Home>Finance>Where Do I Enter Cryptocurrency In Turbotax Desktop

Finance

Where Do I Enter Cryptocurrency In Turbotax Desktop

Published: October 5, 2023

Easily enter your cryptocurrency transactions in TurboTax Desktop with our step-by-step guide. Simplify your finances and maximize your tax deductions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Cryptocurrency has become a popular investment option in recent years, with digital currencies like Bitcoin and Ethereum gaining traction among investors. As the popularity of cryptocurrencies continues to grow, so does the need for accurate and efficient tax reporting. If you have invested in or traded cryptocurrencies, it is important to properly report your transactions to comply with tax obligations. Fortunately, Turbotax Desktop offers a seamless solution for cryptocurrency tax reporting, simplifying the process for taxpayers.

In this article, we will explore how to enter cryptocurrency transactions in Turbotax Desktop, providing a step-by-step guide to help you accurately report your investments. We will also discuss the benefits of using Turbotax Desktop for cryptocurrency tax reporting, common challenges that may arise, and provide valuable tips for reporting your cryptocurrency transactions.

Understanding how to navigate the complexities of cryptocurrency taxation is crucial to ensure compliance with tax laws and avoid potential penalties. By utilizing the functionalities of Turbotax Desktop, you can streamline the process of reporting your cryptocurrency investments and be confident in the accuracy of your tax return.

So, if you’re wondering where and how to enter cryptocurrency in Turbotax Desktop, we’ve got you covered. Let’s dive into the world of cryptocurrency taxation and discover how Turbotax Desktop can simplify the process for you.

Understanding Cryptocurrency and Taxes

Cryptocurrency is a digital or virtual form of currency that utilizes cryptography for secure financial transactions, control the creation of additional units, and verify the transfer of assets. While it offers many advantages, such as decentralization and anonymity, it also comes with tax implications that must be understood and addressed properly.

The Internal Revenue Service (IRS) in the United States considers cryptocurrency as property, rather than traditional currency. This means that the tax treatment of cryptocurrency transactions is similar to buying or selling stocks, bonds, or other investment properties.

When it comes to taxes, there are specific rules and regulations governing cryptocurrency transactions. The IRS requires individuals to report any capital gains or losses resulting from the sale or exchange of cryptocurrency. Additionally, if you receive cryptocurrency as payment for goods or services, it is also considered as taxable income and must be reported.

To accurately report your cryptocurrency transactions, you need to maintain proper records of all your buys, sells, trades, and any other relevant transactions. These records should include the date and time of each transaction, the value in US dollars at the time of the transaction, and any fees associated with the transactions.

Understanding the tax implications of cryptocurrency is essential to avoid any legal issues and ensure compliance with tax laws. Failing to accurately report your cryptocurrency transactions can result in penalties, audits, and other legal consequences.

Benefits of Using Turbotax Desktop

Turbotax Desktop is a popular tax preparation software that offers numerous benefits for taxpayers, especially when it comes to reporting cryptocurrency transactions. Here are some key advantages of using Turbotax Desktop:

1. User-Friendly Interface:

Turbotax Desktop is designed with a user-friendly interface, making it easy for individuals, even those with limited tax knowledge, to navigate and enter their cryptocurrency transactions. The software provides step-by-step guidance and prompts, ensuring that you don’t miss any critical information.

2. Cryptocurrency Support:

Turbotax Desktop provides comprehensive support for reporting cryptocurrency transactions. It allows you to import your cryptocurrency transactions directly from popular exchanges, saving you time and reducing the risk of errors. The software also supports various types of cryptocurrency, ensuring that you can accurately report transactions involving different digital currencies.

3. Automated Calculations:

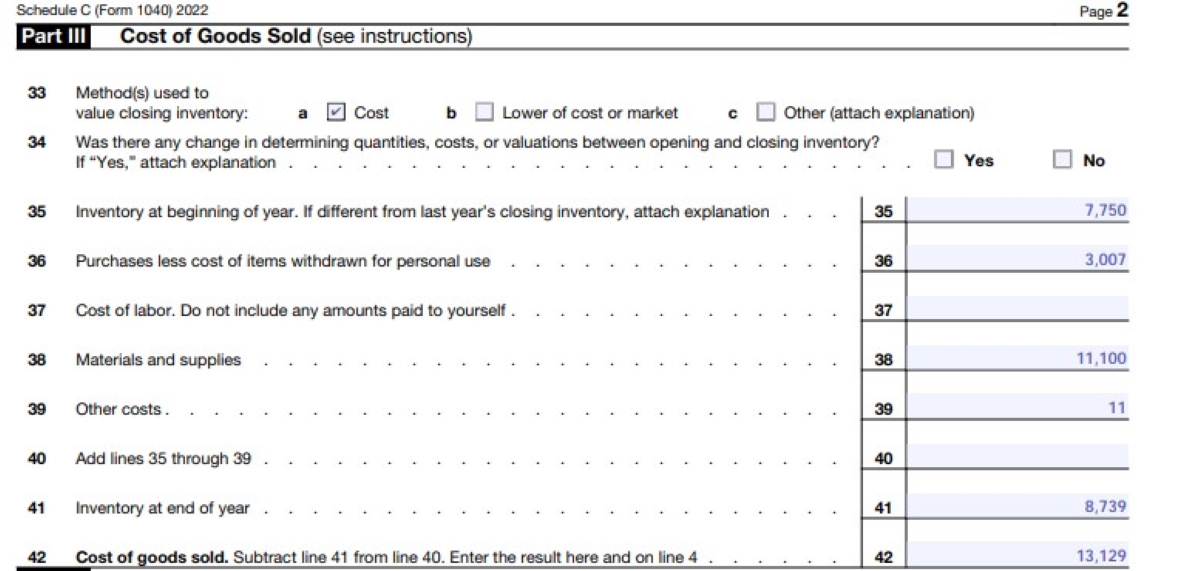

Turbotax Desktop automates the calculations for capital gains or losses on your cryptocurrency investments. By importing your transaction data or entering it manually, the software will automatically calculate the cost basis, capital gains, and losses based on the information provided. This eliminates the need for complex manual calculations and ensures accuracy in your tax reporting.

4. Audit Defense:

Turbotax Desktop offers an optional service called “Audit Defense” that provides assistance in case of an IRS audit. If you face an audit related to your cryptocurrency transactions, the software’s audit defense service will offer guidance, help you understand the audit process, and assist you in preparing the necessary documentation to defend your tax return.

5. Comprehensive Guidance:

Turbotax Desktop provides detailed guidance throughout the tax preparation process. It explains complex tax concepts related to cryptocurrency in simple terms, ensuring that you understand the implications of your transactions and how they should be reported. The software also offers resources and educational materials to help you stay informed about any changes in cryptocurrency tax regulations.

Using Turbotax Desktop can greatly simplify the process of reporting your cryptocurrency transactions. With its user-friendly interface, comprehensive support for cryptocurrency, automated calculations, audit defense services, and detailed guidance, you can confidently navigate the complexities of cryptocurrency taxation and ensure accurate tax reporting.

Step-by-step Guide to Entering Cryptocurrency in Turbotax Desktop

Entering cryptocurrency transactions in Turbotax Desktop may seem daunting at first, but with the following step-by-step guide, you’ll be able to accurately report your investments without hassle:

Step 1: Gather your transaction records

Collect all your transaction records, including buys, sells, trades, and any other relevant cryptocurrency transactions. Make sure you have the date, time, value in US dollars, and any associated fees for each transaction.

Step 2: Open Turbotax Desktop and select “Federal Taxes”

Launch Turbotax Desktop and select the option for “Federal Taxes” to begin the tax preparation process.

Step 3: Enter “Investment Income” section

In the navigation menu, find and select the section related to “Investment Income” or “Stocks, Mutual Funds, Bonds, Other” to enter your cryptocurrency transactions.

Step 4: Select “Cryptocurrency”

Within the “Investment Income” section, you will come across different options. Look for the specific category labeled “Cryptocurrency” or “Virtual Currency” and choose it.

Step 5: Import or enter transaction details

Depending on your preference, you can either import your cryptocurrency transactions directly from popular exchanges or enter the details manually. Turbotax Desktop supports importing transaction data from exchanges such as Coinbase and Binance. If you choose to enter the details manually, follow the prompts and provide the necessary information for each transaction.

Step 6: Review and confirm transaction details

Once you have entered or imported your cryptocurrency transactions, carefully review the details to ensure accuracy. Turbotax Desktop will display a summary of your transactions, including the dates, values, and any associated fees. Double-check this information before moving to the next step.

Step 7: Complete the tax preparation process

Continue navigating through Turbotax Desktop to complete the rest of your tax return. Follow the prompts and provide the required information for other sections, such as income, deductions, and credits. Make sure to review all the entered data before finalizing and filing your tax return.

By following this step-by-step guide, you can easily and accurately enter your cryptocurrency transactions in Turbotax Desktop. Whether you choose to import the transaction data or enter the details manually, ensure that you have all the necessary information and carefully review the accuracy of your entries. With Turbotax Desktop’s user-friendly interface and comprehensive support for cryptocurrencies, reporting your investments has never been easier.

Common Challenges and Troubleshooting

While using Turbotax Desktop to report cryptocurrency transactions offers convenience, there may be some common challenges that you may encounter. Here are a few challenges and troubleshooting tips to help you navigate through them:

1. Importing transaction data:

If you choose to import your cryptocurrency transactions from popular exchanges, you may face issues with the formatting or compatibility of the data. In such cases, double-check that the file format is supported and that the data is correctly formatted. Turbotax Desktop provides resources and support to guide you through this process.

2. Determining cost basis:

Calculating the cost basis for your cryptocurrency transactions can be challenging. Ensure that you have accurate records of the purchase prices and any associated fees. If you are unsure about the cost basis, consult with a tax professional or use online resources provided by Turbotax Desktop to understand how to calculate it correctly.

3. Forks and airdrops:

Forks and airdrops in the cryptocurrency world can present unique challenges when it comes to tax reporting. It is important to properly identify and report any additional digital assets received through forks or airdrops. Familiarize yourself with the specific rules for reporting these types of transactions, and if needed, consult with a tax professional for guidance.

4. Keeping accurate records:

Maintaining accurate and organized records of your cryptocurrency transactions is crucial for tax reporting. In case of an audit or discrepancy, being able to provide the necessary documentation can save you from potential penalties or legal issues. Consider using dedicated cryptocurrency tracking tools or spreadsheets to keep track of your transactions and store any relevant receipts or confirmations.

5. Addressing IRS notices:

If you receive any notices or inquiries from the IRS regarding your cryptocurrency transactions, it is important to address them promptly and accurately. Review the notice carefully and gather any supporting documentation before responding. If you need assistance, Turbotax Desktop’s audit defense service or a tax professional can help you navigate the IRS communication and respond appropriately.

Remember that while Turbotax Desktop simplifies the process of reporting cryptocurrency transactions, it is always advisable to consult with a tax professional or seek additional guidance if you encounter any challenges or uncertainties. The rules and regulations surrounding cryptocurrency taxation are evolving, so staying informed and seeking expert advice can help ensure that you are compliant with the latest requirements.

Tips for Reporting Cryptocurrency Transactions

When it comes to reporting cryptocurrency transactions in Turbotax Desktop, there are several tips and best practices to keep in mind. These tips can help ensure accuracy in your tax reporting and minimize the risk of errors or penalties. Here are some valuable tips to consider:

1. Maintain detailed records:

Keep thorough and organized records of all your cryptocurrency transactions, including buys, sells, trades, and any other relevant activities. Include information such as transaction dates, values in US dollars at the time of the transaction, and any associated fees. Proper record-keeping will make it easier to report your transactions accurately and provide documentation if needed.

2. Understand your tax obligations:

Take the time to understand the specific tax obligations related to your cryptocurrency transactions. Familiarize yourself with the rules and regulations governing cryptocurrency taxation, including reporting capital gains or losses, income from mining or staking, and any other taxable events. Consult IRS guidelines or seek professional advice to ensure compliance.

3. Use cryptocurrency tax software:

Consider utilizing specialized cryptocurrency tax software to help automate the process of calculating capital gains and losses. These tools can integrate with Turbotax Desktop and streamline the reporting of your transactions, reducing the risk of errors and saving you time and effort. Research and choose reputable software that aligns with your needs.

4. Take advantage of educational resources:

Turbotax Desktop provides educational resources to help you understand cryptocurrency tax reporting better. Take advantage of these resources, which include articles, FAQs, and guides, to stay informed about the latest tax regulations and reporting requirements. The more you know, the better equipped you will be to accurately report your cryptocurrency transactions.

5. Consult with a tax professional:

If you are unsure about any aspect of reporting your cryptocurrency transactions, it is advisable to consult with a tax professional who is experienced in cryptocurrency taxation. A tax professional can provide personalized guidance based on your specific situation and ensure that you comply with all tax laws and regulations.

6. Review your return before filing:

Before finalizing and submitting your tax return, take the time to review all the information you have entered. Check for accuracy and ensure that you have reported all your cryptocurrency transactions correctly. Reviewing your return can help catch any errors or omissions and give you peace of mind when filing.

Following these tips can help you navigate the complexities of reporting cryptocurrency transactions and ensure accurate tax reporting. By maintaining detailed records, understanding your tax obligations, using cryptocurrency tax software, leveraging educational resources, consulting with professionals when needed, and thoroughly reviewing your return, you can confidently report your cryptocurrency transactions in Turbotax Desktop.

Conclusion

Reporting cryptocurrency transactions for tax purposes can be a complex and challenging task. However, with the help of Turbotax Desktop, the process becomes much more straightforward and efficient. The user-friendly interface, comprehensive support for cryptocurrencies, automated calculations, and detailed guidance make Turbotax Desktop a valuable tool for accurately reporting your cryptocurrency investments.

Throughout this article, we have explored the importance of understanding cryptocurrency taxation, the benefits of using Turbotax Desktop, a step-by-step guide to entering cryptocurrency transactions, common challenges, troubleshooting tips, and essential tips for reporting cryptocurrency transactions. By following these guidelines, you can ensure compliance with tax obligations, minimize the risk of errors or penalties, and confidently report your cryptocurrency transactions.

It is important to note that the field of cryptocurrency taxation is constantly evolving, and it is essential to stay informed about any changes or updates in tax regulations. Turbotax Desktop provides educational resources and keeps up with these changes to help you stay informed and navigate the intricacies of reporting cryptocurrency transactions.

Remember, maintaining accurate records, understanding your tax obligations, using specialized software, seeking professional advice when needed, and reviewing your return before filing are all key components of properly reporting your cryptocurrency transactions.

By leveraging the capabilities of Turbotax Desktop and following the tips outlined in this article, you can confidently and efficiently report your cryptocurrency transactions, ensuring compliance with tax laws and avoiding any potential issues with the IRS. So, take control of your cryptocurrency tax reporting journey and make the most of the resources available to you.

Disclaimer: This article is for informational purposes only and should not be considered as financial or tax advice. It is recommended to consult with a qualified professional for personalized guidance regarding your specific financial and tax situation.