Finance

How To Calculate Cash Flow In Excel

Modified: February 21, 2024

Learn how to calculate cash flow in Excel with this comprehensive finance tutorial. Understand the importance of managing cash flow for financial success.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Method 1: Using the Simple Cash Flow Formula

- Method 2: Calculating Cash Flow using Excel Functions

- Step 1: Set Up the Excel Worksheet

- Step 2: Input Cash Inflows and Outflows

- Step 3: Calculate Net Cash Flow

- Step 4: Calculate Operating Cash Flow

- Step 5: Calculate Investing Cash Flow

- Step 6: Calculate Financing Cash Flow

- Step 7: Analyzing the Cash Flow Statement

- Conclusion

Introduction

Cash flow is a crucial financial metric that gives insight into the health and stability of a business. It represents the movement of money in and out of a company during a specific period, and it provides valuable information about a company’s ability to generate cash, meet financial obligations, and fuel growth.

Calculating cash flow is essential for both businesses and individuals. For businesses, it helps in evaluating their financial performance, making informed decisions, and planning for future growth. For individuals, understanding their personal cash flow helps in budgeting, managing expenses, and achieving financial goals.

While there are multiple methods to calculate cash flow, one effective and widely used approach is to utilize Excel. Excel provides various functions and formulas that simplify and automate the cash flow calculation process. In this article, we will explore two methods to calculate cash flow using Excel, and provide step-by-step instructions to help you get started.

In Method 1, we will demonstrate how to calculate cash flow using the simple cash flow formula. This method is suitable for individuals or small businesses with straightforward cash inflows and outflows.

In Method 2, we will leverage Excel functions to calculate cash flow. This method is more advanced and suitable for businesses with multiple cash inflows and outflows from different activities, such as operating, investing, and financing.

Whether you are a business owner, finance professional, or simply interested in managing your personal finances, understanding how to calculate cash flow in Excel will empower you to make informed financial decisions and drive financial success.

Method 1: Using the Simple Cash Flow Formula

The simple cash flow formula allows you to calculate cash flow by subtracting the total cash outflows from the total cash inflows. This method is straightforward and suitable for individuals or small businesses with relatively simple cash flow patterns.

To calculate cash flow using the simple formula, follow these steps:

- List all cash inflows: Start by listing all the sources of cash inflows during a specific period. This can include revenue from sales, loans received, investments, or any other sources of cash coming into the business.

- List all cash outflows: Next, list all the cash outflows during the same period. This can include expenses, loan repayments, operating costs, and any other cash disbursements made by the business.

- Add up the cash inflows and cash outflows: Calculate the total cash inflow by adding up all the sources of cash and calculate the total cash outflow by adding up all the cash outflows.

- Subtract the total cash outflows from the total cash inflows: Finally, subtract the total cash outflows from the total cash inflows to obtain the net cash flow. A positive net cash flow indicates that more cash is coming into the business than going out, while a negative net cash flow indicates that more cash is going out than coming in.

Let’s understand this with a simple example. Suppose you are a freelancer and your main source of income is freelance projects. In a month, you earn $5,000 from various freelance projects. Additionally, you have expenses such as office rent ($1,000), utilities ($200), and marketing expenses ($300). Using the simple cash flow formula, your calculation would be:

Total Cash Inflows: $5,000

Total Cash Outflows: $1,000 + $200 + $300 = $1,500

Net Cash Flow: $5,000 – $1,500 = $3,500

In this example, your net cash flow is positive, indicating that you have generated a surplus of $3,500 in cash during the month.

The simple cash flow formula is a quick and straightforward way to determine your cash flow position. However, it is important to note that this method may not capture the complexity of cash flows in larger businesses with multiple activities. For more comprehensive cash flow analysis, you may need to utilize the Excel functions method, which we will discuss in the next section.

Method 2: Calculating Cash Flow using Excel Functions

Calculating cash flow using Excel functions provides a more advanced and comprehensive approach, especially for businesses with multiple cash inflows and outflows from different activities. Excel offers a range of powerful functions that simplify the process and allow for accurate tracking and analysis of cash flow.

To calculate cash flow using Excel functions, follow these steps:

- Set up the Excel worksheet: Create a new worksheet and set up the necessary columns and headings. Typically, you would have columns for date, description, cash inflows, cash outflows, and net cash flow, as well as additional columns for operating, investing, and financing activities if required.

- Input cash inflows and outflows: Enter the specific dates, descriptions, and corresponding amounts for each cash inflow and outflow. For example, if you received $10,000 in revenue from sales, you would enter the date, description, and $10,000 under the cash inflows column.

- Calculate net cash flow: Utilize the SUM function to calculate the total cash inflows and outflows for a specific period. Subtract the total cash outflows from the total cash inflows to determine the net cash flow.

- Calculate operating cash flow: Use relevant Excel functions, such as SUMIF or SUMIFS, to calculate operating cash flow. This involves summing the cash inflows and outflows associated with the day-to-day operations of the business.

- Calculate investing cash flow: Similarly, utilize Excel functions to calculate investing cash flow, which includes cash inflows and outflows related to investments in assets or securities.

- Calculate financing cash flow: Finally, use appropriate Excel functions to calculate financing cash flow, which involves cash inflows and outflows related to financing activities such as loans, equity financing, or dividend payments.

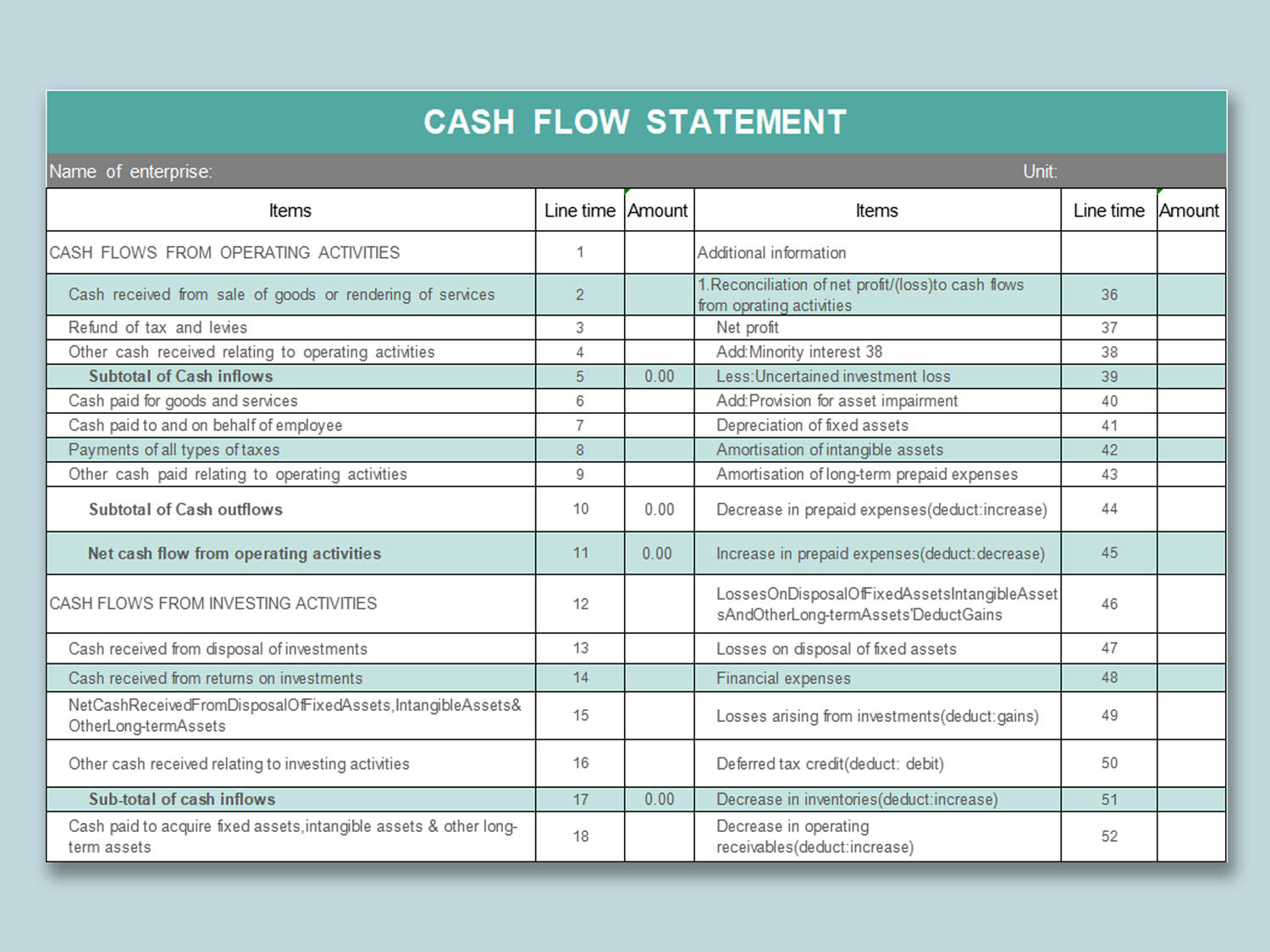

- Analyze the cash flow statement: Once you have all the calculations, review and analyze the cash flow statement to understand the sources and uses of cash, identify any cash flow issues, and make informed financial decisions.

By using Excel functions, you can automate the cash flow calculation process and easily update the cash flow statement as new transactions occur. This method provides a more detailed and accurate picture of your cash flow, enabling better financial planning and analysis.

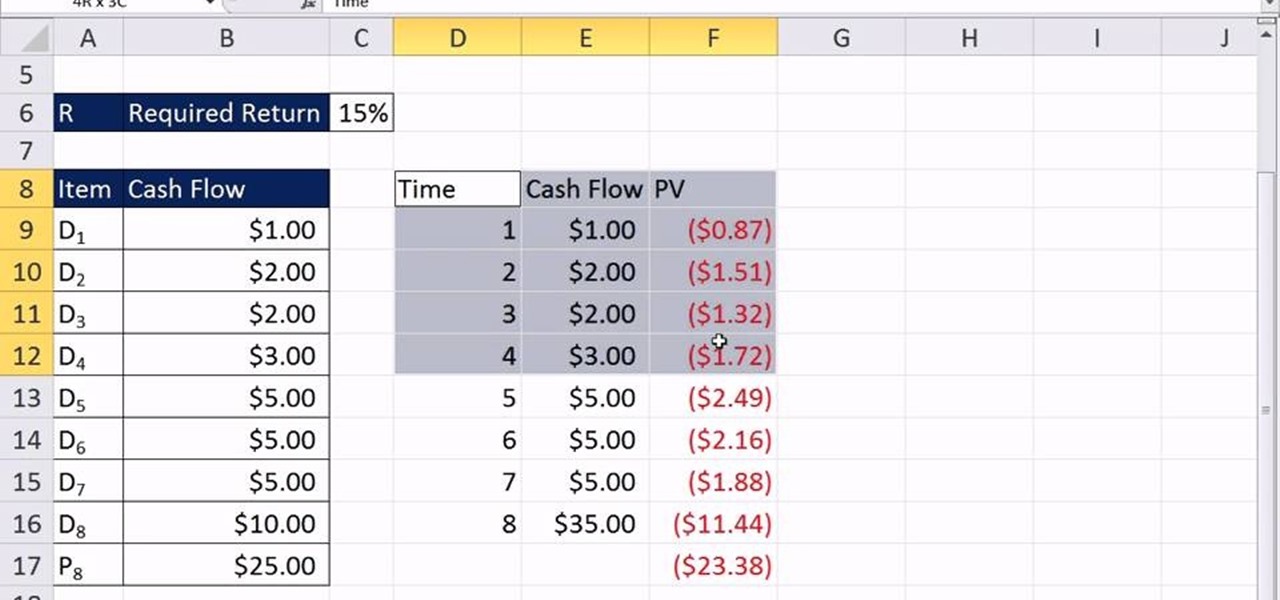

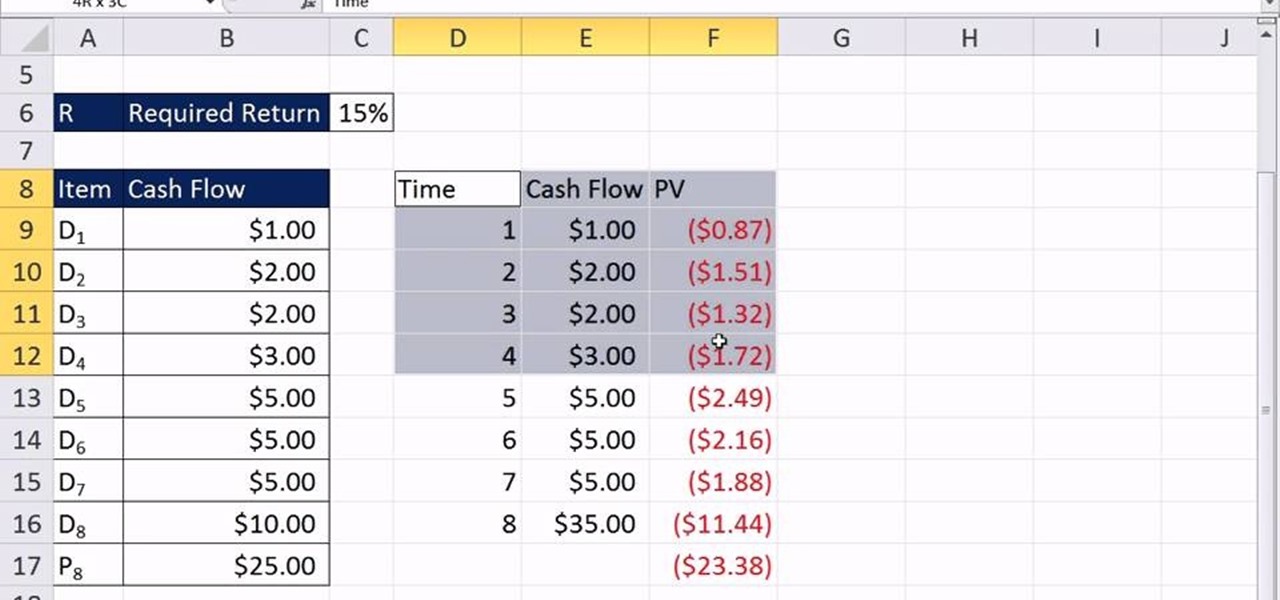

As an example, let’s consider a business with the following cash inflows and outflows for a month:

- Cash Inflows:

- Revenue from sales: $50,000

- Loan received: $20,000

- Interest income: $1,000

- Cash Outflows:

- Operating expenses: $30,000

- Investment in new equipment: $10,000

- Loan repayment: $5,000

- Dividend payment: $2,000

Using the Excel functions method, you would input these transactions into the respective columns and use functions like SUM, SUMIF, and SUMIFS to calculate the net cash flow, operating cash flow, investing cash flow, and financing cash flow.

This method provides a comprehensive analysis of cash flow, enabling you to gain valuable insights into your business’s financial performance, make strategic decisions, and ensure sustainable growth.

Step 1: Set Up the Excel Worksheet

Setting up the Excel worksheet correctly is the first essential step in calculating cash flow using Excel functions. A well-organized worksheet provides a clear structure and layout for inputting and analyzing cash inflows and outflows.

Follow these steps to set up the Excel worksheet:

- Create a new Excel workbook: Open Excel and create a new workbook to begin setting up the worksheet.

- Create column headings: In the first row of the worksheet, create column headings for the following categories: date, description, cash inflows, cash outflows, net cash flow, operating cash flow, investing cash flow, and financing cash flow. You can adjust the width of the columns as needed for readability.

- Format the cells: Format the cells to display the necessary decimal places, currency symbols, and other formatting options that align with your preferences. This formatting will make the cash flow statement more visually appealing and easier to interpret.

- Set up additional columns: If your cash flow analysis requires tracking cash inflows and outflows by operating, investing, and financing activities, create separate columns for each category. This will enable a more detailed breakdown of cash flow by activity.

- Add additional rows: Below the column headings, add multiple rows to accommodate the transactions and cash flow data. The number of rows will depend on the number of transactions expected or historical data you wish to analyze.

- Freeze column headings: To ensure column headings remain visible even when scrolling, use the “Freeze Panes” option in Excel. This feature allows you to keep the column headings in view while entering data in the respective cells.

- Save the Excel worksheet: Finally, save the Excel worksheet with a relevant name and in a location where you can easily access it for future updates and analysis.

By following these steps, you will have a well-structured Excel worksheet that is ready for inputting and analyzing cash inflows and outflows. A properly organized worksheet provides a solid foundation for accurate cash flow calculations and effective financial analysis.

Now that you have set up the Excel worksheet, you are ready to move on to the next step: inputting the cash inflows and outflows data. This step will involve entering the specific details and amounts for each transaction, allowing you to track and analyze the movement of cash within your business.

Step 2: Input Cash Inflows and Outflows

Once you have set up the Excel worksheet, the next step is to input the cash inflows and outflows data. This involves entering the specific details and amounts for each transaction that occurred during the period you are analyzing.

Follow these steps to input cash inflows and outflows:

- Locate the appropriate rows: Identify the rows in the worksheet where you will be entering the cash inflows and outflows data. Typically, these rows will be below the column headings and may already be labeled with “Date” and “Description”.

- Enter the transaction details: Starting from the first empty row, enter the date of the transaction in the “Date” column. Provide a brief description of the transaction in the “Description” column, indicating the source of the cash inflow or the purpose of the cash outflow.

- Enter the cash inflow amount: In the “Cash Inflows” column, input the corresponding amount of cash inflow for that transaction. This could be revenue from sales, loan proceeds, or any other source of cash coming into the business.

- Enter the cash outflow amount: In the “Cash Outflows” column, input the corresponding amount of cash outflow for that transaction. This could include expenses, loan repayments, or any other cash disbursements made by the business.

- Repeat for all transactions: Repeat steps 2 to 4 for each transaction, entering the date, description, cash inflow amount, and cash outflow amount in the respective columns.

By following these steps, you will have entered the relevant data for the cash inflows and outflows that occurred during the specific period you are analyzing. As you input each transaction, make sure to double-check the accuracy of the amounts and ensure they are entered in the correct columns.

Having the cash inflows and outflows data accurately inputted in the Excel worksheet will lay the groundwork for the subsequent calculations and analysis of cash flow. Once you have completed this step, you are ready to move on to the next step: calculating the net cash flow.

Step 3: Calculate Net Cash Flow

With the cash inflows and outflows data inputted in the Excel worksheet, the next step is to calculate the net cash flow. Net cash flow represents the difference between total cash inflows and total cash outflows, providing an overview of the overall cash position.

Follow these steps to calculate the net cash flow:

- Select the cell under the “Net Cash Flow” column for the first row of data.

- Enter the formula: In the selected cell, enter the formula “= Cash Inflows – Cash Outflows”. This formula subtracts the total cash outflows from the total cash inflows.

- Press Enter: Once you have entered the formula, press Enter to calculate the net cash flow for that specific row.

- Auto-fill the formula: To calculate the net cash flow for the remaining rows, simply click and drag the bottom-right corner of the cell with the formula down to auto-fill the formula for all the rows that have data.

By following these steps, you will have calculated the net cash flow for each transaction recorded in the Excel worksheet. The net cash flow value indicates whether there is a positive or negative cash flow for each individual transaction.

The net cash flow is a key indicator of the cash position and financial health of a business. A positive net cash flow demonstrates that more cash is coming into the business than going out, which indicates a healthy financial position. Conversely, a negative net cash flow suggests that more cash is being spent than generated, indicating a potential cash flow problem.

Calculating the net cash flow is a crucial step in understanding the overall cash flow picture. It provides valuable insights into the cash position of the business and helps in making informed financial decisions. Once you have obtained the net cash flow for each transaction, you can proceed to calculate the operating cash flow, investing cash flow, and financing cash flow for a more comprehensive analysis of the cash flow statement.

Step 4: Calculate Operating Cash Flow

After calculating the net cash flow, the next step is to calculate the operating cash flow. Operating cash flow represents the cash generated or used by the day-to-day operations of the business, providing insights into its core activities.

Follow these steps to calculate the operating cash flow:

- Select the cell under the “Operating Cash Flow” column for the first row of data.

- Enter the formula: In the selected cell, enter the formula that sums up the cash inflows and subtracts the cash outflows associated with operating activities. This can be done using Excel functions like SUMIF or SUMIFS.

- Press Enter: Once you have entered the formula, press Enter to calculate the operating cash flow for that specific row.

- Auto-fill the formula: To calculate the operating cash flow for the remaining rows, simply click and drag the bottom-right corner of the cell with the formula down to auto-fill the formula for all the rows that have data.

By following these steps, you will have calculated the operating cash flow for each transaction recorded in the Excel worksheet. The operating cash flow value provides insights into the cash flow generated or utilized by the core operations of the business.

A positive operating cash flow indicates that the business is generating enough cash from its operations to cover its day-to-day expenses. This is a healthy sign of financial stability. Conversely, a negative operating cash flow suggests that the business might be relying on external sources of funding or facing challenges in generating sufficient cash from its operations.

Calculating the operating cash flow allows you to assess the financial performance of the core activities of the business and evaluate its ability to generate sustainable cash flow. It provides key information for making strategic decisions, planning for future growth, and ensuring the financial stability of the business.

Once you have obtained the operating cash flow for each transaction, you can proceed to calculate the investing cash flow and financing cash flow to analyze the complete cash flow statement.

Step 5: Calculate Investing Cash Flow

Calculating the investing cash flow is the next step in analyzing the cash flow statement. Investing cash flow represents the cash inflows and outflows that are associated with the purchase or sale of long-term assets, investments, and other non-operating activities.

Follow these steps to calculate the investing cash flow:

- Select the cell under the “Investing Cash Flow” column for the first row of data.

- Enter the formula: In the selected cell, enter the formula that sums up the cash inflows and subtracts the cash outflows associated with investing activities. You can use Excel functions like SUMIF or SUMIFS to capture specific transactions related to investments.

- Press Enter: Once you have entered the formula, press Enter to calculate the investing cash flow for that specific row.

- Auto-fill the formula: To calculate the investing cash flow for the remaining rows, click and drag the bottom-right corner of the cell with the formula down to auto-fill the formula for all the rows that have data.

By following these steps, you will have calculated the investing cash flow for each transaction recorded in the Excel worksheet. The investing cash flow reflects the cash inflows and outflows associated with activities such as purchasing or selling assets, making investments, and acquiring or divesting subsidiaries.

A positive investing cash flow indicates that the business is investing and expanding its asset base, which can contribute to future growth. On the other hand, a negative investing cash flow suggests that the business is divesting assets or reducing its investment activities.

Calculating the investing cash flow helps assess how the business is allocating and managing its resources for long-term growth. It provides insights into the business’s investment decisions and can aid in evaluating the profitability and return on investment of these activities.

Once you have obtained the investing cash flow for each transaction, you can move on to calculating the financing cash flow, which accounts for cash inflows and outflows related to financing activities such as obtaining loans, issuing stock, or paying dividends.

Step 6: Calculate Financing Cash Flow

Calculating the financing cash flow is the next step in analyzing the cash flow statement. Financing cash flow represents the cash inflows and outflows related to financing activities, such as obtaining loans, issuing or buying back stock, and paying dividends.

Follow these steps to calculate the financing cash flow:

- Select the cell under the “Financing Cash Flow” column for the first row of data.

- Enter the formula: In the selected cell, enter the formula that sums up the cash inflows and subtracts the cash outflows associated with financing activities. Use Excel functions like SUMIF or SUMIFS to capture specific transactions related to financing.

- Press Enter: Once you have entered the formula, press Enter to calculate the financing cash flow for that specific row.

- Auto-fill the formula: To calculate the financing cash flow for the remaining rows, click and drag the bottom-right corner of the cell with the formula down to auto-fill the formula for all the rows that have data.

By following these steps, you will have calculated the financing cash flow for each transaction recorded in the Excel worksheet. The financing cash flow reflects the cash inflows and outflows associated with raising capital, repaying loans, issuing or buying back stock, and other financing activities.

A positive financing cash flow indicates that the business is raising additional capital or generating cash through financing activities. This can include taking on new loans, issuing stock, or receiving investments. Conversely, a negative financing cash flow suggests that the business is repaying loans, buying back stock, or paying dividends.

Calculating the financing cash flow provides insights into how the business is managing its capital structure and funding its operations. It helps to assess the business’s financial strength, its ability to access capital, and its commitment to shareholder returns.

Once you have obtained the financing cash flow for each transaction, you can analyze the complete cash flow statement, which includes the net cash flow, operating cash flow, investing cash flow, and financing cash flow, to gain a comprehensive understanding of the cash position and financial performance of the business.

Step 7: Analyzing the Cash Flow Statement

After calculating the net cash flow, operating cash flow, investing cash flow, and financing cash flow, the final step is to analyze the cash flow statement. Analysis of the cash flow statement provides valuable insights into the financial health, liquidity, and cash management of a business.

Here are key factors to consider when analyzing the cash flow statement:

- Positive or negative cash flow: Start by assessing the overall cash flow trend. A positive net cash flow indicates that more cash is coming into the business than going out, which suggests healthy cash generation. Conversely, a negative net cash flow may indicate potential cash flow challenges that need to be addressed.

- Cash flow from operating activities: Analyze the operating cash flow to evaluate the cash generated or used by the core operations of the business. A positive operating cash flow demonstrates healthy cash generation from day-to-day activities, while a negative cash flow may indicate operating challenges.

- Cash flow from investing activities: Consider the investing cash flow to understand the cash spent or received from long-term asset investments. Positive investing cash flow may indicate growth and expansion efforts, while negative investing cash flow may reflect divestments or reduced investment activities.

- Cash flow from financing activities: Examine the financing cash flow to evaluate the cash inflows and outflows related to financing activities. Positive financing cash flow may indicate capital raising and potential expansion, while negative financing cash flow may result from loan repayments or stock buybacks.

- Net cash flow trend: Look at the trend in the net cash flow over time. A consistent positive net cash flow suggests a sustainable cash position, while significant fluctuations or a consistently negative net cash flow may require further investigation and management actions.

- Comparison to benchmarks: Compare the cash flow statement with industry benchmarks or historical data to assess the business’s cash flow performance relative to similar organizations. This analysis provides a broader context for evaluating the financial health and efficiency of the business’s cash management.

- Identify cash flow issues: Analyze the cash flow statement to identify any potential cash flow issues or areas for improvement. Look for patterns or discrepancies that may indicate cash flow mismanagement, excessive spending, or ineffective financial practices.

- Financial decision-making: Use the insights gained from the cash flow statement analysis to inform financial decision-making. For example, if the operating cash flow is consistently negative, it may indicate a need to improve profitability or implement cost-cutting measures.

By analyzing the cash flow statement, you can gain a deeper understanding of the cash flow dynamics of the business and make informed decisions to optimize cash management, improve financial performance, and ensure long-term sustainability.

Conclusion

Understanding and calculating cash flow is essential for both businesses and individuals. It provides valuable insights into financial performance, helps in making informed decisions, and enables effective cash management.

In this article, we explored two methods to calculate cash flow using Excel. The first method, utilizing the simple cash flow formula, is suitable for individuals or small businesses with straightforward cash flow patterns. It involves subtracting total cash outflows from total cash inflows to determine the net cash flow.

The second method, using Excel functions, is more advanced and comprehensive. It is ideal for businesses with multiple cash inflows and outflows from different activities. By setting up an Excel worksheet and inputting cash inflows and outflows, you can use formulas and functions to calculate net cash flow, operating cash flow, investing cash flow, and financing cash flow.

Each step in the process is crucial for accurately assessing and analyzing the cash flow statement. By considering factors like the overall cash flow trend, cash flow from operating, investing, and financing activities, and comparing to benchmarks, you can gain a comprehensive understanding of your financial health and identify opportunities for improvement.

Moreover, the analysis of the cash flow statement enables better financial decision-making, as it highlights areas of strength and weakness. By addressing cash flow challenges and optimizing cash management, businesses can enhance their financial stability and growth prospects.

Whether you are an individual looking to manage personal finances or a business owner striving for financial success, mastering the art of calculating cash flow using Excel empowers you to make informed decisions, plan strategically, and navigate the ever-changing financial landscape.

By implementing the steps discussed in this article and consistently monitoring your cash flow, you can unlock the potential for financial growth, stability, and long-term success.