Home>Finance>What Is A Consumer Finance Account On Your Credit Report

Finance

What Is A Consumer Finance Account On Your Credit Report

Modified: December 30, 2023

Learn about consumer finance accounts and how they can affect your credit report. Understand the role of finance in managing your credit and financial health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Consumer Finance Accounts

- Impact of Consumer Finance Accounts on Your Credit Report

- Types of Consumer Finance Accounts

- How Consumer Finance Accounts are Reported on Your Credit Report

- Strategies for Managing Consumer Finance Accounts

- Tips for Improving Your Credit Score with Consumer Finance Accounts

- Common Mistakes to Avoid with Consumer Finance Accounts

- Conclusion

Introduction

Welcome to the world of consumer finance accounts! If you’re wondering what these accounts are and how they can impact your credit report, you’ve come to the right place. In this article, we’ll explore the ins and outs of consumer finance accounts and discuss strategies for managing them effectively.

Consumer finance accounts play a significant role in your financial health. They encompass a wide range of credit arrangements that individuals rely on for various purposes, such as purchasing electronics, furniture, or even funding a vacation. These accounts are typically offered by retailers or financial institutions, and they require borrowers to make regular installment payments over a specified period of time.

Understanding how consumer finance accounts work and their implications on your credit report is crucial for maintaining a healthy credit score. Your credit report acts as a financial snapshot that lenders use to assess your creditworthiness. It includes information about your borrowing history, including consumer finance accounts you have opened.

Consumer finance accounts are unique in that they offer a convenient financing option for consumers but can also pose risks if mishandled. Being aware of the different types of accounts available, how they are reported on your credit report, and the potential impact on your credit score is essential for making informed financial decisions.

In the following sections, we will delve into the intricacies of consumer finance accounts, explore the ways they are reported on your credit report, and provide expert strategies for effectively managing these accounts. Additionally, we will share valuable tips for improving your credit score while utilizing consumer finance accounts responsibly.

By the end of this article, you will have a comprehensive understanding of consumer finance accounts and the knowledge needed to navigate this aspect of your financial life confidently. So, let’s dive in and demystify the world of consumer finance accounts!

Understanding Consumer Finance Accounts

Consumer finance accounts are credit arrangements that allow individuals to make purchases and pay for them over time with installment payments. These accounts are commonly offered by retailers or financial institutions and provide an alternative to traditional loans or credit cards.

Unlike credit cards, where you have a revolving line of credit, consumer finance accounts are typically structured as closed-end loans. This means you have a fixed loan amount and set repayment terms, including a predetermined number of monthly payments. In most cases, there is an interest rate associated with these accounts, which varies depending on the lender and your creditworthiness.

Consumer finance accounts are often used for larger purchases, such as electronics, furniture, appliances, or even medical expenses. They are designed to offer consumers a more manageable way to make these purchases by breaking down the cost into affordable monthly payments.

One key feature of consumer finance accounts is that they are usually offered with promotional financing options. These options may include deferred interest or no interest if paid in full within a specific time frame. It’s important to carefully read and understand the terms and conditions of these promotional offers to avoid unexpected fees or interest charges.

It’s essential to recognize that consumer finance accounts can be both beneficial and potentially risky, depending on how they are managed. On one hand, they provide an opportunity for individuals to make necessary purchases when they may not have access to immediate funds. On the other hand, mishandling these accounts can lead to excessive debt, late payments, and ultimately, a negative impact on your credit score.

As a borrower, it’s crucial to carefully consider your ability to repay these accounts before opening them. Evaluate your budget and ensure you can comfortably make the monthly payments without stretching your finances too thin. Additionally, it’s essential to utilize consumer finance accounts responsibly and avoid borrowing more than you can afford to repay.

Now that we have a clear understanding of what consumer finance accounts are let’s explore their impact on your credit report and how they are reported to credit bureaus.

Impact of Consumer Finance Accounts on Your Credit Report

Consumer finance accounts can have a significant impact on your credit report and ultimately influence your credit score. When managed responsibly, these accounts can help build a positive credit history. However, if mishandled, they can negatively impact your creditworthiness.

One of the primary ways consumer finance accounts affect your credit report is through their influence on your payment history. Payment history is one of the most crucial factors in determining your credit score, accounting for approximately 35% of the overall score. Making timely payments on your consumer finance accounts demonstrates responsible financial behavior and can boost your credit score.

Conversely, late payments, defaults, or accounts sent to collection agencies can have detrimental effects on your credit report. These negative marks can remain on your credit report for up to seven years, significantly impacting your creditworthiness and making it harder to secure future credit or loans.

Utilizing consumer finance accounts can also affect your credit utilization ratio. This ratio compares the amount of credit you are utilizing against your total available credit. Lenders often view a lower utilization ratio as a sign of responsible credit management. Opening a consumer finance account increases your overall available credit, which, if managed wisely, can help lower your credit utilization ratio and positively affect your credit score.

Another factor to consider is the age of your consumer finance accounts. Length of credit history is an essential component in determining your credit score, representing approximately 15% of the total score. Keeping consumer finance accounts open for a longer period can contribute positively to your credit history, demonstrating that you have a well-established borrowing history.

It’s important to note that the impact of consumer finance accounts on your credit report depends on how you manage them. By making consistent, on-time payments, keeping your balances low, and managing your overall credit responsibly, you can ensure that consumer finance accounts have a positive impact on your creditworthiness.

Now that we understand the impact of consumer finance accounts on your credit report, let’s delve into the types of consumer finance accounts you may encounter.

Types of Consumer Finance Accounts

Consumer finance accounts come in various forms, each tailored to different purchasing needs and offered by different retailers or financial institutions. Here are some common types of consumer finance accounts:

- Retail installment contracts: These accounts are commonly provided by retailers when you make a purchase, especially for big-ticket items like appliances or furniture. The purchase price is divided into equal monthly installments, typically with interest charged on the outstanding balance.

- Automobile loans: When financing a vehicle purchase, you may enter into an automobile loan agreement. This type of consumer finance account allows you to make monthly payments over a set term until the loan is fully paid off.

- Store credit cards: Many retailers offer their own branded credit cards that can be used for purchases within their stores. These credit cards often come with promotional financing options, such as zero-interest periods or discounts on initial purchases.

- Medical financing: Some healthcare providers offer their own financing options to help patients manage the costs of medical procedures or treatments. These accounts may offer low or zero-interest payment plans over a designated period.

- Electronics and household goods: Electronic retailers and companies offering household goods often provide installment options for customers. This allows individuals to purchase electronic devices or other goods and pay off the balance over time.

- Personal loans: While not specific to any particular retailer, personal loans can be obtained from financial institutions for various purposes. These loans may be used for debt consolidation, home improvements, or other personal expenses.

It’s important to note that the terms and conditions, interest rates, and repayment periods for consumer finance accounts can vary widely. Pay close attention to the details of each account to understand the specific terms, fees, and promotional offers associated with them.

Now that we have explored the different types of consumer finance accounts, let’s move on to understanding how these accounts are reported on your credit report.

How Consumer Finance Accounts are Reported on Your Credit Report

Your consumer finance accounts play a crucial role in your credit history, and how they are reported to the credit bureaus can significantly impact your credit report. Understanding how these accounts are reported can help you make informed decisions and effectively manage your credit.

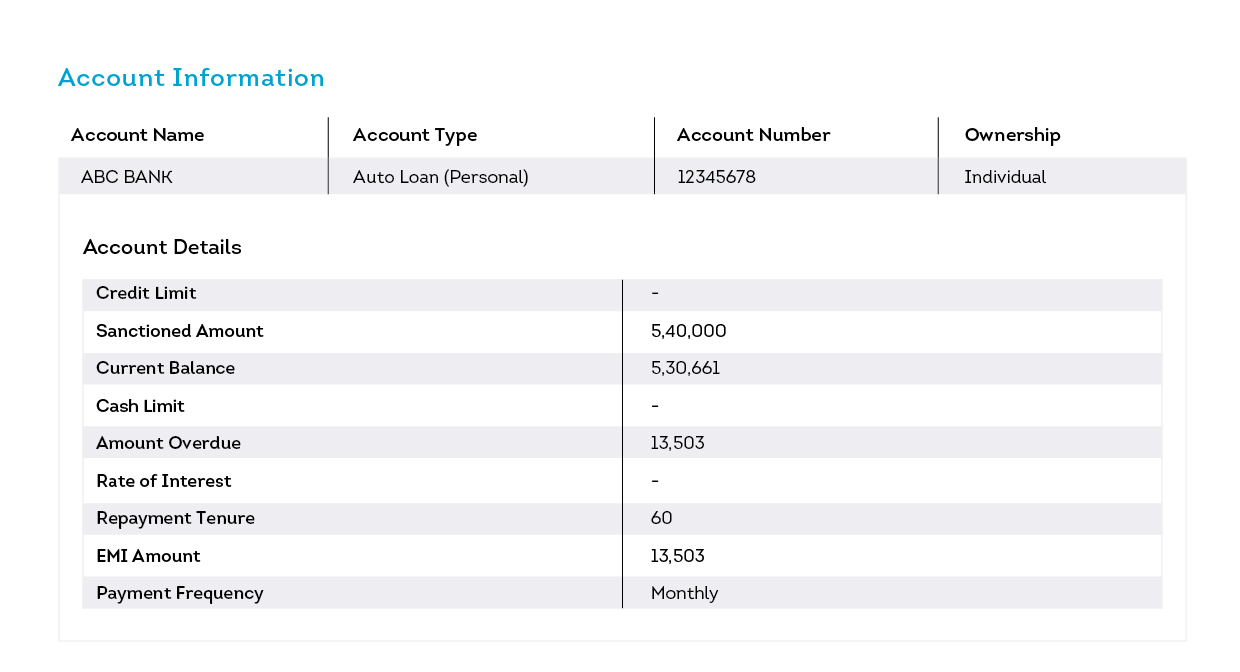

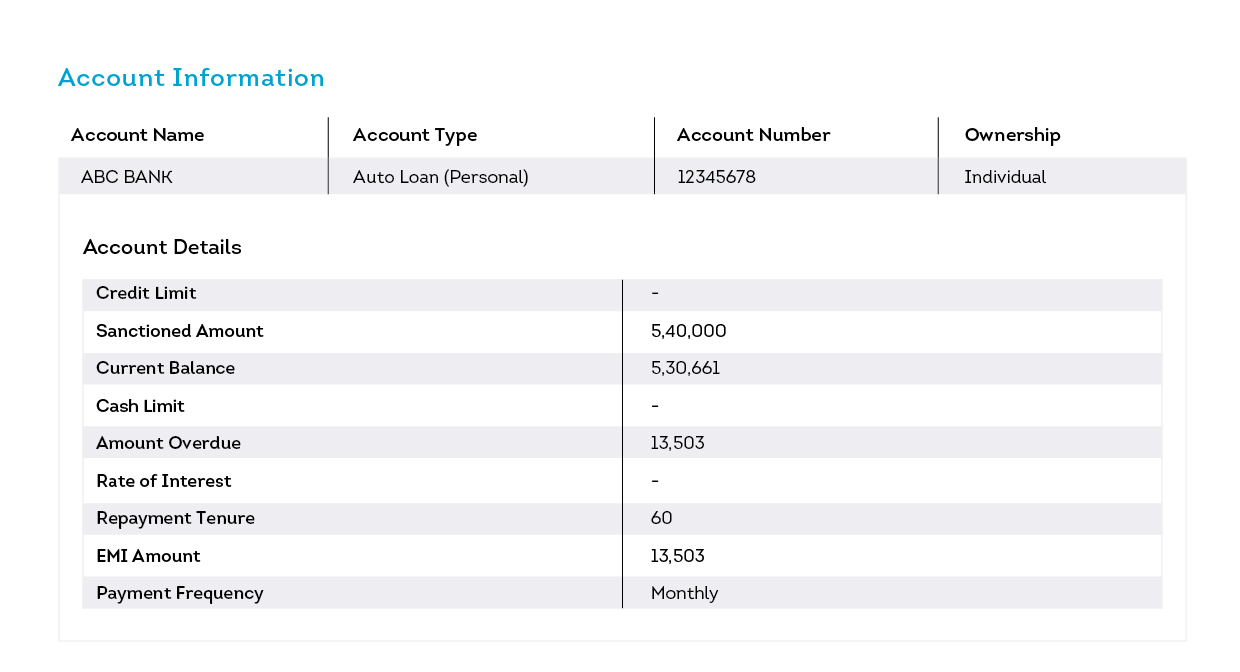

When you open a consumer finance account, the account information is typically reported to one or more of the major credit bureaus: Experian, Equifax, and TransUnion. This information includes details about the account, such as the type of account, the date it was opened, the credit limit (if applicable), the outstanding balance, and your payment history.

Payment history is one of the most critical aspects of reporting consumer finance accounts. Each month, the lender reports whether you made your payment on time, paid less than the minimum amount due, or missed a payment altogether. Late payments can have a detrimental effect on your credit report, leading to a lower credit score.

Additionally, the balance and credit limit of your consumer finance accounts are also reported. These details contribute to your credit utilization ratio, which compares your outstanding balances to your total available credit. A lower credit utilization ratio is generally viewed more favorably and can positively impact your credit score.

The length of your credit history is another factor considered in your credit report. Consumer finance accounts contribute to the overall age of your credit history. Keeping these accounts open for an extended period can demonstrate a longer and more established credit history, positively influencing your creditworthiness.

It’s important to review your credit report regularly to ensure that the information being reported is accurate and up to date. Mistakes in reporting can negatively affect your credit score. If you notice any errors or discrepancies, you can dispute them with the credit bureaus to have them corrected.

Now that we have a solid understanding of how consumer finance accounts are reported on your credit report, let’s explore strategies for effectively managing these accounts.

Strategies for Managing Consumer Finance Accounts

Managing consumer finance accounts responsibly is crucial for maintaining a healthy credit score and financial well-being. Here are some strategies to help you effectively manage your consumer finance accounts:

- Create a budget: Before opening a consumer finance account, assess your financial situation and create a budget. Determine if you can comfortably afford the monthly payments without straining your finances. Consider not only the payments for the consumer finance account but also other financial obligations you have.

- Read the terms and conditions: Before opening a consumer finance account, carefully read and understand the terms and conditions. Pay attention to the interest rate, any promotional financing offers, fees, and the consequences of missed payments or defaults.

- Make payments on time: Timely payments are crucial for maintaining a positive credit history. Set up reminders or automatic payments to ensure you never miss a payment due date. Late payments can negatively impact your credit score.

- Pay more than the minimum: Whenever possible, pay more than the minimum amount due on your consumer finance accounts. Paying more than the minimum helps you reduce the balance faster, saving you money on interest charges and improving your credit utilization ratio.

- Avoid maxing out your credit limit: Keeping your credit utilization ratio low is important for maintaining a healthy credit score. Avoid maxing out your credit limit on your consumer finance accounts and aim to keep your balances below 30% of your available credit.

- Monitor your credit report: Regularly review your credit report to ensure the information being reported is accurate. Look for any discrepancies or errors and report them to the credit bureaus for correction.

- Consider early repayment: If you have the means to do so, consider paying off your consumer finance accounts early. This can help you save money on interest charges and free up your finances sooner.

- Avoid unnecessary credit: Think twice before opening new consumer finance accounts. Opening multiple accounts within a short period can raise red flags to lenders and potentially impact your creditworthiness. Only open accounts that you need and can manage responsibly.

- Communicate with your lender: If you’re facing financial difficulties that may affect your ability to make payments on your consumer finance accounts, reach out to your lender. Often, they may be willing to work with you by offering temporary payment arrangements or alternative solutions.

By following these strategies, you can effectively manage your consumer finance accounts, build a positive credit history, and improve your overall financial well-being.

Now let’s move on to valuable tips for improving your credit score while utilizing consumer finance accounts responsibly.

Tips for Improving Your Credit Score with Consumer Finance Accounts

Consumer finance accounts can be valuable tools for improving your credit score when managed responsibly. Here are some tips to help you maximize the positive impact of these accounts on your creditworthiness:

- Make all payments on time: Timely payments are essential for maintaining a positive credit history. Ensure that you make all payments for your consumer finance accounts on or before the due date to establish a reliable payment record.

- Pay more than the minimum: Whenever possible, pay more than the minimum amount due on your consumer finance accounts. This demonstrates responsible credit utilization and can positively impact your credit score.

- Keep your balances low: Aim to keep your outstanding balances on consumer finance accounts as low as possible. High balances can negatively impact your credit utilization ratio, so paying down your balances regularly can improve your credit score.

- Establish a mix of credit: Having a diverse credit profile is beneficial for your credit score. Alongside consumer finance accounts, consider having other types of credit, such as credit cards or installment loans, to demonstrate your ability to manage different types of credit responsibly.

- Avoid opening too many accounts: While having a mix of credit is important, avoid opening too many consumer finance accounts within a short period. Opening multiple accounts can raise concerns for lenders and potentially negatively impact your credit score.

- Monitor your credit utilization ratio: Keep a close eye on your credit utilization ratio, which is the amount of credit you are using compared to your total available credit. Aim to keep your ratio below 30% to maintain a healthy credit score.

- Be cautious with promotional financing offers: While promotional financing offers can be enticing, make sure you understand the terms and conditions. Deferred interest options, for example, can result in accrued interest if you don’t pay off the balance within the specified time frame.

- Regularly review your credit report: Check your credit report regularly to ensure all information is accurate and up to date. Look for any errors or discrepancies, and report them to the credit bureaus for correction to avoid any negative impact on your credit score.

- Maintain a long credit history: Keeping your consumer finance accounts open for an extended period can positively impact your credit score. Avoid closing old accounts unless necessary, as they contribute to the length of your credit history.

- Seek professional advice if needed: If you are struggling to manage your consumer finance accounts or improve your credit score, consider seeking advice from a credit counseling agency or a financial advisor. They can provide personalized guidance to help you navigate your situation effectively.

By following these tips, you can optimize the positive impact of your consumer finance accounts and boost your credit score over time.

Now, let’s explore common mistakes to avoid when it comes to managing consumer finance accounts.

Common Mistakes to Avoid with Consumer Finance Accounts

While consumer finance accounts can be useful tools for managing purchases and building credit, there are several common mistakes that individuals should avoid. By being aware of these pitfalls, you can navigate your consumer finance accounts more effectively and maintain a healthy financial profile. Here are some common mistakes to avoid:

- Making late payments: Late payments can have a severe impact on your credit score. Always prioritize making your consumer finance account payments on time to avoid negative marks on your credit report.

- Overspending: It’s crucial to stay within your budget and only borrow what you can comfortably afford to repay. Excessive borrowing and overspending can lead to financial stress, missed payments, and a negative impact on your credit score.

- Not reading the terms and conditions: Failing to thoroughly read and understand the terms and conditions of your consumer finance accounts can lead to costly surprises. Be aware of interest rates, promotional offers, and any penalties or fees associated with the account.

- Ignoring your credit utilization ratio: Your credit utilization ratio, which compares your credit card balances to your available credit limit, is an essential factor in your credit score. Avoid maxing out your accounts and aim to keep your credit utilization ratio below 30%.

- Opening too many accounts: Opening multiple consumer finance accounts within a short period can raise red flags with lenders and negatively impact your creditworthiness. Only open new accounts if necessary and carefully consider the implications on your credit score.

- Closing accounts impulsively: Closing consumer finance accounts prematurely can negatively impact your credit history and credit score. Unless necessary, keep your accounts open to maintain a longer credit history, which is favorable for your creditworthiness.

- Falling for high-interest financing options: While promotional offers may seem appealing, it’s essential to carefully evaluate the terms and potential interest charges. Some deferred interest options can lead to significant fees if the balance isn’t paid within the specified timeframe.

- Ignoring your credit report: Failing to regularly review your credit report can allow errors or discrepancies to go unnoticed. Regularly monitor your report to ensure its accuracy and dispute any incorrect information promptly.

- Using consumer finance accounts for unnecessary purchases: It’s important to use consumer finance accounts for essential purchases rather than indulgent or unnecessary items. Consider whether the purchase is truly needed and fits within your budget before using credit.

- Not seeking professional advice when needed: If you find yourself struggling to manage your consumer finance accounts or improve your credit, don’t hesitate to seek advice from a credit counseling agency or financial advisor. They can provide guidance tailored to your specific situation and help you make informed decisions.

Avoiding these common mistakes will help you maintain a strong and healthy financial profile while maximizing the benefits of your consumer finance accounts. Now, let’s conclude our discussion and wrap up the key takeaways.

Conclusion

Consumer finance accounts have become an integral part of our financial lives, offering opportunities for making necessary purchases and building credit. However, it’s essential to understand how these accounts impact our credit reports and how to effectively manage them to maintain a healthy credit score.

In this article, we explored the various types of consumer finance accounts, including retail installment contracts, store credit cards, automobile loans, and personal loans. We discussed how these accounts are reported on your credit report, emphasizing the importance of making timely payments, keeping balances low, and maintaining a diverse credit profile.

We also provided valuable strategies for managing consumer finance accounts, such as creating a budget, reading and understanding the terms and conditions, and making payments on time. Additionally, we shared tips for improving your credit score by paying more than the minimum, monitoring your credit utilization ratio, and seeking professional advice when needed.

Avoiding common mistakes, such as making late payments, overspending, and opening too many accounts, is crucial for maintaining a positive credit history. By being mindful of these pitfalls, you can navigate your consumer finance accounts responsibly and avoid unnecessary credit troubles.

Remember to regularly monitor your credit report for accuracy and dispute any errors promptly. And finally, if you find yourself facing financial difficulties, don’t hesitate to seek guidance from credit counseling agencies or financial advisors to help you make informed decisions and regain control of your credit.

By understanding how consumer finance accounts work, utilizing them responsibly, and implementing effective strategies, you can build a strong credit profile and achieve your financial goals. With these tools in hand, you are equipped to make informed decisions and successfully navigate the world of consumer finance accounts.