Home>Finance>How Does Selling Shares On The Stock Exchange Benefit Companies?

Finance

How Does Selling Shares On The Stock Exchange Benefit Companies?

Published: January 17, 2024

Discover how selling shares on the stock exchange benefits companies in the world of finance. Explore the advantages and growth opportunities it offers.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

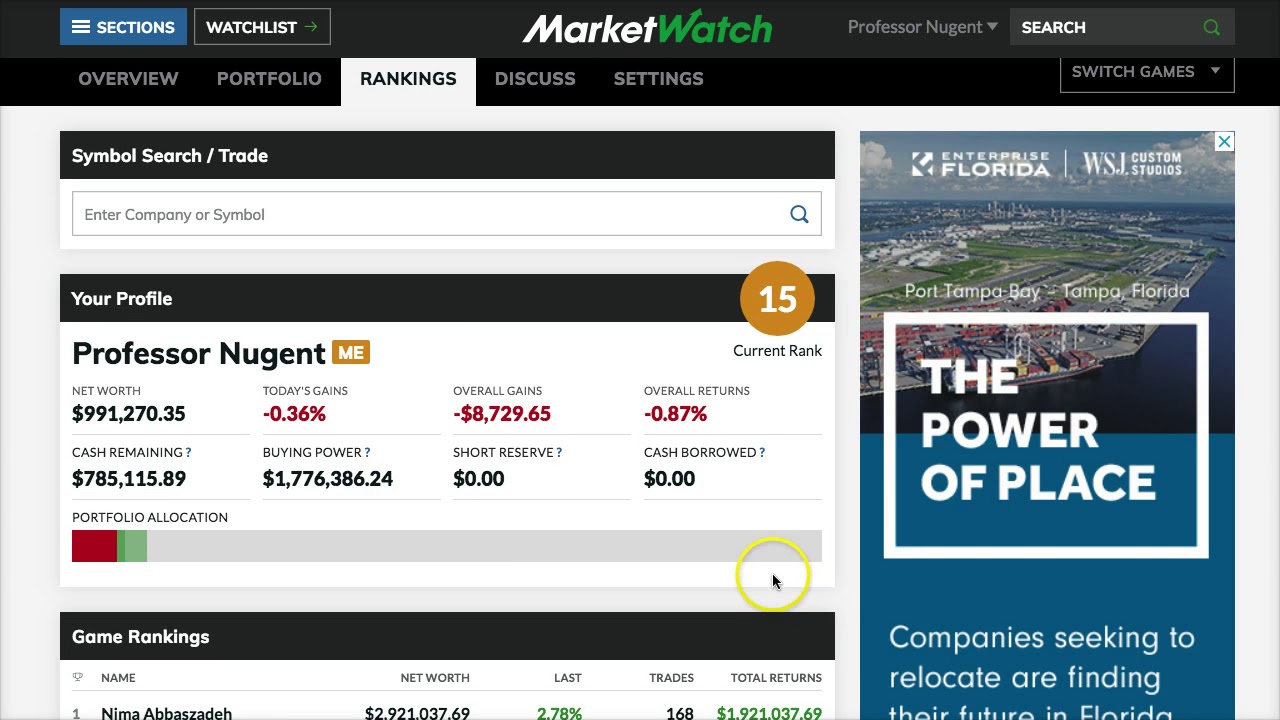

When it comes to raising capital and expanding their business, companies have several options at their disposal. One popular method is selling shares on the stock exchange. This allows companies to offer ownership rights to interested investors in exchange for capital infusion. By doing so, companies can access a wide pool of potential investors and leverage the benefits that come with being listed on a public stock exchange.

Stock exchanges serve as platforms where buyers and sellers can trade shares of publicly listed companies. These exchanges provide a marketplace that facilitates the buying and selling of stocks, enabling companies to raise funds and investors to reap financial rewards. The process of selling shares on a stock exchange offers several advantages to companies looking for growth and financial stability.

In this article, we will explore the various ways in which selling shares on the stock exchange benefits companies. From increased capital and funding options to improved liquidity and access to partnerships, listing on the stock exchange can provide companies with a significant competitive edge in the market.

Increased Capital and Funding Options

One of the primary benefits of selling shares on the stock exchange is the ability to raise capital. By offering shares to investors, companies can generate significant funds that can be used for various purposes. This infusion of capital opens up a world of possibilities for companies, allowing them to invest in research and development, expand their operations, and pursue new business opportunities.

When a company decides to go public and sell shares on the stock exchange, it gains access to a large pool of potential investors. This includes institutional investors, such as pension funds and mutual funds, as well as individual investors who are looking to grow their wealth. These investors are willing to purchase shares of the company in exchange for a stake in its ownership, providing the company with the necessary funds to fuel its growth.

Furthermore, selling shares on the stock exchange provides companies with the opportunity for additional funding options. Once a company is listed on the exchange, it can issue additional shares in the future, offering current shareholders the chance to increase their investment or attracting new investors to participate. This ability to issue additional shares not only allows the company to raise more capital but also helps in diversifying its ownership base.

In addition to traditional equity funding, being listed on the stock exchange can also open doors to other fundraising options. Companies can issue bonds or other debt securities, leveraging their listed status to access debt capital markets. This gives them a broader range of funding sources and can be particularly advantageous during times of economic volatility or when specific projects require financing.

Overall, by selling shares on the stock exchange, companies can significantly increase their capital and funding options. This influx of funds can be instrumental in fueling growth, achieving strategic objectives, and increasing shareholder value.

Liquidity for Shareholders

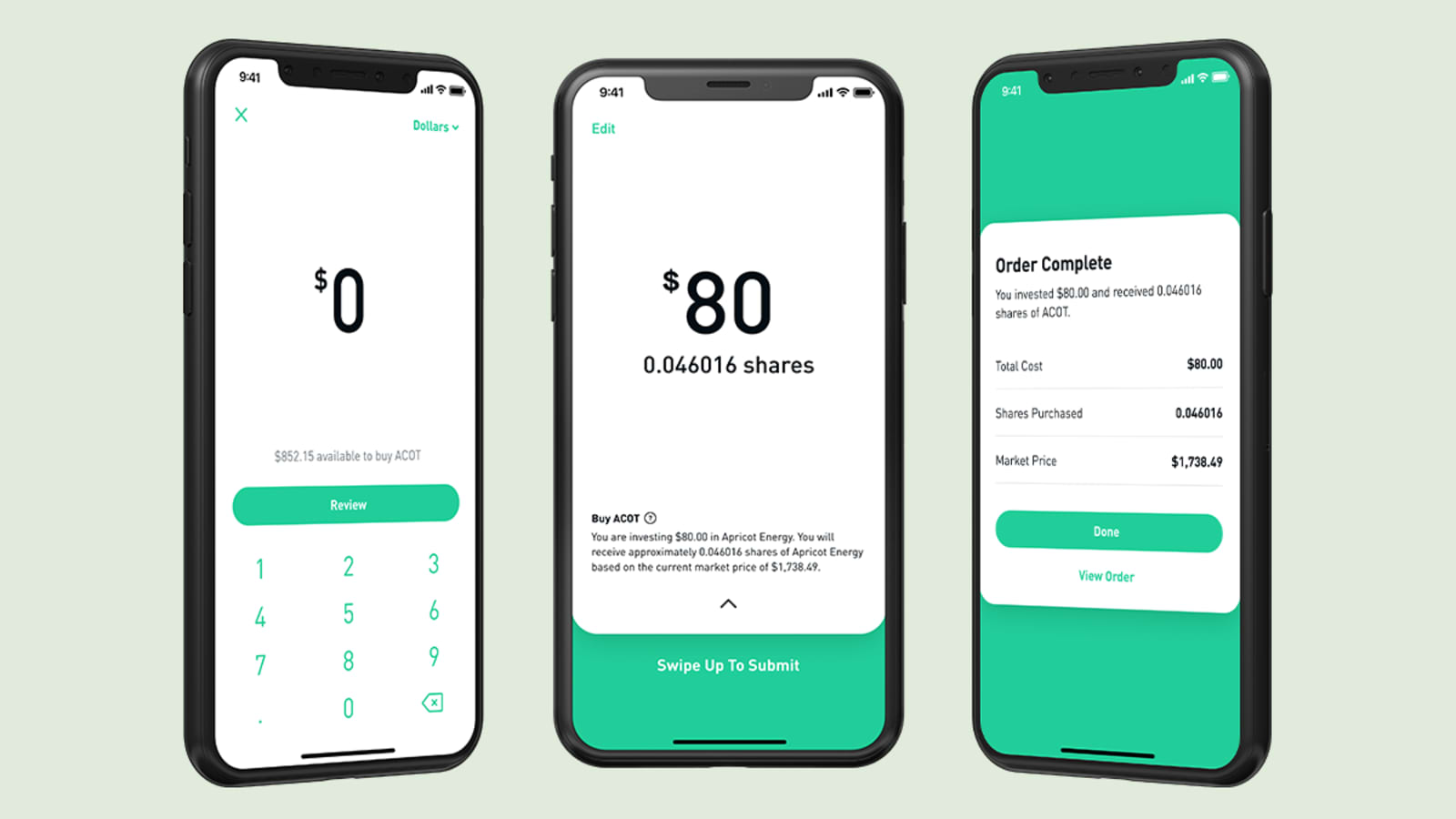

Another major benefit that comes with selling shares on the stock exchange is the enhanced liquidity it provides for shareholders. When a company is listed on the exchange, its shares can be freely bought and sold by investors, creating a liquid market for the company’s stock.

Liquidity refers to the ease with which an asset, in this case, shares of a company, can be converted into cash without causing a significant impact on its price. By offering shares on the stock exchange, companies enable their shareholders to easily sell their holdings if they need cash or wish to exit their investment. This liquidity allows shareholders to have greater control over their investment and provides them with the flexibility to respond to changing financial circumstances.

In contrast, if a company remains privately held, it can often be difficult for shareholders to find buyers for their shares. This lack of liquidity can result in shareholders being stuck with their investment and having limited options to realize its value. By listing on the stock exchange, companies alleviate this issue and provide an avenue for shareholders to easily monetize their holdings.

The enhanced liquidity also attracts a broader range of investors. When shares are publicly traded, institutional investors, retail investors, and even market makers can participate in buying and selling activities. This diversity of participants increases market depth and stability, ensuring a fair and efficient pricing mechanism for the company’s shares.

Moreover, the liquidity provided by the stock exchange can have positive implications for the company itself. The ability for shareholders to easily buy and sell shares can lead to increased demand, which can drive the stock price higher. A higher stock price not only benefits existing shareholders but also enhances the company’s reputation and valuation in the market.

Overall, by selling shares on the stock exchange, companies provide liquidity to their shareholders, allowing them to easily buy and sell their holdings. This liquidity not only benefits the investors themselves but also attracts a wider range of participants and contributes to the overall stability and growth of the company.

Enhanced Company Visibility and Prestige

Listing shares on the stock exchange provides companies with a significant boost in visibility and prestige. By becoming a public company, a company’s name, brand, and financial performance are exposed to a wide audience of investors, analysts, and the general public. This increased visibility can have numerous benefits for the company.

Firstly, being listed on the stock exchange enhances a company’s credibility and reputation. When a company goes through the rigorous process of meeting the listing requirements and becomes a public entity, it demonstrates to investors and stakeholders that it has met certain financial and regulatory standards. This perception of credibility can attract new investors and strengthen relationships with existing stakeholders, such as suppliers, customers, and partners.

Secondly, being listed on the stock exchange provides a platform for companies to showcase their financial performance and growth potential. The regular reporting requirements imposed by the exchange, such as quarterly financial statements and annual reports, provide transparency and accountability. This allows investors and analysts to assess the company’s performance and make informed investment decisions. The visibility provided by the stock exchange can help the company attract a broader investor base and potentially lead to increased liquidity and demand for its shares.

Furthermore, the stock exchange acts as a marketing channel for companies. Being listed on a recognized exchange provides opportunities for media coverage, analyst research, and increased exposure to potential investors. This increased visibility can help the company attract attention from institutional investors, who may have specific investment mandates and criteria that require companies to be listed on reputable exchanges.

Additionally, the prestige associated with being listed on the stock exchange can enhance a company’s image and attractiveness to various stakeholders. It can drive customer confidence, as being a publicly traded company signifies stability and long-term commitment. It can also attract top talent, as employees may be drawn to the potential for employee stock ownership plans and the opportunity to work for a well-known and respected company.

Overall, selling shares on the stock exchange elevates a company’s visibility, credibility, and prestige. It provides a platform for financial transparency, opens doors to media coverage and investor attention, and can enhance the company’s reputation in the market.

Opportunities for Growth and Expansion

Listing shares on the stock exchange creates opportunities for companies to fuel their growth and expand their operations. By accessing the public market, companies can raise funds to invest in new projects, technologies, and markets.

One major advantage of going public is the increased access to capital. Companies can use the funds raised through share offerings to finance various growth initiatives, such as expanding their production capacity, launching new products or services, or entering new markets. This infusion of capital can provide the company with the necessary resources to seize growth opportunities and gain a competitive edge.

Moreover, being a publicly traded company can attract the attention of institutional investors, who often seek long-term investment opportunities in growing companies. These investors may bring not only financial resources but also strategic guidance and industry expertise to help the company navigate expansion plans and make informed decisions.

Listing on the stock exchange can also enhance a company’s ability to attract partnerships and collaborations. Publicly traded companies often have increased visibility and credibility, making them more appealing to potential business partners. Strategic alliances or joint ventures can enable companies to access new markets, leverage complementary strengths, and drive innovation. Such partnerships can provide avenues for growth and expansion that may not have been possible as a private entity.

Furthermore, the share price of a publicly traded company can serve as a currency for acquisitions. By having a liquid and tradable stock, companies can pursue growth through mergers and acquisitions. This ability to use stock as a form of payment can offer attractive opportunities to combine forces with other companies, access new technologies or intellectual property, and expand into new business areas.

Last but not least, being listed on the stock exchange can help attract research coverage and analyst attention. Analysts closely monitor publicly traded companies, producing research reports, and providing insights into the company’s financial performance and growth prospects. This coverage can attract investor interest, increase the company’s visibility, and potentially result in higher demand and a higher stock price.

In summary, selling shares on the stock exchange provides companies with opportunities for growth and expansion. The ability to access capital, attract institutional investors, form strategic partnerships, and use stock as a currency for acquisitions can significantly accelerate a company’s growth trajectory and unlock new possibilities.

Improving Financial Performance

Listing shares on the stock exchange can have a positive impact on a company’s financial performance. The process of going public and being subject to the regulatory requirements of the exchange can promote financial discipline, transparency, and accountability.

Firstly, the transparency requirements of the stock exchange can lead to better financial management practices. Companies that are publicly traded are obligated to file regular financial reports, such as quarterly statements and annual reports, which provide timely and accurate information about their financial performance. This increased transparency allows investors, analysts, and other stakeholders to assess the company’s financial health and make informed investment decisions. The need to meet these reporting requirements pushes companies to implement robust financial systems, processes, and controls, leading to improved financial management and performance.

Secondly, being listed on the stock exchange can attract a broader and more diverse investor base. As the company’s shares become available to a larger pool of potential investors, it can attract institutional investors with significant resources and expertise. These investors often conduct thorough due diligence and analysis before investing. The scrutiny from these investors can drive companies to implement sound financial practices, corporate governance standards, and strategic planning, ultimately improving the company’s financial performance.

Moreover, being publicly traded can increase access to financing options and reduce the cost of capital. Companies listed on the stock exchange may find it easier to raise additional funds through secondary offerings or debt issuances. The market liquidity associated with being listed can also make it easier for companies to attract favorable interest rates when borrowing funds. Access to affordable capital can enable companies to invest in growth opportunities, research and development, and operational improvements, all of which can contribute to improved financial performance.

Furthermore, the stock market can provide valuable feedback on a company’s financial performance. The share price of a publicly traded company can act as a barometer for market sentiment and investor confidence. A consistently strong financial performance can attract investor attention, resulting in an increase in demand for the company’s shares and a corresponding increase in stock price. This positive feedback loop can create a favorable environment for the company’s financial success.

Overall, being listed on the stock exchange can have a transformative effect on a company’s financial performance. The increased transparency, access to capital, and market feedback can drive companies to adopt disciplined financial practices, attract institutional investors, reduce the cost of capital, and ultimately enhance their financial performance.

Access to Acquisitions and Partnerships

Listing shares on the stock exchange provides companies with expanded opportunities for acquisitions and partnerships. Being a publicly traded company can enhance a company’s strategic position and attract potential business collaborators or acquisition targets.

Firstly, the increased visibility and credibility that come with listing on the stock exchange can make a company more attractive to potential partners. Other companies, including startups, established firms, or even competitors, may be more inclined to form strategic alliances or engage in joint ventures with a publicly traded company. These partnerships can allow for complementary strengths, shared resources, and access to new markets, driving innovation and expanding the company’s market reach.

Additionally, being a publicly traded company provides a valuable currency for acquisitions. When a company’s shares are actively traded on the stock exchange, its stock can be used as a form of payment to acquire other companies. This allows the company to expand its business portfolio rapidly, access new technologies or intellectual property, and enter new market segments. The ability to use stock as a means of acquisition can offer flexibility and potential cost savings compared to all-cash transactions.

Furthermore, the heightened visibility in the public market can attract potential acquisition targets. Companies seeking growth or looking to exit may view a publicly traded company as an appealing acquirer due to its access to capital, market presence, and potentially higher valuation. The increased liquidity of a publicly traded company’s stock can also make it more attractive to potential sellers, as it offers a more straightforward path for stockholders to convert their ownership into cash.

Moreover, being listed on the stock exchange exposes a company to a network of investment bankers, brokers, and financial advisors who specialize in mergers and acquisitions. These professionals can provide valuable guidance, market insights, and assistance in identifying and evaluating potential acquisition opportunities. The resources and expertise of these intermediaries can help companies navigate the complex landscape of acquisitions and forge successful partnerships.

In summary, selling shares on the stock exchange provides companies with increased access to acquisitions and partnerships. The enhanced visibility, credibility, and use of stock as a currency can attract potential partners, increase attractiveness for acquisition targets, and provide avenues for strategic growth and expansion.

Conclusion

Selling shares on the stock exchange offers numerous benefits to companies looking to raise capital, increase visibility, and drive growth. By going public, companies gain access to a wider pool of potential investors, allowing them to secure the necessary funds to finance their expansion plans and invest in opportunities that can propel their business forward.

The enhanced liquidity provided by the stock exchange ensures that shareholders have the flexibility to easily buy and sell their holdings, improving their control over their investment and providing an avenue to realize the value of their shares when needed.

Additionally, listing on the stock exchange elevates a company’s visibility, credibility, and prestige. It attracts attention from investors, analysts, and potential partners, and can open doors to media coverage, research coverage, and new business opportunities.

Selling shares on the stock exchange not only enhances a company’s financial performance but also expands its access to capital. This can be crucial for funding innovative projects, entering new markets, and pursuing strategic acquisitions.

Furthermore, being listed on the stock exchange can create opportunities for partnerships and collaborations. It allows companies to form strategic alliances, joint ventures, and negotiate mutually beneficial partnerships, leveraging the credibility and market presence that comes with being publicly traded.

In conclusion, selling shares on the stock exchange provides companies with a platform for growth, increased access to capital, enhanced financial discipline, and the ability to pursue strategic opportunities. It elevates a company’s profile and opens doors to a world of possibilities for expansion and success.