Home>Finance>How Do I Change My Homeowners Insurance With Escrow

Finance

How Do I Change My Homeowners Insurance With Escrow

Modified: February 21, 2024

Looking to change your homeowners insurance with escrow? Learn how to navigate the process and manage your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Escrow Accounts

- Why You Might Need to Change Homeowners Insurance

- Steps to Change Homeowners Insurance with Escrow

- Review Your Current Insurance Policy

- Research and Compare Insurance Providers

- Obtain Quotes for New Insurance Policies

- Select the Best Insurance Policy for Your Needs

- Notify Your Current Insurance Provider

- Provide Insurance Information to Your Lender

- Update Your Escrow Account Information

- Monitor the Transition Process

- Conclusion

Introduction

Changing homeowners insurance can be a necessary task for homeowners, especially if they have an escrow account set up for their mortgage payments. An escrow account is typically established by the lender to collect and disburse funds for property taxes, homeowners insurance, and other related expenses. When it comes to changing homeowners insurance with an escrow account, the process may seem daunting at first, but with the right knowledge and steps, it can be manageable.

Understanding how escrow accounts work is important in order to grasp why you might need to change your homeowners insurance. An escrow account helps ensure that homeowners can cover their property tax and insurance payments. The lender collects a portion of the homeowner’s monthly mortgage payment and sets it aside in the escrow account. When the homeowners insurance premium is due, the lender pays it directly from the escrow account. This setup provides convenience and peace of mind to both the homeowner and the lender.

There are several reasons why you might need to change your homeowners insurance. It could be due to a change in circumstances such as moving to a new home, refinancing your mortgage, or simply wanting to find a better insurance provider with more favorable rates and coverage options. Whatever the reason may be, the process of changing homeowners insurance with an escrow account involves multiple steps that need to be followed carefully.

In this article, we will guide you through the step-by-step process of changing your homeowners insurance with an escrow account. From reviewing your current policy to updating your escrow account information, we will provide you with the necessary information to make this transition as smooth as possible.

Understanding Escrow Accounts

An escrow account is a financial arrangement where a third party, typically a title company or a mortgage lender, holds funds on behalf of the homeowner for specific purposes, such as property taxes and homeowners insurance. The purpose of an escrow account is to ensure that these necessary expenses are paid on time and in full.

When it comes to homeowners insurance, an escrow account is commonly used to collect and disburse funds for the insurance premium. Instead of the homeowner paying the insurance premium directly to the insurance company, the lender deducts a portion of the monthly mortgage payment and sets it aside in the escrow account. This ensures that there is enough money available to pay the insurance premium when it becomes due.

Escrow accounts provide benefits to both homeowners and lenders. For homeowners, it simplifies the process of budgeting for property taxes and homeowners insurance. Instead of having to come up with a lump sum for these expenses, they can spread the cost over the course of the year through their monthly mortgage payments. This can help with managing cash flow and avoiding the risk of falling behind on payments.

For lenders, escrow accounts provide assurance that the homeowner’s property taxes and homeowners insurance are being paid. This helps protect their investment in the property and ensures that the property remains adequately insured.

It’s important to note that not all homeowners are required to have an escrow account. In some cases, homeowners may choose to pay their property taxes and homeowners insurance directly to the respective entities, rather than through an escrow account. This is known as “waiving escrows.”

Before deciding whether to have an escrow account or not, it’s crucial to understand the requirements set by your lender and the laws and regulations in your area. Some lenders may require an escrow account for certain types of mortgages or if the down payment is below a certain threshold. Consult with your lender to determine what options are available to you.

Why You Might Need to Change Homeowners Insurance

There are several reasons why you might need to change your homeowners insurance policy. Understanding these reasons will help you determine if it’s necessary to make a change and guide you through the process.

1. Change in Insurance Needs: Over time, your insurance needs may change. For example, if you have made renovations or additions to your home, you may need to increase your coverage to adequately protect the new additions. On the other hand, if you have downsized or made significant improvements to your home’s security, you may be eligible for discounts on your insurance premium.

2. Better Coverage and Rates: Insurance companies frequently adjust their rates and coverage options. As a homeowner, you should periodically evaluate your insurance policy to ensure that you are getting the best coverage at the most competitive rates. By shopping around and comparing quotes from different insurers, you may find a policy that offers better coverage and more affordable premiums.

3. Dissatisfaction with Current Insurer: If you are dissatisfied with your current insurance company’s customer service, claims handling, or overall experience, it may be time to switch insurers. It’s important to feel confident in your insurance company’s ability to provide support and assistance when you need it most.

4. Change in Circumstances: Life is full of changes, and some of these changes may require adjustments to your homeowners insurance. Examples include moving to a new home, getting married or divorced, or starting a home-based business. Each of these circumstances may warrant a change in your insurance policy to ensure that your coverage aligns with your new situation.

5. Financial Considerations: Personal financial circumstances can also play a role in your decision to change homeowners insurance. If you are facing financial hardship or looking to reduce your monthly expenses, finding a policy with a lower premium may be beneficial. However, it’s important to carefully review the coverage offered and make sure it meets your needs.

Remember, it’s crucial to inform your mortgage lender if you plan to make changes to your homeowners insurance, especially if you have an escrow account. Your lender needs to be aware of these changes to update your escrow account accordingly and avoid any potential issues.

Steps to Change Homeowners Insurance with Escrow

Changing homeowners insurance when you have an escrow account requires careful coordination between you, your current insurance provider, and your mortgage lender. Here are the steps you should follow to ensure a smooth transition:

- Review Your Current Insurance Policy: Begin by reviewing your current homeowners insurance policy. Take note of important details such as coverage limits, deductibles, and premium amounts. This will help you evaluate if your current policy still meets your needs or if it’s time to make a change.

- Research and Compare Insurance Providers: Next, research and compare insurance providers. Look for companies that offer the coverage you need at competitive rates. Consider factors such as customer reviews, financial stability, and claims handling reputation.

- Obtain Quotes for New Insurance Policies: Collect quotes from the insurance providers you are considering. Provide them with accurate information about your home, its location, and any relevant details. Compare the quotes and select the policy that offers the best combination of coverage and affordability.

- Select the Best Insurance Policy for Your Needs: Once you have gathered quotes, carefully analyze the coverage, exclusions, and endorsements provided by each policy. Consider factors such as liability limits, personal property coverage, and additional coverages that may be important to you. Choose the policy that best aligns with your needs and budget.

- Notify Your Current Insurance Provider: Once you have selected a new insurance policy, notify your current insurance provider about your decision to switch. Provide them with the effective date of cancellation and any required documentation they may need. Make sure to keep a record of your cancellation request for your reference.

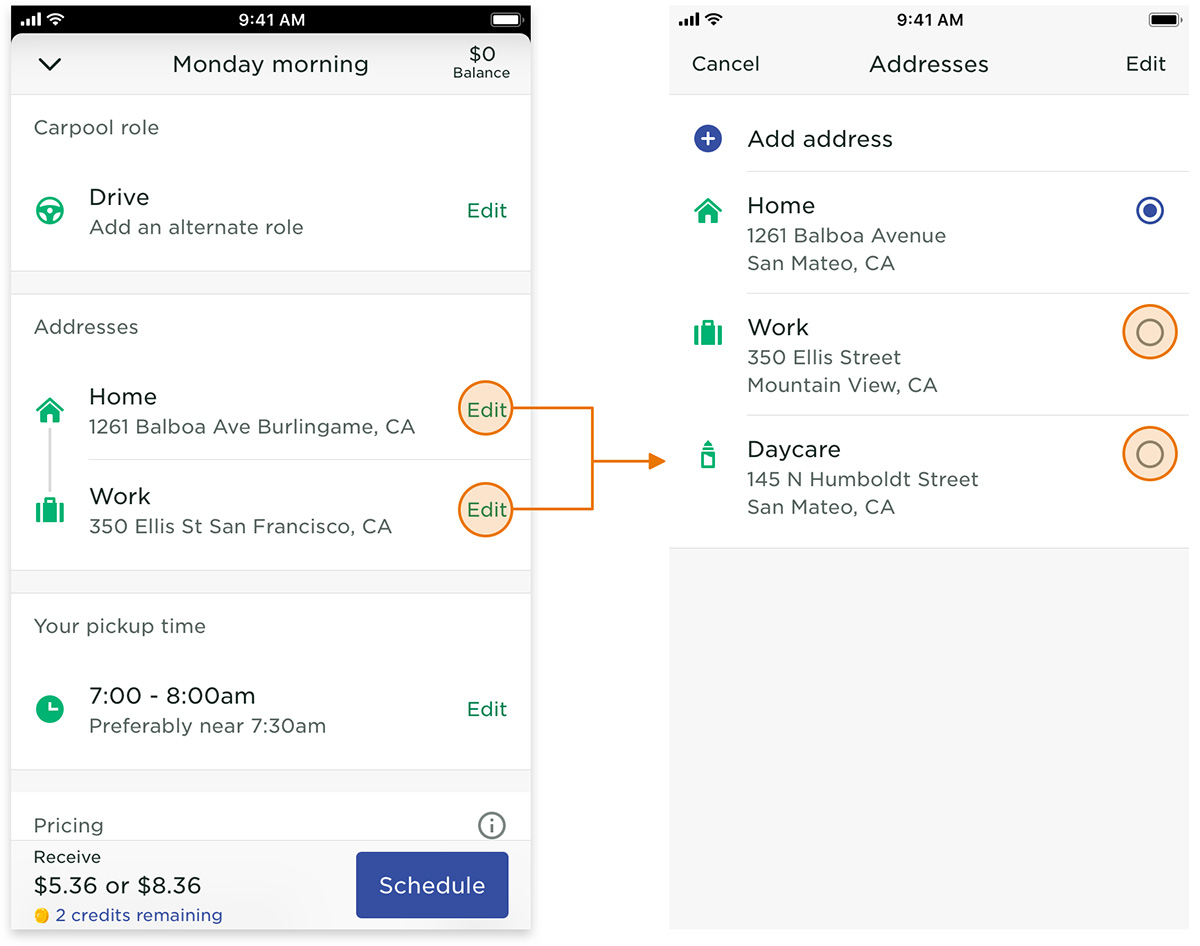

- Provide Insurance Information to Your Lender: Inform your mortgage lender about your new insurance policy. They will need the updated insurance information to make the necessary adjustments to your escrow account. Provide them with a copy of your new declarations page and any other required documentation.

- Update Your Escrow Account Information: Coordinate with your mortgage lender to update your escrow account information. This includes updating details such as the insurance provider, policy number, and premium amount. Ensure that the changes are accurately reflected to avoid any disruptions in payment or coverage.

- Monitor the Transition Process: Keep a close eye on the transition process to ensure that your old insurance policy is cancelled, and your new policy is properly in effect. Verify with your mortgage lender that the changes to your escrow account have been successfully made. Stay in communication with your new insurance provider to address any issues or concerns that may arise.

Changing homeowners insurance with an escrow account may seem like a complex process, but by following these steps and maintaining open communication with your insurance provider and mortgage lender, you can successfully make the transition and ensure your home remains protected.

Review Your Current Insurance Policy

The first step in changing homeowners insurance with an escrow account is to review your current insurance policy. Take the time to thoroughly examine your policy and understand the coverage it provides. Here are some key aspects to consider:

- Coverage Limits: Evaluate the coverage limits of your current policy. Are they sufficient to protect your home and belongings? Consider any changes to your property or valuable assets that may require adjustments to your coverage limits.

- Deductibles: Take note of your current deductibles, which are the amounts you are responsible for paying out of pocket before your insurance coverage kicks in. Assess whether the deductibles align with your financial situation and if adjusting them makes sense for your needs.

- Premium Amount: Review the premium amount you are currently paying for homeowners insurance. Consider whether it is competitive with rates offered by other insurance providers. If your premium has significantly increased, it may be worth exploring other options to lower your costs.

- Coverage Types: Understand the types of coverage included in your policy, such as dwelling coverage, personal property coverage, liability coverage, and additional coverages like water damage or identity theft. Evaluate whether your current policy adequately protects you in various scenarios.

- Exclusions and Endorsements: Identify any exclusions or limitations in your policy that may impact your coverage. Additionally, take note of any endorsements or optional coverages you have added to your policy, as it may affect the premium amount.

- Claims History: Assess your claims history and the frequency with which you have filed claims in the past. Be aware that a high number of claims could impact your future insurance rates or eligibility with certain insurance providers.

By reviewing your current insurance policy, you will have a clear understanding of the coverage you currently have and whether it meets your needs. This will help guide you in making informed decisions when exploring new insurance options.

Research and Compare Insurance Providers

Once you have reviewed your current insurance policy, it’s time to research and compare different insurance providers. This step is crucial in finding a policy that offers the coverage and pricing that align with your needs. Here’s how to approach this process:

- Seek Recommendations: Start by asking friends, family, or trusted advisors for recommendations on insurance providers they have had positive experiences with. Their firsthand experiences can offer valuable insights.

- Check Online Reviews: Utilize online platforms and review websites to gather information and read customer reviews about insurance companies you are considering. Look for patterns and trends in the feedback to get a sense of their customer service, claims handling, and overall reputation.

- Verify Financial Stability: Assess the financial stability of insurance providers by reviewing their financial ratings from reputable rating agencies such as Standard & Poor’s, Moody’s, or A.M. Best. A financially stable company is more likely to fulfill its obligations in the event of a claim.

- Assess Coverage Offerings: Review the coverage options available from each insurance provider. Consider the types of coverage they offer, as well as any additional coverages or endorsements that may be relevant to your specific needs.

- Consider Pricing: While price is not the only factor to consider, it’s important to compare insurance premiums from different providers. Request quotes based on your specific needs and compare the pricing to ensure you are getting a competitive rate.

- Research Discounts: Inquire about potential discounts that may be available to you based on factors such as your home’s security features, claim-free history, or bundling multiple insurance policies with the same provider.

- Evaluate Customer Service: Customer service is crucial when it comes to insurance. Research how each insurance provider handles customer inquiries, claims processes, and overall responsiveness. A provider with excellent customer service can make a significant difference in your experience.

By conducting thorough research and comparing multiple insurance providers, you can gain a better understanding of what each company offers and identify those that best meet your requirements. Remember to prioritize not just the price, but also the quality of coverage and level of customer service provided by each insurer.

Obtain Quotes for New Insurance Policies

Once you have researched and identified potential insurance providers, the next step is to obtain quotes for new insurance policies. Gathering quotes will allow you to compare pricing and coverage options to find the best policy for your needs and budget. Here’s how to go about this process:

- Provide Accurate Information: When requesting quotes, be sure to provide accurate and detailed information about your home, including its location, size, construction type, security features, and any recent renovations or upgrades. This will ensure that the quotes you receive are tailored to your specific circumstances.

- Consider Coverage Options: Discuss the coverage options available with each insurance provider. Inquire about the types of coverage they offer, such as dwelling coverage, personal property coverage, liability coverage, and any additional endorsements or riders that may be relevant to your needs.

- Request Comparable Coverage Levels: To accurately compare quotes, request that each insurance provider provide quotes based on the same coverage levels and deductibles. This will allow you to make a fair comparison of pricing and determine which provider offers the most competitive rates.

- Explore Discounts: Inquire about any potential discounts that may be available to you. Insurance providers often offer discounts for factors such as home security systems, smoke alarms, multiple policies with the same provider, or claim-free records. By exploring discounts, you may be able to lower your insurance premium.

- Review Policy Exclusions: Pay attention to any exclusions listed in the quotes you receive. Exclusions are specific situations or events that are not covered by the insurance policy. Make sure you understand what is and isn’t covered to avoid surprises in the future.

- Consider Customer Reviews: While obtaining quotes, take the time to read customer reviews and testimonials for each insurance provider. This can give you an idea of the experiences others have had with the company, particularly in terms of claims handling and customer service.

By obtaining quotes from multiple insurance providers, you can compare their offerings in terms of coverage and pricing. This will enable you to make an informed decision about the best insurance policy for your needs, striking a balance between the coverage provided and the cost of premiums.

Select the Best Insurance Policy for Your Needs

After obtaining quotes from different insurance providers, it’s time to select the best insurance policy that suits your needs. This step requires careful consideration of coverage, pricing, and other factors that are important to you as a homeowner. Here’s how to make an informed decision:

- Evaluate Coverage Levels: Review the coverage levels offered by each insurance policy. Consider the limits for dwelling coverage, personal property coverage, liability coverage, and any additional coverages or endorsements. Choose a policy that adequately protects your home and belongings in line with your specific requirements.

- Assess Deductibles: Consider the deductibles associated with each policy. Assess whether the deductibles are affordable for you in case of a claim or if you would prefer to adjust them to better align with your financial situation.

- Compare Pricing: Compare the premiums offered by each insurance provider. Consider not only the overall cost but also the payment terms and any discounts that may apply. Remember, the cheapest policy is not always the best option if it does not provide adequate coverage.

- Consider Policy Exclusions: Take note of any exclusions or limitations in each policy. Make sure you understand what is and isn’t covered by the insurance policy. Assess whether any exclusions are deal-breakers or if you can manage the risks associated with them.

- Assess Customer Service: Evaluate the reputation and customer service track record of each insurance provider. Look for reviews or ratings regarding their claims handling, responsiveness, and overall customer satisfaction. A reliable and responsive insurance company can make a significant difference in your insurance experience.

- Review Financial Stability: Verify the financial stability of the insurance company. Research their financial ratings from reputable rating agencies to ensure they have the resources to fulfill their obligations in the event of a claim.

- Consider Additional Benefits: Take into account any additional benefits or features offered by the insurance policies. Some policies may provide added services like identity theft protection or coverage for temporary living expenses while your home is being repaired.

Ultimately, the best insurance policy for you will depend on a combination of coverage, pricing, customer service, and other factors that align with your needs and preferences as a homeowner. Take the time to carefully evaluate each policy and choose the one that offers the optimal balance between coverage and affordability.

Notify Your Current Insurance Provider

Once you have decided to switch to a new homeowners insurance policy, it’s important to notify your current insurance provider about your decision. By informing them in a timely and proper manner, you can ensure a smooth transition and avoid any potential issues. Here’s how to notify your current insurance provider:

- Review the Cancellation Policy: Before contacting your current insurance provider, review the cancellation policy outlined in your current insurance policy. Familiarize yourself with any notice requirements and avoid any potential penalties or fees for early cancellation.

- Call or Write a Letter: Reach out to your insurance provider via phone or write a formal letter to inform them of your intent to cancel your policy. Include relevant details such as your policy number, effective date of cancellation, and the reason for the cancellation.

- Proof of New Coverage: Provide your current insurance provider with proof of your new insurance coverage. This can be in the form of a declarations page from your new insurer, which outlines the details of your new policy.

- Request Confirmation: Ask for written confirmation from your current insurance provider that your policy will be cancelled as requested. This will serve as proof that you have properly notified them and that your coverage will end as of the specified date.

- Arrange Refund: If you have prepaid your insurance premium for the year, inquire about any potential refund for the unused portion of your premium. Discuss the refund process and ensure that it will be issued promptly.

- Keep Documentation: Keep copies of all correspondence, including cancellation letters, proof of new coverage, and any confirmation and refund information. This documentation will be valuable for reference and record-keeping purposes.

Notify your current insurance provider well in advance of your policy’s expiration or renewal date. This will give them sufficient time to process the cancellation and make the necessary adjustments to your account.

Remember, if you have an escrow account for your homeowners insurance, you should also notify your mortgage lender of the change in insurance provider. Provide them with the necessary documentation to ensure that the transition is accurately reflected in your escrow account.

By following these steps and effectively communicating with your current insurance provider, you can smoothly cancel your existing policy and facilitate a seamless switch to your new homeowners insurance coverage.

Provide Insurance Information to Your Lender

When changing homeowners insurance with an escrow account, it’s essential to inform your mortgage lender about the switch and provide them with the necessary information regarding your new insurance policy. This step ensures that your lender has accurate and up-to-date insurance information for your property. Here’s what you need to do:

- Contact Your Mortgage Lender: Reach out to your mortgage lender to let them know about the change in your homeowners insurance. This can be done through a phone call or by sending them a formal written notice.

- Provide Insurance Documentation: Furnish your mortgage lender with the necessary documentation related to your new insurance policy. This usually includes a copy of the declarations page, which outlines the details of your coverage, including the insurance provider, policy number, effective dates, and premium amount.

- Update Insurance Contact Information: Verify that your mortgage lender has the correct contact information for your insurance provider. This includes their mailing address, phone number, and any other relevant details. Accurate information is crucial for effective communication and coordination between your lender and insurance provider.

- Confirm Billing Arrangements: Ensure that your mortgage lender is aware of how your new insurance policy will be billed. If you pay the premium directly, inform your lender that you are responsible for making the payments. If your premium will be paid through your escrow account, confirm the details with your lender.

- Coordinate Effective Dates: Coordinate with your lender to ensure that the effective dates of your new insurance policy align with your escrow account. This will help prevent any gaps or duplicates in coverage and ensure that your lender has accurate information for disbursing funds.

- Keep Records: Maintain copies of all communication and documentation exchanged with your mortgage lender. This will serve as evidence that you have provided the required information and can be useful for reference in the future.

Open and clear communication with your mortgage lender is crucial when changing homeowners insurance with an escrow account. By providing them with the necessary insurance information and coordinating the details, you can ensure that your escrow account is updated accurately and that your lender has the correct information for future insurance payments.

Update Your Escrow Account Information

Updating your escrow account information is an important step when changing homeowners insurance with an escrow account. This ensures that your mortgage lender has accurate and up-to-date information regarding your new insurance policy and can properly disburse funds for insurance payments. Here’s what you need to do:

- Contact Your Mortgage Servicer: Reach out to your mortgage servicer, who manages your escrow account, to inform them about the change in your homeowners insurance. This can be done through a phone call or by sending them a formal written notice.

- Provide Insurance Documentation: Furnish your mortgage servicer with the necessary documentation related to your new insurance policy. This typically includes a copy of the declarations page from your new insurer, which outlines the details of your coverage and confirms the insurance provider, policy number, effective dates, and premium amount.

- Update Insurance Contact Information: Verify that your mortgage servicer has accurate contact information for your insurance provider. This includes their mailing address, phone number, and any other relevant details. Accurate information is crucial for effective communication between your mortgage servicer and insurance provider.

- Confirm Premium Amount: Ensure that your mortgage servicer has the correct premium amount for your new insurance policy. This will allow them to adjust the escrow portion of your monthly mortgage payment accordingly and prevent any discrepancies in payment amounts.

- Coordinate Effective Dates: Coordinate with your mortgage servicer to align the effective dates of your new insurance policy with your escrow account. This will ensure a seamless transition between your old and new insurance policies and avoid any gaps or overlaps in coverage.

- Review Escrow Analysis: After the updates have been made, review the next escrow analysis statement provided by your mortgage servicer. This statement will show the adjusted escrow payment amount based on your new insurance policy. Confirm that the adjustments have been made correctly.

- Monitor Future Statements: Continually monitor your escrow account statements to ensure that the correct amount is being deposited into your account for insurance payments. Contact your mortgage servicer promptly if you notice any discrepancies or errors.

Keeping your escrow account information updated is crucial to ensure that your insurance payments are made on time and accurately. By notifying your mortgage servicer, providing them with the necessary documentation, and reviewing your escrow statements, you can ensure that your escrow account reflects the correct information related to your new homeowners insurance policy.

Monitor the Transition Process

After you have taken all the necessary steps to change homeowners insurance with an escrow account, it’s important to monitor the transition process to ensure everything goes smoothly. By staying proactive and attentive, you can address any potential issues or concerns that may arise. Here’s what you should do:

- Confirm Cancellation of Previous Policy: Follow up with your previous insurance provider to confirm that your old policy has been cancelled as requested. Obtain written confirmation or a cancellation notice to keep for your records. This will serve as proof that your previous policy is no longer in effect.

- Verify Activation of New Policy: Contact your new insurance provider to verify that your new policy is active and in effect. Confirm the coverage details, effective dates, and premium payment arrangements. Keep a copy of your new policy documents for your records.

- Check Escrow Account Updates: Review your escrow account statements or online portal to ensure that the updates to your insurance information have been accurately reflected. Verify that the correct insurance provider, policy number, and premium amount are listed. Contact your mortgage lender or servicer if you notice any discrepancies.

- Monitor Premium Payments: Keep an eye on your mortgage statements to ensure that the correct amount is being deducted for your homeowners insurance premium from your escrow account. If there are any discrepancies or issues, promptly contact your mortgage lender or servicer to address the situation.

- Stay in Communication: Maintain open communication with both your new insurance provider and your mortgage lender or servicer. Notify them of any changes in your contact information or circumstances that may affect your insurance coverage or escrow account. This will facilitate smooth communication and prevent any lapses or misunderstandings.

- Address Concerns Promptly: If you encounter any issues or concerns during the transition process, such as delayed premium payments or incorrect information on your escrow account, address them promptly. Contact your mortgage lender or insurance provider to seek clarification and resolution.

- Follow Up on Outstanding Tasks: Keep track of any outstanding tasks or follow-up actions required, such as providing additional documentation or updating information. Ensure that you complete these tasks in a timely manner to avoid any disruptions in your insurance coverage or escrow account management.

By actively monitoring the transition process and taking proactive steps, you can ensure that the changes to your homeowners insurance policy and escrow account are successfully implemented. Regular monitoring allows you to address any potential issues and maintain a seamless and uninterrupted insurance coverage for your home.

Conclusion

Changing homeowners insurance with an escrow account may seem like a complex process, but by following the necessary steps and staying proactive, you can successfully navigate the transition. Reviewing your current insurance policy, researching and comparing insurance providers, obtaining quotes, and selecting the best policy for your needs are essential tasks. It’s important to notify your current insurance provider and mortgage lender of the changes, providing them with the necessary documentation and updated insurance information.

Throughout the process, monitoring the transition is crucial to ensure a smooth and seamless experience. By verifying the cancellation of your previous policy, confirming the activation of the new policy, checking your escrow account updates, and monitoring premium payments, you can address any issues or discrepancies that may arise swiftly.

Remember to maintain open communication with both your insurance provider and mortgage lender or servicer, keeping them informed of any changes, concerns, or updates that may affect your coverage or escrow account. By staying vigilant and addressing any outstanding tasks promptly, you can ensure a successful transition to your new homeowners insurance policy.

Changing homeowners insurance with an escrow account is an important decision that should not be taken lightly. By understanding the process and following the steps outlined in this article, you can make informed decisions, secure the best coverage for your needs, and ensure that your insurance and escrow accounts are properly managed.

Always consult with your insurance provider, mortgage lender, or a qualified professional for specific guidance and advice tailored to your unique circumstances. By doing so, you can navigate the transition smoothly and protect your most valuable asset, your home.