Home>Finance>How Financial Planners Help With Retirement Planning

Finance

How Financial Planners Help With Retirement Planning

Published: January 21, 2024

Discover how financial planners assist with retirement planning and ensure your financial future. Gain expert knowledge in finance to make informed decisions for a secure retirement.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Assessing Retirement Goals and Financial Situation

- Creating a Customized Retirement Plan

- Managing Retirement Investments

- Tax Planning Strategies for Retirement

- Social Security and Pension Analysis

- Healthcare and Long-term Care Planning

- Estate Planning for Retirement

- Monitoring and Adjusting the Retirement Plan

- Conclusion

Introduction

Retirement planning is a crucial aspect of financial management that requires careful consideration and expert guidance. As people approach their golden years, it becomes essential to ensure they have a solid financial plan in place to maintain their desired lifestyle and financial security. This is where financial planners play a vital role.

A financial planner is a trained professional who specializes in helping individuals and families navigate the complexities of retirement planning. They provide personalized guidance and craft customized strategies to help clients achieve their retirement goals. By assessing their clients’ financial situation, risk tolerance, and retirement aspirations, financial planners create comprehensive retirement plans that are tailored to their unique needs and circumstances.

The process of retirement planning involves various key elements, including assessing retirement goals and financial situation, creating a customized retirement plan, managing retirement investments, tax planning strategies, analyzing social security and pension options, healthcare and long-term care planning, estate planning, and ongoing monitoring and adjustments.

This article will delve into each of these areas in detail, highlighting the importance of financial planners in guiding individuals towards a secure and fulfilling retirement.

Assessing Retirement Goals and Financial Situation

Before embarking on a retirement plan, it is essential to have a clear understanding of your retirement goals and assess your current financial situation. This is the foundation on which your retirement plan will be built.

A financial planner plays a crucial role in assisting individuals in defining their retirement goals. They take into account various factors such as desired retirement age, lifestyle expectations, travel plans, and any specific retirement dreams or aspirations. By understanding these goals, a financial planner can help clients set realistic and achievable targets for their retirement savings.

The next step in the assessment process is evaluating the individual’s current financial situation. This includes a comprehensive analysis of income, expenses, assets, and liabilities. A financial planner helps clients to understand their net worth, cash flow, and potential savings for retirement.

During this evaluation, financial planners consider any existing retirement accounts, pensions, or other investments to gauge the current state of the retirement nest egg. They also assess other sources of income that will contribute to the retirement fund, such as social security benefits or part-time employment.

By thoroughly assessing the retirement goals and financial situation, a financial planner can determine how much needs to be saved to achieve the desired retirement lifestyle. They also identify any gaps between the current financial position and the projected needs for retirement.

Financial planners utilize sophisticated financial planning tools to create projections and simulations to estimate the required savings and investment returns to achieve the retirement goals. They take into account factors like inflation, life expectancy, and investment performance to develop a realistic plan.

By having a clear assessment of retirement goals and financial status, individuals can have a solid foundation for retirement planning. This assessment provides valuable insights for financial planners to devise a customized retirement plan that aligns with their clients’ objectives and ensures a comfortable retirement.

Creating a Customized Retirement Plan

Once retirement goals and financial situations have been assessed, the next step is to create a customized retirement plan. This plan serves as a roadmap to achieve financial security and meet retirement objectives.

A financial planner takes into account various factors when developing a customized retirement plan. They consider the client’s risk tolerance, time horizon, and investment preferences. By understanding these factors, a financial planner can recommend an appropriate asset allocation strategy, ensuring a balanced and diversified investment portfolio.

The retirement plan also takes into account the individual’s income sources, such as pensions, social security benefits, or rental income. Depending on the client’s situation, a financial planner may suggest strategies to maximize these income sources and optimize the retirement plan.

Another important element of the retirement plan is determining the optimal savings rate. A financial planner assists individuals in setting realistic savings goals based on their income and expenses. They help clients identify areas where they can cut costs or increase their savings to accelerate their retirement savings.

One critical aspect of creating a customized retirement plan is accounting for inflation. A financial planner considers the impact of inflation on future expenses and adjusts the retirement plan accordingly. By factoring in inflation, they ensure that the retirement savings will be sufficient to maintain the desired standard of living over the years.

In addition to inflation, financial planners also consider the individual’s life expectancy. By projecting life expectancy, they can estimate how long the retirement savings need to last. This allows for a more accurate assessment of the required savings and investment strategy.

Throughout the planning process, financial planners keep clients informed about the progress of their retirement plan. They regularly review and update the plan as needed, considering any changes in the client’s financial situation or goals. This ensures that the retirement plan remains relevant and aligned with the client’s evolving needs.

A customized retirement plan provides individuals with a clear roadmap towards their retirement goals. By working with a financial planner, individuals can have confidence in their plan and feel empowered to take the necessary steps to achieve financial security in retirement.

Managing Retirement Investments

Once a retirement plan is in place, the next crucial step is effectively managing retirement investments. Proper management of investments ensures that retirement savings grow and generate a steady income stream during retirement.

A financial planner plays a vital role in helping individuals make informed investment decisions. They consider various factors such as risk tolerance, time horizon, and investment goals when recommending suitable investment options.

One common investment strategy for retirement is asset allocation. A financial planner helps clients allocate their investments across different asset classes, such as stocks, bonds, and real estate, based on their risk tolerance and investment objectives. By diversifying investments, individuals can mitigate risk and potentially maximize returns.

Reallocation of assets is another critical aspect of investment management. As individuals age and approach retirement, their risk tolerance may change. A financial planner regularly evaluates the risk profile and adjusts the asset allocation accordingly to align with the client’s changing needs and objectives.

Investment selection is also a part of managing retirement savings. Financial planners conduct thorough research and analysis to identify suitable investment opportunities, whether it be mutual funds, index funds, or individual stocks. They consider factors such as performance history, fees, and risk factors to guide clients towards suitable and well-performing investments.

Monitoring and reviewing the performance of investments is essential in managing retirement savings. A financial planner regularly monitors the performance of the investment portfolio, making adjustments as necessary to optimize returns. This proactive approach helps to ensure that the retirement savings are on track to meet the projected goals.

Furthermore, a financial planner helps clients navigate market volatility and economic changes. They provide guidance and support during challenging market conditions, helping individuals make informed decisions without succumbing to emotional biases.

Managing retirement investments is an ongoing process. Regular reviews with a financial planner are essential to ensure that the investment strategy remains aligned with the client’s retirement goals and risk tolerance. This continuous monitoring and adjustment help individuals stay on track and make the most of their retirement savings.

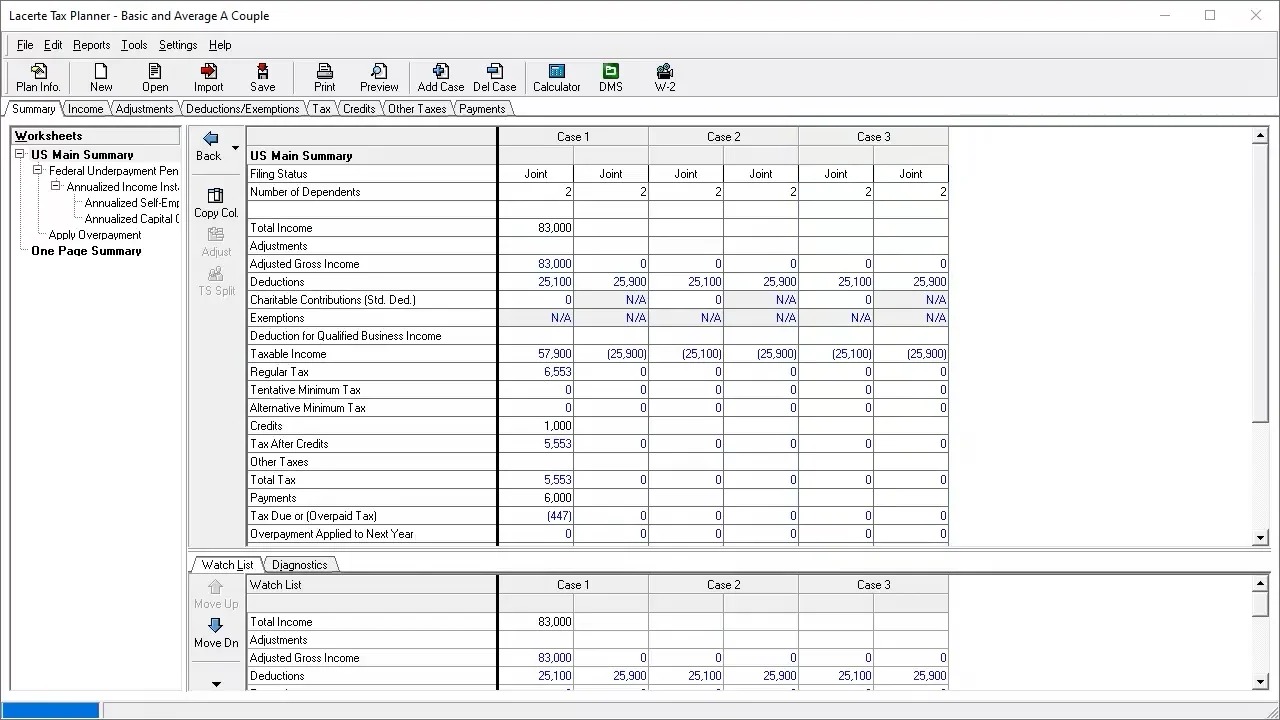

Tax Planning Strategies for Retirement

When it comes to retirement planning, tax considerations play a crucial role in maximizing income and preserving wealth. Implementing effective tax planning strategies can help retirees minimize their tax liabilities and optimize their retirement savings.

A financial planner who specializes in retirement planning can offer valuable guidance on tax-efficient strategies that can be integrated into the overall retirement plan. These strategies may include:

- Maximizing Contributions to Retirement Accounts: A financial planner can advise individuals on contributing the maximum allowable amounts to tax-advantaged retirement accounts, such as 401(k)s or IRAs, to benefit from tax deductions and defer taxes on investment growth until retirement.

- Strategic Withdrawal Strategies: By carefully strategizing the timing and amount of retirement account withdrawals, individuals can minimize their taxable income in retirement. A financial planner can create a distribution plan that considers factors such as tax brackets and required minimum distributions (RMDs) to optimize tax efficiency.

- Utilizing Roth Conversions: A financial planner may recommend converting traditional retirement accounts into Roth IRAs. While this may trigger short-term tax liabilities, it can provide tax-free withdrawals in retirement and potential tax savings in the long run.

- Managing Social Security Benefits: Financial planners can help retirees determine the most tax-efficient strategy for claiming Social Security benefits. By considering factors such as income thresholds and timing of withdrawals, individuals can minimize the tax consequences associated with Social Security.

- Utilizing Tax-efficient Investments: Financial planners can recommend investments that offer tax advantages, such as municipal bonds or tax-managed funds, to minimize tax liabilities and maximize after-tax returns.

- Charitable Giving: A financial planner can assist retirees in implementing charitable giving strategies that provide tax benefits, such as donating appreciated securities or establishing charitable remainder trusts.

By utilizing these and other tax planning strategies, retirees can optimize their income and preserve a larger portion of their retirement savings.

It is important to note that tax laws and regulations can change over time. Working with a knowledgeable financial planner ensures that retirees stay up-to-date with the latest tax rules and take advantage of new opportunities to minimize their tax burdens.

Overall, integrating tax planning strategies into the retirement plan can help individuals maximize their retirement income and maintain greater financial flexibility throughout their golden years.

Social Security and Pension Analysis

Social Security and pensions are important components of retirement income for many individuals. Understanding how to optimize these benefits and make informed decisions about them is crucial in retirement planning. A financial planner with expertise in social security and pension analysis can provide valuable insights and guidance in this area.

One of the key tasks of a financial planner is to conduct a thorough analysis of an individual’s Social Security benefits. They consider factors such as the individual’s work history, age, and projected retirement age to determine the most beneficial time to start collecting benefits.

A financial planner will assess the implications of starting Social Security benefits early or delaying them. By considering expected lifespan, retirement income needs, and potential spousal benefits, they can help individuals make an informed decision that maximizes their lifetime benefit.

Furthermore, a financial planner can provide valuable strategies for optimizing pension benefits. They analyze the terms and conditions of the pension plan and help individuals navigate complex options, such as lump-sum payouts versus lifetime annuity payments.

Financial planners consider other factors that may impact pension benefits, such as early retirement options, survivor benefits, and cost-of-living adjustments. By understanding the intricacies of the pension plan, they can assist individuals in making decisions that align with their retirement goals and financial needs.

In cases where an individual has both Social Security and pension benefits, a financial planner performs a comprehensive analysis to determine the most advantageous claiming strategies. They consider the interplay between Social Security and pension benefits to maximize income while minimizing tax implications.

Moreover, a financial planner can help clients navigate complex scenarios, such as working while receiving Social Security benefits or managing multiple pensions. They provide guidance on how these situations may affect their overall retirement income and offer strategies to optimize their financial outcomes.

By conducting a social security and pension analysis, financial planners ensure that individuals make informed decisions regarding these critical sources of retirement income. They help individuals understand the rules, options, and implications associated with social security and pension benefits, ultimately maximizing their overall retirement income and financial security.

Healthcare and Long-term Care Planning

As individuals approach retirement, planning for healthcare and long-term care becomes increasingly important. Healthcare expenses can significantly impact retirement savings, and long-term care needs may require specialized financial strategies. A financial planner can provide valuable guidance in navigating these areas.

One key aspect of healthcare planning is understanding Medicare. A financial planner can help individuals understand the different parts of Medicare, the associated costs, and the optimal time to enroll. They can also assist in evaluating supplemental insurance options, such as Medigap policies or Medicare Advantage plans, to ensure comprehensive coverage.

Long-term care planning is another crucial component. Financial planners can help individuals assess the potential need for long-term care and the associated costs. They can recommend long-term care insurance policies or alternative strategies, such as setting up a dedicated savings account or exploring hybrid insurance policies that combine long-term care coverage with other benefits.

Additionally, financial planners can assist clients in considering alternatives to formal long-term care, such as aging in place modifications or community-based programs. They evaluate the costs and benefits of these options and help individuals make informed decisions based on their financial situation and preferences.

Careful consideration of healthcare and long-term care expenses is essential in retirement planning. Financial planners work with individuals to estimate future healthcare costs, taking into account factors such as inflation, known health conditions, and family medical history. By incorporating these estimates into the retirement plan, individuals can better prepare for healthcare expenses.

Long-term care planning also involves considering potential caregiving needs for oneself or a spouse. Financial planners work with individuals to understand the impact of caregiving on family dynamics and finances. They can assist in exploring options such as long-term care insurance for family caregivers or legal arrangements, such as powers of attorney or living wills.

A comprehensive healthcare and long-term care plan provides individuals with peace of mind and financial security in retirement. By working with a financial planner, individuals can gain a clear understanding of their healthcare needs, explore cost-effective strategies, and proactively prepare for potential long-term care scenarios.

Estate Planning for Retirement

Estate planning is a critical component of retirement planning that ensures the smooth transfer of assets and protects the financial well-being of loved ones. A financial planner who specializes in estate planning can provide valuable guidance in creating an effective estate plan.

Estate planning involves several important elements. One key aspect is creating a will, which outlines how assets will be distributed and who will be responsible for managing the estate after death. A financial planner can help individuals draft a comprehensive and legally sound will that reflects their wishes.

In addition to a will, financial planners may recommend other estate planning tools such as trusts. Trusts can be utilized to minimize estate taxes, provide for dependents with special needs, or establish philanthropic legacies. A financial planner can explain the different types of trusts and assist in selecting the most appropriate option based on the individual’s goals and circumstances.

Another essential aspect of estate planning is ensuring that healthcare and financial decisions are handled appropriately in the event of incapacity. A financial planner can help individuals establish powers of attorney and healthcare directives, appointing trusted individuals to make decisions on their behalf and ensuring their wishes are carried out.

Furthermore, estate planning involves considering estate tax implications. A financial planner can evaluate an individual’s estate and recommend strategies to minimize estate taxes, such as gifting strategies or charitable planning.

Financial planners also assist individuals in reviewing and updating beneficiary designations on various accounts, such as retirement accounts and life insurance policies, to ensure alignment with their estate plan. This helps to avoid unintended consequences and ensures that assets are distributed according to their wishes.

Regular reviews with a financial planner are essential in estate planning. Over time, individuals may experience changes in their financial situation, family dynamics, or goals, necessitating updates to the estate plan. A financial planner helps to ensure that the estate plan remains current and relevant.

Estate planning is a crucial component of retirement planning that protects assets, minimizes taxes, and ensures that individuals’ wishes are carried out. By working with a financial planner, individuals can create a comprehensive estate plan that provides peace of mind and preserves their financial legacy.

Monitoring and Adjusting the Retirement Plan

Retirement planning is not a one-time event but an ongoing process that requires regular monitoring and adjustments. A financial planner plays a crucial role in ensuring that the retirement plan remains on track and aligned with individuals’ evolving needs and goals.

Monitoring the retirement plan involves regularly reviewing the progress toward retirement goals and assessing the performance of investments. A financial planner keeps a close eye on various factors, such as market conditions, economic trends, and changes in personal circumstances, to evaluate if any adjustments are necessary.

By tracking the retirement plan, a financial planner helps individuals stay informed about the performance of their investments and any potential risks or opportunities that may arise. They provide regular reports and updates, allowing individuals to make informed decisions about their retirement savings.

In addition to monitoring, a financial planner helps individuals stay on track by making necessary adjustments to the retirement plan. Changes in personal circumstances, such as a job change, fluctuating income, or unexpected expenses, may require modifications to the original plan.

For example, a financial planner may recommend adjusting the savings rate, revisiting the asset allocation strategy, or considering additional income streams to adapt to changing circumstances. These adjustments ensure that the retirement plan remains realistic and achievable.

A financial planner also considers external factors such as changes in tax laws, Social Security regulations, or healthcare policies that may impact the retirement plan. By staying informed about these changes, they can help individuals navigate potential challenges or take advantage of new opportunities that arise.

Ongoing communication with a financial planner is crucial in the monitoring and adjustment process. Regular check-ins, either in person or virtually, allow individuals to discuss any concerns or changes in their financial situation, ensuring that the retirement plan remains tailored to their needs and goals.

In summary, monitoring and adjusting the retirement plan is a critical aspect of successful retirement planning. By working with a financial planner, individuals can ensure that their retirement plan remains current, optimized, and aligned with their financial objectives. Regular monitoring and proactive adjustments help individuals stay on track and make the most of their retirement savings.

Conclusion

Retirement planning is a complex and multifaceted process that requires careful consideration, expertise, and ongoing attention. Working with a financial planner who specializes in retirement planning is essential to navigate the intricacies of this journey and achieve financial security in retirement.

A financial planner assists individuals in assessing their retirement goals and financial situation, creating a customized retirement plan, managing retirement investments, implementing tax planning strategies, analyzing Social Security and pension options, planning for healthcare and long-term care needs, and developing an estate plan.

Throughout the retirement planning process, a financial planner provides valuable insights, recommendations, and strategies to optimize retirement savings and income. They monitor the retirement plan, make necessary adjustments, and keep individuals informed about changes that may impact their financial future.

By working with a financial planner, individuals can gain peace of mind, knowing that their retirement plan is based on sound financial principles and tailored to their unique needs and aspirations. Financial planners bring a deep understanding of the financial landscape and provide guidance that helps individuals make informed decisions, ultimately maximizing their retirement savings and ensuring a comfortable and fulfilling retirement.

It is important to start the retirement planning process early and seek the guidance of a qualified financial planner. Whether you are just starting your career or nearing retirement age, a financial planner can help you create a solid retirement plan and guide you on the path to financial freedom.

In conclusion, partnering with a skilled financial planner is the key to successful retirement planning. With their expertise and knowledge, individuals can confidently navigate the complexities of retirement, enjoy financial security, and embark on a fulfilling post-work life.