Finance

How To Prepare A P&L

Published: February 29, 2024

Learn how to prepare a profit and loss statement with our comprehensive guide. Master the basics of finance and take control of your business's financial health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where businesses strive to understand their financial health and make informed decisions. One essential tool for this purpose is the Profit and Loss statement, commonly known as the P&L statement. In this comprehensive guide, we will delve into the intricacies of preparing a P&L statement, equipping you with the knowledge and skills necessary to navigate the financial landscape of a business.

Understanding the P&L statement is crucial for assessing the profitability and performance of a company over a specific period. It provides a snapshot of the revenue, costs, and expenses incurred, offering valuable insights into the financial standing of the business. By analyzing the P&L statement, stakeholders can make strategic decisions, identify areas for improvement, and gauge the overall financial viability of the enterprise.

Whether you are a budding entrepreneur, a seasoned business owner, or a finance enthusiast, mastering the art of preparing a P&L statement is a valuable asset. This guide will walk you through the process, from gathering financial data to analyzing the results, empowering you to harness the power of financial information for informed decision-making.

So, fasten your seatbelt as we embark on a journey to demystify the intricacies of preparing a P&L statement, unraveling the financial story of a business and empowering you with the knowledge to make sound financial decisions. Let's dive into the world of numbers, charts, and insights, and unlock the secrets hidden within the Profit and Loss statement.

Understanding P&L

Before delving into the nitty-gritty of preparing a P&L statement, it’s crucial to grasp the fundamental purpose and components of this financial document. The P&L statement, also known as the income statement, provides a summary of a company’s revenues, expenses, and profits over a specific period, typically a fiscal quarter or year. It serves as a vital tool for assessing the financial performance and profitability of a business.

The P&L statement follows a simple equation: Revenue – Expenses = Profit (or Loss). By comparing the total revenue generated with the expenses incurred, the statement reveals whether a company has made a profit or incurred a loss during the specified period. This insight is invaluable for stakeholders, including business owners, investors, and creditors, as it offers a clear picture of the company’s financial health.

Within the P&L statement, revenues encompass all income generated from primary business activities, such as sales of products or services, while expenses encompass the costs incurred in generating revenue, including operating expenses, interest, and taxes. The bottom line of the P&L statement, the net profit or loss, reflects the residual income after accounting for all expenses. A positive figure indicates a profit, while a negative figure signifies a loss.

Understanding the P&L statement is akin to reading the financial story of a business. It provides insights into revenue sources, cost structures, and overall profitability, enabling stakeholders to identify trends, make informed decisions, and formulate strategies for sustainable growth. As we proceed further, we will explore the intricate process of gathering financial data, organizing expenses, calculating revenue, and analyzing the P&L statement, unraveling the valuable insights it holds for businesses of all sizes.

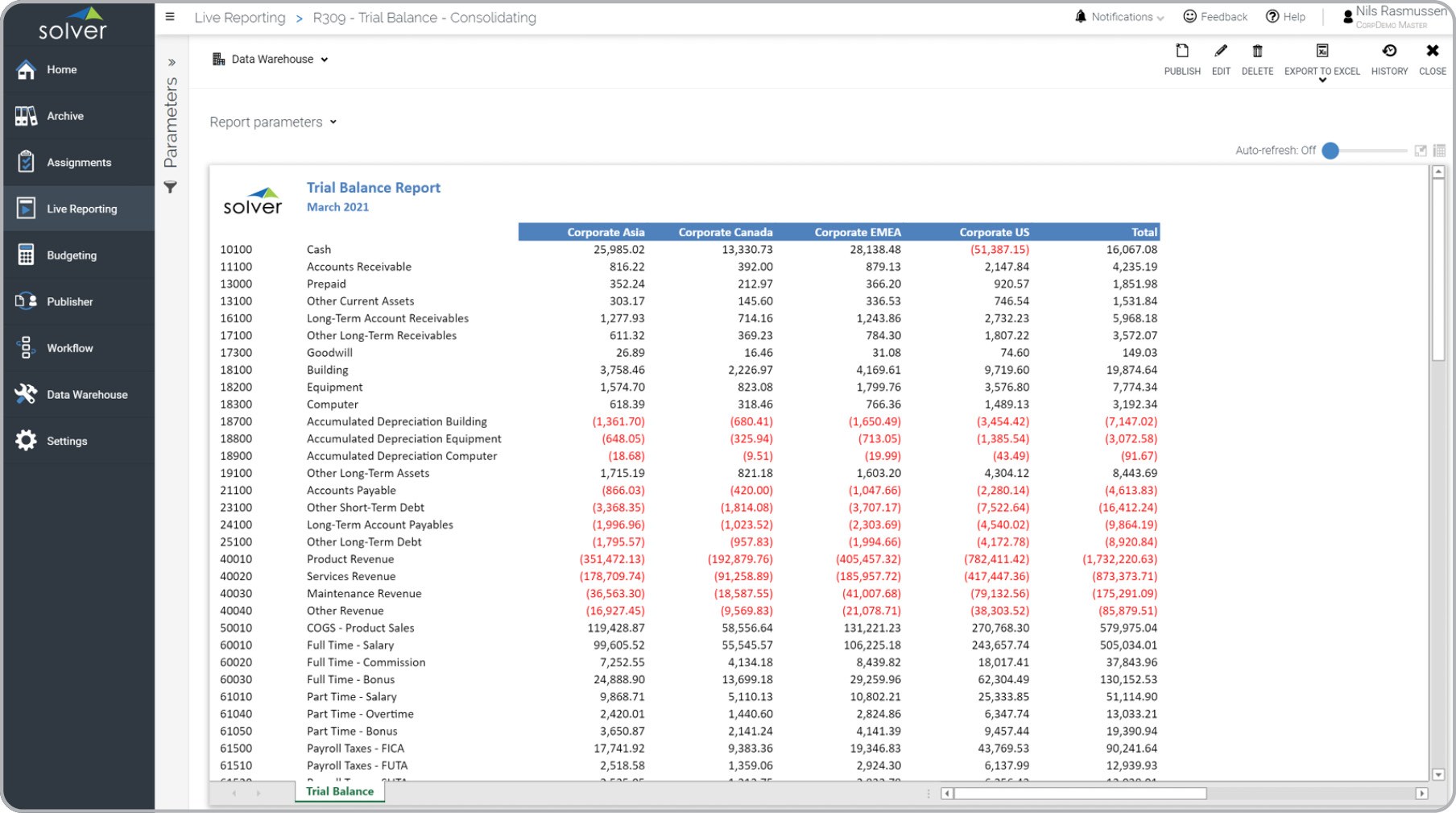

Gathering Financial Data

Preparing a comprehensive P&L statement begins with the meticulous collection of financial data from various sources within the organization. This process involves gathering information related to revenues, expenses, and other financial transactions that occurred during the specified period. Here’s a step-by-step guide to effectively gather the necessary financial data for your P&L statement:

- Revenue Sources: Start by compiling data on all sources of revenue, including sales of goods or services, interest income, and any other income streams relevant to the business. This may involve extracting sales data from the point of sale systems, reviewing contracts, and reconciling revenue records.

- Expense Documentation: Collect detailed records of all expenses incurred by the business, such as operating expenses, cost of goods sold, salaries, rent, utilities, and other overhead costs. This may require reviewing invoices, receipts, and financial reports to ensure accuracy and completeness.

- Financial Statements: Review the company’s balance sheet and cash flow statement to gain a comprehensive understanding of the financial position and cash flows, which can provide valuable insights for preparing the P&L statement.

- Accounting Records: Access the general ledger and accounting records to ensure that all financial transactions are accurately captured and categorized. This step is crucial for maintaining the integrity and accuracy of the P&L statement.

- External Data Sources: Consider any external data sources or industry benchmarks that may provide context and comparison for the financial performance of the business. This can include market research data, industry reports, and economic indicators.

By meticulously gathering financial data from these sources, you lay the groundwork for a robust and accurate P&L statement. Attention to detail and accuracy in data collection is paramount, as the reliability of the statement hinges on the quality of the underlying financial data. Once the data is gathered, the next step involves organizing expenses and categorizing revenue to construct a comprehensive P&L statement that reflects the financial reality of the business.

Organizing Expenses

Organizing expenses is a critical step in preparing a P&L statement, as it lays the foundation for accurately assessing the costs incurred in generating revenue and operating the business. Effectively categorizing and organizing expenses ensures that the P&L statement provides a clear and detailed breakdown of the financial outflows during the specified period. Here’s a systematic approach to organizing expenses for the P&L statement:

- Categorization: Begin by categorizing expenses into relevant groups, such as operating expenses, cost of goods sold, administrative expenses, marketing expenses, and any other specific categories pertinent to the business. This segmentation enables a comprehensive analysis of cost structures and facilitates decision-making.

- Expense Allocation: Allocate each expense to the appropriate category to ensure that all costs are accurately reflected in the P&L statement. For example, direct costs related to production or service delivery should be allocated to the cost of goods sold, while administrative and overhead expenses should be categorized separately.

- Accrual Basis Accounting: Adhere to the accrual basis of accounting, where expenses are recognized when incurred, regardless of when the cash payment occurs. This principle ensures that expenses are matched with the revenues they generate, providing a more accurate depiction of the business’s financial performance.

- Review and Verification: Thoroughly review and verify each expense entry to eliminate errors and discrepancies. This involves reconciling expense records, cross-referencing with financial documents, and ensuring that all expenses are accounted for in the appropriate period.

- Consistency and Transparency: Maintain consistency in expense categorization and ensure transparency in the allocation of costs. This practice facilitates comparability across different reporting periods and enhances the credibility of the P&L statement.

By meticulously organizing expenses according to these guidelines, you establish a solid framework for constructing an accurate and insightful P&L statement. The organized expense data serves as the cornerstone for evaluating the cost structure, identifying areas of efficiency or inefficiency, and making informed decisions to optimize the financial performance of the business.

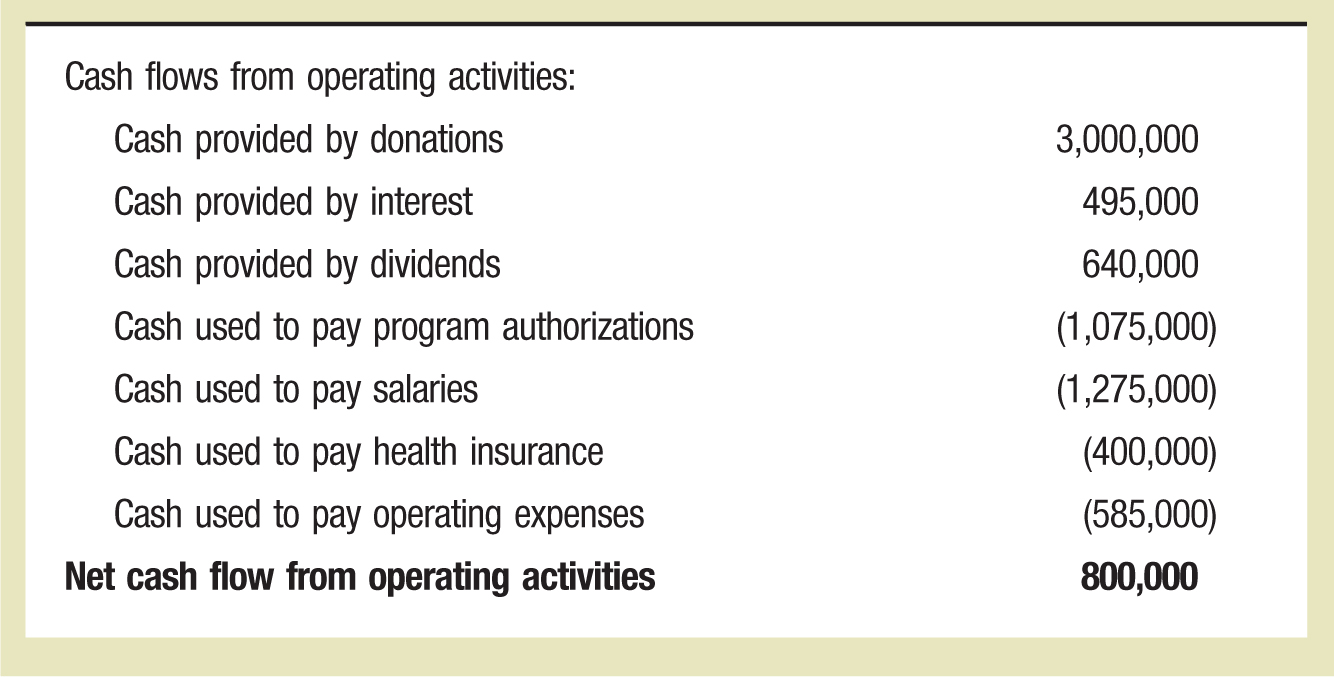

Calculating Revenue

Calculating revenue is a pivotal aspect of preparing a comprehensive P&L statement, as it provides a clear picture of the income generated from core business activities. Accurately quantifying revenue is essential for evaluating the financial performance and profitability of the business. Here’s a detailed guide to effectively calculate revenue for the P&L statement:

- Sales Revenue: Begin by aggregating the sales data from all revenue-generating activities, including the sales of goods or services. This may involve consolidating sales records from different product lines, services, or geographical segments to capture the total sales revenue.

- Interest and Investment Income: Include any interest income from investments, dividends, or other sources of passive income. These non-operating revenues contribute to the overall revenue stream and should be accounted for in the P&L statement.

- Revenue Recognition: Adhere to the principle of revenue recognition, recognizing revenue when it is earned, regardless of when the cash is received. This ensures that revenue is matched with the corresponding expenses, providing an accurate representation of the business’s financial performance.

- Adjustments and Allowances: Consider any adjustments or allowances related to sales returns, discounts, or uncollectible accounts. These adjustments impact the net revenue figure and should be factored into the calculation to reflect the true economic value of revenue generated.

- Multiple Revenue Streams: If the business has multiple revenue streams, such as subscription-based services, licensing fees, or one-time sales, ensure that each stream is accurately captured and accounted for in the P&L statement.

By meticulously calculating revenue based on these guidelines, you ensure that the P&L statement accurately reflects the income generated from core business operations and other revenue sources. This comprehensive revenue calculation sets the stage for analyzing the profitability of the business and gaining valuable insights into the revenue-generating aspects of the enterprise.

Analyzing the P&L

Once the financial data is gathered, expenses are organized, and revenue is calculated, the next crucial step in preparing a P&L statement is the analysis phase. Analyzing the P&L statement involves interpreting the financial information to gain insights into the business’s performance, profitability, and overall financial health. Here’s a comprehensive guide to effectively analyze the P&L statement:

- Profitability Assessment: Evaluate the net profit or loss to assess the overall profitability of the business during the specified period. Compare the net profit margin with previous periods or industry benchmarks to gauge the business’s financial performance.

- Trend Analysis: Identify trends in revenue and expenses over multiple reporting periods to discern patterns and fluctuations. This analysis can reveal seasonality, cyclical trends, or anomalies that impact the financial performance of the business.

- Cost Structure Evaluation: Examine the composition of expenses to understand the cost structure of the business. Identify areas of significant expenditure, cost-saving opportunities, and operational efficiency to optimize the allocation of resources.

- Revenue Composition: Break down the revenue sources to understand the contribution of each revenue stream to the overall income. This analysis provides insights into the diversification of revenue and the performance of different business segments or product lines.

- Key Performance Indicators (KPIs): Utilize relevant financial ratios and KPIs, such as gross margin, operating margin, and return on investment, to assess the financial health and efficiency of the business. These metrics offer valuable benchmarks for performance evaluation.

- Variance Analysis: Conduct a thorough variance analysis to compare actual performance against budgeted or forecasted figures. Variances highlight deviations from expected outcomes and prompt further investigation into the underlying reasons for the discrepancies.

By engaging in a comprehensive analysis of the P&L statement, stakeholders gain a deeper understanding of the business’s financial performance, identify areas for improvement, and make informed decisions to drive sustainable growth. The insights derived from the analysis phase serve as a springboard for strategic planning, resource allocation, and performance enhancement, empowering businesses to navigate the complex financial landscape with clarity and confidence.

Conclusion

Congratulations on embarking on the journey of demystifying the intricacies of preparing a Profit and Loss (P&L) statement. As we conclude this comprehensive guide, it’s essential to underscore the significance of the P&L statement as a powerful tool for assessing the financial performance and profitability of a business. By mastering the art of preparing and analyzing the P&L statement, stakeholders can gain valuable insights into the revenue, expenses, and overall financial health of the enterprise, enabling informed decision-making and strategic planning.

Throughout this guide, we’ve uncovered the fundamental components and steps involved in preparing a P&L statement, from gathering financial data to meticulously organizing expenses and calculating revenue. The meticulous process of organizing and analyzing financial data equips businesses with the knowledge to evaluate their profitability, identify cost-saving opportunities, and optimize their revenue streams.

As you venture into the realm of financial analysis, remember that the P&L statement is not merely a financial document; it is a narrative of the business’s financial journey, encapsulating the triumphs, challenges, and opportunities encountered along the way. The insights gleaned from the P&L statement serve as a compass, guiding businesses toward sustainable growth, operational efficiency, and informed decision-making.

Armed with the knowledge acquired from this guide, you are poised to harness the power of financial information, unravel the stories hidden within the numbers, and navigate the dynamic landscape of business finance with confidence and clarity. Whether you are a budding entrepreneur, a seasoned business owner, or a finance enthusiast, the ability to prepare and analyze a P&L statement is a valuable asset that empowers you to decipher the financial story of a business and steer it toward success.

As you continue your financial journey, remember that the P&L statement is not just a financial artifact; it is a dynamic tool that illuminates the path to financial prosperity and resilience. Embrace the insights it offers, leverage its power to make informed decisions, and let the P&L statement be your trusted companion in the pursuit of financial excellence.