Finance

Filing Extension Definition

Published: November 23, 2023

Learn what a filing extension is in finance and how it can benefit your financial planning. Stay on top of your deadlines with our expert guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Filing Extension: Definition and Importance

Welcome to our FINANCE category, where we go in-depth to provide you with valuable insights on various finance-related topics. Today, we’re diving into the world of filing extensions. Have you ever wondered what filing extensions are and why they are important? Well, you’re in the right place! In this blog post, we’ll explore the definition of filing extensions and highlight their significance in the realm of finance.

Key Takeaways:

- Filing extensions provide additional time for individuals or businesses to submit their required financial documents.

- Extensions can help avoid late-filing penalties and provide the opportunity for more accurate completion of financial records.

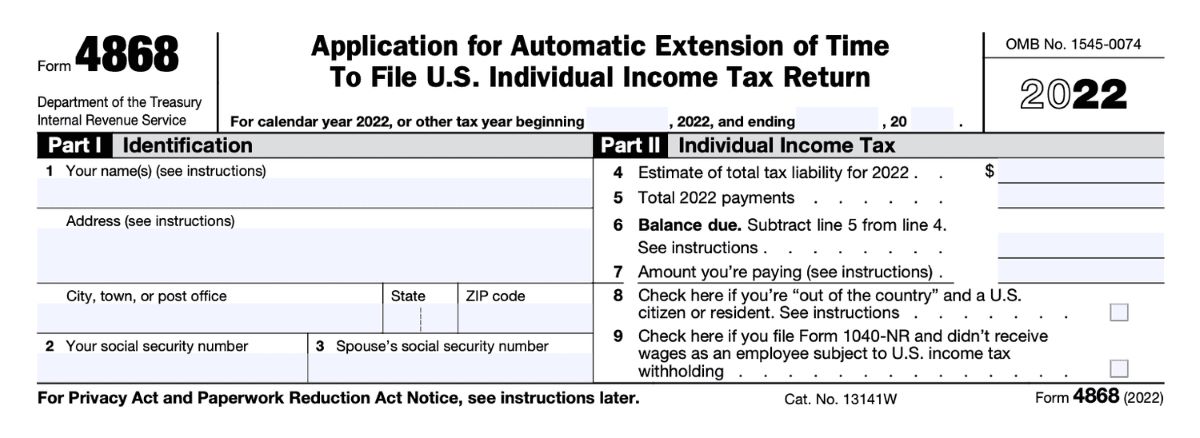

Now, let’s get down to business and uncover the meaning of filing extensions. Picture this – tax season is in full swing, and you find yourself running out of time to gather all the necessary documents and complete your tax return. In this situation, a filing extension can come to the rescue. A filing extension is an official request made to the relevant authorities to extend the deadline for submitting financial documents, such as tax returns, annual reports, or other financial statements.

Extensions are granted for a variety of reasons, including unforeseen circumstances, complicated financial situations, or the need for additional time to gather essential information. It’s important to note that filing extensions do not exempt individuals or businesses from fulfilling their financial obligations; they simply provide additional time to complete the necessary paperwork.

So, why are filing extensions so important? Here are a few reasons:

- Avoid Late-Filing Penalties: Filing financial documents beyond their due dates can result in hefty penalties imposed by regulatory bodies. By obtaining a filing extension, individuals and businesses can extend their deadlines and prevent these unnecessary fines.

- Accurate Completion of Financial Records: Rushing through the process of compiling financial statements can lead to errors or omissions. Filing extensions allow for more time to accurately complete financial records, ensuring greater accuracy and reducing the risk of costly mistakes.

- Organizational Benefits: Filing extensions provide individuals and businesses with an opportunity to better organize their financial documents, gather additional information, and gather necessary documentation, resulting in more thorough and comprehensive financial records.

As with any financial process, it’s important to follow the specific guidelines and requirements outlined by the appropriate regulatory bodies when seeking a filing extension. These guidelines may differ depending on the type of financial document and the governing jurisdiction.

In conclusion, filing extensions play a crucial role in the finance world by providing individuals and businesses with additional time to complete and submit their financial documents. They help avoid penalties, ensure accurate financial records, and provide an opportunity for better organization. If you find yourself in need of a filing extension, be sure to consult the relevant authorities to understand the specific guidelines and requirements.

We hope this blog post has shed some light on the definition and importance of filing extensions. Stay tuned for more informative articles and insights right here on our finance category!