Finance

Good Delivery Definition

Published: December 1, 2023

In finance, the term "good delivery" refers to the process of transferring securities from one party to another in accordance with specific standards. Learn more about the definition and importance of good delivery.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Good Delivery Definition in Finance

Welcome to our FINANCE category, where we provide valuable insights and information on various aspects of financial terms and concepts. In this blog post, we will be discussing the Good Delivery Definition in finance. If you’ve ever wondered what exactly this term means and how it impacts financial transactions, you’ve come to the right place!

Key Takeaways:

- Good Delivery refers to the process of meeting the specific requirements for the transfer of securities or commodities.

- It ensures that the assets being exchanged are of a certain quality and meet the standards set by the relevant market.

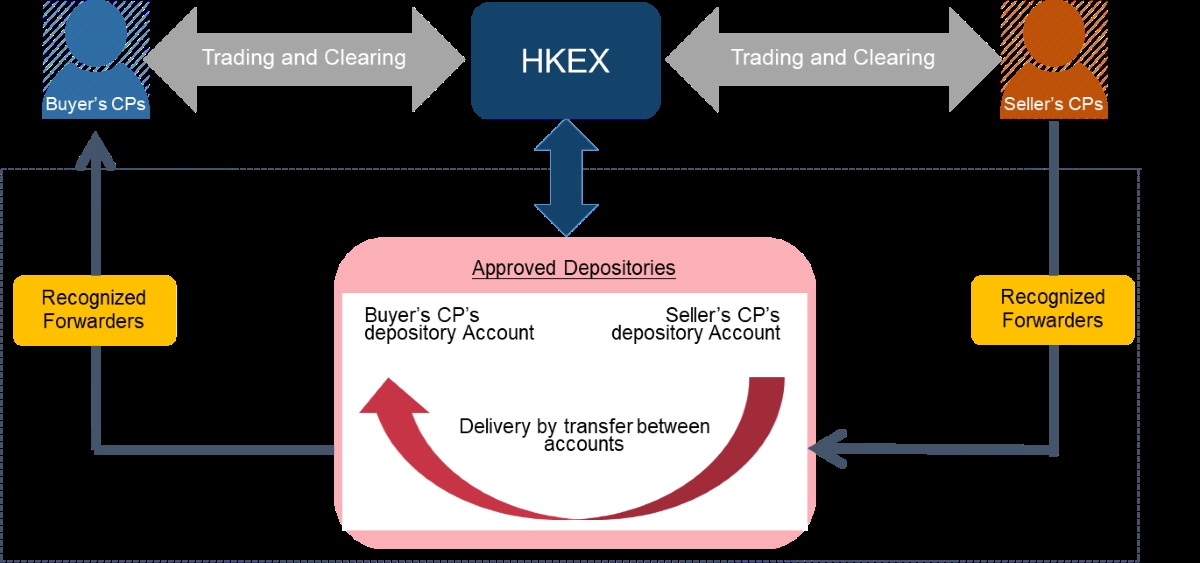

First, let’s understand what Good Delivery means in the context of finance. Whenever securities or commodities are traded, they need to be physically or electronically transferred from the seller to the buyer. Good Delivery ensures that this transfer process meets the specific requirements set by the relevant market.

When assets are delivered, they must meet specific standards to ensure their authenticity and quality. These standards include criteria such as size, weight, purity, and other relevant attributes. The purpose of establishing these standards is to maintain transparency and fairness in financial transactions. By adhering to Good Delivery practices, market participants can trust that the assets they are receiving are genuine and meet the necessary quality standards.

The criteria for Good Delivery vary depending on the type of asset being traded. For example, in the case of precious metals like gold or silver, the Good Delivery standards specify the size, weight, purity, and even the physical appearance of the bullion bars or coins. Similarly, in the case of securities, Good Delivery refers to meeting the requirements set by clearinghouses or institutional investors, such as the correct method of endorsement or the absence of any physical damage to the share certificates.

So, why is Good Delivery important in finance? Here are a few reasons:

- Market Confidence: By ensuring that assets meet the necessary standards, Good Delivery helps build trust and confidence among market participants. It reduces the risk of counterfeit assets or substandard quality being exchanged, promoting fair and transparent trading.

- Liquidity and Efficiency: Good Delivery practices contribute to the smooth functioning of financial markets as they facilitate the transfer of assets seamlessly. When market participants know that the assets they are trading conform to the agreed-upon standards, it increases the liquidity and efficiency of the marketplace.

- Compliance and Regulatory Requirements: Good Delivery standards are often established by regulatory bodies or organizations within the financial industry. Adhering to these standards ensures compliance with regulatory requirements, safeguarding against potential legal and financial risks.

In conclusion, Good Delivery is a crucial concept in finance that ensures the exchange of assets meets the necessary standards set by the market. By adhering to Good Delivery practices, market participants can trade with confidence, knowing that the assets they are receiving are genuine and of the expected quality. It contributes to market efficiency, builds trust among participants, and helps meet regulatory compliance. Understanding Good Delivery is essential for anyone involved in financial transactions or interested in the inner workings of financial markets.