Finance

How Much Is Flood Insurance In Arkansas?

Published: November 11, 2023

Looking for flood insurance in Arkansas? Find out how much it costs with our finance experts. Protect your assets and be prepared for any unexpected flooding.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to Arkansas, the beautiful state known for its stunning scenery and vibrant communities. While Arkansas offers many benefits to its residents, it is also prone to natural disasters, including floods. Flooding can cause significant damage to homes and properties, leading to substantial financial losses. That’s why it’s crucial for homeowners in Arkansas to understand the importance of flood insurance.

Flood insurance provides coverage specifically for damages caused by floods, which are not typically covered by standard homeowner’s insurance policies. It offers financial protection against the devastating effects of floods, such as structural damages, content loss, and restoration expenses.

In this article, we will explore flood insurance in Arkansas, including the factors that affect flood insurance rates, the requirements set by the state, the average cost of flood insurance, and tips for determining the right coverage amount and saving on premiums. By the end of the article, you will have a comprehensive understanding of flood insurance in Arkansas and be better equipped to protect your home and property.

So, whether you live in the bustling Little Rock metropolitan area or the scenic communities of Fayetteville or Hot Springs, understanding flood insurance is essential. Let’s delve into the details and ensure you have the knowledge needed to safeguard your home against the destructive force of floods.

Understanding Flood Insurance

Flood insurance is a specialized type of insurance coverage that protects homeowners and renters from losses due to flooding. It is designed to provide financial assistance for repairing or replacing damaged property, as well as covering the costs associated with flood-related damages.

Unlike homeowners insurance, which typically covers damages from fire, theft, or other perils, flood insurance specifically covers damages caused by flooding. This includes damages caused by heavy rain, hurricanes, river overflow, or flash floods. Without adequate flood insurance, homeowners and renters may be left to bear the financial burden of flood-related losses on their own.

It’s important to note that flood insurance is typically not included in standard homeowner’s insurance policies. To obtain flood coverage, homeowners and renters must purchase a separate flood insurance policy from the National Flood Insurance Program (NFIP) or a private insurance provider.

Flood insurance policies typically cover both the structure of the home and its contents. The structure coverage includes the building itself, as well as its foundation, electrical and plumbing systems, HVAC systems, and built-in appliances. Content coverage includes personal belongings such as furniture, electronics, clothing, and other valuable items within the home.

When considering flood insurance, it’s crucial to understand the terms and conditions of the policy. This includes the coverage limits, deductibles, and exclusions. It’s recommended to review the policy details carefully and consult with an insurance professional to ensure you have the appropriate coverage based on your specific needs and location.

Now that we have a basic understanding of flood insurance, let’s explore the factors that can affect flood insurance rates in Arkansas.

Factors Affecting Flood Insurance Rates

There are several factors that can influence the cost of flood insurance premiums in Arkansas. Understanding these factors can help homeowners and renters anticipate the potential costs and make informed decisions when purchasing flood insurance. Here are the key factors that can affect flood insurance rates:

- Location: The location of your property plays a significant role in determining flood insurance rates. Areas that are prone to frequent flooding or located in high-risk flood zones will have higher premiums compared to areas with lesser flood risks.

- Elevation: The elevation of your property relative to the base flood level can impact insurance rates. Higher elevations are considered to have a lower risk of flooding and may qualify for lower premiums.

- Building type: The type of building you own or rent can affect flood insurance rates. Factors such as the construction material, design, and the presence of protective features like flood vents can influence premiums.

- Coverage amount: The amount of coverage you choose for your property can also impact the cost of flood insurance. Opting for higher coverage limits will result in higher premiums.

- Deductible: The deductible is the amount you must pay out of pocket before the flood insurance coverage kicks in. Choosing a higher deductible can lower your premiums, but it will also mean you have a higher financial responsibility in the event of a flood.

- Previous flood claims: If your property has a history of flood claims, it may affect your flood insurance rates. Multiple flood claims could result in higher premiums as it suggests a higher risk of future losses.

- Age of the property: The age of the building can also be a factor in determining flood insurance rates. Older properties may have outdated infrastructure and may be considered at higher risk of flooding, resulting in higher premiums.

It’s important to keep in mind that flood insurance rates can vary depending on the insurance provider and the specific policy. It’s recommended to obtain quotes from multiple insurance companies to compare rates and coverage options.

Now that we understand the factors that can affect flood insurance rates, let’s delve into the specific flood insurance requirements in Arkansas.

Flood Insurance Requirements in Arkansas

Arkansas, like many other states, has specific requirements when it comes to flood insurance. These requirements are in place to ensure that homeowners and renters in flood-prone areas have adequate coverage to protect themselves and their properties. Here are the key flood insurance requirements in Arkansas:

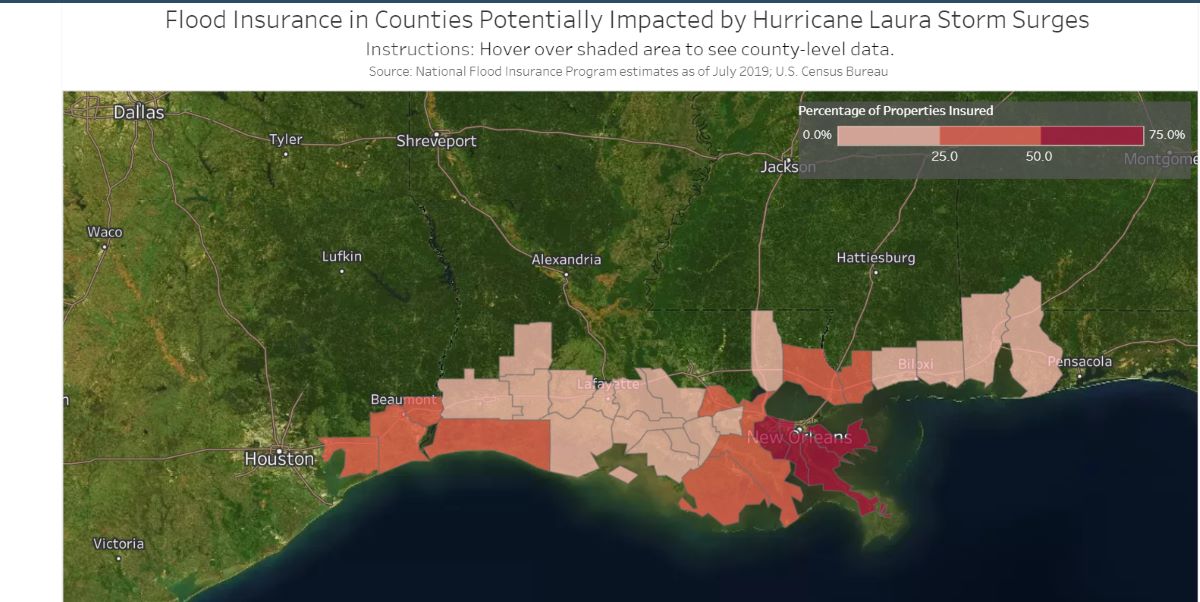

- Flood Risk Zones: Arkansas utilizes flood risk maps provided by the Federal Emergency Management Agency (FEMA) to designate different flood zones. These zones are categorized as high-risk, moderate-risk, or low-risk areas based on the likelihood of flooding. Homeowners and renters in high-risk flood zones are typically required by their mortgage lenders to carry flood insurance.

- Federal Requirements: If you have a federally regulated or insured mortgage on a property located in a high-risk flood zone, you are legally required to have flood insurance. This requirement is mandated by the National Flood Insurance Program (NFIP). Failure to obtain flood insurance can result in penalties or the denial of a loan.

- Private Lender Requirements: Even if you do not have a federally regulated mortgage, your lender may still require flood insurance if your property is located in a high-risk flood zone. It’s important to check with your lender to determine their specific requirements.

- Voluntary Coverage: While flood insurance is mandatory for certain properties, it is also available for homeowners and renters outside of high-risk flood zones. Even if your property is in a moderate- or low-risk zone, it’s still recommended to consider purchasing flood insurance to protect yourself from unexpected flooding events.

It’s worth noting that flood insurance in Arkansas is primarily provided through the National Flood Insurance Program (NFIP). This program is administered by FEMA and offers flood insurance policies to homeowners, renters, and business owners in participating communities. Private flood insurance policies are also available in Arkansas through select insurers.

Now that we understand the flood insurance requirements in Arkansas, let’s explore the average cost of flood insurance in the state.

Average Cost of Flood Insurance in Arkansas

The cost of flood insurance in Arkansas can vary depending on several factors, including the location of the property, the level of flood risk, the coverage amount, and the deductible chosen. While it’s difficult to provide an exact estimate for flood insurance rates, understanding the average cost can give you a general idea of what to expect.

According to the National Flood Insurance Program (NFIP), the average annual premium for flood insurance in Arkansas is around $700. However, keep in mind that this is just an average, and rates can vary significantly based on the specific circumstances of your property.

Properties located in high-risk flood zones are likely to have higher premiums compared to properties in moderate- or low-risk zones. Additionally, the value of your property and the coverage limits you choose will also influence the cost of your flood insurance policy.

It’s important to note that the cost of flood insurance is also determined by the deductible you select. A higher deductible can help reduce the premium cost, but it also means you will have a larger out-of-pocket expense in the event of a flood.

To get an accurate quote for flood insurance in Arkansas, it is recommended to reach out to an insurance provider or agent who specializes in flood insurance. They can assess the specific characteristics of your property, take into account various risk factors, and provide you with a personalized quote.

Now that we have an understanding of the average cost of flood insurance in Arkansas, let’s explore how to determine the right coverage amount for your property.

Determining the Right Coverage Amount

When it comes to purchasing flood insurance in Arkansas, it’s important to determine the right coverage amount to adequately protect your property. The coverage amount should be sufficient to cover the cost of rebuilding or repairing your home and replacing your belongings in the event of a flood. Here are some key considerations to help you determine the right coverage amount:

- Property Value: Assess the value of your property, including the structure and the contents. Consider the size, materials, and features of your home, as well as the value of your personal belongings. It’s important to have enough coverage to fully rebuild or replace these items in the event of a flood.

- Evaluation from Professionals: Consult with professionals such as appraisers, contractors, or insurance agents who can provide you with estimates on the cost of rebuilding your property. They can consider factors like labor costs, construction materials, and local market conditions to help you determine the appropriate coverage amount.

- Assessing Flood Risk: Consider the flood risk in your area. If you live in a high-risk flood zone, it may be wise to have a higher coverage amount. Assess the potential damage that a flood could cause and ensure your coverage includes the necessary funds for repairs or replacements.

- Factor in Additional Expenses: Keep in mind that flood damage can lead to additional expenses beyond the cost of rebuilding or replacing your property. This may include temporary housing, debris removal, or additional living expenses while your home is being repaired. Factor in these potential costs when determining your coverage amount.

- Review Your Policy Regularly: As time goes on, the value of your property and belongings may change. It’s essential to review your flood insurance policy regularly and update the coverage amount accordingly. This will help ensure that you have adequate coverage in case of a flood.

Remember that while it’s crucial to have sufficient coverage, it’s also important to consider your budget and the affordability of the premium. Balancing the appropriate coverage amount with a premium you can afford is key.

By carefully assessing these factors and considering the advice of professionals, you can determine the right coverage amount for your property and have peace of mind knowing that you are adequately protected against flood-related losses.

Now let’s explore some ways to save on flood insurance premiums in Arkansas.

Ways to Save on Flood Insurance

Flood insurance is a valuable investment that provides financial protection against the devastating effects of floods. However, it’s understandable that homeowners in Arkansas would want to find ways to save on their flood insurance premiums. Here are some strategies to help you reduce the cost of flood insurance:

- Evaluate your Flood Risk: Understanding the flood risk for your property can help you make informed decisions about the coverage you need. If you live in a low- to moderate-risk area, you may qualify for lower premiums.

- Opt for Higher Deductibles: Choosing a higher deductible can lower your flood insurance premiums. However, it’s important to ensure that you can afford to pay the higher deductible in the event of a flood.

- Invest in Flood Mitigation Measures: Implementing flood mitigation measures can help lower your flood risk and potentially reduce your premiums. This may include elevating utilities, installing flood-resistant barriers, or improving drainage systems on your property.

- Utilize Elevation Certificates: If your property has an elevation certificate, provide it to your insurance provider. Elevation certificates document the elevation of your property and can help determine accurate flood insurance rates.

- Consider Bundling Insurance Policies: Some insurance providers offer discounts when you bundle multiple insurance policies together, such as combining your flood insurance with your homeowner’s insurance.

- Shop Around for Different Quotes: It’s important to compare quotes from multiple insurance providers to ensure you are getting the best coverage at the most competitive price. Consider both NFIP policies and private flood insurance options.

- Work with an Insurance Professional: Consulting with an insurance professional who specializes in flood insurance can provide valuable insights and help you navigate the process. They can assist in finding cost-effective solutions tailored to your specific needs.

- Stay Informed About NFIP Updates: The National Flood Insurance Program (NFIP) periodically updates its policies and rates. Stay informed about any changes in legislation, insurance requirements, or available discounts that may benefit you.

Implementing these strategies can potentially help you save money on your flood insurance premiums while ensuring that you have the necessary coverage to protect your property. Remember, it’s important to strike a balance between affordable premiums and adequate coverage.

Now that we have explored ways to save on flood insurance, let’s summarize what we’ve learned.

Conclusion

Flood insurance is a crucial form of protection for homeowners and renters in Arkansas, where the risk of flooding is a constant concern. Understanding the nuances of flood insurance can help you make informed decisions and adequately safeguard your property and belongings.

In this article, we discussed the importance of flood insurance and its specific relevance to Arkansas. We explored the factors that can affect flood insurance rates, including location, elevation, building type, coverage amount, deductible, previous flood claims, and the age of the property.

We also delved into the flood insurance requirements in Arkansas, highlighting the roles of flood risk zones, federal regulations, and private lender requirements. It’s essential to comply with these requirements to ensure adequate protection for your home and fulfill any obligations set by your mortgage lender.

Estimating the average cost of flood insurance in Arkansas provides a general guideline, but it’s crucial to obtain personalized quotes from insurance providers to accurately determine the cost based on your property’s specific characteristics and risk factors.

To determine the right coverage amount, evaluating your property’s value, consulting with professionals, considering flood risk, and factoring in additional expenses are all important steps. Regularly reviewing and updating your flood insurance policy is also vital to ensure you have adequate coverage over time.

To save on flood insurance premiums, exploring options such as evaluating flood risk, opting for higher deductibles, implementing flood mitigation measures, bundling insurance policies, and shopping around for quotes can make a significant difference in your expenses.

Remember, consulting with an insurance professional who specializes in flood insurance can provide invaluable guidance throughout the process.

Overall, by understanding flood insurance, its requirements, and factors that influence rates, you can protect your home, belongings, and financial well-being in the face of potential floods. Prioritizing flood insurance now can save you from significant financial hardships and provide peace of mind for the future.