Finance

How Do I Enter Cryptocurrency In Turbotax

Published: October 5, 2023

Learn how to enter cryptocurrency transactions in TurboTax easily with our step-by-step guide. Manage your finance and ensure accurate reporting for tax purposes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Installing TurboTax

- Step 2: Setting Up Your TurboTax Account

- Step 3: Navigating to the Cryptocurrency Section

- Step 4: Entering Cryptocurrency Income

- Step 5: Reporting Cryptocurrency Sales

- Step 6: Deducting Cryptocurrency Losses

- Step 7: Reporting Cryptocurrency Mining

- Step 8: Completing Your Cryptocurrency Tax Return

- Conclusion

Introduction

Welcome to the world of cryptocurrency! As digital currencies gain popularity and acceptance, it’s essential to understand how to accurately report and enter your cryptocurrency transactions for tax purposes. In this article, we will guide you through the process of entering cryptocurrency in TurboTax, the popular tax preparation software.

TurboTax provides a user-friendly and intuitive interface that simplifies the process of filing your taxes, including reporting your cryptocurrency earnings and investments. By following the steps outlined in this article, you’ll be able to navigate TurboTax’s cryptocurrency section with confidence and accurately report your earnings.

It’s important to note that the Internal Revenue Service (IRS) considers cryptocurrency as property instead of currency, meaning it is subject to capital gains tax. Whether you buy, sell, exchange, or mine cryptocurrencies, each transaction may have tax implications. Therefore, it’s crucial to report your cryptocurrency activities correctly to comply with tax regulations and avoid potential penalties.

Before getting started, make sure you have gathered all necessary documentation relating to your cryptocurrency transactions. This includes records of purchases, sales, exchanges, mining income, and any relevant expenses or losses. By having this information readily available, you’ll be able to enter your cryptocurrency details accurately in TurboTax and maximize your deductions or minimize your tax liability.

In the following sections, we will walk you through the process of entering various types of cryptocurrency activities in TurboTax. From reporting cryptocurrency income and sales to deducting losses and mining income, we’ve got you covered. So let’s dive in and learn how to enter cryptocurrency in TurboTax!

Step 1: Installing TurboTax

The first step in entering cryptocurrency in TurboTax is to install the software. TurboTax offers different versions, including online and desktop versions, to cater to your preferences and filing needs. Here’s how you can install TurboTax:

- Visit the TurboTax website and select the version that suits your needs. You can choose between the online version or the desktop version, which you can install on your computer.

- Follow the prompts to download and install TurboTax.

- If you have selected the online version, you will be prompted to create an account or sign in if you already have one. If you have chosen the desktop version, you will need to enter your license key to activate the software.

- Once you have successfully installed TurboTax, you can launch the software either from your desktop or by logging into your TurboTax account online.

Remember to check the system requirements before installing TurboTax to ensure compatibility with your device. It’s also recommended to keep your TurboTax software up to date to benefit from the latest features and tax law changes.

Now that you have installed TurboTax, you’re ready to move on to the next step: setting up your TurboTax account and preparing to enter your cryptocurrency transactions. Stay tuned!

Step 2: Setting Up Your TurboTax Account

Now that you have installed TurboTax, it’s time to set up your account. Setting up your TurboTax account allows you to save and securely access your tax information, track your progress, and easily file your taxes. Follow these steps to create and set up your TurboTax account:

- If you haven’t done so already, launch TurboTax from your desktop or log into your TurboTax account online.

- If you’re a new user, click on the “Create Account” or a similar option to start the account setup process. If you’re a returning user, sign in using your credentials.

- Provide the required information, such as your name, email address, and password, to create your TurboTax account.

- After successfully creating your account, TurboTax may ask you additional questions to tailor the software to your individual tax situation and maximize your deductions. Answer these questions accurately to ensure that TurboTax provides you with the most relevant information and guidance.

- Once your account is set up, TurboTax may prompt you to choose your filing status, such as single, married filing jointly, or head of household. Select the option that applies to your situation.

- You may also be asked to provide basic personal information, such as your Social Security number, date of birth, and address. Enter this information carefully and accurately.

- Review the terms and conditions, privacy policy, and any other legal agreements before proceeding. If you agree, click “Accept” or a similar button to confirm your acceptance.

Now that your TurboTax account is set up, you are ready to start entering your cryptocurrency transactions. In the next step, we will guide you through navigating to the cryptocurrency section in TurboTax. Continue reading to learn more!

Step 3: Navigating to the Cryptocurrency Section

Once you have set up your TurboTax account, it’s time to navigate to the cryptocurrency section. TurboTax makes it easy to find the specific section dedicated to reporting your cryptocurrency transactions. Here’s how you can access the cryptocurrency section in TurboTax:

- Launch TurboTax from your desktop or log into your TurboTax account online.

- Once you are logged in, TurboTax will typically ask you a series of questions to determine your tax situation. Answer these questions accurately, as they will help TurboTax identify whether you have engaged in any cryptocurrency activities.

- If TurboTax detects cryptocurrency transactions or activities on your account, it will automatically direct you to the cryptocurrency section. Look for a specific section titled “Cryptocurrency” or “Virtual Currency” in the navigation menu.

- If TurboTax does not lead you directly to the cryptocurrency section, you can manually navigate to it by selecting the “Federal Taxes” or a similar option from the main menu. Then, look for a subsection related to “Investment Income” or “Investment Sales.”

- Within the Investment Income or Investment Sales section, you should find a subsection specifically addressing cryptocurrency transactions. Click on the appropriate option to enter the cryptocurrency section.

Once you have successfully accessed the cryptocurrency section in TurboTax, you are ready to start entering your cryptocurrency income, sales, and other relevant information. In the next step, we will guide you through the process of entering cryptocurrency income in TurboTax. Keep reading to learn more!

Step 4: Entering Cryptocurrency Income

Now that you have navigated to the cryptocurrency section in TurboTax, it’s time to enter your cryptocurrency income. This includes any earnings you have received from activities such as mining, staking, or receiving cryptocurrencies as payment. Follow these steps to accurately report your cryptocurrency income:

- In the cryptocurrency section, look for an option to report income or earnings. It might be labelled as “Enter Cryptocurrency Income” or something similar.

- Click on the designated option to start entering your cryptocurrency income.

- TurboTax will likely provide you with different categories to choose from. Select the appropriate category that matches your cryptocurrency income source, such as mining or staking.

- Enter the necessary details about your cryptocurrency income. This may include the amount earned, the date of receipt, and any associated expenses.

- If TurboTax offers the option to import cryptocurrency income data from popular exchanges or wallet providers, consider using this feature to streamline the process. Ensure that the imported information is accurate and matches your actual earnings.

- Continue following the prompts and enter any additional information required to complete the reporting of your cryptocurrency income.

- Review your entries for accuracy before moving on to the next step.

It’s important to note that if you have received any cryptocurrency as payment for goods or services, you also need to report the fair market value of the cryptocurrency at the time of the transaction. TurboTax may provide you with an option to calculate this value based on historical prices or market data.

By accurately reporting your cryptocurrency income, you are ensuring compliance with tax regulations and avoiding potential penalties. In the next step, we will guide you through reporting cryptocurrency sales in TurboTax. Stay tuned!

Step 5: Reporting Cryptocurrency Sales

Now that you have entered your cryptocurrency income in TurboTax, it’s time to report any cryptocurrency sales you have made. This includes selling, exchanging, or disposing of your cryptocurrencies for fiat currency or other digital assets. Here’s how you can accurately report your cryptocurrency sales in TurboTax:

- In the cryptocurrency section of TurboTax, look for an option to report sales or exchanges. It may be labelled as “Enter Cryptocurrency Sales” or something similar.

- Click on the designated option to start entering your cryptocurrency sales.

- Specify the type of transaction you made, such as selling, exchanging, or gifting your cryptocurrency.

- Enter the details of each individual transaction, including the date of the sale, the amount of cryptocurrency sold, and any associated fees or expenses.

- If you have multiple transactions to report, TurboTax may provide you with the option to import transaction data from popular exchanges or wallet providers. Utilize this feature to simplify the reporting process.

- Consider using specific tax identification methods if you sold the same cryptocurrency multiple times during the tax year. TurboTax may offer the option to select between FIFO (First-In, First-Out), LIFO (Last-In, First-Out), or specific identification methods.

- Continue following the prompts and enter any additional information required to complete the reporting of your cryptocurrency sales.

- Review your entries for accuracy before proceeding to the next step.

Remember to include all taxable events related to your cryptocurrency sales, such as trading one cryptocurrency for another or using cryptocurrency to purchase goods or services. Each transaction may have tax consequences, and accurately reporting your cryptocurrency sales will help ensure compliance with tax regulations.

In the next step, we will guide you through deducting cryptocurrency losses in TurboTax. Keep reading to learn more!

Step 6: Deducting Cryptocurrency Losses

If you have experienced losses from your cryptocurrency investments, you may be eligible to deduct them from your overall tax liability. Deducting cryptocurrency losses can help offset your taxable income and potentially lower your tax bill. Here’s how you can deduct cryptocurrency losses in TurboTax:

- In the cryptocurrency section of TurboTax, look for an option to report losses or deductions. It may be labelled as “Deduct Cryptocurrency Losses” or something similar.

- Click on the designated option to start entering your cryptocurrency losses.

- Indicate the type of loss you incurred, such as capital loss or business loss, depending on your specific situation.

- Enter the necessary details of each individual loss, including the date of the loss, the amount of cryptocurrency involved, and any associated expenses.

- If you have multiple losses to report, TurboTax may provide you with the option to import loss data from popular exchanges or wallet providers. Utilize this feature to streamline the process.

- Follow the prompts to enter additional information, such as the cost basis of the cryptocurrency and any other relevant details.

- Review your entries for accuracy before proceeding to the next step.

It’s important to note that there are specific rules and limitations regarding the deduction of cryptocurrency losses. Consult with a tax professional or refer to IRS guidelines to ensure you are deducting losses appropriately.

By deducting your cryptocurrency losses, you can potentially mitigate the impact of those losses on your overall tax liability. In the next step, we will guide you through reporting cryptocurrency mining in TurboTax. Keep reading to learn more!

Step 7: Reporting Cryptocurrency Mining

If you have been involved in cryptocurrency mining activities, it’s important to report your mining income accurately in TurboTax. Cryptocurrency mining involves using specialized hardware to solve complex mathematical problems, which validates and adds transactions to the blockchain. Here’s how you can report cryptocurrency mining in TurboTax:

- In the cryptocurrency section of TurboTax, look for an option to report mining income or activities. It may be labelled as “Enter Cryptocurrency Mining” or something similar.

- Click on the designated option to start entering your cryptocurrency mining details.

- Provide the necessary information about your mining activities, such as the type of cryptocurrency mined, the date of mining, and the amount of cryptocurrency earned.

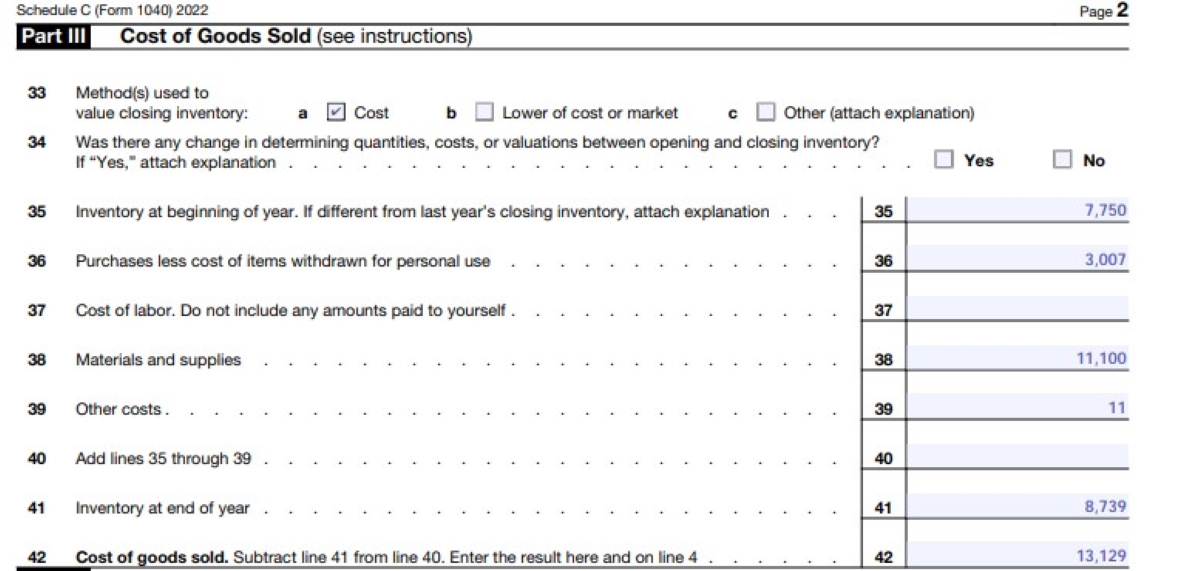

- If applicable, enter any associated expenses or additional details related to your mining operations. This could include costs for electricity, mining pools, hardware purchases, and operational expenses.

- Consider using the option to import mining income data from specialized mining software or platforms. This will help streamline the process and ensure accurate reporting.

- Follow the prompts in TurboTax to provide any additional information that may be required for reporting cryptocurrency mining income.

- Review your entries for accuracy before proceeding to the next step.

Keep in mind that cryptocurrency mining income is subject to both income tax and self-employment tax. Make sure to consult with a tax professional or refer to IRS guidelines to ensure compliance with tax regulations and to claim any eligible deductions or credits related to your mining activities.

In the next step, we will guide you through completing your cryptocurrency tax return in TurboTax. Read on to learn more!

Step 8: Completing Your Cryptocurrency Tax Return

After entering all your cryptocurrency activities in TurboTax, it’s time to complete your cryptocurrency tax return. This final step ensures that all your cryptocurrency income, sales, losses, and mining activities are accurately reported. Follow these steps to complete your cryptocurrency tax return in TurboTax:

- Review all the information you have entered for accuracy. Double-check that you have included all relevant transactions and details, such as income, sales, losses, and mining activities.

- Take advantage of TurboTax’s error-checking mechanisms to identify any potential issues or discrepancies. TurboTax will alert you to any missing information, potential errors or inconsistencies in your entries.

- Ensure that you have accounted for all taxable events related to your cryptocurrency activities, including trading one cryptocurrency for another or using cryptocurrency for purchases.

- Review any applicable deductions or credits related to your cryptocurrency activities. TurboTax may offer options to claim deductions or credits for things like mining expenses or charitable contributions made with cryptocurrency.

- Carefully review your cryptocurrency tax summary and any tax calculations generated by TurboTax. Pay attention to your tax liability, any refund due, or any amount owed to the IRS.

- If you are satisfied with the accuracy of your tax return, proceed to file your return electronically using the e-filing option provided by TurboTax. Alternatively, if you prefer to file a paper return, TurboTax can generate the necessary forms for you to print and mail.

- After filing your tax return, make sure to keep a copy of your filed return and any supporting documentation related to your cryptocurrency activities for future reference.

Completing your cryptocurrency tax return accurately and on time is crucial for complying with tax regulations. TurboTax provides a step-by-step approach to help you navigate the complexities of reporting cryptocurrency activities while maximizing deductions and minimizing your tax liability.

As tax regulations pertaining to cryptocurrencies are constantly evolving, it’s essential to stay updated and consult with a tax professional to ensure compliance with current tax laws.

Congratulations! You have now successfully completed your cryptocurrency tax return using TurboTax.

Thank you for following this guide. Happy filing!

Conclusion

Entering cryptocurrency in TurboTax may seem daunting at first, but with the right guidance, you can accurately report your cryptocurrency transactions and ensure compliance with tax regulations. TurboTax makes the process straightforward, providing a user-friendly interface and step-by-step instructions.

In this article, we walked you through the process of entering cryptocurrency in TurboTax, from installing the software to completing your tax return. We covered important steps such as setting up your TurboTax account, navigating to the cryptocurrency section, and reporting various cryptocurrency activities, including income, sales, losses, and mining.

By following the steps outlined in this guide, you can enter your cryptocurrency transactions with confidence and ensure that all taxable events are properly reported. It’s important to note that tax regulations pertaining to cryptocurrencies can be complex and subject to change. Therefore, it is always a good idea to consult with a tax professional or stay updated on IRS guidelines to ensure compliance.

Remember to keep proper documentation of your cryptocurrency transactions, including records of purchases, sales, exchanges, mining income, and any associated expenses or losses. This documentation will be essential in case of an audit or if you need to refer back to your cryptocurrency activities in the future.

By accurately reporting your cryptocurrency transactions, you not only fulfill your tax obligations but also contribute to the transparency and legitimacy of the cryptocurrency industry as a whole. It’s important for individuals in the cryptocurrency space to be responsible taxpayers and help shape the future of regulation and acceptance.

We hope this guide has been helpful in navigating the process of entering cryptocurrency in TurboTax. By following the steps outlined here, you can confidently file your taxes and ensure compliance with tax regulations.

Remember, if you have any specific questions or concerns about your individual tax situation, it’s best to consult with a qualified tax professional who can provide personalized advice based on your unique circumstances.

Thank you for reading, and best of luck with your cryptocurrency tax filing!