Finance

Price Swap Derivative Definition

Published: January 11, 2024

Discover the definition and benefits of price swap derivatives in the world of finance. Explore how these instruments can help manage risk and enhance portfolio returns.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Price Swap Derivatives: A Key Component of Modern Finance

When it comes to navigating the complex world of finance, it’s essential to have a solid understanding of different financial instruments and how they work. One such instrument is a Price Swap Derivative, which plays a crucial role in the modern financial landscape. In this blog post, we will explore the definition, uses, and benefits of Price Swap Derivatives.

What is a Price Swap Derivative?

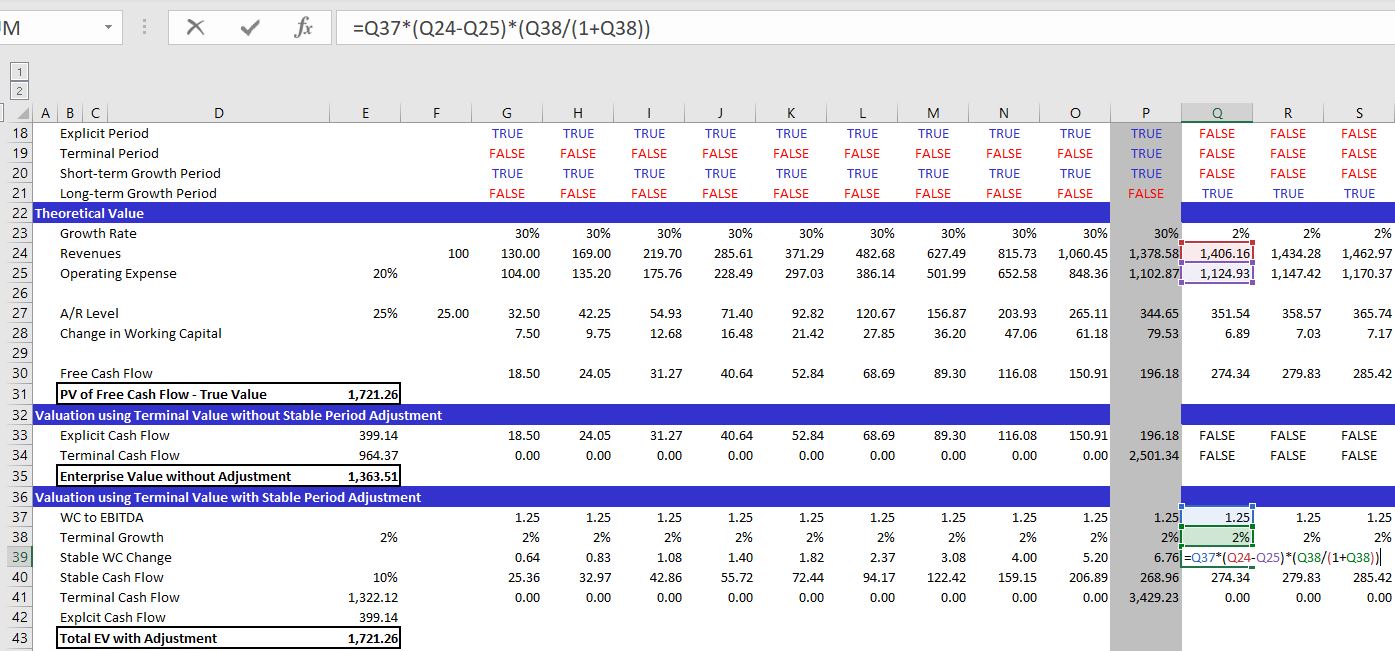

A Price Swap Derivative is a financial contract between two parties that allows them to exchange the cash flows derived from the price movement of an underlying asset. Common underlying assets include commodities, currencies, interest rates, and equities. The primary purpose of a Price Swap Derivative is to hedge against or speculate on price movements, allowing participants to manage risk and potentially generate profits.

Key Takeaways:

- A Price Swap Derivative is a financial contract used to exchange cash flows based on the price movement of an underlying asset.

- Derivatives provide participants with a means to manage risk and potentially generate profits through hedging or speculation.

Uses of Price Swap Derivatives

Price Swap Derivatives find extensive application in various areas of finance. Here are some common uses:

- Hedging: Businesses and investors can use Price Swap Derivatives to hedge against potential price movements in commodities, currencies, and interest rates. By entering into a Price Swap contract, participants can offset the impact of price fluctuations and protect their portfolios from unexpected financial losses.

- Speculation: Traders and investors also use Price Swap Derivatives as vehicles for speculation. By taking positions on expected price movements, they can potentially profit from market fluctuations without directly owning the underlying assets.

- Portfolio Diversification: Price Swap Derivatives offer an effective way for investors to diversify their portfolios. By including derivatives with different underlying assets, investors can spread their risk and potentially increase returns.

The Benefits of Price Swap Derivatives

Price Swap Derivatives provide several benefits to market participants:

- Risk Management: By using derivatives, businesses and investors can mitigate their exposure to price fluctuations and manage financial risks more effectively. This allows for greater stability and protection against potential losses.

- Enhanced Returns: For those who understand the risks involved, Price Swap Derivatives offer a potential avenue for generating significant profits. Through speculation and taking advantage of price movements, market participants can enhance their overall investment returns.

- Increased Flexibility: Price Swap Derivatives provide participants with flexibility in their investment strategies. Whether it’s hedging against potential losses or seeking speculative opportunities, derivatives offer a variety of options that suit individual risk tolerances and financial objectives.

By gaining a comprehensive understanding of Price Swap Derivatives, investors and businesses can make informed decisions to optimize their financial positions and achieve their objectives. Whether you’re looking to hedge against price fluctuations or capitalize on market opportunities, derivatives are a powerful tool in the world of finance.