Finance

How Does Working Capital Affect Cash Flow

Published: December 20, 2023

Understanding the impact of working capital on cash flow is crucial in finance. Explore how managing your working capital can optimize your cash flow.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to the financial health of a business, two crucial terms that often come into play are working capital and cash flow. While these terms might seem similar, they actually represent different aspects of a company’s financial operations. Understanding the relationship between working capital and cash flow is essential for business owners and financial managers as it directly impacts the company’s ability to meet short-term obligations, invest in growth opportunities, and manage day-to-day operations.

Working capital refers to the difference between a company’s current assets and current liabilities. In simple terms, it represents the funds available for the company to cover its day-to-day expenses, such as paying suppliers, meeting payroll obligations, and maintaining inventory levels. Positive working capital indicates that a company has enough resources to cover its short-term obligations, while negative working capital suggests that a company may struggle to fulfill its financial responsibilities in the near future.

Cash flow, on the other hand, refers to the movement of money into and out of a business. It represents the inflow and outflow of cash during a specific period and reflects the company’s ability to generate and manage its cash resources. A positive cash flow means that the company is generating more cash inflows than outflows, indicating a healthy financial position. Conversely, a negative cash flow implies that the company is spending more cash than it is generating, which can lead to financial strain and potential liquidity issues.

While working capital and cash flow are distinct concepts, they are closely interrelated. Working capital directly impacts cash flow and can either contribute to or hinder a company’s ability to maintain a steady stream of cash. Proper management of working capital is crucial for achieving a positive cash flow and ensuring the long-term sustainability of the business.

In the following sections, we will explore the relationship between working capital and cash flow in more detail, including how working capital can have both positive and negative impacts on cash flow. We will also discuss the factors that influence working capital and strategies for effectively managing it to optimize cash flow.

Definition of Working Capital

Working capital is a key metric used in financial analysis to assess the short-term liquidity and operational efficiency of a business. It represents the funds available to meet current obligations and sustain day-to-day operations. In simple terms, working capital is the difference between a company’s current assets and current liabilities.

Current assets encompass cash, accounts receivable, inventory, and other assets that are expected to be converted into cash within one year or the normal operating cycle of the business, whichever is longer. These assets are essential for the company’s ongoing operations and contribute to its ability to generate revenue.

On the other hand, current liabilities consist of accounts payable, short-term debt, and other obligations that are expected to be settled within one year or the normal operating cycle. These liabilities represent the company’s financial obligations that need to be met in the near term.

The formula to calculate working capital is:

Working Capital = Current Assets – Current Liabilities

A positive working capital indicates that a company has more current assets than current liabilities. This implies that the company has enough resources to cover its short-term obligations, such as paying suppliers, employees, and other operational expenses. Positive working capital is essential for the smooth functioning of a business and helps maintain financial stability.

A negative working capital, on the other hand, suggests that the company’s current liabilities exceed its current assets. This situation can arise when a company relies heavily on short-term financing to meet its obligations or when its payables exceed its receivables. Negative working capital may pose challenges in meeting financial obligations and could indicate potential liquidity issues or an inefficient use of resources.

It’s important to note that while positive working capital is generally preferred, excessively high levels of working capital may also be a concern. This can indicate poor inventory management or a buildup of excess cash that is not being effectively utilized. Striking the right balance in maintaining an optimal level of working capital is crucial for ensuring the smooth operation and financial health of a business.

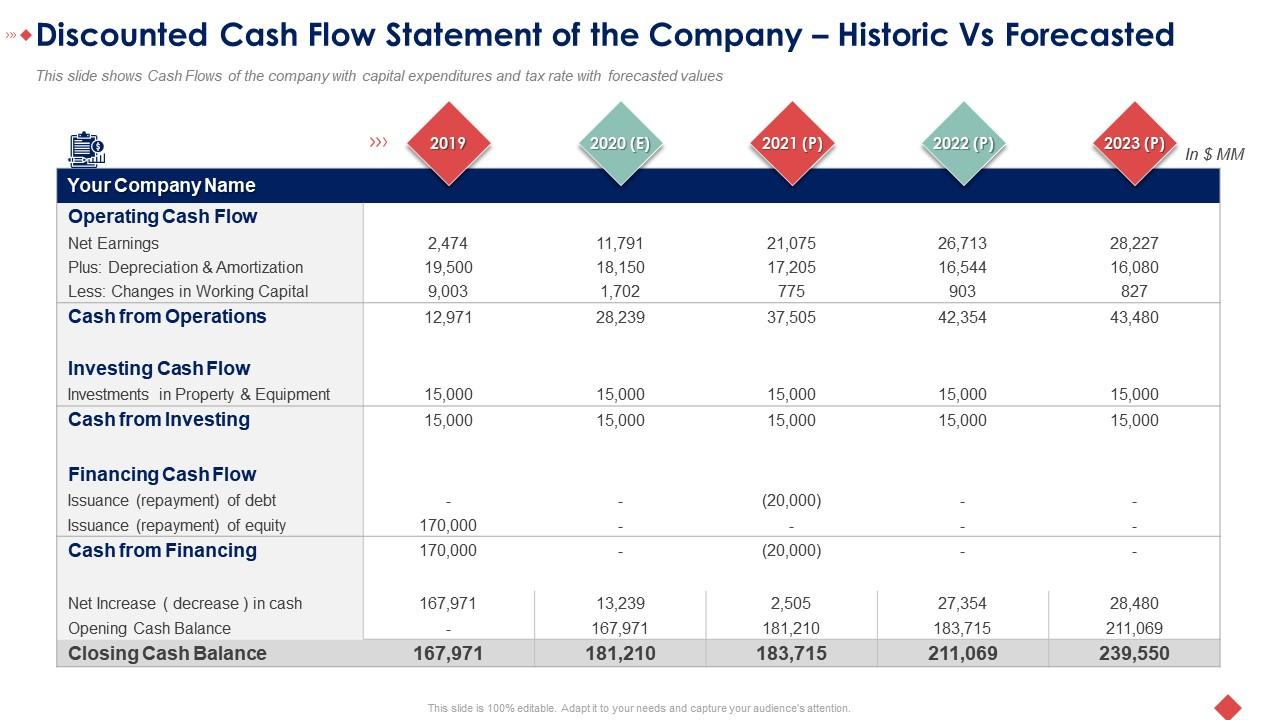

Cash Flow Statement

The cash flow statement is a financial statement that provides a detailed overview of the cash inflows and outflows of a business during a specific period. It is a crucial document for understanding the cash position and cash management of a company and is a key component of financial reporting.

The cash flow statement is divided into three main sections: operating activities, investing activities, and financing activities.

1. Operating Activities: This section of the cash flow statement includes the cash flows generated from the company’s primary operations. It shows the cash inflows and outflows directly related to the production and delivery of the company’s goods or services. Examples of cash inflows from operating activities include cash received from customers, interest received, and dividends received. Cash outflows can include payments to suppliers, salaries and wages, operating expenses, and interest paid.

2. Investing Activities: This section includes the cash flows related to the company’s investments in long-term assets and investments. It shows the cash inflows and outflows from buying or selling fixed assets, such as property, plant, and equipment, as well as investments in stocks, bonds, and other securities. Cash inflows from investing activities can include proceeds from the sale of assets or investments, while cash outflows can include the purchase of new assets or investments.

3. Financing Activities: This section reflects the cash flows related to the company’s financing activities, such as obtaining funds from investors and repaying debt. It includes cash inflows from the issuance of debt or equity, as well as cash outflows from debt repayments, dividends paid to shareholders, and share repurchases.

The cash flow statement provides valuable insights into a company’s ability to generate and manage cash. It helps stakeholders, such as investors, lenders, and analysts, assess the company’s cash flow generating capacity and evaluate its financial stability and liquidity. Positive cash flow indicates that the company is generating more cash than it is spending, providing a cushion for meeting financial obligations, investing in growth opportunities, and distributing returns to shareholders. Negative cash flow, on the other hand, signals potential financial challenges and may require further investigation to identify the underlying reasons and take appropriate corrective actions.

By analyzing the cash flow statement, businesses can gain a holistic view of their cash position and make informed decisions regarding working capital management, investment strategies, and financing options. It is crucial for companies to regularly review and analyze their cash flow statements to ensure they have a clear understanding of their financial standing and can effectively plan for future growth and sustainability.

Relationship between Working Capital and Cash Flow

The relationship between working capital and cash flow is intricate and crucial for the financial health and operational efficiency of a business. Working capital directly impacts cash flow, and understanding this relationship is essential for effective financial management.

Working capital affects cash flow in several ways:

1. Cash Flow from Operations: Working capital has a significant impact on the cash flow generated from day-to-day operations. As working capital represents the funds available to cover short-term obligations, it directly affects a company’s ability to collect cash from customers, manage inventory, and pay suppliers and employees. A well-managed and positive working capital position enables the company to generate higher cash inflows from operations, which contribute to a positive cash flow.

2. Cash Flow Cycle: The management of working capital affects the cash flow cycle of a business. The cash flow cycle refers to the time it takes for a company to convert its investment in inventory and other assets into cash from sales. By effectively managing working capital components, such as inventory levels and accounts receivable, a company can accelerate the cash flow cycle and improve its cash conversion efficiency.

3. Liquidity and Accessibility of Cash: Working capital is a key determinant of a company’s liquidity position. Adequate working capital ensures that a business has sufficient cash on hand to meet short-term financial obligations as they arise. This improves the company’s accessibility to cash, making it easier to manage day-to-day expenses, pay creditors on time, and seize growth opportunities when they arise. Conversely, a shortage of working capital can lead to cash flow constraints and difficulties in meeting financial obligations.

4. Cash Flow Forecasting: Working capital plays a vital role in cash flow forecasting and planning. By analyzing and projecting working capital needs, businesses can anticipate their future cash flow requirements and take proactive measures to manage their cash position effectively. Accurate cash flow forecasting enables businesses to make informed decisions regarding financing, investment, and expenditure, contributing to a stable and positive cash flow.

It is important to note that managing working capital is a balance between having sufficient resources to meet short-term obligations and avoiding excessive tied-up capital. While a positive working capital is generally desirable, businesses should strive to maintain an optimal level of working capital to avoid unnecessary financial strain or potential losses from overstocking inventory or offering overly lenient credit terms.

Overall, working capital and cash flow are closely intertwined, with working capital management directly influencing the cash flow position of a business. By effectively managing working capital components and optimizing cash flow generation and usage, businesses can ensure their financial stability, meet short-term obligations, and position themselves for long-term growth.

Positive Impact of Working Capital on Cash Flow

Working capital has a significant positive impact on a company’s cash flow and plays a crucial role in maintaining a healthy financial position. Effective management of working capital elements can help improve cash flow in several ways:

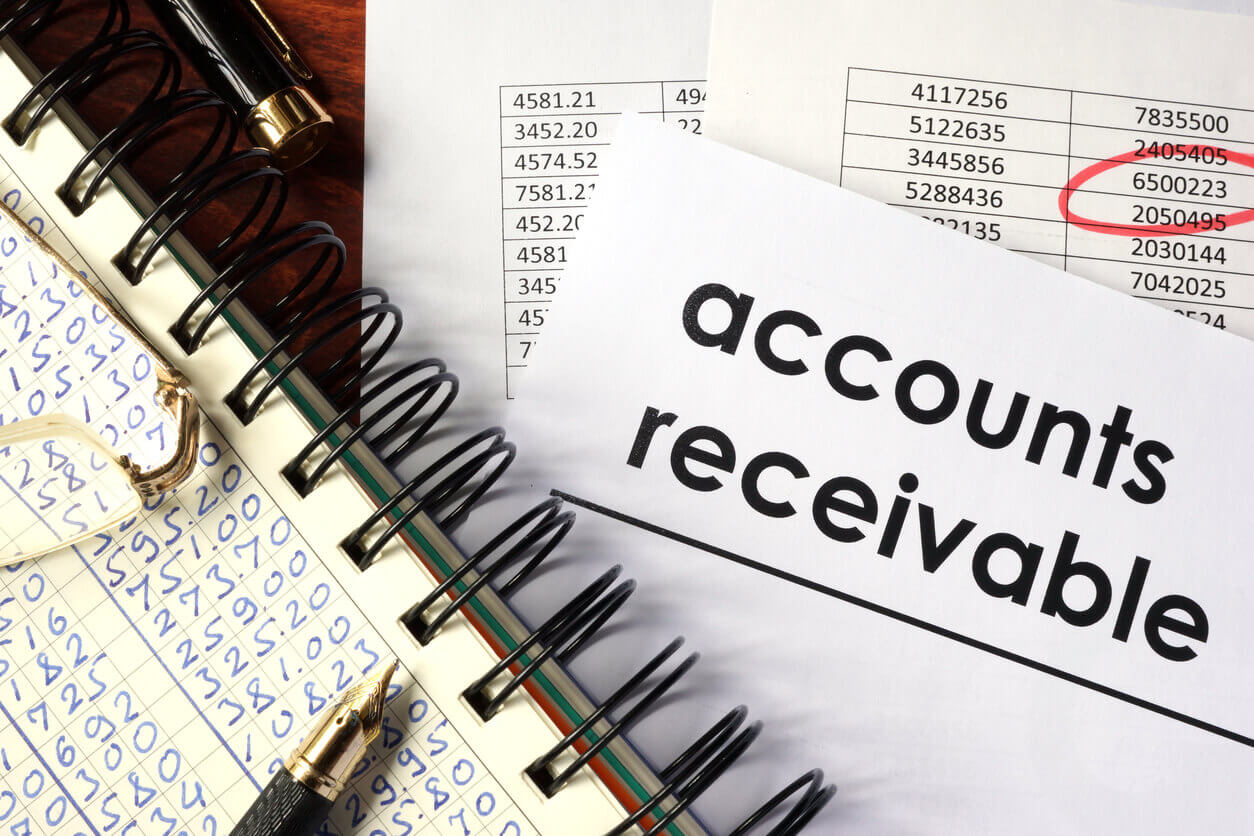

1. Prompt Collection of Accounts Receivable: Efficient management of accounts receivable can accelerate cash inflows and improve cash flow. By implementing streamlined billing processes, providing clear payment terms and incentives, and actively following up on outstanding payments, businesses can reduce the average collection time, ensuring quicker cash receipts and a positive impact on cash flow.

2. Optimal Inventory Management: Inventory represents tied-up capital, and managing it effectively can positively impact cash flow. By optimizing inventory levels, implementing just-in-time inventory practices, and monitoring demand patterns, businesses can reduce carrying costs and storage expenses, freeing up cash for other operational needs or investments.

3. Negotiating Favorable Credit Terms with Suppliers: Skilful negotiation of credit terms with suppliers can lead to extended payment periods, providing businesses with more time to generate cash flow from their operations before paying their obligations. This can help to improve cash flow by better aligning cash outflows with cash inflows.

4. Efficient Cash Flow Cycle: Managing working capital components, such as accounts payable, receivables, and inventory, influences the speed of the cash flow cycle. By minimizing the time it takes to convert raw materials into finished goods and collect cash from customers, businesses can enhance their cash flow efficiency. This enables them to generate more cash inflows and optimize the utilization of available resources.

5. Access to Credit Facilities: Maintaining a positive working capital position and demonstrating effective management can enhance a company’s ability to secure credit facilities or obtain favorable financing terms. Having access to additional sources of funding can help bridge any temporary gaps in cash flow, provide flexibility, and support investment opportunities for further growth.

By focusing on these strategies and actively managing working capital, businesses can improve cash flow, enhance their liquidity position, and ensure the availability of resources to meet short-term obligations and invest in growth opportunities. It is important for businesses to regularly monitor their working capital metrics, conduct cash flow analysis, and adjust strategies accordingly to maintain a positive impact on cash flow.

Negative Impact of Working Capital on Cash Flow

While maintaining a positive working capital is generally favorable for cash flow, there are situations where working capital can have a negative impact on a company’s cash flow. It is important to be aware of these potential negative effects and take appropriate actions to mitigate them:

1. Excessive Inventory: Holding excessive inventory ties up cash that could be used for other purposes. If inventory levels are too high relative to the demand or sales cycle, it can lead to cash flow constraints. Businesses need to carefully manage and monitor inventory levels to avoid overstocking and ensure a healthy balance between meeting customer demand and optimizing cash flow.

2. Slow Collection of Accounts Receivable: Delays in collecting payments from customers can create cash flow challenges. If customers are slow to pay or if credit terms are too lenient, it can result in a negative impact on cash flow. Implementing effective credit control measures, such as credit checks, early payment incentives, and proactive collection efforts, can help mitigate this risk.

3. Inefficient Accounts Payable Management: If a business has poor control over its accounts payable process, it may face late payment penalties or miss out on early payment discounts. This can strain cash flow as it may force the company to use cash to settle obligations faster, reducing the availability of cash for other purposes. Optimizing the accounts payable process and negotiating favorable payment terms with suppliers can help alleviate this negative impact.

4. Poor Cash Flow Forecasting: Inaccurate cash flow forecasting can lead to unexpected cash flow gaps and challenges. Without a clear understanding of future cash requirements, a company may struggle to meet its financial obligations, negatively impacting cash flow. Regularly reviewing and updating cash flow forecasts, considering factors such as seasonality, market conditions, and business expansion plans, is vital for effective cash flow management.

5. Inadequate Working Capital Funding: Insufficient working capital funding can result in liquidity problems and hamper cash flow. If a business lacks the necessary capital to cover its short-term obligations, it may face cash flow difficulties, impacting its ability to operate smoothly and fulfill financial obligations. Exploring financing options, such as bank loans, lines of credit, or equity financing, can help address this issue and provide the necessary working capital to support cash flow needs.

To mitigate these negative impacts, businesses should regularly monitor and analyze their working capital position, implement sound cash flow management practices, and continually reassess their strategies to optimize working capital efficiency. It is crucial for businesses to strike a balance between maintaining adequate working capital levels and avoiding excessive tied-up capital to ensure a positive impact on cash flow.

Factors Influencing Working Capital

Working capital is influenced by a variety of factors that can impact a company’s overall financial health and operational efficiency. Understanding these factors is essential for effectively managing working capital. Here are some key factors that influence working capital:

1. Nature of the Business: The type of industry and the nature of the business can have a significant impact on the working capital requirements. Different industries have different working capital dynamics based on their business cycles, sales patterns, and operational needs. For example, manufacturing companies typically have higher working capital requirements due to the need to maintain inventory levels, while service-oriented businesses may have lower working capital needs.

2. Seasonality and Demand Fluctuations: Businesses that experience seasonal fluctuations in demand often face varying working capital requirements. During peak seasons, companies may require higher levels of working capital to manage increased production, inventory, and staffing needs. Anticipating seasonal fluctuations and planning working capital requirements accordingly can help prevent cash flow gaps or excess capital tied up during periods of low demand.

3. Sales and Revenue Growth: As businesses grow and generate higher sales revenue, their working capital requirements may increase. Increased sales can lead to higher accounts receivable, inventory levels, and operational costs, requiring additional working capital to support business expansion and sustain operations. Scaling working capital alongside sales growth is crucial for maintaining a positive financial position.

4. Credit Policy and Terms: The credit policy and terms offered by a company can have a direct impact on working capital. If a company offers more extended credit terms to its customers, it may face delayed cash inflows, potentially affecting working capital availability. Striking a balance between offering competitive credit terms and managing cash flow effectively is vital to maintain working capital stability.

5. Inventory Management: Effective inventory management is crucial for optimizing working capital. Excessive inventory ties up capital and may lead to cash flow constraints, while insufficient inventory can result in stockouts and lost sales opportunities. Implementing inventory control systems, adopting just-in-time practices, and monitoring demand patterns can help strike the right balance and minimize the negative impact on working capital.

6. Accounts Payable Management: Managing accounts payable effectively can positively influence working capital. Extending payment terms with suppliers and negotiating favorable pricing can help businesses optimize cash flow by maintaining better control over cash outflows. Timely payment of obligations while taking advantage of early payment discounts can also contribute to a healthy working capital position.

7. Business Relationships: The relationships a company maintains with its customers, suppliers, and other stakeholders can impact working capital. Strong relationships with customers can lead to timely payments, reducing the risk of delayed cash inflows. Similarly, healthy relationships with suppliers can support favorable credit terms and ensure a smooth supply chain, which aids in managing working capital effectively.

It is important for businesses to regularly assess these factors and their impact on working capital. By understanding the key drivers of working capital requirements, businesses can proactively implement strategies to optimize cash flow, maintain a healthy financial position, and support sustainable growth.

Strategies for Managing Working Capital

Effective management of working capital is crucial for maintaining a healthy financial position, optimizing cash flow, and ensuring the smooth operation of a business. Here are some strategies that can help businesses manage their working capital effectively:

1. Cash Flow Forecasting: Creating accurate cash flow forecasts is essential for managing working capital. By projecting future cash inflows and outflows, businesses can anticipate their working capital needs and plan accordingly. This allows for better control over cash flow and minimizes the risk of cash flow gaps or excess working capital.

2. Inventory Management: Implementing efficient inventory management practices is key to optimizing working capital. Conducting regular inventory audits, monitoring demand patterns, and adopting just-in-time inventory practices can help reduce carrying costs and prevent excess inventory buildup. This frees up working capital for other operational needs and investment opportunities.

3. Accounts Receivable Optimization: Streamlining the accounts receivable process is crucial for managing working capital. Setting clear payment terms, sending timely and accurate invoices, and actively following up on outstanding payments can expedite cash collections. Additionally, businesses can offer incentives for early payments or consider implementing effective credit control measures to minimize the risk of bad debts.

4. Accounts Payable Optimization: Managing accounts payable is equally important for working capital management. Negotiating favorable payment terms with suppliers and taking advantage of early payment discounts can improve cash flow by extending payment periods. However, it is important to maintain good supplier relationships and ensure timely payment to avoid any negative impact on business relationships.

5. Efficient Cash Flow Cycle: Shortening the cash flow cycle can help optimize working capital. By minimizing the time it takes to convert raw materials into finished goods and collect cash from customers, businesses can improve their cash flow position. This can be achieved through strategies such as implementing efficient production processes, offering quick and convenient payment options for customers, and improving supply chain management.

6. Working Capital Financing: Exploring financing options to support working capital needs can provide businesses with liquidity and flexibility. This can include obtaining short-term loans, lines of credit, or invoice financing to bridge temporary cash flow gaps. However, it is important to carefully assess the costs and risks associated with financing options and ensure they align with the business’s financial goals and capabilities.

7. Continuous Monitoring and Analysis: Regularly monitoring and analyzing working capital metrics is essential for effective management. This includes keeping track of key performance indicators (KPIs) such as current ratio, cash conversion cycle, and days sales outstanding (DSO). Monitoring these metrics allows businesses to identify any potential issues, take corrective actions, and make informed decisions to optimize working capital.

Ultimately, effective working capital management requires a holistic approach that involves aligning various business functions and stakeholders. By implementing these strategies, businesses can improve cash flow, enhance financial stability, and position themselves for sustainable growth and success.

Conclusion

Working capital and cash flow are vital aspects of a company’s financial health, and understanding their relationship is crucial for effective financial management. Working capital represents the funds available to cover short-term obligations and sustain day-to-day operations, while cash flow depicts the movement of money into and out of the business.

Positive working capital and healthy cash flow are essential for a company’s growth, stability, and ability to meet financial obligations. Effective management of working capital can have a significant impact on cash flow, as it influences various aspects of a company’s operations, such as inventory management, accounts receivable and payable, and cash flow cycle.

By adopting strategies such as cash flow forecasting, optimizing inventory, streamlining accounts receivable and payable processes, and effectively managing the cash flow cycle, businesses can ensure sufficient working capital and positive cash flow. These strategies, when combined with prudent financial decision-making, can help businesses navigate challenges, seize growth opportunities, and maintain a stable financial position.

It is essential for businesses to continuously monitor and analyze their working capital position, as this will enable them to identify any potential issues, implement necessary adjustments, and make informed decisions to optimize working capital and cash flow.

In conclusion, working capital and cash flow are intricately connected, with working capital directly influencing cash flow. Successful management of working capital is fundamental to the financial well-being of a business. By employing effective strategies and maintaining a balance between adequate working capital and optimal cash flow, businesses can improve their financial stability, enhance liquidity, and position themselves for long-term success.