to make strategic financial decisions. Here are a few reasons why excess cash flow is important:

- Investments: Excess cash flow can be used to fund new projects, research and development, and expand the business.

- Debt Reduction: Companies can use excess cash flow to pay down outstanding debts, reducing interest expenses and improving financial health.

- Dividend Distribution: Excess cash flow can be distributed as dividends to shareholders, providing a return on their investment.

- Acquisitions: Companies with excess cash flow can acquire other businesses or invest in strategic partnerships.

By effectively managing excess cash flow, companies can optimize their financial position and create value for their shareholders.

Conclusion

Excess cash flow is a crucial financial metric that allows companies to make strategic decisions with their surplus funds. By calculating and managing excess cash flow wisely, businesses can invest in growth, reduce debt, reward shareholders, and pursue new opportunities. Understanding excess cash flow empowers individuals and businesses to make sound financial choices and drive long-term success.