Home>Finance>Cash Flow Per Share: Definition And Calculation Formula

Finance

Cash Flow Per Share: Definition And Calculation Formula

Modified: December 29, 2023

Learn the definition and calculation formula for cash flow per share in finance. Understand how this metric helps assess a company's profitability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Cash Flow Per Share

When it comes to evaluating a company’s financial health, there are several key metrics that investors and analysts look at. One of these important metrics is cash flow per share. Cash flow per share provides valuable insights into a company’s ability to generate cash and its profitability. In this article, we will define cash flow per share and discuss how it is calculated.

Key Takeaways

- Cash flow per share is a financial metric that measures the amount of cash a company generates per outstanding share of its stock.

- Cash flow per share is an important metric for both investors and analysts, as it provides insights into a company’s profitability and ability to generate cash.

Definition of Cash Flow Per Share

Cash flow per share is a financial metric that measures the amount of cash a company generates per outstanding share of its stock. It is calculated by dividing the company’s cash flow from operations by the number of outstanding shares. Cash flow from operations includes cash generated from a company’s core business activities, such as sales of goods or services, and excludes cash flows from financing or investing activities.

Cash flow per share is an important metric for both investors and analysts, as it provides insights into a company’s profitability and ability to generate cash. By comparing the cash flow per share of different companies within the same industry or sector, investors can gain a better understanding of which companies are more efficient at generating cash.

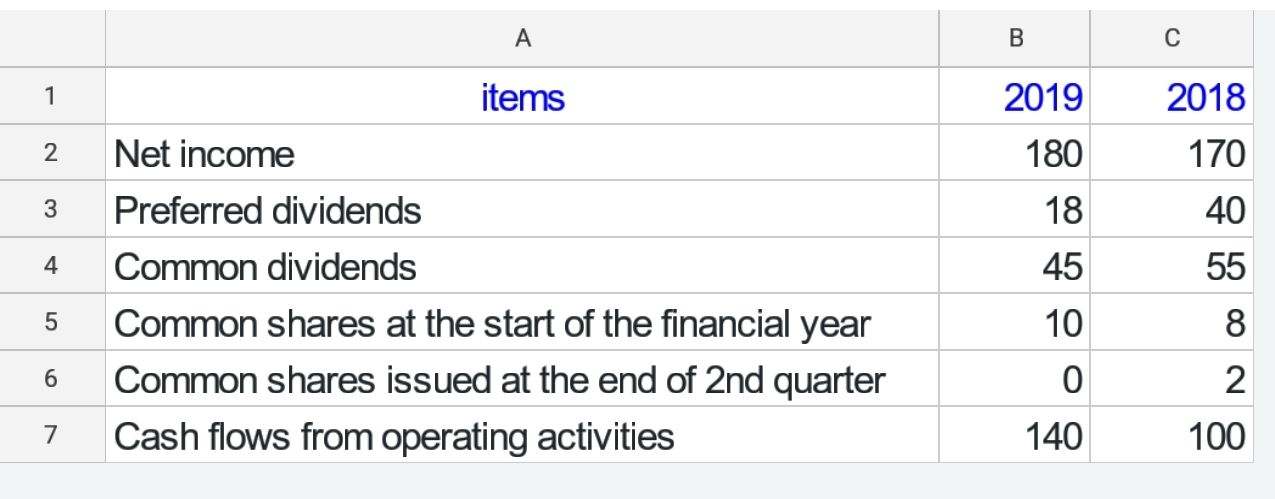

Calculation Formula for Cash Flow Per Share

The calculation formula for cash flow per share is relatively simple. It is calculated by dividing the cash flow from operations by the number of outstanding shares:

Cash Flow Per Share = Cash Flow from Operations / Number of Outstanding Shares

To find the cash flow from operations, you can refer to a company’s financial statements, particularly the statement of cash flows. The number of outstanding shares can be found in a company’s balance sheet or through financial websites or databases that provide company information.

Once you have both the cash flow from operations and the number of outstanding shares, you can divide the former by the latter to find the cash flow per share. This metric will give you a clear picture of how much cash a company generates for each share of its stock.

In Conclusion

Cash flow per share is a valuable metric for investors and analysts to assess a company’s profitability and ability to generate cash. By calculating this metric and comparing it across different companies, investors can make informed decisions about which companies to invest in. Remember that cash flow per share is just one piece of the puzzle, and it should be considered alongside other key financial metrics and factors before making any investment decisions.