Finance

How To Get An Investment Banking Internship

Modified: December 30, 2023

Looking to break into the finance industry? Learn how to secure an investment banking internship and jumpstart your career in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Overview of Investment Banking Internships

- Importance of an Investment Banking Internship

- Researching and Identifying Potential Internship Opportunities

- Preparing Your Resume and Cover Letter

- Networking and Building Connections in the Industry

- Practicing for Interviews and Technical Questions

- Successfully Navigating the Interview Process

- Accepting and Making the Most of an Internship Offer

- Conclusion

Introduction

Welcome to the world of investment banking internships! If you’re considering a career in finance, gaining practical experience through an internship is an excellent way to kickstart your journey. Investment banking internships provide a unique opportunity to work alongside industry professionals, gain valuable skills, and make meaningful connections in the field.

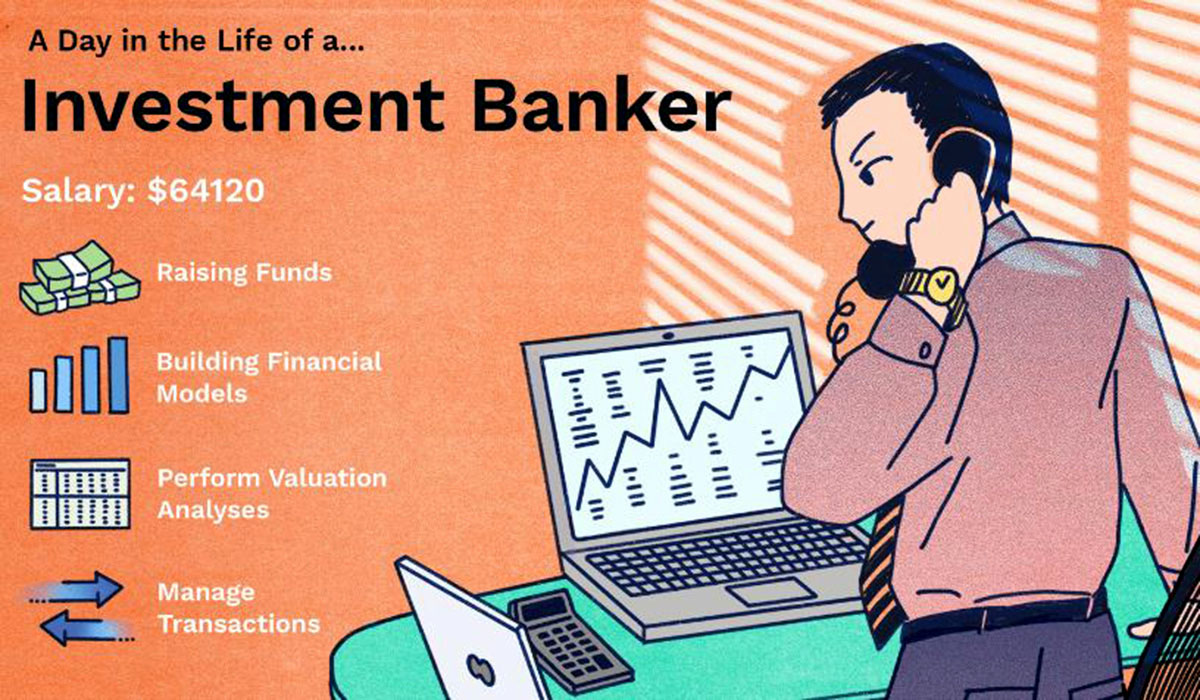

Investment banking is a highly competitive and lucrative industry that deals with raising capital, mergers and acquisitions, and providing financial advice to corporations and government entities. It requires a strong foundation in finance and a deep understanding of the markets. By securing an internship in this field, you’ll gain firsthand exposure to the fast-paced and dynamic world of investment banking.

Internships play a crucial role in shaping your future career trajectory. They offer a real-world glimpse into the day-to-day responsibilities of an investment banker and allow you to apply the theoretical knowledge you’ve acquired through your studies. As an intern, you’ll have the opportunity to contribute to projects, learn from experienced professionals, and assess whether investment banking is the right fit for you.

During your internship, you’ll likely work on a wide range of assignments, including financial modeling, industry research, due diligence, and client communication. These tasks will allow you to develop critical skills such as analytical thinking, problem-solving, and effective communication – all essential qualities sought after in the investment banking industry.

Furthermore, internships provide a valuable networking opportunity. You’ll have the chance to connect with professionals in the finance industry, build relationships, and potentially secure a full-time job offer after graduation. The connections you make during your internship can serve as a stepping stone for your career and open doors to future opportunities.

In this comprehensive guide, we will take you through the process of obtaining an investment banking internship. We’ll cover everything from researching and identifying potential opportunities, preparing your resume and cover letter, to networking and acing the interview process. By the end, you’ll have a roadmap to help you navigate this competitive field and secure the internship of your dreams.

So, if you’re ready to embark on an exciting journey into the world of investment banking internships, let’s get started!

Overview of Investment Banking Internships

Investment banking internships offer a unique opportunity for students and recent graduates to gain practical experience and insight into the functioning of the finance industry. These internships typically last for a few months, during which interns are immersed in various aspects of investment banking, such as mergers and acquisitions, capital raising, and financial analysis.

Interns are generally assigned to specific departments within an investment bank, such as mergers and acquisitions, equity capital markets, or debt capital markets. Throughout the internship, they work closely with professionals in their respective departments, assisting them with research, financial modeling, and client communication.

One of the primary goals of an investment banking internship is to provide interns with real-world exposure to the fast-paced and high-pressure environment of the finance industry. This helps them gain a deeper understanding of investment banking operations and the roles and responsibilities of various team members.

During the internship, interns often work on live deals and projects, contributing to the overall success of the team. They may assist in conducting due diligence, analyzing financial statements, and creating valuation models. This hands-on experience allows interns to develop transferable skills and make a tangible impact.

In addition to the technical skills gained, investment banking internships also provide opportunities for personal and professional growth. Interns learn to manage their time effectively, work in teams, and communicate with clients from different backgrounds and cultures. These skills are essential for a successful career in investment banking.

Networking is a crucial aspect of an internship in investment banking. Interns have the chance to connect with professionals at all levels within the organization, attend networking events, and build relationships that can potentially lead to future job opportunities. Building a strong network early on can greatly enhance an intern’s chances of securing a full-time position in the industry.

Internships in investment banking are highly competitive, with many top firms receiving thousands of applications for a limited number of positions. Therefore, it’s important for aspiring interns to take the application process seriously and prepare themselves thoroughly.

Overall, investment banking internships provide a valuable learning experience and serve as a launching pad for a successful career in finance. They give interns a taste of the industry, help them develop essential skills, and allow them to make connections that can shape their future.

Importance of an Investment Banking Internship

An investment banking internship is more than just a line on your resume. It is a valuable opportunity to gain practical experience, develop essential skills, and make meaningful industry connections. Here are some key reasons why an internship in investment banking is important:

- Gain Hands-On Experience: Internships provide a chance to apply the theoretical knowledge gained through coursework to real-world situations. Working on live projects and deals allows interns to experience the fast-paced and dynamic nature of investment banking. This hands-on experience helps develop key skills, such as financial modeling, data analysis, and problem-solving.

- Explore the Industry: Investment banking internships offer a glimpse into the day-to-day operations of the industry. Interns have the opportunity to work alongside professionals from various departments and gain insight into the different areas of investment banking, such as mergers and acquisitions, capital markets, and corporate finance. This exposure helps interns make informed decisions about their career path within finance.

- Build a Strong Network: Networking is a vital component of a successful career in finance. During an internship, interns have the chance to connect with professionals at different levels within the organization. Building relationships and making a positive impression can open doors to future job opportunities. Additionally, interns can attend networking events and interact with industry experts, further expanding their network.

- Enhance Transferable Skills: Investment banking internships provide an ideal environment to develop critical skills that are valuable in any professional setting. These include teamwork, communication, time management, attention to detail, and the ability to work under pressure. Mastering these skills during an internship can greatly enhance an intern’s employability and set them apart from their peers.

- Test Career Fit: Internships allow individuals to assess whether a career in investment banking aligns with their interests, skills, and long-term goals. The exposure to the industry provides valuable insights into the challenges and rewards of working as an investment banker. Interns can use this experience to make informed decisions about their future career path.

- Increase Job Prospects: Having an investment banking internship on your resume significantly improves your chances of securing future job opportunities. Employers highly value candidates with practical experience and a proven track record. A successful internship showcases your commitment, dedication, and ability to thrive in a competitive work environment, making you a more desirable candidate for full-time positions in investment banking.

Ultimately, an investment banking internship is a gateway to a successful career in finance. It provides the practical skills, industry exposure, and networking opportunities needed to excel in this competitive field. For aspiring finance professionals, an internship in investment banking is a crucial step towards achieving their career goals.

Researching and Identifying Potential Internship Opportunities

When it comes to securing an investment banking internship, thorough research and careful identification of potential opportunities are essential. Here are some steps to help you in your search:

- Research Investment Banks: Start by researching prominent investment banks that offer internship programs. Look for banks that align with your interests, values, and target geographical location. Consider factors such as the bank’s reputation, size, culture, and the projects they are involved in. This research will help you narrow down your options and focus on the banks that best suit your goals.

- Explore University Programs: Many universities have established connections with investment banks and may have specific programs or partnerships in place. Research if your university has any formal relationships with investment banks and inquire about internship opportunities they may offer exclusively to students.

- Attend Career Fairs and Events: Career fairs and networking events are excellent opportunities to connect with representatives from investment banks. Research the upcoming career fairs in your area and make a list of the banks attending. Prepare your elevator pitch and bring copies of your resume to make a good impression and inquire about potential internship opportunities.

- Utilize Online Resources: Online platforms like LinkedIn, Glassdoor, and company websites are valuable resources for finding internship opportunities. Follow investment banks on LinkedIn to receive updates on internships and job openings. Glassdoor provides insights into the interview process and experiences of previous interns, helping you gauge the company culture and expectations.

- Network with Professionals: Tap into your existing network and reach out to professionals in the investment banking industry. Attend industry events, join finance-related clubs or organizations, and connect with alumni who are working in the field. Networking can potentially lead to valuable connections and insider information about internship opportunities.

- Consider Small and Boutique Firms: Don’t overlook smaller or boutique investment banking firms. While they may not have the same level of name recognition as larger banks, they can still offer valuable internship experiences and exposure to unique deal opportunities. These firms often have a more intimate working environment, allowing interns to have a hands-on role in projects.

- Apply Early and Be Selective: Investment banking internships are highly competitive, so it’s crucial to apply early and prioritize your applications. Tailor your resume and cover letter to highlight relevant skills and experiences. Be strategic in selecting the banks you apply to; rather than applying to every opportunity, focus on a few that align with your goals and where you believe you have the best chance of success.

Remember, the more effort and time you invest in researching and identifying potential internship opportunities, the higher your chances of finding a placement that aligns with your career aspirations. Stay proactive, be persistent, and leverage every resource available to secure an internship that will kickstart your journey in the world of investment banking.

Preparing Your Resume and Cover Letter

When applying for an investment banking internship, your resume and cover letter are key components of your application. Here are some tips to ensure they make a strong impression:

- Showcase Relevant Skills and Experiences: Tailor your resume to highlight your relevant skills and experiences. Emphasize any coursework, projects, or extracurricular activities that demonstrate your knowledge of finance, data analysis, and critical thinking. Include internships or part-time jobs that showcase your ability to work in a fast-paced, deadline-driven environment.

- Quantify Achievements: Use numbers and metrics to quantify your achievements whenever possible. For example, highlight the size of a project you worked on, the amount of funds you helped raise, or the percentage increase in revenue as a result of your contributions. This will make your accomplishments more impactful and demonstrate your ability to deliver tangible results.

- Highlight Leadership and Teamwork Skills: Investment banking requires strong teamwork and leadership abilities. Highlight instances where you successfully collaborated with a team, took on leadership roles, or managed projects efficiently. Demonstrating your ability to work well in a team and lead when necessary will make you stand out as a desirable candidate.

- Show Interest in the Firm: Research the investment bank you’re applying to and demonstrate your interest in their work and culture. Customize your cover letter to explain why you are specifically interested in that firm and how your skills align with their values and goals. This shows your dedication and genuine interest in the company.

- Keep it Professional and Concise: Your resume and cover letter should be professional and error-free. Use a clean and easy-to-read format, and proofread multiple times to ensure there are no typos or grammatical errors. Keep your resume concise, focusing on the most relevant information and avoiding irrelevant details. Aim for a one-page resume if possible.

- Highlight Technical Skills: Investment banking requires proficiency in financial analysis, financial modeling, and data analysis. Highlight any technical skills you have, such as proficiency in Microsoft Excel, financial modeling software, or programming languages. These skills are highly sought after and can give you a competitive edge.

- Include Relevant Certifications: If you have earned any relevant certifications or completed courses in finance or investment banking, be sure to include them on your resume. These certifications demonstrate your commitment to learning and can add credibility to your application.

- Seek Feedback: Don’t hesitate to seek feedback from professors, career advisors, or mentors. They can provide valuable insights and help you fine-tune your resume and cover letter. Incorporate their suggestions to further strengthen your application.

Remember, your resume and cover letter are your first impression to potential employers. Take the time to craft them carefully and tailor them to each specific application. A well-crafted resume and cover letter will enhance your chances of securing an investment banking internship and set you apart from other candidates.

Networking and Building Connections in the Industry

Networking is a vital component of a successful career in the investment banking industry. Building connections with professionals in the field can create valuable opportunities for internships, job placements, and career advancements. Here are some important strategies for networking and building connections:

- Attend Industry Events: Attend conferences, seminars, and networking events focused on finance and investment banking. These events provide valuable opportunities to meet professionals from various investment banks, as well as potential mentors and industry experts. Be proactive in engaging with others and make genuine connections.

- Reach Out to Alumni: Leverage the power of your university alumni network. Alumni who have pursued careers in finance can offer valuable advice and insights. Connect with them through alumni events, LinkedIn, or university career services. Request informational interviews or seek guidance on breaking into the industry.

- Join Finance Clubs and Organizations: Engage in finance-related clubs and organizations in your college or community. These groups often host events, workshops, and networking sessions where you can meet like-minded individuals and professionals in the industry. Active involvement in these organizations demonstrates your commitment and passion for finance.

- Utilize Social Media: Create a professional presence on platforms like LinkedIn, where you can connect with professionals, join finance groups, and share relevant content. Engage with industry leaders, comment on their posts, and contribute to discussions. Active participation can help you gain visibility and build meaningful relationships.

- Informational Interviews: Request informational interviews with professionals in investment banks or related fields. Be respectful of their time and come prepared with thoughtful questions. This is not a formal job interview, but an opportunity to gain insights about their career path, the industry, and potentially establish a connection for future opportunities.

- Maintain Relationships: Building connections is not just about making initial contact; it is about nurturing relationships over time. Stay in touch with professionals you meet by sending occasional emails or connecting on social media. Attend alumni or industry events regularly to maintain and strengthen your network.

- Offer Value: Networking is a two-way street. Look for opportunities to offer value to professionals you meet. Share industry articles, provide insights on a particular topic, or offer to assist with a project. Demonstrating your willingness to contribute and be helpful can leave a lasting impression.

- Follow Up: After connecting with someone, always follow up with a personalized thank-you message or email. Express your appreciation for their time and insights. This simple gesture helps solidify the connection and leaves a positive impression.

Remember, effective networking is about building genuine relationships. It requires time, effort, and a sincere interest in connecting with others. Cultivating a strong network will not only open doors to internship opportunities but can also provide ongoing support and guidance throughout your career in investment banking.

Practicing for Interviews and Technical Questions

Preparing for interviews and technical questions is a crucial step in securing an investment banking internship. Here are some key strategies to help you practice effectively:

- Research Common Interview Questions: Familiarize yourself with common interview questions asked in investment banking interviews. Research online resources, interview guides, and industry forums to get an idea of the types of questions that are often asked. This will help you anticipate and prepare thoughtful responses.

- Review Technical Concepts: Investment banking interviews often include technical questions to assess your knowledge of finance and investment concepts. Brush up on financial modeling, valuation methods, accounting principles, and industry trends. Use resources like textbooks, online courses, and practice problem sets to strengthen your technical skills.

- Practice Mock Interviews: Find a partner, such as a friend, mentor, or career advisor, to conduct mock interviews with you. Practice answering both behavioral and technical questions while simulating a real interview environment. This will help you become more comfortable expressing your thoughts and improve your ability to articulate complex concepts.

- Utilize Online Resources: Take advantage of online resources that offer mock interview platforms or video recordings of sample investment banking interviews. These resources allow you to practice in a self-paced manner and observe your performance, enabling you to identify areas for improvement.

- Networking with Professionals: Reach out to professionals working in investment banking and request informational interviews. In addition to gaining industry insights, these meetings can provide an opportunity to ask about interview experiences and expectations. Their firsthand advice can help you better prepare for interviews and gain a perspective from those who have gone through the process.

- Stay Updated with Market News: Stay informed about current events and market trends in finance. Read financial news publications, follow industry blogs, and stay updated on recent deals and mergers. Being well-informed allows you to discuss relevant topics confidently and demonstrate your knowledge and interest in the field.

- Develop a Story Library: Investment banking interviews often involve behavioral questions that require candidates to share experiences and demonstrate skills such as leadership, teamwork, and problem-solving. Maintain a collection of stories from your past experiences that highlight your accomplishments, challenges overcome, and lessons learned. Tailor these stories to answer different types of behavior-based questions.

- Gain Feedback and Evaluate: Seek feedback from mentors, professors, or professionals in the industry. After conducting mock interviews or informational interviews, ask for feedback on your performance. Take note of areas where you can improve and work on refining your responses and communication skills accordingly.

Remember, practice is essential for interview success. The more you practice, the more comfortable and confident you’ll become. Put in the effort to prepare thoroughly, and approach each interview as a learning opportunity. With practice and preparation, you’ll be well-equipped to handle the challenging interview process and increase your chances of securing an investment banking internship.

Successfully Navigating the Interview Process

The interview process is a critical step in securing an investment banking internship. It’s important to approach each interview with confidence and preparedness. Here are some key strategies to help you navigate the interview process successfully:

- Research the Company: Thoroughly research the investment bank you are interviewing with. Familiarize yourself with their recent deals, company culture, and values. This will demonstrate your genuine interest in the firm and help you tailor your answers to align with their objectives.

- Practice your Elevator Pitch: Prepare a concise and impactful elevator pitch that highlights your skills, experiences, and career aspirations. This pitch should not only showcase your qualifications but also convey your passion for investment banking. Practice delivering it confidently, as it will likely be one of the first questions during an interview.

- Be Proficient in Technical Concepts: Investment banking interviews often include technical questions to assess your understanding of financial concepts and modeling techniques. Allocate time to review and practice core technical concepts, such as valuation methods, financial statement analysis, and financial modeling. Be prepared to apply these concepts to case studies or real-world scenarios.

- Highlight Relevant Skills and Experiences: Structure your responses in a way that highlights your most relevant skills and experiences. Use the STAR (Situation, Task, Action, Result) method to effectively communicate your accomplishments. Focus on demonstrating qualities such as teamwork, problem-solving, analytical thinking, and attention to detail.

- Showcase Your Passion: Investment banking is a demanding field, and employers want to see that you are genuinely enthusiastic about the industry. Convey your passion for finance and investment banking throughout the interview. Share specific instances where you demonstrated your commitment, and express your eagerness to learn and contribute.

- Ask Intelligent Questions: Prepare a list of thoughtful questions to ask the interviewer. This demonstrates your interest in the role and company. Inquire about the culture, future opportunities, and specific projects or deals that the firm has been involved in. Avoid asking questions that can easily be found on the company’s website or through basic research.

- Practice Professional Etiquette: Dress professionally and arrive early for the interview to demonstrate your punctuality and respect for the interviewer’s time. Maintain eye contact, engage in active listening, and exhibit a positive demeanor throughout the interview. Remember to express gratitude for the opportunity at the end of the interview.

- Reflect on Each Interview: After each interview, take time to reflect on your performance. Evaluate your responses, identify areas where you can improve, and take note of any questions or scenarios that caught you off guard. Use this feedback to fine-tune your preparation for future interviews.

- Stay Persistent and Positive: Navigating the interview process can be challenging, and it’s essential to stay persistent and positive. Rejections are a natural part of the process, so treat each interview as a valuable learning experience. Stay motivated, continue improving your skills, and remain confident in your abilities.

Remember, successful navigation of the interview process requires preparation, practice, and a positive mindset. By implementing these strategies, you can increase your chances of securing an investment banking internship and take a step closer to launching your career in finance.

Accepting and Making the Most of an Internship Offer

Receiving an internship offer in the investment banking industry is an exciting accomplishment. Once you’ve received an offer, it’s important to handle the acceptance process professionally and make the most of the opportunity. Here are some steps to help you navigate this stage:

- Review and Evaluate the Offer: Carefully review the internship offer, including the start and end dates, compensation, and any other terms or conditions. Assess whether the offer aligns with your expectations and career goals. Consider factors such as the reputation of the investment bank, the location, and the potential for learning and growth.

- Communicate Professionally: Once you’ve made a decision, promptly communicate your acceptance to the firm. Respond professionally to the individual who extended the offer, expressing your gratitude and enthusiasm. Be clear and concise in your response, and follow any instructions provided by the company regarding necessary documentation or paperwork.

- Prepare for the Internship: Before starting your internship, take the time to prepare yourself. Research the investment bank and the specific department you’ll be working in. Familiarize yourself with the company culture, recent deals, and any ongoing projects. Review key technical concepts and industry trends to ensure you are well-prepared to contribute from day one.

- Establish Clear Goals: Set clear goals for what you hope to achieve during your internship. Reflect on what you want to learn, the skills you want to develop, and the connections you want to make. Discuss these goals with your supervisor or mentor within the investment bank to align expectations and receive guidance on how to make the most of your internship experience.

- Build Relationships: Networking is crucial even after you’ve accepted the internship offer. Connect with your future colleagues or other interns through LinkedIn or other professional platforms. Attend any pre-internship events or orientation sessions to start building relationships early on. Remember, the connections you make can be valuable throughout your career.

- Be Proactive and Eager to Learn: Approach your internship with a proactive mindset. Take the initiative to seek out additional projects or tasks, ask for feedback on your work, and demonstrate your eagerness to learn. Show enthusiasm and a willingness to contribute to the team. This proactive approach can lead to greater exposure and additional learning opportunities.

- Seek Feedback and Learn from the Experience: Throughout your internship, seek feedback from your supervisor or mentor. This will help you identify areas of improvement and further develop your skills. Actively participate in any training sessions or workshops offered by the firm. Embrace the opportunity to learn from experienced professionals and leverage the internship as a stepping stone for your future career.

- Network Beyond Your Team: While interning, make an effort to network with professionals in other departments or teams. Attend company events, engage in conversations with different individuals, and express interest in their work. This broader network can provide insights into different areas of the investment bank and potentially open doors to new opportunities in the future.

- Leave a Lasting Impression: Aim to leave a positive and lasting impression at the end of your internship. Deliver high-quality work, meet deadlines, and demonstrate a strong work ethic. Express gratitude to your supervisors and colleagues for the opportunity and any guidance they provided. Leave the door open for future connections and maintain relationships built during your internship.

Accepting an investment banking internship offer is just the first step. By preparing yourself, setting goals, building relationships, and being proactive during your internship, you can make the most of this valuable opportunity. Embrace the learning experience, seize every opportunity to grow, and nurture the connections you make. Your internship can serve as a foundation for a successful career in investment banking.

Conclusion

Congratulations on completing this comprehensive guide to securing an investment banking internship! By following the steps outlined in this article, you have gained invaluable knowledge and insights into the process of researching, preparing for, and navigating the world of investment banking internships.

We began by discussing the importance of internships in the finance industry and how they provide practical experience, help you develop essential skills, and build a strong professional network. We then explored various strategies for researching and identifying potential internship opportunities, including networking, attending career fairs, and utilizing online resources.

Next, we delved into the crucial aspects of preparing your resume and cover letter. Highlighting relevant skills and experiences, quantifying achievements, and demonstrating a genuine interest in the firm are crucial components of crafting a compelling application.

We also explored the vital role of networking and building connections in the investment banking industry. Attending industry events, engaging with professionals, and seeking mentorship can create opportunities for internships, job placements, and continued career growth.

Moreover, we provided guidance on practicing for interviews and technical questions. By researching common interview questions, reviewing technical concepts, and engaging in mock interviews, you can boost your confidence and improve your performance during the interview process.

Once you receive an internship offer, we discussed the importance of accepting it professionally and making the most of the opportunity. From setting clear goals and building relationships to being proactive, seeking feedback, and leaving a lasting impression, you can maximize your internship experience and set yourself up for future success in the field.

In conclusion, securing an investment banking internship requires dedication, preparation, and a proactive mindset. By following the steps outlined in this guide, you’ve equipped yourself with the knowledge and strategies needed to navigate the competitive landscape of investment banking internships. Remember to stay persistent, embrace learning opportunities, and build a strong professional network. With these tools in hand, you are well on your way to launching a successful career in finance.

Best of luck on your journey!