Finance

How Long After I Sell My Stocks On Robinhood

Published: January 17, 2024

Learn about the timeframe for selling stocks on Robinhood and the impact on your finance. Plan your investment strategy wisely to optimize returns.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

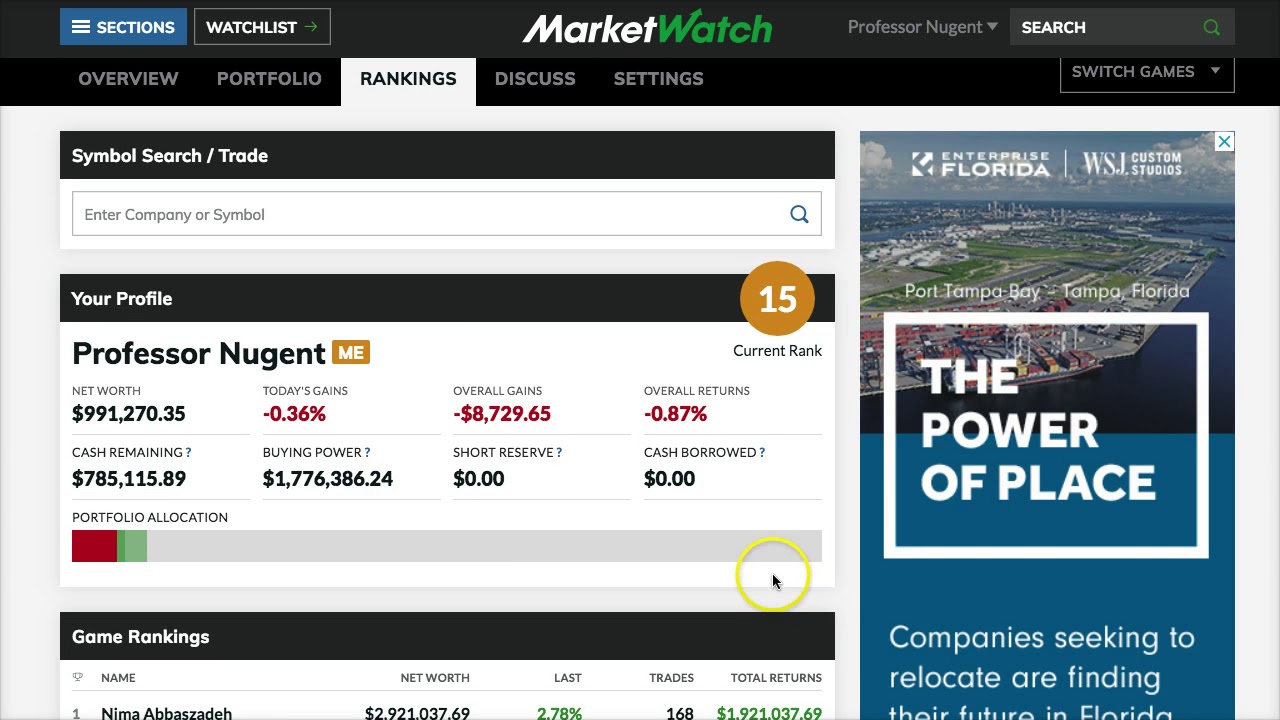

Selling stocks is a common practice for investors to secure profits or reallocate their investment portfolios. If you are using Robinhood, a popular online brokerage platform, to trade stocks, you may be wondering how long it takes for the funds to become available after selling your shares. Understanding the timing and process of selling stocks on Robinhood can help you effectively manage your investments and make informed decisions.

Robinhood has gained popularity among investors due to its user-friendly interface and commission-free trading. It allows individuals to buy and sell stocks, ETFs, and cryptocurrencies with ease. However, the timing for funds availability after selling stocks on Robinhood is subject to certain factors that we will explore in this article.

In this article, we will delve into the selling process on Robinhood and discuss the settlement period for sold stocks. We will also explore the factors that affect the timing of funds availability and outline strategies for maximizing efficiency when selling stocks.

Please note that the information provided here is based on general practices and may vary depending on specific circumstances. It is always advisable to refer to the official Robinhood website or seek professional guidance for accurate and up-to-date information.

Understanding the Selling Process on Robinhood

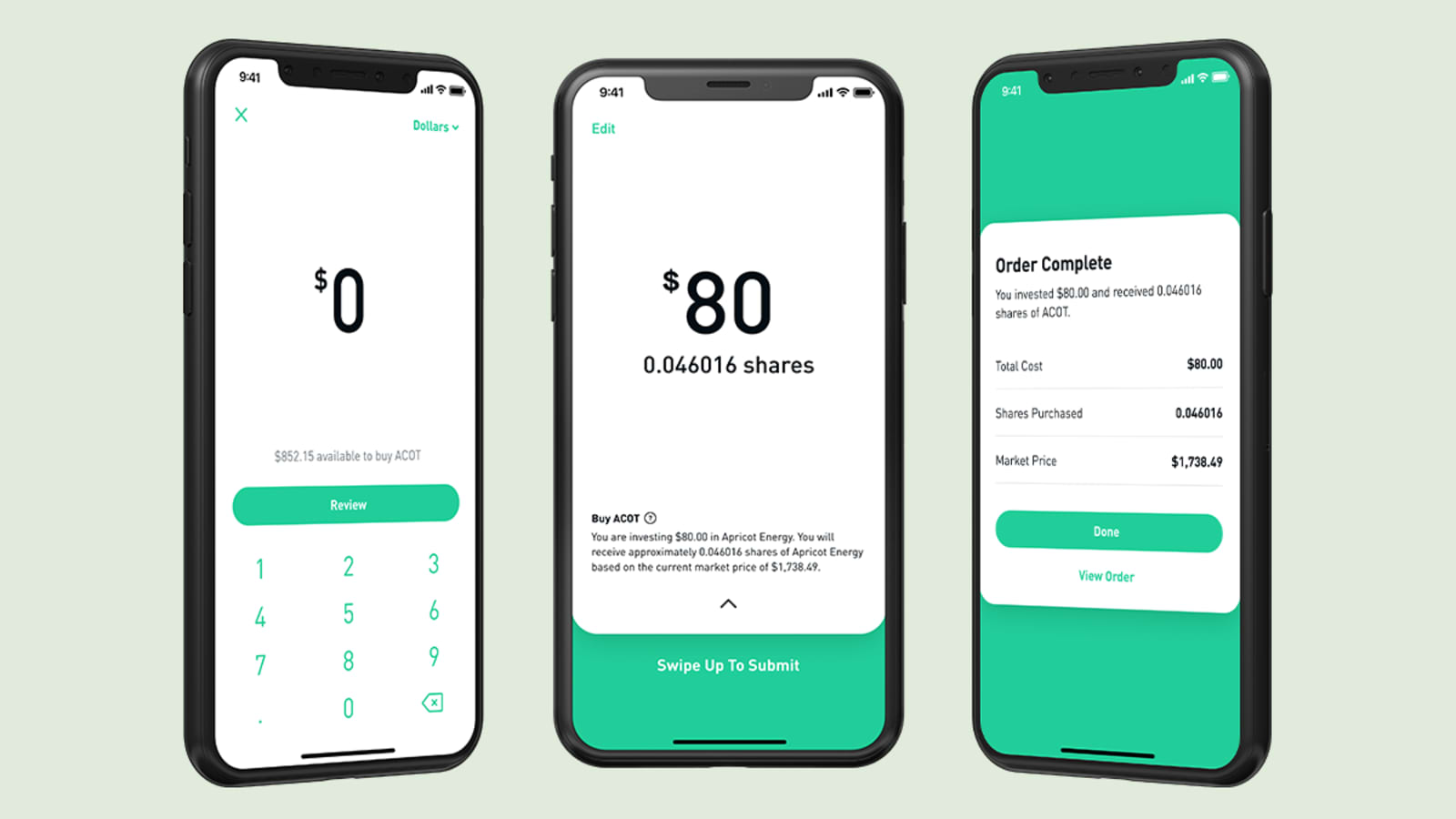

Before we dive into the timing of funds availability, let’s first understand how the selling process works on Robinhood. When you decide to sell your stocks on the platform, you are essentially placing a sell order. This order indicates your intention to sell a specific number of shares of a particular stock at the prevailing market price.

Once you have placed a sell order, Robinhood begins executing it. The platform automatically searches for buyers who are interested in purchasing the stock at or near the price you have specified. The selling process continues until all your shares have been sold or until the order expires.

During the selling process, it’s important to keep in mind that stock prices fluctuate constantly. Therefore, the actual price at which your shares are sold may vary slightly from the market price at the time you placed the sell order. Additionally, the timing of the execution may be influenced by market conditions and the availability of buyers.

Robinhood also provides users with options to specify the type of sell order, such as a market order or a limit order. A market order indicates that you are willing to sell your shares at the current market price, while a limit order allows you to set a specific price at which you are willing to sell. It’s important to understand the implications of each order type and choose the one that aligns with your investment goals and risk tolerance.

Once your sell order is executed, the settlement process begins. This is the period during which the transaction is finalized, and the funds are transferred to your account. The length of the settlement period can vary depending on several factors, which we will discuss in the next section.

Settlement Period for Sold Stocks

After your sell order is executed on Robinhood, a settlement period follows before the funds from the sale are made available for withdrawal or further investing. The settlement period refers to the time it takes for the transaction to be officially completed and for ownership of the sold shares to be transferred to the buyer.

On Robinhood, the standard settlement period for sold stocks is two business days, also known as T+2. This means that if you sell your stocks on Monday, the funds will typically be available for withdrawal or reinvestment in your Robinhood account on Wednesday. However, it’s important to note that weekends and stock market holidays are not counted as business days in the settlement period, so the timeframe may be slightly longer in those cases.

During the settlement period, the stock you sold is still listed in your portfolio as “pending settlement.” This means that you no longer have ownership of the shares, but the transaction is being processed. It’s important to refrain from attempting to sell those pending settlement shares during this time, as it can lead to potential violations of the SEC’s free-riding and good faith settlement rules.

It’s worth mentioning that Robinhood offers a feature called “instant settlement” for certain accounts. With instant settlement, the funds from the sale of stocks are made available immediately for reinvestment or withdrawal. However, this feature is only available for Robinhood Gold members who meet specific account balance criteria. If you have Robinhood Gold and qualify for instant settlement, the settlement period for sold stocks will be shortened significantly.

It’s important to be aware that the settlement period may differ for other types of securities, such as options or cryptocurrencies. Therefore, it’s advisable to refer to the official Robinhood website or contact their customer support for specific information regarding the settlement period for different financial instruments.

Availability of Proceeds after Selling Stocks

Once the settlement period for sold stocks on Robinhood is complete, the proceeds from the sale become available for withdrawal or reinvestment. You can access these funds in your Robinhood account and decide how you want to utilize them.

To check the availability of your proceeds, you can navigate to the “Account” tab on the Robinhood app or website. Here, you will find the cash balance, which represents the amount of funds you can withdraw or use for new investments. The cash balance is updated once the settlement is complete and the proceeds are credited to your account.

Robinhood allows you to choose from various options regarding the use of the available proceeds. You can withdraw the funds to your linked bank account, which typically takes a few business days for the transfer to be completed. Alternatively, you can choose to reinvest the proceeds by purchasing other stocks, ETFs, or cryptocurrencies.

When deciding how to use the proceeds, it’s important to consider your investment goals, risk tolerance, and market conditions. It may be beneficial to conduct thorough research and analysis before making any investment decisions. Additionally, keep in mind that the availability of the proceeds for withdrawal or reinvestment is subject to certain factors that we will explore in the next section.

To make the most of your proceeds, you can also consider utilizing Robinhood’s fractional shares feature. Fractional shares allow you to invest in a particular stock or ETF with as little as $1, enabling you to diversify your portfolio and allocate funds efficiently.

Lastly, it’s essential to note that any gains from selling stocks may be subject to taxes. Depending on your tax jurisdiction and the holding period of the sold stocks, you may be liable to pay capital gains taxes. It’s recommended to consult with a tax professional to understand your tax obligations and take advantage of any potential tax-saving strategies.

Factors Affecting the Timing of Funds Availability

While the standard settlement period for sold stocks on Robinhood is two business days, the actual timing of funds availability may be influenced by several factors. Understanding these factors can help you anticipate any potential delays in receiving your funds.

1. Market Conditions: The overall market conditions can impact the speed at which your sell order is executed and settled. During periods of high trading volume or market volatility, it may take longer for your sell order to be matched with a buyer and for the settlement to occur. Conversely, in calmer market conditions, the process may be expedited.

2. Stock Specific Factors: Different stocks may have varying settlement procedures based on corporate actions or market regulations. For example, if a stock you sold is subject to a pending merger or acquisition, the settlement period may be extended to accommodate the necessary administrative processes. It’s important to be aware of any specific factors that may affect the timing of funds availability for the stocks you are selling.

3. Account Activity: The frequency of your trading activities and your account history can impact the timing of funds availability. If you have a history of frequent trading or if there are any suspicious activities associated with your account, it may take longer for the funds to become available.

4. External Transfers: If you are transferring the proceeds from your Robinhood account to a linked external bank account, the timing of the transfer will be subject to the processing speed of the banking system. Typically, bank transfers may take a few business days to complete, especially if there are weekends or holidays involved.

5. Robinhood Gold Membership: As mentioned earlier, being a Robinhood Gold member and qualifying for instant settlement can significantly shorten the settlement period for sold stocks. With instant settlement, your funds become immediately available for withdrawal or reinvestment, providing quicker access to your proceeds.

It’s important to note that while there may be external factors influencing the timing of funds availability, Robinhood strives to process transactions efficiently and provide a seamless user experience. In most cases, the two business day settlement period is adhered to, ensuring that your funds are accessible in a timely manner.

Potential Delays in Receiving Funds

While Robinhood aims to provide a smooth and efficient process for selling stocks and accessing funds, there may be situations where delays occur. It’s important to be aware of these potential delays to avoid any unexpected challenges or inconveniences.

1. Market Holidays: Stock markets are closed on certain holidays, and these days are not included in the settlement period calculation. If your sell order coincides with a market holiday, it can extend the settlement period by an additional day or more.

2. Weekends: Similar to market holidays, weekends are not considered business days for the settlement process. If you sell stocks on a Friday, for example, the settlement period will be extended until the start of the next business day, typically on Tuesday.

3. Account Verification: If there are any issues with verifying your account or if Robinhood requires additional documentation, it can result in delays in receiving your funds. It’s crucial to ensure that your account is fully verified and up to date to minimize potential delays.

4. Technical Glitches: While rare, technical glitches or system outages can occur on trading platforms, including Robinhood. In such cases, the processing of sell orders and settlement may be temporarily disrupted, leading to delays in receiving your funds. It’s advisable to stay informed about any system updates or maintenance schedules to anticipate any potential disruptions.

5. Unsettled Funds: If you have recently made other stock sales or deposits, the proceeds from those transactions may still be in the settlement period. In this case, the funds may not be immediately available for withdrawal or reinvestment until the settlement is complete. It’s important to consider any unsettled funds in your account to accurately determine the available balance.

While Robinhood endeavors to minimize potential delays, it’s important to remain patient and allow sufficient time for the settlement period to complete. If you anticipate any urgent need for your funds, it may be beneficial to plan your sell orders accordingly, considering weekends, holidays, and potential processing delays.

If you encounter any unexpected delays or have concerns about the availability of your funds, it’s advisable to reach out to Robinhood’s customer support for assistance. They can provide specific information and guidance based on your account and the circumstances of your sell order.

Strategies for Maximizing Efficiency in Selling Stocks

Efficiently selling stocks on Robinhood can help you take advantage of favorable market conditions and optimize your investment portfolio. Here are some strategies to consider for maximizing efficiency in the selling process:

1. Set Clear Investment Goals: Before selling your stocks, it’s important to have a clear understanding of your investment goals. Are you looking to secure profits, rebalance your portfolio, or make strategic adjustments? Having a specific goal in mind can guide your selling decisions and help you determine the best time to sell.

2. Monitor Market Conditions: Keeping a close eye on market trends and stock performance can be beneficial when deciding to sell. Take note of relevant news, company announcements, and industry trends that may impact the price of your stocks. Selling during favorable market conditions can increase your chances of achieving desirable outcomes.

3. Utilize Stop Loss Orders: To protect yourself from potential losses in volatile markets, consider setting stop loss orders when selling stocks on Robinhood. A stop loss order allows you to specify a price at which you want to sell your stocks if the price drops below a certain threshold. This strategy can help minimize losses and automate the selling process.

4. Employ Trailing Stop Orders: Trailing stop orders are another useful tool for maximizing efficiency. With a trailing stop order, you can set a percentage or dollar amount below the current market price. The sell order will automatically adjust as the stock price rises, locking in potential gains while allowing for further upside potential.

5. Diversify Your Portfolio: Maintaining a well-diversified portfolio is a key strategy in any investment approach. By spreading your investments across different sectors, industries, and asset classes, you can reduce the impact of individual stock performance on your overall portfolio. This can help minimize risk and provide more flexibility when selling stocks.

6. Consider Tax Implications: Before selling stocks, it’s important to understand the potential tax implications. Stocks held for a longer period may qualify for long-term capital gains tax rates, which can be more favorable than short-term capital gains rates. Consult with a tax professional to ensure you are maximizing any potential tax benefits and making informed decisions.

7. Use Limit Orders: When placing a sell order, consider using limit orders to specify the minimum price at which you are willing to sell your stocks. This gives you more control over the selling price and helps protect against selling at a lower price than desired. However, keep in mind that a limit order may not guarantee execution if the market price does not reach your specified limit.

8. Regularly Review Your Portfolio: Periodically reviewing your portfolio is essential for optimizing your investments. Assess the performance of your stocks, evaluate market trends, and make necessary adjustments based on your investment strategy and goals. Regular monitoring ensures you stay informed and can take action when needed.

Remember, every investor’s circumstances and goals are unique. It’s crucial to align these strategies with your individual needs and risk tolerance. By considering these strategies, you can improve the efficiency of your selling process and make informed decisions that align with your investment objectives.

Conclusion

Selling stocks on Robinhood is a straightforward process that allows investors to secure profits, rebalance their portfolios, and make strategic adjustments. Understanding the timing and factors that affect the availability of funds after selling stocks is crucial for effectively managing your investments.

The settlement period for sold stocks on Robinhood is typically two business days. However, this timeframe may be influenced by various factors such as market conditions, specific stock considerations, and account activity. It’s important to be aware of potential delays that may arise from market holidays, weekends, account verification, technical glitches, or unsettled funds.

To maximize efficiency in selling stocks, it’s advisable to set clear investment goals, monitor market conditions, utilize tools like stop loss and trailing stop orders, diversify your portfolio, consider tax implications, use limit orders, and regularly review your investments. These strategies can help you make informed decisions and optimize your selling process.

Remember that Robinhood offers additional features and options such as instant settlement for Robinhood Gold members and fractional shares, which can enhance your trading experience and provide more flexibility.

As with any investment decision, it’s crucial to conduct thorough research, stay informed, and consult with professionals if needed. By understanding the selling process on Robinhood and implementing effective strategies, you can unlock the potential of your investments and achieve your financial goals.

Please note that the information provided in this article is intended for educational purposes only and should not be construed as financial advice. Always do your own research and consider your individual circumstances before making any investment decisions.