Finance

How Hard Is Investment Banking

Modified: December 30, 2023

Discover the challenges and complexities of investment banking in the finance industry. Gain insights into the demanding nature of this competitive field.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

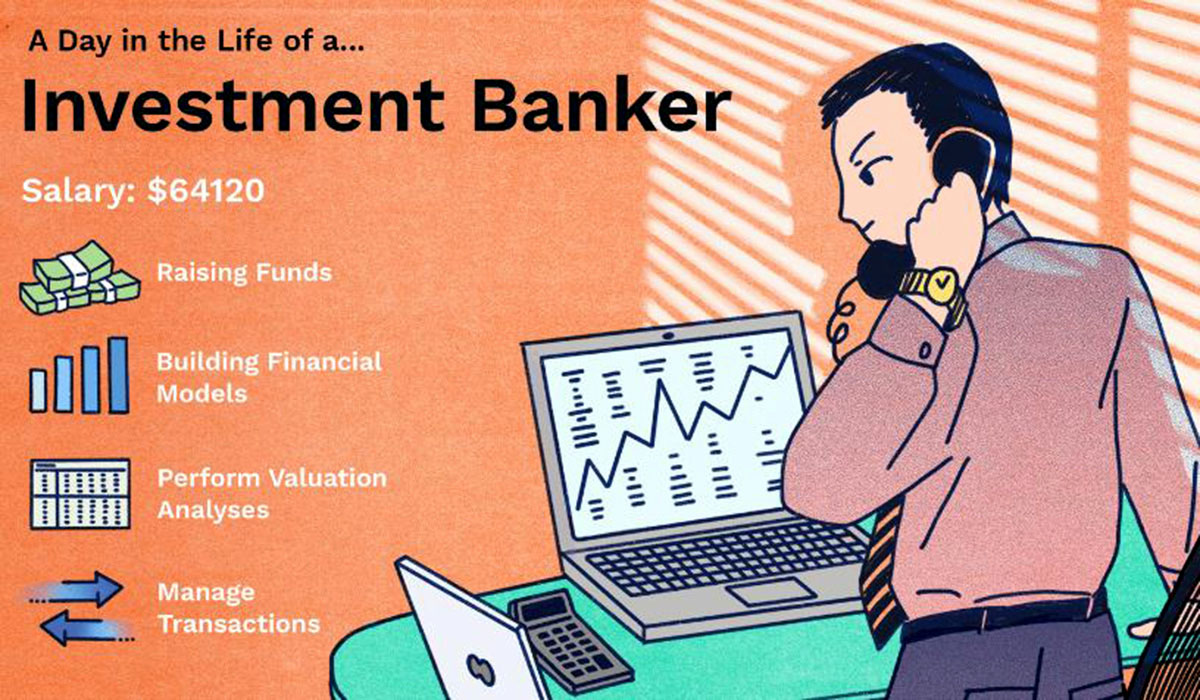

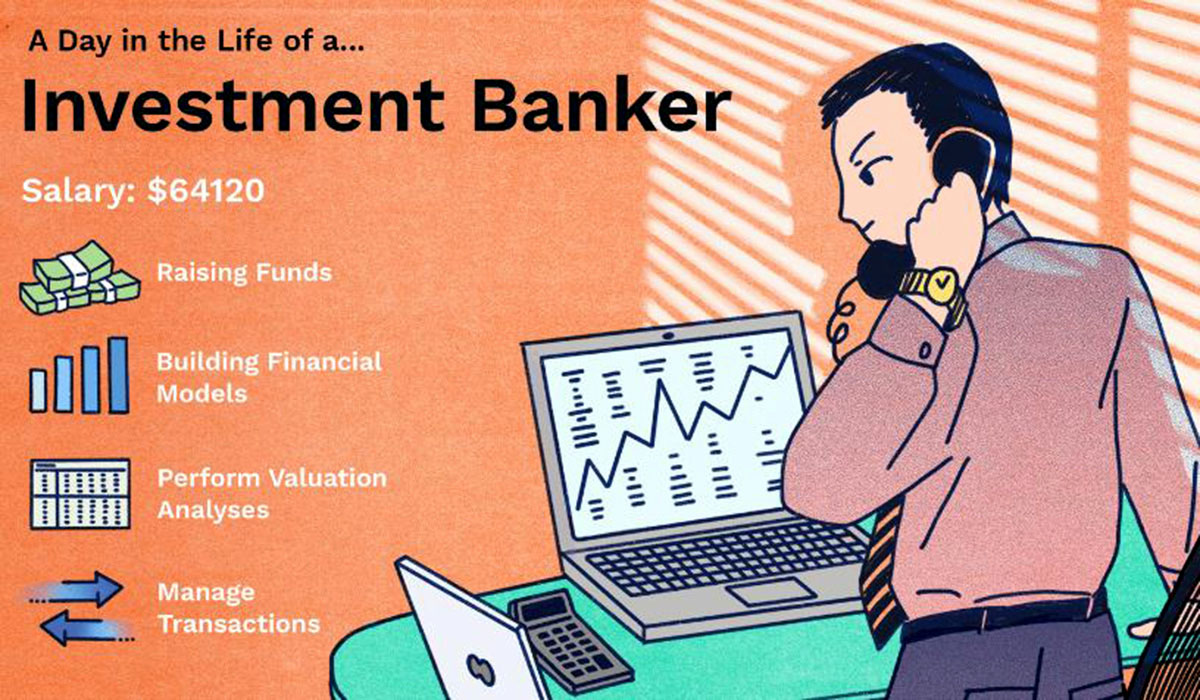

Investment banking, often glamorized in movies and television shows, is a financially rewarding yet highly demanding career path. It is a sector of the finance industry that involves raising capital, providing financial advice, and executing complex financial transactions for corporations, governments, and other entities. Investment bankers play a crucial role in facilitating mergers and acquisitions, underwriting securities offerings, and advising clients on strategic financial decisions.

However, the path to becoming a successful investment banker is not an easy one. It requires a combination of exceptional analytical skills, a strong work ethic, and a deep understanding of financial markets. In this article, we will delve into the world of investment banking, exploring the skills and knowledge required, the educational background necessary, the job market and competition, work-life balance, salary and compensation, and the job outlook and industry trends.

So, if you have ever wondered how hard it is to break into the investment banking industry or what it takes to succeed in this competitive field, keep reading. By the end of this article, you will have a clearer understanding of the challenges and rewards that come with pursuing a career in investment banking.

Overview of Investment Banking

Investment banking is a specialized field within the finance industry that focuses on providing financial services to corporations, governments, and other entities. It encompasses a wide range of activities, including mergers and acquisitions, underwriting securities offerings, raising capital, and advising clients on financial strategies.

One of the key functions of investment bankers is to facilitate mergers and acquisitions (M&A). They help companies evaluate potential acquisition targets, negotiate deals, and structure transactions to maximize value for their clients. Investment bankers also play a critical role in underwriting securities offerings, such as initial public offerings (IPOs) and bond issuances. They assist companies in pricing and marketing their securities and ensure compliance with regulatory requirements.

Raising capital is another important aspect of investment banking. Investment bankers help companies secure funding through various channels, such as issuing debt or equity securities or arranging syndicated loans. They analyze the financial position of the client, assess market conditions, and devise strategies to raise capital efficiently and cost-effectively.

Aside from M&A, underwriting, and capital raising, investment bankers provide strategic financial advice to their clients. They conduct in-depth financial analysis, assess risks and opportunities, and develop tailored strategies to optimize their clients’ financial performance. This requires a deep understanding of financial markets, economic trends, and industry dynamics.

Investment banking operates on a global scale, with major financial centers such as New York, London, and Hong Kong serving as hubs for these activities. Some of the top investment banks in the world include Goldman Sachs, JPMorgan Chase, and Morgan Stanley.

In summary, investment banking is a multifaceted sector of the finance industry that involves facilitating M&A, underwriting securities offerings, raising capital, and providing strategic financial advice. It requires a high level of expertise, analytical skills, and market knowledge to navigate the complexities of this field.

The Skills and Knowledge Required

Working in investment banking requires a unique set of skills and knowledge. The nature of the job demands individuals who possess strong analytical abilities, attention to detail, and excellent problem-solving skills. Here are some of the key skills and knowledge required to thrive in the field of investment banking:

- Financial Analysis: Investment bankers must have a solid foundation in financial analysis. They need to be adept at interpreting financial statements, conducting valuation analyses, and assessing the financial health of companies. Strong quantitative skills are essential to analyze complex financial models and make informed investment decisions.

- Industry Knowledge: Having a deep understanding of the industries in which clients operate is crucial. Investment bankers need to stay updated with market trends, economic conditions, and industry specificities. This knowledge allows them to provide accurate and relevant advice to clients when making strategic financial decisions.

- Communication Skills: Effective communication is essential in investment banking. Investment bankers must be able to articulate complex financial concepts to clients and colleagues in a clear and concise manner. Excellent verbal and written communication skills are necessary for writing reports, presenting investment recommendations, and building relationships with clients.

- Negotiation Skills: Investment bankers frequently engage in negotiations during M&A transactions and other financial deals. The ability to negotiate effectively and achieve favorable outcomes for clients is a valuable skill. This includes developing persuasive arguments, understanding the interests of all parties involved, and finding common ground for mutually beneficial agreements.

- Attention to Detail: In investment banking, accuracy and attention to detail are paramount. Financial transactions involve complex documentation, legal contracts, and regulatory compliance. Investment bankers must have a meticulous eye for detail to minimize errors and ensure that all aspects of a transaction are properly executed.

These skills and knowledge are typically honed through formal education, on-the-job training, and real-world experience. Many investment bankers have backgrounds in finance, economics, or related fields. Advanced degrees such as an MBA or a CFA (Chartered Financial Analyst) designation can also provide a solid foundation for a career in investment banking.

It is worth noting that while these skills and knowledge are fundamental, the investment banking industry is highly competitive. Therefore, continuously updating and expanding one’s skills is essential for success in this field.

Education and Background

Education and background play significant roles in building a successful career in investment banking. While there is no strict requirement for a specific degree or background, certain educational paths and experiences can enhance your prospects in this competitive industry.

Many investment bankers have undergraduate degrees in finance, economics, accounting, or business. These fields provide a solid foundation in financial concepts, quantitative analysis, and business fundamentals. However, it is not uncommon to find investment bankers with diverse backgrounds, such as engineering, mathematics, or humanities. What matters most is the ability to demonstrate a strong aptitude for financial analysis and a genuine interest in the field.

For individuals aspiring to reach higher positions in investment banking, pursuing an advanced degree can be beneficial. Many professionals pursue Master of Business Administration (MBA) programs to develop a broader understanding of business management and enhance their leadership skills. Additionally, earning a Chartered Financial Analyst (CFA) designation can demonstrate expertise in investment analysis and portfolio management.

Internships and relevant work experience are highly valued in the investment banking industry. Participating in internships at investment banks or other financial institutions allows individuals to gain practical experience, develop professional networks, and demonstrate their commitment to the field. These experiences can provide valuable insights into the day-to-day operations of investment banking and help individuals decide if it is the right career path for them.

Furthermore, having strong analytical and quantitative skills is crucial in investment banking. Proficiency in financial modeling, data analysis, and using software such as Excel and Bloomberg Terminal is highly desirable. Additionally, being familiar with industry-specific software, such as financial analysis tools and trading platforms, can give individuals a competitive edge.

Aside from education and technical skills, possessing strong interpersonal skills and the ability to work well in teams is essential. Investment banking often involves collaborating with colleagues, clients, and other stakeholders. Effective communication, leadership, and relationship-building skills are necessary to succeed in this environment.

While education and background lay the foundation for a career in investment banking, it is important to note that relevant experience, networking, and a strong work ethic are equally critical. Taking on challenging assignments, volunteering for additional responsibilities, and seeking mentorship within the industry can significantly enhance one’s chances of securing a position in investment banking.

In summary, a combination of formal education, relevant experience, and a diverse background can position individuals well for a career in investment banking. However, it is essential to continuously update skills, stay informed about industry trends, and demonstrate a genuine passion for the field to thrive in this competitive industry.

Job Market and Competition

The job market for investment banking is highly competitive, attracting talented individuals from diverse academic backgrounds and experiences. The prestige, financial rewards, and opportunities for career advancement make it an attractive field for aspiring professionals.

Entry-level positions in investment banking are typically highly sought after, with a limited number of available slots compared to the number of applicants. Investment banks often recruit from top-tier universities and target individuals with exceptional academic records, relevant internships, and a demonstrated interest in finance.

The competition for these positions is intense, and candidates face a rigorous selection process that includes multiple rounds of interviews, exams, and case studies. Employers look for candidates with strong analytical skills, problem-solving abilities, and a solid understanding of financial markets and valuation techniques.

Networking is also a crucial aspect of career success in investment banking. Building relationships with professionals in the industry, attending industry events, and leveraging personal connections can open doors to job opportunities and internships. Many capital markets firms also actively recruit through campus career fairs and information sessions.

Furthermore, the job market for investment banking is heavily influenced by market conditions and economic cycles. During periods of economic growth, investment banks tend to expand their teams and recruit more aggressively. Conversely, during economic downturns, banks may implement hiring freezes or reduce their workforce. It is important to be aware of these market dynamics and adjust expectations accordingly.

Once individuals secure a position in investment banking, the competition doesn’t end. The industry is known for its demanding work environment and high-performance expectations. Professionals must continuously prove their value by delivering exceptional results, building strong client relationships, and demonstrating a commitment to professional growth.

It is worth noting that the competition in investment banking is not limited to entry-level positions. Advancing in the industry requires sustained dedication, exceptional performance, and the ability to adapt to changing market conditions. The competition intensifies at each level, from analyst to associate, vice president to managing director.

In summary, the job market for investment banking is highly competitive, requiring individuals to possess impressive qualifications and stand out among a pool of talented applicants. Building a strong network, staying informed about industry trends, and continuously developing skills are essential to succeed in this competitive field.

Work-Life Balance

Work-life balance is a critical aspect to consider when pursuing a career in investment banking. The nature of the industry often demands long working hours, tight deadlines, and high pressure. Achieving a healthy balance between work and personal life can be challenging, but it is not impossible.

Investment bankers are known for their intense work schedules, with 80-hour workweeks being common. The demanding workload often requires working late nights, weekends, and even holidays to meet client demands and execute transactions. This can result in limited free time and put a strain on personal relationships and well-being.

However, many investment banks have recognized the importance of work-life balance and have implemented initiatives to promote it. Some firms have introduced flexible work arrangements, remote working options, and wellness programs to support employees’ mental and physical well-being. These initiatives aim to enable employees to manage their time effectively and find a balance between their professional and personal lives.

It is important for individuals in investment banking to prioritize self-care and establish boundaries to maintain work-life balance. This may involve setting limits on working hours, taking regular breaks, and engaging in activities that provide relaxation and stress relief. Additionally, effective time management skills, such as prioritizing tasks and delegating when necessary, can help individuals maintain a more balanced lifestyle.

Building a support system is also crucial in managing work-life balance in investment banking. Surrounding oneself with understanding family and friends who can provide emotional support can make a significant difference. It is also beneficial to connect with colleagues who are going through similar experiences and can relate to the unique demands of the industry.

While work-life balance may be challenging in the early years of an investment banking career, it often improves with experience and advancement. As individuals gain more seniority and responsibility, they may have greater control over their schedules and the ability to delegate tasks to junior team members.

It is important to note that work-life balance looks different for everyone and may vary depending on personal circumstances and career goals. Some individuals thrive in fast-paced, high-intensity environments and find fulfillment in their work, while others may prioritize more time for personal pursuits.

In summary, work-life balance is a significant consideration in the field of investment banking. While the industry is known for its demanding work hours, adopting effective time management strategies, prioritizing self-care, and building a support network can help individuals achieve a more balanced lifestyle.

Salary and Compensation

Investment banking is well-known for its lucrative salary and compensation packages. The financial rewards in this industry are often one of the main factors that attract individuals to pursue a career in investment banking.

The compensation structure in investment banking typically consists of a base salary, annual bonuses, and additional benefits. The base salary serves as a fixed component of the total compensation and varies based on factors such as experience, position, and location. Entry-level analysts can expect a competitive base salary, often higher than in other industries.

The annual bonus is a significant component of an investment banker’s compensation. The bonus amount is usually performance-based and is tied to individual and firm-wide achievements. It can make up a substantial portion of the overall compensation and can be several times higher than the base salary. The bonus amount is influenced by factors such as revenue generation, deal closings, client relationships, and overall performance of the firm.

In addition to base salary and annual bonuses, investment bankers often receive additional benefits and perks. These may include health insurance, retirement plans, paid time off, gym memberships, and other lifestyle benefits. Some investment banks also offer employee stock ownership plans (ESOPs) or stock options as a form of long-term incentive.

The salary and compensation in investment banking can vary significantly depending on factors such as the size and reputation of the firm, location, level of seniority, and performance of the individual. In major financial centers like New York or London, investment bankers generally earn higher salaries compared to other regions.

It is important to note that while the salary and compensation in investment banking are attractive, it is essential to consider the demanding nature of the job and the long working hours associated with it. The high compensation often comes with significant sacrifices and a fast-paced, high-pressure work environment.

Furthermore, it is worth mentioning that the salaries and compensation packages in investment banking have been under scrutiny in recent years. Some argue that the long working hours and high stress levels may not adequately compensate for the sacrifices made. It is important for individuals to carefully weigh the financial rewards against the personal trade-offs and determine if the compensation package aligns with their long-term goals and priorities.

In summary, investment banking offers lucrative salary and compensation packages, with annual bonuses often serving as a significant portion of the overall earnings. However, it is essential to consider the demanding nature of the job and the personal sacrifices required to excel in this industry.

Job Outlook and Industry Trends

The job outlook for investment banking can be influenced by a variety of factors, including market conditions, regulatory changes, and technological advancements. Staying informed about industry trends is crucial for individuals considering a career in investment banking or those already working in the field.

One significant trend in the investment banking industry is the increasing focus on technology and digital innovation. Technological advancements, such as artificial intelligence, blockchain, and data analytics, are reshaping the way financial transactions are conducted and analyzed. Investment banks are increasingly adopting these technologies to improve efficiency, enhance risk management, and provide more personalized services to clients. This trend opens up new opportunities for professionals with expertise in financial technology and data analysis.

Another trend is the growing emphasis on sustainability and environmental, social, and governance (ESG) factors in investment decision-making. Investors are placing greater importance on companies’ environmental and social impact, as well as their governance practices. As a result, investment banks are incorporating ESG considerations into their analyses and offering specialized services to meet the increasing demand for sustainable investments. This trend creates opportunities for individuals with expertise in sustainable finance and ESG analysis.

The job outlook for investment banking can also be influenced by the global economic landscape. Economic growth, geopolitical stability, and market conditions affect the volume and size of transactions, ultimately impacting the demand for investment banking services. During periods of economic expansion, the job market in investment banking tends to be more robust, with increased deal activity and hiring. Conversely, economic downturns can result in reduced deal flow and potential hiring freezes.

Regulatory changes can also significantly impact the job outlook in investment banking. Following the financial crisis of 2008, stricter regulations were implemented to enhance transparency and reduce risk in the financial industry. Compliance and regulatory functions have become increasingly important, creating job opportunities in areas such as risk management, compliance advisory, and regulatory reporting.

The COVID-19 pandemic has also had an impact on the investment banking industry. Market volatility, disrupted deal flow, and remote working arrangements have presented challenges for firms. However, investment banks have shown resilience and adaptability in navigating these uncertain times. The pandemic has accelerated the adoption of digital tools and remote collaboration technologies, changing the way investment banking professionals work.

Furthermore, diversity and inclusion have become key focus areas in the industry. Investment banks are actively working on improving gender and ethnic diversity within their organizations, recognizing the importance of diverse perspectives and experiences in driving innovation and success.

In summary, the job outlook in investment banking is influenced by various factors, including technological advancements, sustainability trends, economic conditions, regulatory changes, and market uncertainties. Staying informed about these industry trends and developing relevant skills can help individuals navigate the evolving landscape and succeed in a competitive job market.

Conclusion

Investment banking offers a challenging yet rewarding career path for individuals with an aptitude for finance, strong analytical skills, and a passion for the financial markets. It is a sector that plays a vital role in facilitating mergers and acquisitions, raising capital, and providing strategic financial advice to corporations, governments, and other entities.

Throughout this article, we have explored various aspects of investment banking, including the skills and knowledge required, the educational background necessary, the job market and competition, work-life balance, salary and compensation, and industry trends. It is important for individuals considering a career in investment banking to understand the demands and challenges of the industry, as well as the potential rewards.

Breaking into investment banking requires a combination of a solid educational foundation, relevant work experience, and exceptional interpersonal skills. The competition for job opportunities can be intense, prompting individuals to continuously develop their skills, network, and stay informed about industry trends.

While investment banking offers attractive salary and compensation packages, it is crucial to consider the demanding nature of the job and the potential impact on work-life balance. Working long hours, meeting tight deadlines, and handling high-pressure situations are common in this field. However, with effective time management, support systems, and a commitment to personal well-being, individuals can achieve a healthier work-life balance.

Looking ahead, investment banking is evolving to adapt to technological advancements, sustainability considerations, and changing market dynamics. Professionals with expertise in financial technology, data analytics, and sustainable finance are well-positioned to capitalize on emerging trends. As the global economy recovers from the impacts of the COVID-19 pandemic, the industry will continue to undergo transformations.

In conclusion, investment banking offers aspiring professionals the opportunity to work in a dynamic and financially rewarding field. It requires a combination of skills, knowledge, commitment, and adaptability to succeed. By staying informed about industry trends, continuously developing skills, and maintaining a healthy work-life balance, individuals can navigate this competitive industry and build a fulfilling and successful career in investment banking.