Finance

How To Sell Stocks On Charles Schwab

Published: January 18, 2024

Learn how to sell stocks on Charles Schwab and manage your finance with this step-by-step guide. Maximize your investing potential and take control of your financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Stock Selling Process on Charles Schwab

- Step 1: Logging into your Charles Schwab Account

- Step 2: Navigating to the “Trade” Tab

- Step 3: Selecting the Stock you Want to Sell

- Step 4: Choosing the Order Type and Quantity

- Step 5: Reviewing and Confirming the Sell Order

- Step 6: Monitoring and Managing your Selling Activity

- Conclusion

Introduction

Welcome to the exciting world of stock trading! If you’re considering selling stocks on Charles Schwab, one of the leading online brokerage platforms, you’ve come to the right place. Selling stocks is an essential part of managing your investment portfolio, and understanding the process can help you make informed decisions and potentially maximize your returns.

Charles Schwab is renowned for its user-friendly interface and robust trading tools, making it an ideal platform for both novice and experienced investors. Whether you’re looking to sell a single stock or liquidate a larger portion of your portfolio, Charles Schwab provides a seamless and secure environment to execute your trades.

In this article, we’ll guide you through the step-by-step process of selling stocks on Charles Schwab. From logging into your account to confirming your sell order, we’ll cover everything you need to know to navigate the platform with confidence.

It’s important to note that before selling stocks, it’s crucial to conduct thorough research and analysis to determine the best time to sell for your specific investment goals. Market conditions, company performance, and your personal risk tolerance should all be taken into consideration.

Now, let’s dive into the exciting world of selling stocks on Charles Schwab and empower you to make informed trading decisions!

Understanding the Stock Selling Process on Charles Schwab

Before delving into the step-by-step process of selling stocks on Charles Schwab, it’s important to understand the key concepts and terminology associated with stock trading.

Firstly, when you sell a stock, you are essentially transferring ownership of that stock to another party in exchange for cash. The price at which you sell your stock is determined by the current market price, which is influenced by supply and demand dynamics, company performance, and overall market trends.

On Charles Schwab, you have the option to sell stocks that you previously purchased through the platform or transfer stocks from external brokerage accounts for selling purposes. This flexibility allows you to consolidate your investments in one place for ease of management.

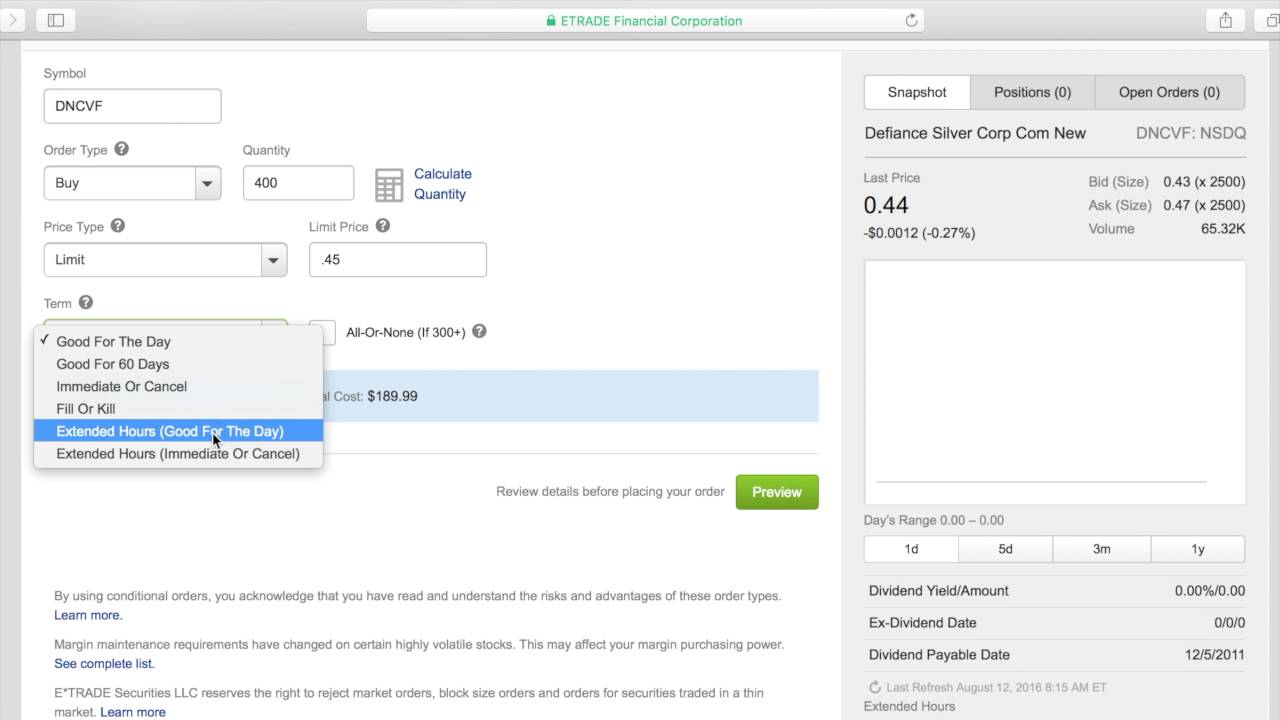

When selling stocks, it’s important to consider the type of order you want to place. Charles Schwab offers various order types to suit different trading strategies:

- Market order: With a market order, you sell your stock at the current market price, ensuring a quick execution. However, the actual price at which your order is executed may vary slightly from the quoted price due to market fluctuations.

- Limit order: A limit order allows you to set a specific price at which you want to sell your stock. The order will only be executed if the stock reaches or exceeds your specified price.

- Stop order: With a stop order, you set a “stop price” below the current market price. Once the stock price reaches or falls below the stop price, your sell order is triggered, helping you limit potential losses. However, it’s important to note that stop orders may not always guarantee a specific sell price.

To ensure a seamless selling experience on Charles Schwab, it is advisable to familiarize yourself with these order types and choose the one that best aligns with your investment strategy and risk tolerance.

Now that you have a basic understanding of the stock selling process, let’s move on to the practical steps involved in selling stocks on Charles Schwab.

Step 1: Logging into your Charles Schwab Account

The first step to selling stocks on Charles Schwab is logging into your account. Assuming you have already set up an account, you can follow these simple steps:

- Open your preferred web browser and go to the Charles Schwab website (www.schwab.com).

- Click on the “Log In” button located at the top right corner of the page.

- Enter your username and password in the designated fields.

- Click on the “Log In” button to access your account.

It’s important to ensure that you have a strong and secure password for your Charles Schwab account to protect your sensitive information.

If you haven’t set up a Charles Schwab account yet, you will need to go through the account opening process first. This typically involves providing personal and financial information, completing a risk assessment questionnaire, and agreeing to the terms and conditions of the brokerage platform.

Once you are logged into your Charles Schwab account, you will have access to a wealth of features and tools to manage your investments and execute trades.

In the next step, we will explore how to navigate to the “Trade” tab on Charles Schwab, where you can initiate the process of selling your stocks.

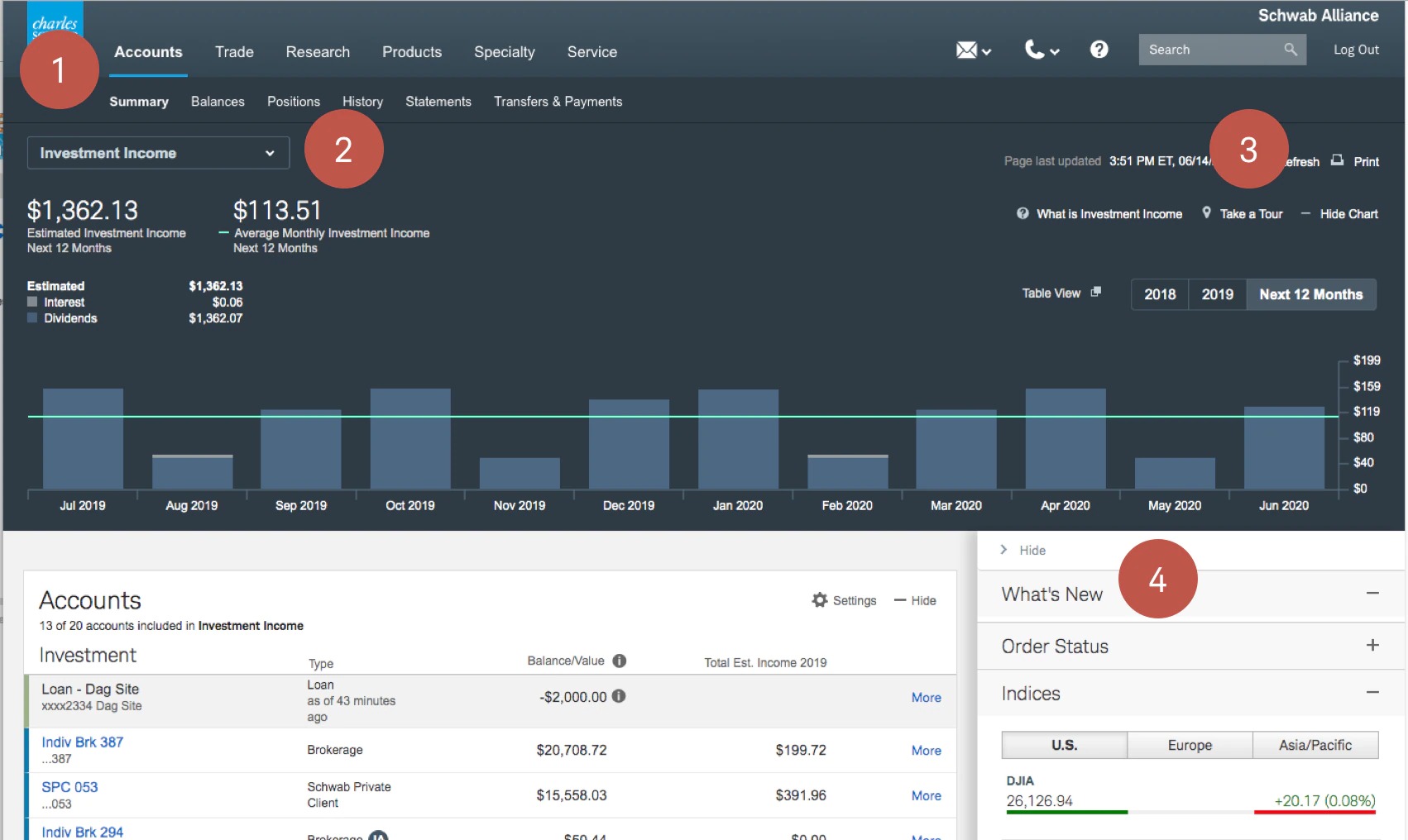

Step 2: Navigating to the “Trade” Tab

After logging into your Charles Schwab account, the next step in selling stocks is navigating to the “Trade” tab. Follow these straightforward instructions to find the “Trade” tab:

- Once you are logged in, you will be directed to your account homepage. Take a moment to familiarize yourself with the layout and various sections of the page.

- Look for the navigation bar at the top of the page. It typically contains options such as “Accounts,” “Research,” and “Tools.”

- Locate the “Trade” tab in the navigation bar. It may be in the form of a drop-down menu or a standalone tab, depending on the website layout at the time.

- Click on the “Trade” tab to access the trade platform.

Once you are on the trade platform, you will have access to a range of tools and features to facilitate your selling process. The platform is designed to provide a user-friendly and intuitive experience, with various sections and options to explore.

It’s worth noting that Charles Schwab offers both web-based and mobile trading platforms, ensuring you can manage your investments conveniently from your computer or smartphone. The navigation process may differ slightly between the web and mobile versions, but the core features and functionality remain consistent.

Now that you have successfully found the “Trade” tab, let’s move on to the next step: selecting the stock you want to sell.

Step 3: Selecting the Stock you Want to Sell

Once you have accessed the “Trade” tab on Charles Schwab, the next step in selling stocks is selecting the specific stock or stocks you want to sell. Follow these steps:

- On the trade platform, you will typically see a search bar or a section labeled “Search for a security” or “Symbol lookup.” This is where you can enter the stock symbol or company name of the stock you want to sell.

- Type in the stock symbol or company name and click on the search button or press Enter.

- A list of search results will appear, displaying stocks matching your search criteria. Review the results and identify the specific stock you want to sell. You may need to take note of the stock ticker symbol for easier reference.

- Click on the desired stock from the search results to access the stock’s trading page.

On the stock’s trading page, you will find a wealth of information about the stock, including its current price, historical performance, market news, and related data. Take some time to analyze the stock’s performance and evaluate the potential benefits and risks of selling at the current time.

It’s important to note that during times of market volatility, the prices of stocks can fluctuate rapidly. Taking the time to research and analyze the stock’s performance can help you make informed decisions and potentially optimize your selling strategy.

Now that you have selected the stock you want to sell, let’s move on to the next step: choosing the order type and quantity.

Step 4: Choosing the Order Type and Quantity

After selecting the stock you want to sell on Charles Schwab, the next step is to choose the order type and quantity for your sell order. Here’s how:

- On the stock’s trading page, locate the section where you can enter the details of your sell order. This is typically found near the stock’s current price and trading information.

- Choose the order type that best aligns with your selling strategy. Charles Schwab offers different order types, including market orders, limit orders, and stop orders. Select the appropriate order type based on your desired selling price and execution preferences.

- Enter the quantity of shares you want to sell in the designated field. You can either specify the exact number of shares or use a percentage of your total holdings. Take into consideration any transaction fees or minimum requirements that may apply.

- Review the details of your sell order, including the order type and quantity, to ensure accuracy.

Choosing the right order type is essential as it determines how your sell order will be executed. A market order will execute at the current market price, while a limit order allows you to specify a particular price at which you want to sell. A stop order, on the other hand, will trigger a sell order once the stock price reaches or falls below a specified stop price.

It’s important to consider your investment goals and risk tolerance when selecting the order type and quantity. Additionally, keep in mind that order execution may vary depending on market conditions, liquidity, and trading volume.

Once you are satisfied with the order type and quantity, you can proceed to the next step: reviewing and confirming your sell order.

Step 5: Reviewing and Confirming the Sell Order

After selecting the order type and quantity for your sell order on Charles Schwab, it is crucial to thoroughly review and confirm the details before finalizing the transaction. Follow these steps to review and confirm your sell order:

- Carefully review the order details displayed on the order confirmation page. Double-check the stock symbol, order type, quantity, and any additional parameters you set.

- Take a moment to review the estimated costs, including any transaction fees or commissions associated with the sell order.

- Consider the current market conditions and any relevant news or updates that may impact the stock’s price. This information can help you make an informed decision about proceeding with the sell order.

- Ensure that the selling price aligns with your investment goals and expectations. If you set a limit or stop price, verify that it reflects your desired selling price.

- Once you have thoroughly reviewed the sell order details, click on the “Confirm” or “Place Order” button to execute the transaction.

It’s important to note that market orders are usually executed instantly at the prevailing market price, while limit orders and stop orders may not be executed immediately if the specified price conditions are not met. It’s vital to have realistic expectations regarding the timing and execution of your sell order.

Upon confirming your sell order, Charles Schwab will generate a confirmation number and provide an order status update. You can typically find this information on the order confirmation page or in your account transaction history.

Remember to keep a record of the confirmation number and any other relevant details for future reference or documentation purposes.

Now that you have reviewed and confirmed your sell order, it’s time to move on to the final step: monitoring and managing your selling activity.

Step 6: Monitoring and Managing your Selling Activity

After executing your sell order on Charles Schwab, it’s essential to actively monitor and manage your selling activity. Here are some key steps to consider:

- Keep an eye on the status of your sell order. You can typically track the progress of your order through the order status page on Charles Schwab. This will provide updates on whether your order has been filled, partially filled, or is still pending execution.

- Monitor the stock’s price movement after executing your sell order. This will allow you to gauge the effectiveness of your selling strategy and evaluate the outcome of your trade. Charles Schwab provides real-time stock quotes and market data to help you stay informed.

- Consider setting up price alerts or notifications for the stock you sold. This can help you stay informed of any significant price changes or market developments that could impact your investment decisions in the future.

- Regularly review your portfolio and track your overall investment performance. Selling stocks is just one aspect of managing your investment portfolio. It’s important to regularly assess your holdings, reassess your investment goals, and make any necessary adjustments to optimize your portfolio.

- Keep records of your sell orders, including the confirmation numbers, transaction details, and any relevant documentation. This will help you stay organized for tax purposes and maintain a comprehensive record of your trading activities.

- Consider consulting with a financial advisor or utilizing advanced tools and resources provided by Charles Schwab to gain deeper insights into your selling activity and make informed investment decisions.

Managing your selling activity is an ongoing process that requires vigilance and proactive decision-making. By staying informed and actively monitoring your stocks, you can adjust your investment strategy as needed and strive for consistent portfolio growth.

Remember that investing in the stock market carries inherent risks. It’s important to approach selling stocks with a disciplined and well-informed mindset, considering factors such as market conditions, company performance, and your own financial goals.

Congratulations! You have now completed the six-step process of selling stocks on Charles Schwab. By following these steps and staying engaged with your investments, you are well-positioned to make informed decisions and navigate the exciting world of stock trading.

Happy investing!

Conclusion

Congratulations on completing the journey of selling stocks on Charles Schwab! We have covered the essential steps involved in selling stocks, from logging into your account to monitoring and managing your selling activity. By following this comprehensive guide, you are now equipped to confidently navigate the world of stock trading on Charles Schwab.

Remember, selling stocks is a strategic decision that should be based on thorough research, analysis, and consideration of market conditions. Always strive to align your selling strategy with your investment goals and risk tolerance.

Charles Schwab provides a user-friendly platform with intuitive features and tools that empower investors to execute trades efficiently. Through the trade platform, you can choose from various order types, such as market orders, limit orders, and stop orders, to customize your selling approach.

Additionally, it’s important to actively monitor your selling activity and stay informed about the stock market. Regularly review your portfolio, track your investment performance, and make adjustments as needed to optimize your investment strategy.

Lastly, consider seeking guidance from a financial advisor or utilizing the advanced resources provided by Charles Schwab to gain further insights and make informed decisions.

Remember, investing in the stock market entails risks, and past performance does not guarantee future results. It’s essential to conduct thorough research, diversify your portfolio, and stay disciplined in your investment approach.

Now, armed with the knowledge and steps outlined in this guide, you are ready to embark on your selling journey on Charles Schwab. Take your time, make informed decisions, and enjoy the excitement of managing your investment portfolio.

Happy selling and best of luck with your trading endeavors!