Home>Finance>How Long Should You Wait Before Opening Another Credit Card

Finance

How Long Should You Wait Before Opening Another Credit Card

Published: October 24, 2023

Discover the optimal timing for opening a new credit card and managing your finances. Learn how long you should wait before applying for another credit card.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Opening a new credit card can be a tempting prospect, offering the potential for increased rewards, better perks, and improved financial flexibility. However, it’s important to approach credit card applications strategically and consider the potential impact on your credit score before diving in. So, how long should you wait before opening another credit card?

There is no one-size-fits-all answer to this question, as the ideal timeframe between credit card applications can vary depending on personal financial goals and individual circumstances. However, there are several factors to consider when deciding how long to wait.

Firstly, it’s important to evaluate your current financial situation. Are you carrying a significant amount of credit card debt? Opening another credit card may not be the best move if you are struggling to manage your existing debt. It’s crucial to prioritize paying off any outstanding balances before considering applying for a new credit card.

Secondly, take a look at your credit score. The number of credit inquiries and new accounts can influence your credit score. Each credit card application typically triggers a hard inquiry, which can cause a temporary dip in your score. If you have recently applied for a credit card or loan, it may be wise to wait until your credit score has had a chance to recover before submitting another application.

Additionally, consider your financial goals and needs. Are you looking to consolidate debt, earn rewards, or build credit history? Understanding your objectives can help determine the timing of your next credit card application.

Furthermore, think about the specific credit card you are interested in. Some credit card issuers have specific rules and limitations on how frequently you can apply for their cards. Make sure to do your research and familiarize yourself with any restrictions that may apply.

Overall, it’s essential to be mindful of your current financial circumstances and credit goals when deciding how long to wait before opening another credit card. Taking the time to evaluate these factors will allow you to make an informed decision that aligns with your financial objectives while minimizing any potential negative impacts on your credit score.

Factors to Consider

When determining how long to wait before opening another credit card, it’s crucial to consider various factors that can affect your financial situation and creditworthiness. By carefully evaluating these factors, you can make an informed decision that aligns with your needs and goals. Here are some key factors to keep in mind:

- Credit Utilization Ratio: Your credit utilization ratio is the amount of credit you are currently using compared to your total credit limit. Opening a new credit card can potentially increase your available credit, which may improve your credit utilization ratio. However, if you have a high utilization rate already, taking on additional credit could negatively impact your score.

- Current Debt Level: If you are carrying a significant amount of credit card debt or other loans, it might be wise to address those obligations before applying for another credit card. Adding more credit could potentially increase your debt burden and make it harder to manage your finances effectively.

- Payment History: Your payment history plays a significant role in your credit score. If you have a history of missing payments or late payments, it’s important to work on improving your payment habits before applying for additional credit.

- Credit Score: Your credit score is a numerical representation of your creditworthiness. Each time you apply for a new credit card, a hard inquiry is typically initiated, which can temporarily lower your credit score. Understanding your current credit score can help you determine the best timing for a new credit card application.

- Reward Programs: If you are interested in earning credit card rewards, it’s essential to research different reward programs and choose one that aligns with your spending habits and financial goals. Some reward programs offer sign-up bonuses, so considering the timing of your application can help maximize your rewards.

- Financial Goals: Take into account your financial goals before applying for a new credit card. If you are planning to make a major purchase or apply for a loan in the near future, it may be wise to hold off on opening a new credit card to avoid any negative impact on your creditworthiness.

By considering these factors, you can make an informed decision on how long to wait before opening another credit card. It’s crucial to weigh the potential benefits against the possible risks and make a decision that aligns with your financial situation and goals.

Impact on Credit Score

Opening another credit card can have both positive and negative impacts on your credit score. Understanding these effects can help you make an informed decision on when to apply for a new credit card.

One of the primary factors that can impact your credit score is the credit utilization ratio, which is the amount of credit you are currently using compared to your total credit limit. When you open a new credit card, you increase your available credit, which can lower your overall credit utilization. This can have a positive impact on your credit score, as lower credit utilization is generally viewed favorably by lenders.

However, it’s important to consider the potential negative impact of a new credit card on your credit score as well. Each time you apply for a credit card, a hard inquiry is typically initiated on your credit report. Multiple hard inquiries within a short period of time can lower your credit score temporarily. Therefore, it’s crucial to space out your credit card applications to minimize the potential negative impact on your score.

AdditioCnally, opening a new credit card means taking on new debt, even if you plan to use it responsibly and pay off the balance in full each month. Lenders may view the additional debt as a risk if you have a history of carrying high balances on multiple credit cards. This can negatively affect your credit score, especially if your credit utilization increases as a result.

Another factor to consider is the average age of your credit accounts. The longer you have a credit card account, the more it contributes to the average age of your credit history. Opening a new credit card will reduce the average age of your accounts, potentially impacting your credit score. However, this impact is typically minimal and may be offset by other positive factors, such as lowered credit utilization.

Overall, opening a new credit card can have a mixed impact on your credit score. Lowering your credit utilization and increasing your available credit can be positive, but the temporary dip in your score due to a hard inquiry and the potential for increased debt should also be considered. It’s important to weigh these factors and make a decision that aligns with your financial goals and creditworthiness.

Credit Card Application Timeline

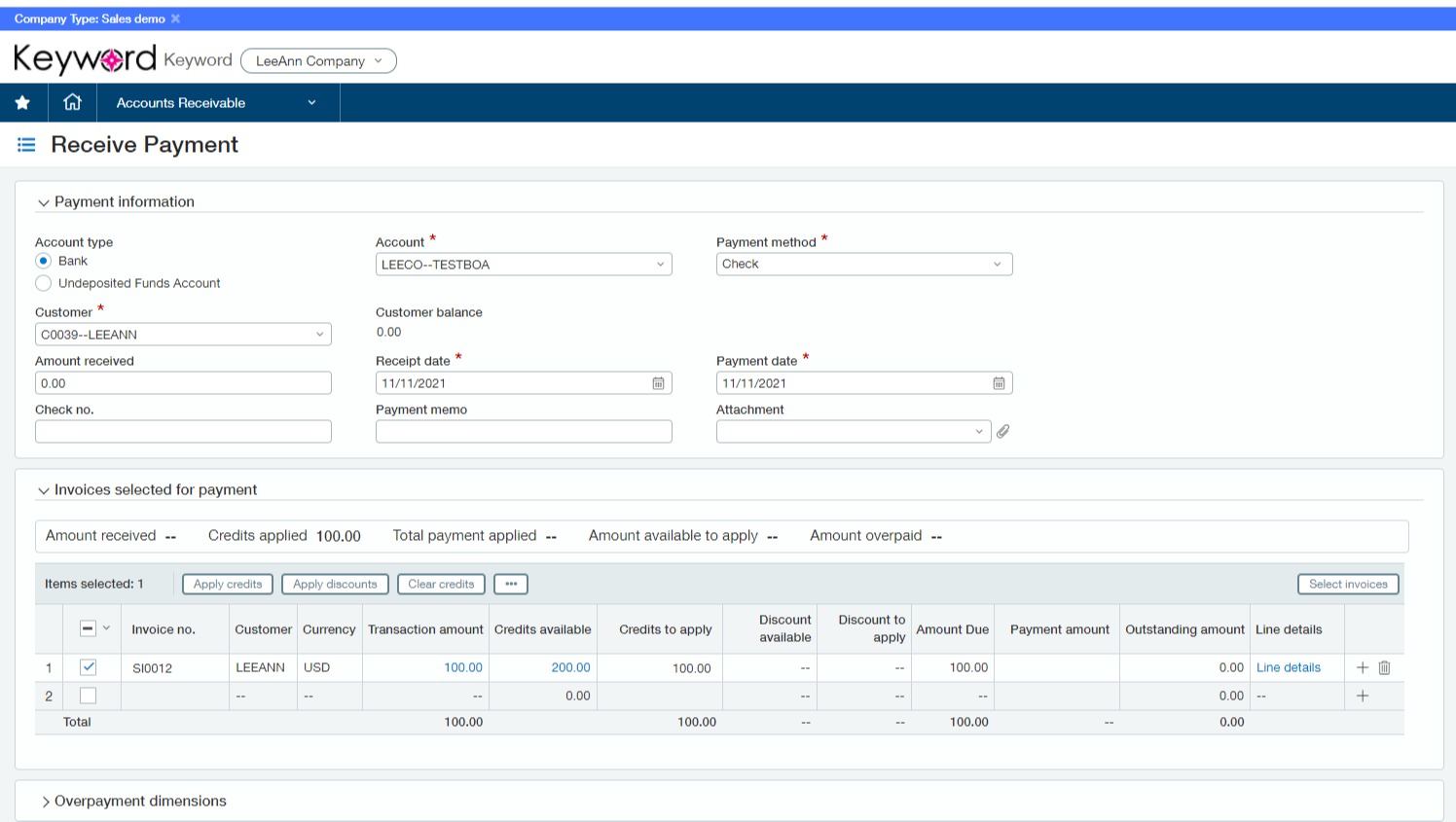

Understanding the credit card application timeline is essential for managing your finances and credit effectively. It’s important to be aware of the various stages involved in the application process to ensure a smooth experience. Here is a breakdown of the typical credit card application timeline:

- Research and Comparison: Before applying for a credit card, take the time to research and compare different options available to you. Consider factors such as interest rates, annual fees, rewards programs, and any special promotions or benefits. This stage can vary in duration depending on how thorough your research is and how quickly you can make a decision.

- Completing the Application: Once you’ve chosen the credit card that fits your needs, it’s time to complete the application. This usually involves providing personal information such as your name, address, social security number, and income details. Some credit card applications can be completed online, while others may require filling out a physical form and sending it via mail. The time it takes to complete the application will vary depending on the application method and the level of detail required.

- Processing and Review: After submitting your application, the credit card issuer will process and review the information provided. This stage involves verifying your identity, assessing your creditworthiness, and evaluating your financial situation. The duration of this stage can vary but is typically a matter of days to a few weeks.

- Approval or Denial: Once your application undergoes a thorough review, you will receive a decision from the credit card issuer. If approved, you’ll typically receive the card within a week or two. If denied, the issuer will provide a reason for the denial, which may include factors such as insufficient credit history, a low credit score, or excessive outstanding debt. In some cases, you may have the option to appeal the decision or improve your creditworthiness before reapplying.

- Activation and Usage: Upon receiving your credit card, you will need to activate it before you can start using it. This usually involves calling a designated activation number or visiting the card issuer’s website. Once activated, you can begin using the card for purchases, earning rewards, and enjoying any benefits or perks associated with the card.

It’s important to note that the timeline can vary for each individual and is influenced by factors such as the credit card issuer’s processing times, the complexity of your application, and any additional requirements or verifications needed during the review process.

By understanding the typical credit card application timeline, you can plan ahead, manage your expectations, and ensure a smooth experience from research to card activation.

Strategizing Your Credit Card Applications

When it comes to opening multiple credit cards, strategic planning is key to maximizing the benefits and minimizing any negative impacts. Here are some tips to help you strategize your credit card applications:

- Consider Your Financial Goals: Before applying for a new credit card, consider your financial goals and needs. Are you looking to earn travel rewards, cash back, or establish credit history? Analyzing your objectives will help you determine the types of cards that align with your goals and guide your application strategy.

- Timing is Important: Timing your credit card applications is crucial to minimize any potential negative impact on your credit score. Applying for multiple cards within a short period of time can lead to multiple hard inquiries, which can temporarily lower your score. Spread out your applications to maintain a healthy credit profile.

- Research Credit Card Issuers: Different credit card issuers have their own application rules and restrictions. Some issuers may limit the number of cards you can have with their brand, or have specific waiting periods between card applications. Research the guidelines of each issuer to ensure you comply with their requirements.

- Utilize Sign-Up Bonuses: Many credit cards offer attractive sign-up bonuses to entice new customers. These bonuses often come with spending requirements within a specified timeframe. By strategically timing your credit card applications, you can maximize the opportunity to earn multiple sign-up bonuses while meeting the spending thresholds.

- Manage Your Credit Utilization: Aim to keep your credit utilization ratio low, as it plays a significant role in your credit score. Opening a new credit card can increase your available credit and lower your utilization ratio, which is beneficial. However, if you have a history of carrying high balances, be mindful of taking on additional debt.

- Track Annual Fees: Some credit cards come with annual fees. Before applying, consider whether the benefits and rewards of the card outweigh the annual fee. If you already have cards with annual fees, be mindful of the cumulative fees and reassess the value of each card to avoid unnecessary costs.

- Monitor Your Credit Score: Keep a close eye on your credit score before, during, and after the application process. Regularly checking your score will help you gauge the impact of your credit card applications and ensure you’re aware of any unexpected changes or errors on your credit report.

By strategizing your credit card applications, you can make informed decisions that align with your financial goals, minimize potential negative impacts on your credit score, and maximize the benefits of multiple credit cards. Remember to research, plan, and evaluate your options before applying to ensure you’re making the most of your credit card journey.

Conclusion

Opening another credit card can offer a range of benefits, but it’s important to approach the process strategically. By considering factors such as your financial goals, credit score, and credit utilization, you can make an informed decision about when to apply for a new credit card. Timing is crucial to avoid potential negative impacts on your credit score, such as multiple hard inquiries or increased debt.

Take the time to research different credit cards and compare their features, rewards programs, and fees. Consider your financial goals and evaluate the potential benefits and drawbacks of each card. Additionally, be aware of any restrictions or guidelines set by credit card issuers, as each company may have different policies regarding application frequency.

Strategizing your credit card applications can help you maximize the rewards and benefits while maintaining a healthy credit profile. Timing your applications to take advantage of sign-up bonuses and managing your credit utilization can lead to a positive credit card experience. Regularly monitor your credit score and reassess your credit card portfolio to ensure you are on track to meet your financial goals.

Remember, opening another credit card should be a well-considered decision that aligns with your financial situation and goals. By being strategic with your credit card applications, you can make the most of the opportunities they provide while maintaining a strong credit profile.