Finance

Foreign Fund Definition

Published: November 26, 2023

Find out the meaning and significance of foreign fund in finance. Explore how foreign funds impact the global financial market and economy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Foreign Fund: Exploring the Basics of International Finance

Welcome to our Finance category blog post! In this article, we will delve into the fascinating world of Foreign Fund and provide you with a comprehensive understanding of this important concept in international finance.

What is a Foreign Fund?

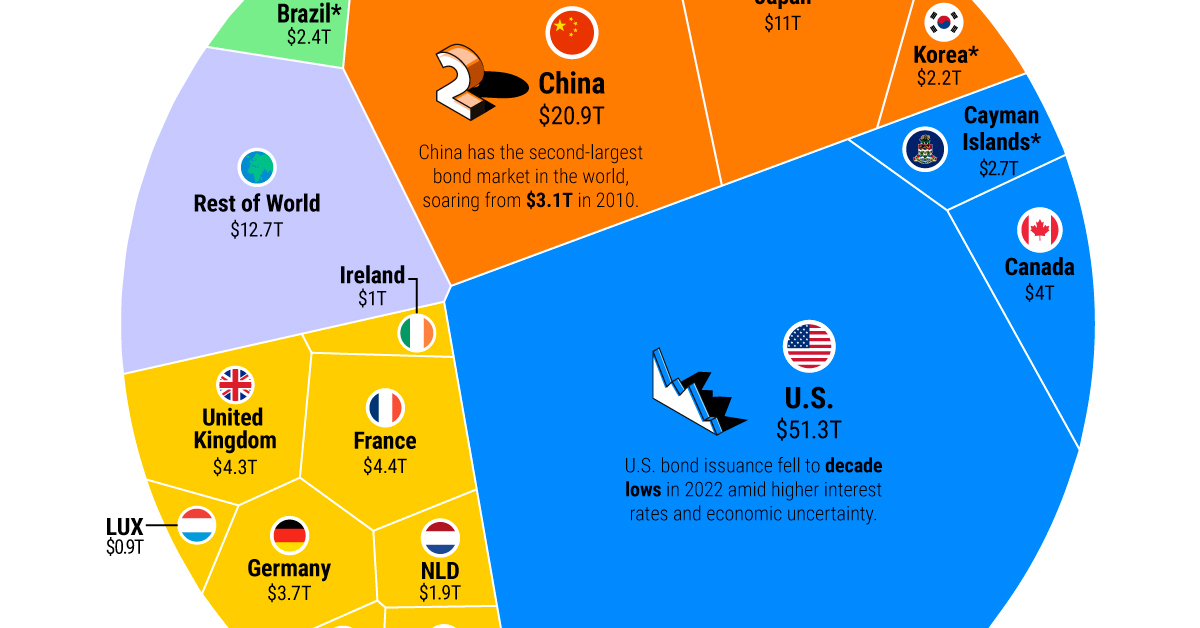

A Foreign Fund refers to a type of investment fund that focuses on international markets and assets rather than solely investing domestically. These funds offer individuals and institutions the opportunity to gain exposure to foreign stocks, bonds, currencies, and other assets.

Foreign funds can be categorized into different types, such as international funds, which invest in a portfolio comprising of securities from various countries, and global funds, which invest in both domestic and international securities.

Key Takeaways:

- Foreign funds are investment funds that focus on international markets and assets.

- They offer individuals and institutions exposure to foreign stocks, bonds, currencies, and other assets.

Why Invest in Foreign Funds?

Investing in foreign funds can provide a variety of benefits for investors. Here are a few reasons why individuals and institutions choose to allocate a portion of their portfolio to these funds:

- Diversification: Foreign funds allow investors to diversify their portfolios by spreading their investments across different foreign markets. By investing in a variety of countries and industries, investors can mitigate risk and potentially enhance returns.

- Access to Global Opportunities: Investing in foreign funds opens up opportunities to capitalize on the growth potential and unique investment opportunities offered by different countries. By expanding one’s investment horizons beyond domestic markets, investors are exposed to a broader range of assets and industries.

- Currency Exposure: Foreign funds provide exposure to different currencies, allowing investors to potentially benefit from the fluctuation in currency exchange rates. This can be advantageous for those looking to hedge against currency risk or take advantage of currency appreciation.

- Expert Management: Foreign funds are managed by experienced professionals who have in-depth knowledge of global markets, economies, and local conditions. This expertise can help navigate the complexities of investing in foreign markets and maximize investment returns.

In Conclusion

Foreign funds are a vital component of international finance, offering investors opportunities for diversification, exposure to global markets, and access to unique investment opportunities. By considering the benefits and understanding the risks associated with investing in foreign funds, individuals and institutions can make informed decisions to optimize their investment portfolios.

Remember, if you’re looking to expand your investment horizon and tap into the vast potential of global markets, exploring foreign funds could be a step in the right direction!