Home>Finance>What Type Of Questions Are Required In A Risk Assessment

Finance

What Type Of Questions Are Required In A Risk Assessment

Published: January 15, 2024

In a risk assessment for finance, various types of questions are essential to determine the potential risks involved and develop effective mitigation strategies. Discover what questions are required for a comprehensive finance risk assessment.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Risk Assessment

- The Purpose of Questions in Risk Assessment

- Categories of Questions in Risk Assessment

- Questions Related to Hazard Identification

- Questions Related to Risk Analysis

- Questions Related to Risk Evaluation

- Questions Related to Risk Treatment

- Questions Related to Risk Monitoring

- Importance of Including Stakeholder Input in Risk Assessment

- Conclusion

Introduction

In any business or organizational setting, it is crucial to identify, assess, and manage risks effectively. Risk assessment is a valuable tool that helps evaluate potential risks and determine appropriate measures to mitigate them. By conducting a comprehensive risk assessment, businesses can proactively address threats and make informed decisions to protect their assets, reputation, and bottom line.

The process of risk assessment involves asking a series of well-crafted questions to gain a thorough understanding of potential risks. These questions delve into various aspects of the organization, such as operations, finance, legal, and human resources, to identify vulnerabilities and develop strategies to mitigate them.

The purpose of this article is to explore the different types of questions that are required in a risk assessment and their significance in the overall process. By understanding the role of questions in risk assessment, businesses can enhance their risk management practices and minimize the impact of potential threats.

Additionally, this article will highlight the importance of stakeholder input in risk assessment. Incorporating the perspectives and expertise of relevant stakeholders is crucial in ensuring a comprehensive and accurate evaluation of risks, as each stakeholder brings unique insights into the organization’s operations, industry, and relevant external factors.

By the end of this article, readers will have gained a deeper understanding of the role of questions in risk assessment and the value of stakeholder involvement in this process. This knowledge will empower businesses to conduct more effective risk assessments and develop robust risk management strategies to safeguard their interests.

Understanding Risk Assessment

Risk assessment is a systematic and structured process that involves the identification, analysis, evaluation, and management of potential risks that could affect an organization’s objectives. It provides a framework for organizations to proactively identify and assess potential threats and develop strategies to mitigate or minimize their impact.

The primary goal of risk assessment is to enable organizations to make informed decisions by considering the likelihood and impact of various risks. By understanding the potential risks they face, organizations can prioritize resources and implement appropriate measures to prevent or mitigate those risks.

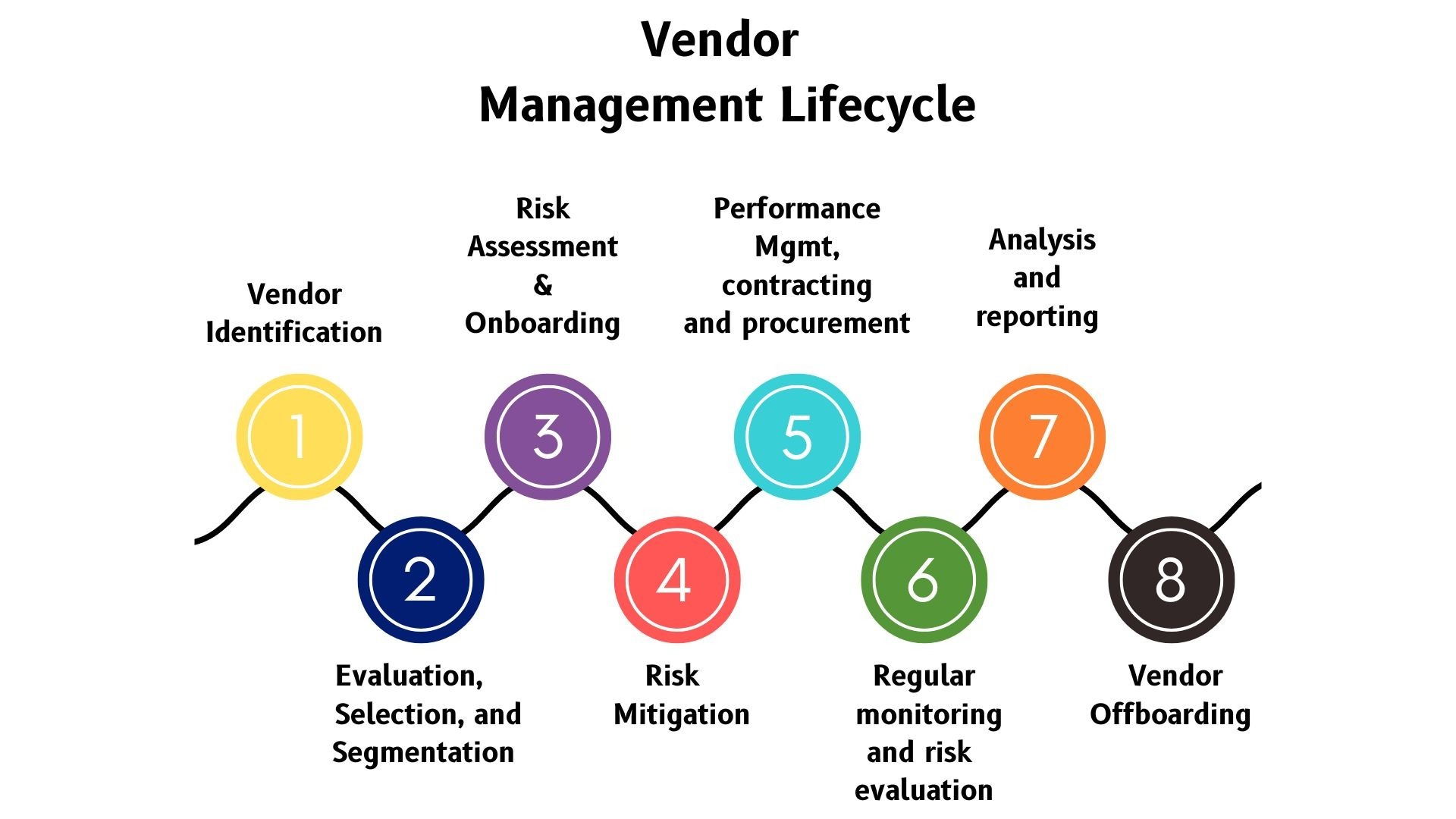

There are several key steps involved in the risk assessment process:

- Identify Risks: The first step is to identify and document potential risks that could pose a threat to the organization. This involves conducting a thorough assessment of internal and external factors that may affect the organization’s operations, financial stability, reputation, and compliance.

- Analyze Risks: Once the risks have been identified, they need to be analyzed to determine their potential impact and likelihood. This involves gathering relevant data, assessing the vulnerabilities within the organization, and evaluating the potential consequences of each risk.

- Evaluate Risks: After analyzing the risks, they need to be evaluated to determine their significance. This involves assigning a risk rating or score based on the likelihood and impact of each risk. By evaluating risks, organizations can prioritize their resources and focus on addressing the most critical and high-impact risks.

- Treat Risks: Once risks have been evaluated, organizations must develop and implement strategies to treat or mitigate the identified risks. This can involve various risk management techniques, such as implementing controls, transferring risk through insurance, or accepting the risk based on strategic objectives.

- Monitor Risks: Risk assessment is an ongoing process, and organizations need to continually monitor and review the effectiveness of their risk management strategies. This involves regularly assessing the changing risk landscape and making necessary adjustments to ensure the organization remains resilient to emerging threats.

Overall, risk assessment provides organizations with a structured approach to identify, analyze, evaluate, and manage potential risks. By following this process, organizations can make informed decisions that help safeguard their operations, maintain financial stability, and protect their reputation in an ever-changing business environment.

The Purpose of Questions in Risk Assessment

Questions play a crucial role in the risk assessment process as they help gather relevant information, identify potential risks, and assess their significance. The purpose of asking questions in risk assessment is multi-fold:

- Information Gathering: Questions serve as a means to collect detailed and specific information about various aspects of the organization. They help identify potential threats, vulnerabilities, and opportunities that may impact the achievement of business objectives.

- Problem Identification: Questions facilitate the identification of potential risks by probing into different areas of the organization. They help uncover potential weaknesses in processes, systems, or controls that could lead to adverse events or negative outcomes.

- Evaluation of Likelihood: Questions aid in assessing the likelihood of risks occurring by gathering relevant data, facts, and insights. This enables organizations to prioritize risks based on their likelihood and focus efforts on those with a higher probability of occurrence.

- Assessment of Impact: By asking questions, organizations can assess the potential impact of risks on various aspects of their operations, such as financials, reputation, customer satisfaction, and regulatory compliance. This helps in determining the severity and magnitude of each risk.

- Identification of Control Measures: Questions help in identifying suitable control measures that can be implemented to mitigate or prevent risks. By understanding the underlying causes and factors contributing to the risks, organizations can develop targeted and effective risk management strategies.

- Engagement and Collaboration: Asking questions during the risk assessment process encourages engagement and collaboration within the organization. It allows different stakeholders to provide their input, perspectives, and expertise, fostering a sense of ownership and collective responsibility for managing risks.

- Documentation and Reporting: Questions serve as a framework for documenting and reporting the findings of the risk assessment process. They help structure the information gathered, ensuring that all relevant details are captured and can be communicated effectively to key stakeholders.

By asking the right questions, organizations can gain deeper insights into their risk landscape, enabling them to develop informed risk mitigation strategies. Effective questioning techniques help organizations identify blind spots, anticipate potential risks, and make proactive decisions to protect their interests and achieve their strategic objectives.

Categories of Questions in Risk Assessment

In a risk assessment, it is crucial to ask the right questions to gather relevant information about potential risks. These questions can be categorized into different areas to ensure a comprehensive evaluation of risks. The following are the key categories of questions typically used in risk assessments:

- Questions Related to Hazard Identification: These questions focus on identifying the potential hazards or threats that may impact the organization. They aim to uncover risks associated with physical, operational, financial, or environmental factors. For example, “Are there any potential safety hazards in the workplace?” or “What are the key operational risks that could disrupt business operations?”

- Questions Related to Risk Analysis: These questions delve into the analysis of risks to assess their likelihood, impact, and vulnerability. They aim to gather data and insights that help evaluate the severity and potential consequences of each risk. For example, “What are the historical trends and patterns of the identified risks?” or “What are the key factors that contribute to the likelihood of each risk occurrence?”

- Questions Related to Risk Evaluation: These questions focus on the evaluation of risks to determine their significance and prioritize resources accordingly. They aim to assign risk ratings or scores based on the likelihood and impact of each risk. For example, “What is the potential financial impact of each risk?” or “How would the occurrence of each risk affect the achievement of strategic objectives?”

- Questions Related to Risk Treatment: These questions explore the strategies and measures that can be implemented to treat or mitigate identified risks. They aim to identify the most appropriate risk management techniques, such as implementing controls, transferring risk through insurance, or accepting the risk based on strategic objectives. For example, “What control measures can be implemented to minimize the impact of each risk?” or “Is there any insurance coverage available for managing certain risks?”

- Questions Related to Risk Monitoring: These questions focus on the ongoing monitoring and review of risks to ensure the effectiveness of risk management strategies. They aim to assess the changing risk landscape and make necessary adjustments to maintain resilience. For example, “How frequently should the risks be monitored and reviewed?” or “What are the key indicators or triggers to signal a change in the risk profile?”

By categorizing questions in risk assessments, organizations can ensure a comprehensive evaluation of potential risks. Each category serves a specific purpose in gathering information, analyzing risks, evaluating their significance, and developing suitable risk management strategies. Effective utilization of these categories allows businesses to identify, assess, and manage risks more effectively, ultimately enhancing their ability to navigate uncertainties and achieve their objectives.

Questions Related to Hazard Identification

Hazard identification is a crucial step in the risk assessment process as it helps organizations identify potential threats or hazards that may pose risks to their operations. By asking targeted questions in this phase, organizations can uncover a wide range of hazards and ensure a comprehensive evaluation. The following are examples of questions related to hazard identification:

- Physical Hazards: What are the potential physical hazards in the workplace, such as machinery, equipment, or infrastructure that could pose safety risks to employees?

- Operational Hazards: What are the key operational risks that could disrupt business operations, such as supply chain disruptions, technology failures, or process inefficiencies?

- Environmental Hazards: Are there any environmental hazards that could impact the organization, such as natural disasters, pollution, or climate-related risks?

- Financial Hazards: What are the potential financial risks that the organization may face, such as pricing volatility, credit risks, or inadequate financial controls?

- Legal and Compliance Hazards: Are there any legal or compliance risks that could result in penalties, litigation, or damage to reputation, such as non-compliance with industry regulations or data protection laws?

- Human Factors: What are the potential risks associated with human behaviors and actions, such as employee errors, lack of training, or inadequate safety protocols?

- Social and Reputation Hazards: Are there any social or reputation risks that could impact the organization’s image and relationships with stakeholders, such as public scandals, negative publicity, or social media backlash?

- Health Hazards: Are there any health risks to employees or customers, such as exposure to harmful substances, ergonomic issues, or inadequate safety protocols?

- Supply Chain Hazards: What are the potential risks associated with the organization’s supply chain, such as dependency on specific suppliers, logistics challenges, or geopolitical risks?

By asking these questions, organizations can identify a wide range of potential hazards that could pose risks to their operations. The information gathered through these questions will provide the foundation for further risk analysis, evaluation, and the development of appropriate risk management strategies.

Questions Related to Risk Analysis

Risk analysis is a crucial step in the risk assessment process as it involves assessing the likelihood and impact of identified risks. By asking targeted questions in this phase, organizations can gather data and insights to analyze the severity and potential consequences of each risk. The following are examples of questions related to risk analysis:

- Likelihood Assessment: What are the historical trends and patterns associated with each identified risk? Are there any specific factors that contribute to the likelihood of each risk occurrence?

- Impact Assessment: What are the potential consequences of each risk on various aspects of the organization, such as financials, operations, reputation, or compliance?

- Internal Controls: What internal controls are in place to mitigate the likelihood and impact of each risk? Are they effective, or are there any weaknesses that need to be addressed?

- External Factors: Are there any external factors, such as market conditions, regulatory changes, or geopolitical events, that could influence the likelihood and impact of each risk?

- Dependencies: Are there any dependencies or interrelationships among different risks? How might the occurrence of one risk affect the likelihood or impact of another risk?

- Data and Insights: What sources of data, insights, or expert opinions can be utilized to assess the likelihood and impact of each risk? Are there any gaps in data availability or knowledge?

- Scenario Analysis: What potential scenarios can be considered to understand different outcomes and their implications? How would each risk behave under different scenarios?

- Thresholds and Tolerances: What are the acceptable thresholds or tolerances for each risk in terms of likelihood and impact? At what point does a risk become unacceptable or require immediate action?

- Uncertainty and Sensitivity: What are the uncertainties associated with each risk? How sensitive are the likelihood and impact assessments to changes in underlying assumptions or variables?

By asking these questions, organizations can conduct a thorough analysis of the identified risks, assessing their likelihood and impact based on relevant data, insights, and expert opinions. This analysis sets the stage for further evaluation and the development of risk management strategies tailored to each risk’s severity and potential consequences.

Questions Related to Risk Evaluation

Risk evaluation is a critical step in the risk assessment process as it involves determining the significance of identified risks and prioritizing resources accordingly. By asking targeted questions in this phase, organizations can assign risk ratings or scores and assess the overall impact of each risk. The following are examples of questions related to risk evaluation:

- Severity Assessment: What is the potential severity or magnitude of each risk’s impact on the organization, its operations, financials, reputation, or compliance?

- Likelihood Assessment: Considering the factors influencing the likelihood of each risk occurrence, what is the probability of each risk happening?

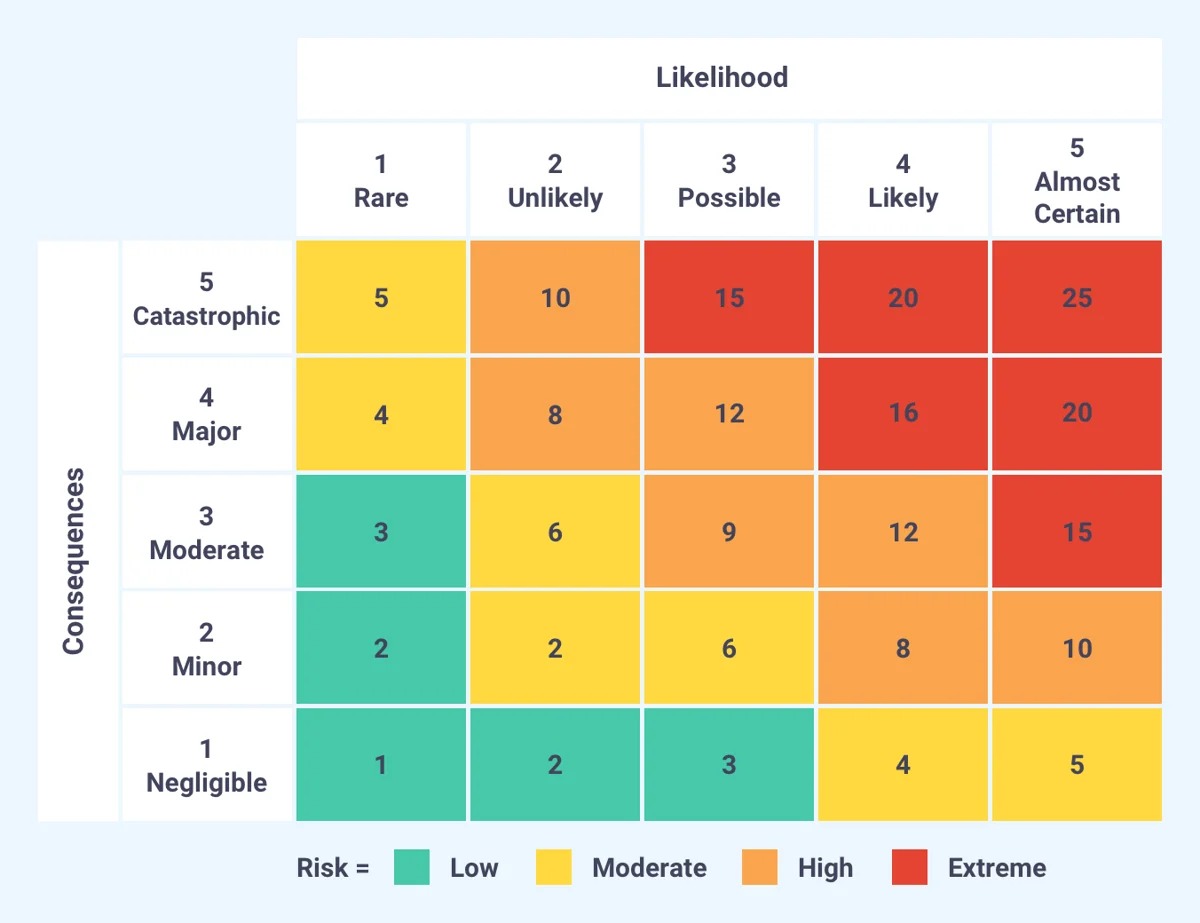

- Risk Rating: Based on the likelihood and impact assessments, what risk rating or score can be assigned to each risk to indicate its significance?

- Prioritization: How should the risks be prioritized based on their risk ratings and the organization’s strategic objectives, resources, and risk appetite?

- Overall Risk Assessment: What is the collective risk profile of the organization when considering all identified risks together?

- Risk Interdependencies: How do the identified risks interact or depend on each other? Are there any risks that could exacerbate the impact of others?

- Risk Heat Map: How can the risk assessment results be visually represented using a risk heat map or similar graphical tool to highlight the severity and likelihood of each risk?

- Tolerance Levels: What are the organization’s acceptable tolerance levels for different levels of risks? At what point does a risk become unacceptable or require immediate attention?

- Risk Appetite Alignment: How well do the identified risks align with the organization’s risk appetite and strategic objectives?

By asking these questions, organizations can evaluate and prioritize the identified risks based on their significance and potential impact. This evaluation helps determine the focal points for risk management efforts, enabling the organization to allocate resources effectively and address the most critical risks promptly.

Questions Related to Risk Treatment

Risk treatment is a crucial phase in the risk assessment process as it involves developing and implementing strategies to mitigate or manage identified risks. By asking targeted questions in this phase, organizations can identify appropriate risk management techniques and determine the most effective measures to address each risk. The following are examples of questions related to risk treatment:

- Risk Control Measures: What control measures can be implemented to minimize the likelihood or impact of each risk? Are there any specific controls that are already in place?

- Cost-Benefit Analysis: What is the cost of implementing each control measure compared to the potential benefits in reducing the risk’s likelihood or impact?

- Control Effectiveness: How effective are the existing control measures in mitigating or managing each risk? Are there any gaps or weaknesses that need to be addressed?

- Risk Transfer: Can certain risks be transferred to external parties through insurance, contracts, or other means? What are the potential benefits and limitations of risk transfer?

- Risk Acceptance: Are there risks that the organization is willing to accept based on its risk appetite and strategic objectives? What are the justifications for accepting these risks?

- Risk Avoidance: Are there certain risks that can be completely avoided by changing processes, systems, or operations? What are the potential benefits and trade-offs of risk avoidance?

- Risk Reduction: Can the likelihood or impact of certain risks be reduced through process improvements, training programs, or other means? How feasible and effective are these risk reduction measures?

- Residual Risk: After implementing the control measures, what level of residual risk remains? Is the residual risk within acceptable levels, or does further action need to be taken?

- Monitoring and Review: How will the implemented risk treatment measures be monitored and reviewed for effectiveness? What are the indicators or triggers that signify the need for adjustments or reassessments?

By asking these questions, organizations can develop a comprehensive understanding of the available risk treatment options and select the most suitable strategies for each identified risk. This ensures that appropriate measures are implemented to mitigate or manage risks effectively, aligning with the organization’s risk appetite and strategic objectives.

Questions Related to Risk Monitoring

Risk monitoring is a critical component of the risk assessment process as it involves the ongoing tracking and review of identified risks and implemented risk management strategies. By asking targeted questions in this phase, organizations can ensure that risks are continually assessed, and the effectiveness of risk management measures is evaluated. The following are examples of questions related to risk monitoring:

- Monitoring Frequency: How frequently should the identified risks be monitored and reviewed to ensure timely detection of any changes or emerging risks?

- Key Risk Indicators: What are the key indicators or metrics that can be monitored to assess the potential occurrence or impact of each risk?

- Reporting Mechanisms: How should risk monitoring information be reported and communicated to relevant stakeholders within the organization?

- Response Plan: What is the response plan in case a monitored risk exceeds pre-defined thresholds or triggers? Who is responsible for initiating and executing the response plan?

- Review of Control Measures: How effective are the implemented control measures in mitigating or managing each risk? Are there any adjustments or improvements needed?

- External Factors: Are there any external factors, such as regulatory changes, technological advancements, or industry trends, that may impact the organization’s risk landscape? How will these factors be monitored?

- Lessons Learned: What can be learned from previous risk incidents or near-misses? How can these insights be utilized to enhance risk monitoring and management practices?

- Emerging Risks: How are emerging risks identified and monitored? What processes or mechanisms are in place to capture and assess new and unforeseen risks?

- Continuous Improvement: How is the risk assessment and monitoring process continuously reviewed and improved to ensure its effectiveness over time?

By asking these questions, organizations can establish a robust risk monitoring framework that enables timely detection of changes in the risk landscape. Regular monitoring and review of risks ensure that risk management strategies remain effective in addressing potential threats and help in identifying new risks that may emerge. This ongoing evaluation allows organizations to adapt and respond to changing circumstances, ultimately enhancing their ability to navigate uncertainties and protect their interests.

Importance of Including Stakeholder Input in Risk Assessment

Stakeholders play a crucial role in the success and resilience of an organization. Including their input in the risk assessment process is of paramount importance as it brings diverse perspectives, expertise, and insights that contribute to a more comprehensive evaluation of risks. The following highlights the importance of including stakeholder input in risk assessment:

- Broadens the Scope of Risk Identification: Stakeholders from different departments, functions, or levels of the organization can provide unique insights and identify risks that might be overlooked by others. Their diverse perspectives help capture a broader range of risks that may impact different areas of the organization.

- Enhances Accuracy of Risk Analysis: Stakeholders possess specific knowledge and expertise related to their roles or areas of operations. Their input helps in gathering accurate data, conducting precise risk assessments, and understanding the potential likelihood and impact of identified risks.

- Promotes Ownership and Accountability: Engaging stakeholders in the risk assessment process fosters a sense of ownership and accountability. By involving them, they become actively invested in identifying and managing risks, leading to increased commitment and responsibility in implementing risk management strategies.

- Ensures Relevant Risk Treatment Strategies: Stakeholder input allows for a better understanding of the applicable risk treatment measures. They can provide insights into the feasibility, effectiveness, and practicality of various strategies, enabling the organization to develop and implement the most suitable risk treatment approaches.

- Considers External Perspectives: Stakeholders may include external parties such as customers, suppliers, regulators, or industry experts. Their input provides valuable external perspectives on risks that may have far-reaching consequences beyond the organization’s internal operations.

- Identifies Emerging Risks: Stakeholders, especially those closely involved in industry trends or regulatory changes, can contribute to the identification of emerging risks. Their input helps the organization stay ahead of potential risks and proactively develop strategies to address them.

- Informs Stakeholder Communication: Involving stakeholders in risk assessment enables organizations to communicate the outcomes effectively. By considering their input, the organization can ensure that risk communication is tailored to the needs and expectations of stakeholders, fostering transparency and trust.

- Promotes Organizational Learning: By including stakeholder input, organizations create opportunities for knowledge sharing and organizational learning. Stakeholders can share their experiences, lessons learned, and best practices, enriching the risk assessment process and promoting continuous improvement.

In summary, including stakeholder input in the risk assessment process is essential to gather a well-rounded understanding of the risks that an organization faces. By appreciating the diverse perspectives and insights of stakeholders, organizations can make more informed decisions, enhance risk management practices, and foster a culture of collaboration and shared responsibility.

Conclusion

Risk assessment is a vital process for organizations to proactively identify, assess, and manage potential risks that may impact their operations, financial stability, reputation, and compliance. Throughout the risk assessment journey, asking the right questions is fundamental to gather relevant information, analyze risks, evaluate their significance, and develop appropriate risk management strategies.

The purpose of questions in risk assessment is multifaceted. They facilitate information gathering, problem identification, likelihood and impact assessment, identification of control measures, engagement and collaboration, documentation, and reporting. Questions serve as a framework to navigate each stage of the risk assessment process and ensure a comprehensive evaluation of risks.

By categorizing questions in risk assessments, organizations can cover various facets of risk evaluation. Questions related to hazard identification uncover potential threats in different areas such as physical, operational, financial, environmental, legal, and human factors. Questions related to risk analysis delve into the likelihood and consequences of identified risks, while questions related to risk evaluation assess their significance, prioritizing resources accordingly.

Moreover, questions related to risk treatment focus on identifying appropriate risk management techniques and strategies to mitigate or manage risks effectively, while questions related to risk monitoring enable the ongoing tracking and review of risks and the evaluation of risk management strategies’ effectiveness.

Importantly, including stakeholder input in the risk assessment process enhances the depth and accuracy of risk evaluation. Stakeholders contribute diverse perspectives, expertise, and insights that aid in comprehensive risk identification, accurate risk analysis, relevant risk treatment strategies, and the identification of emerging risks. Their participation fosters ownership, accountability, and organizational learning while ensuring that risk management strategies are aligned with the organization’s objectives and risk appetite.

In conclusion, asking the right questions and incorporating stakeholder input in the risk assessment process empowers organizations to make informed decisions, enhance risk management practices, and navigate uncertainties with confidence. By continuously evaluating and adapting their risk management strategies, organizations can safeguard their interests, maintain resilience, and thrive in an ever-changing business landscape.